Reports

Sale

Global Pharmaceutical Contract Packaging Market Size, Share: By Industry: Small Molecule, Biopharmaceutical, Vaccine; By Type: Sterile, Non-Sterile; By Packaging: Plastic Bottles, Caps and Closures, Blister Packs, Prefilled Syringes, Parenteral Vials and Ampoules; Regional Analysis; Market Dynamics; Competitive Landscape; 2024-2032

Global Pharmaceutical Contract Packaging Market Outlook

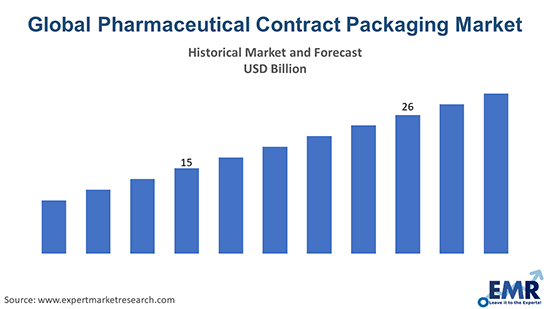

The global pharmaceutical contract packaging market size was valued at USD 24.18 billion in 2023. The market is further projected to grow at a CAGR of 7.5% between 2024 and 2032, reaching a value of USD 46.21 billion by 2032.

Key Takeaways

- The market is driven by the increasing demand for temperature-controlled products, biologics, and personalised medicines.

- Prefilled syringes are gaining popularity among healthcare professionals, as they offer convenience and accuracy for drug delivery.

- Some of the key players in the pharmaceutical packaging industry include Ropack Inc., PCI Pharma Services, Adelphi Healthcare Packaging, and UNICEP Packaging LLC.

Pharmaceutical contract packaging is the outsourcing for secondary activities such as product packaging and labelling to third parties. A contract pharmaceutical packager provides services, installations, as well as equipment, ranging from drug packaging design to the testing of the packaged drug. Pharmaceutical companies employ secondary packaging companies because it is more reliable, profitable, and helps them improve customer satisfaction and provides brand recognition.

A growing focus on sustainability is likely to drive the use of recyclable and biodegradable materials in pharmaceutical packaging products, which is predicted to aid in pharmaceutical contract packaging market growth. The thriving demand for convenient packaging, which makes it easier to manage the storage and use of pharmaceuticals, is expected to have a positive impact on the pharmaceutical contract packaging market outlook.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Key Trends and Developments

Growing adoption of smart packaging technologies, rising environmental concerns, and increasing need for reliable packaging of medicines are increasing the demand for pharmaceutical contract packaging solutions

| Date | Company | News |

| February 2024 | Almac Pharma Services | Received the renewal of its HPRA Certificate of GMP compliance for its European facility after a comprehensive audit |

| February 2024 | Berry Global | Unveiled a new Circular Stretch Film Innovation and Training Centre aimed at developing sustainable and flexible packaging solutions |

| December 2023 | PCI Pharma Services | Announced the full operation of three new automated sterile fill-finish machines at its San Diego and Melbourne facilities |

| October 2023 | Adelphi Healthcare Packaging | Adelphi’s partner STELLA acquired seven new state-of-the-art injection moulding machines in Q4 of 2023 and plans to introduce more machines in early 2024 |

| Trends | Impact |

| Increasing demand for biologics and biosimilars | Biologics and biosimilars require specialised packaging and handling, which creates opportunities for contract packaging organisations (CPOs) to offer value-added services and solutions. |

| Growing adoption of smart packaging technologies | Smart packaging technologies, such as RFID, NFC, and QR codes, can enhance product traceability, security and provide interactive features for consumers. CPOs can leverage these technologies to differentiate their offerings and increase customer loyalty. |

| Rising environmental concerns and regulations | Environmental issues, such as plastic waste, carbon footprint, and resource depletion, have prompted governments and consumers to demand more sustainable and eco-friendly packaging solutions. CPOs can gain a competitive edge by adopting green packaging materials and practices, such as biodegradable, recyclable, and reusable packaging. |

| Shifting consumer preferences and expectations | Consumers are becoming more aware and demanding of the quality, safety, and convenience of pharmaceutical products. CPOs meet these expectations by offering innovative and flexible packaging designs, such as child-resistant, senior-friendly, and smart packaging, which, in turn, can lead to pharmaceutical contract packaging market expansion. |

Global Pharmaceutical Contract Packaging Market Trends

One of the main factors that results in pharmaceutical contract packaging market development is the introduction of strict rules and regulations for product labelling. Moreover, pharmaceutical contract packaging companies can use different types of packaging and can easily solve problems arising from diverse packaging requirements, compared to drug makers. These manufacturers invest in research and development programs to improve the quality of their products.

Moreover, these organisations also help pharmaceutical firms establish a dynamic platform for distributing drugs and medical devices in various regions. Furthermore, the increasing use of smart packaging solutions, such as QR codes, is expected to provide a positive pharmaceutical contract packaging market outlook.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Segmentation

Global Pharmaceutical Contract Packaging Market Report and Forecast 2024-2032 offers a detailed analysis of the market based on the following segments:

| Market Breakup | Categories |

| Industry | Small Molecule, Biopharmaceutical, Vaccine |

| Product Type | Sterile, Non-Sterile |

| Packaging | Plastic Bottles, Caps and Closures, Blister Packs, Prefilled Syringes, Parenteral Vials and Ampoules |

| Region | United States, Europe, China, India, Others |

Sterile products to hold significant market share as they offer high level of quality and safety

The sterile product segment accounted for the largest share in pharmaceutical contract packaging market. Sterile products are those that are free from any viable microorganisms, such as injectables, ophthalmics, inhalables, and biologics. Sterile products require a high level of quality and safety, as they are directly administered to the patients. Therefore, the demand for sterile contract packaging is high, as it ensures the sterility, stability, and integrity of the products.

On the other hand, non-sterile products are those that do not require sterility, such as oral solids, oral liquids, topical creams, and gels. Non-sterile products require a lower level of quality and safety, as they are not directly administered to the patients. As per pharmaceutical contract packaging market analysis, the demand for non-sterile contract packaging is also high, as it offers flexibility to pharmaceutical companies and can be customised.

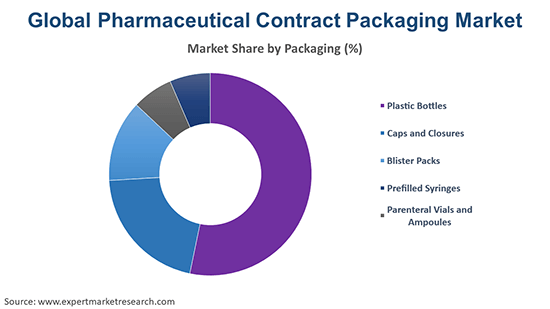

Plastic bottles will bolster the pharmaceutical contract packaging market growth as they are low in cost and easy to handle

The plastic bottles segment is expected to increase the pharmaceutical contract packaging market value as they are widely used for oral solid and liquid formulations, such as tablets, capsules, syrups, and suspensions. Plastic bottles also offer advantages such as low cost, high durability, easy handling, and recyclability.

Caps and closures are used to seal and protect the pharmaceutical products from contamination, tampering, and leakage. Caps and closures include screw caps, flip-top caps, child-resistant caps, tamper-evident caps, and dispensing caps. The caps and closures segment is expected to witness a growing pharmaceutical contract packaging market share due to the increasing demand for safe and secure packaging, the growing preference for convenience and ease of use, and the emergence of smart and interactive caps and closures.

Prefilled syringes are used for injectable formulations, such as vaccines, biologics, and biosimilars. Prefilled syringes consist of a glass or plastic barrel, a plunger, a needle, and a cap. Prefilled syringes are the fastest growing segment in the pharmaceutical contract packaging market as they offer advantages such as ease of administration, dosage accuracy, reduced wastage, and enhanced safety.

Furthermore, parenteral vials and ampoules are made of glass or plastic and have a rubber stopper and a metal seal. Parenteral vials and ampoules offer benefits such as sterility, stability, and compatibility. The pharmaceutical contract packaging market projects that share of parenteral vials and ampoules segment will grow at a steady rate. The growth of this segment can be attributed to the increasing demand for sterile and aseptic packaging, the rising incidence of infectious and chronic diseases, and the expansion of the biosimilar market.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Competitive Landscape

Market players are providing contract packaging services to pharmaceutical manufacturers, ensuring efficient and reliable packaging solutions for medicines and healthcare products.

| Company Name | Year Founded | Headquarters | Products/Services |

| Adelphi Healthcare Packaging | 1947 | West Sussex, United Kingdom | Primary and secondary packaging materials, filling and sealing equipment, laboratory equipment, and cold chain solutions |

| Almac Group | 1968 | Craigavon, Northern Ireland | Pharmaceutical development, clinical trial services, commercial packaging, and supply chain management |

| Berry Global Inc. | 1967 | Indiana, United States | Plastic packaging products, such as bottles, jars, tubes, closures, caps, and labels |

| PCI Services | 1979 | Illinois, United States | Clinical and commercial packaging, global distribution, and analytical testing |

Other key players in the global pharmaceutical contract packaging market include Sharp Corporation, among others.

Global Pharmaceutical Contract Packaging Market Analysis by Region

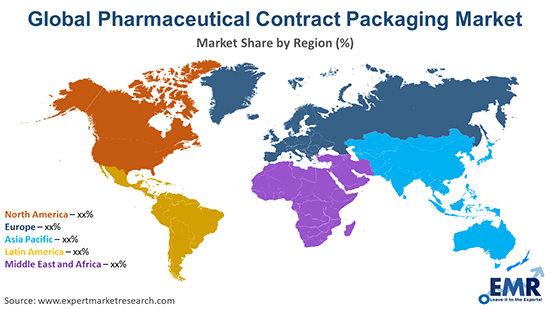

United States leads the market share due to rising healthcare spending, which creates a demand for packaging solutions

The United States represents the world's largest market in pharmaceutical contract packaging, followed by China and India. The tremendous growth of pharmaceutical contract packaging market in United States is majorly driven by the rising healthcare spending, increasing geriatric population, and the increasing value of pharmaceutical exports. The growth is further driven by the high demand for innovative and specialised packaging solutions, the presence of leading pharmaceutical companies and contract packagers, and the stringent regulatory standards for quality and safety.

On the other hand, the pharmaceutical contract packaging market size in China is driven by the rapid growth of the pharmaceutical industry, the increasing outsourcing of packaging services, and the rising demand for biologics and biosimilars. According to pharmaceutical contract packaging market report, the Indian market is driven by the low-cost advantage, the availability of skilled labour, the increasing exports of generic drugs, and the growing domestic demand for pharmaceutical products.

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Industry |

|

| Breakup by Type |

|

| Breakup by Packaging |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Snapshot

6.1 Global

6.2 Regional

7 Opportunities and Challenges in the Market

8 Global Pharmaceutical Contract Packaging Market Analysis

8.1 Key Industry Highlights

8.2 Global Pharmaceutical Contract Packaging Historical Market (2018-2023)

8.3 Global Pharmaceutical Contract Packaging Market Forecast (2024-2032)

8.4 Global Pharmaceutical Contract Packaging Market by Industry

8.4.1 Small Molecule

8.4.1.1 Historical Trend (2018-2023)

8.4.1.2 Forecast Trend (2024-2032)

8.4.2 Biopharmaceutical

8.4.2.1 Historical Trend (2018-2023)

8.4.2.2 Forecast Trend (2024-2032)

8.4.3 Vaccine

8.4.3.1 Historical Trend (2018-2023)

8.4.3.2 Forecast Trend (2024-2032)

8.5 Global Pharmaceutical Contract Packaging Market by Type

8.5.1 Sterile

8.5.1.1 Historical Trend (2018-2023)

8.5.1.2 Forecast Trend (2024-2032)

8.5.2 Non-Sterile

8.5.2.1 Historical Trend (2018-2023)

8.5.2.2 Forecast Trend (2024-2032)

8.6 Global Pharmaceutical Contract Packaging Market by Packaging

8.6.1 Plastic Bottles

8.6.1.1 Historical Trend (2018-2023)

8.6.1.2 Forecast Trend (2024-2032)

8.6.2 Caps and Closures

8.6.2.1 Historical Trend (2018-2023)

8.6.2.2 Forecast Trend (2024-2032)

8.6.3 Blister Packs

8.6.3.1 Historical Trend (2018-2023)

8.6.3.2 Forecast Trend (2024-2032)

8.6.4 Prefilled Syringes

8.6.4.1 Historical Trend (2018-2023)

8.6.4.2 Forecast Trend (2024-2032)

8.6.5 Parenteral Vials and Ampoules

8.6.5.1 Historical Trend (2018-2023)

8.6.5.2 Forecast Trend (2024-2032)

8.7 Global Pharmaceutical Contract Packaging Market by Region

8.7.1 United States

8.7.2 Europe

8.7.3 China

8.7.4 India

8.7.5 Others

9 Regional Analysis

9.1 United States

9.1.1 Historical Trend (2018-2023)

9.1.2 Forecast Trend (2024-2032)

9.2 Europe

9.2.1 Historical Trend (2018-2023)

9.2.2 Forecast Trend (2024-2032)

9.3 China

9.3.1 Historical Trend (2018-2023)

9.3.2 Forecast Trend (2024-2032)

9.4 India

9.4.1 Historical Trend (2018-2023)

9.4.2 Forecast Trend (2024-2032)

10 Market Dynamics

10.1 SWOT Analysis

10.1.1 Strengths

10.1.2 Weaknesses

10.1.3 Opportunities

10.1.4 Threats

10.2 Porter’s Five Forces Analysis

10.2.1 Supplier’s Power

10.2.2 Buyers Power

10.2.3 Threat of New Entrants

10.2.4 Degree of Rivalry

10.2.5 Threat of Substitutes

10.3 Key Indicators for Demand

10.4 Key Indicators for Price

11 Value Chain Analysis

12 Price Analysis

12.1 United States Historical Price Trends (2018-2023) and Forecast (2024-2032)

12.2 Europe Historical Price Trends (2018-2023) and Forecast (2024-2032)

12.3 China Historical Price Trends (2018-2023) and Forecast (2024-2032)

12.4 India Historical Price Trends (2018-2023) and Forecast (2024-2032)

13 Manufacturing Process

13.1 Detailed Process Flow

13.2 Operations Involved

13.3 Mass Balance and Raw Material

14 Project Details and Cost Analysis

14.1 Land, Location and Site Development

14.2 Construction

14.3 Plant Layout

14.4 Plant Machinery

14.5 Raw Material Requirement

14.6 Packaging

14.7 Transportation

14.8 Utilities

14.9 Manpower

14.10 Other Capital Investment

15 Loans and Financial Assistance

16 Project Economics

16.1 Capital Cost of Project

16.2 Techno-Economic Parameters

16.3 Product Pricing and Margins

16.4 Taxation and Depreciation

16.5 Income Projections

16.6 Expenditure Projections

16.7 Financial Analysis

17 Competitive Landscape

17.1 Market Structure

17.2 Company Profiles

17.2.1 Adelphi Healthcare Packaging

17.2.1.1 Company Overview

17.2.1.2 Product Portfolio

17.2.1.3 Demographic Reach and Achievements

17.2.1.4 Financial Summary

17.2.1.5 Certifications

17.2.2 Almac Group

17.2.2.1 Company Overview

17.2.2.2 Product Portfolio

17.2.2.3 Demographic Reach and Achievements

17.2.2.4 Financial Summary

17.2.2.5 Certifications

17.2.3 Berry Global Inc.

17.2.3.1 Company Overview

17.2.3.2 Product Portfolio

17.2.3.3 Demographic Reach and Achievements

17.2.3.4 Financial Summary

17.2.3.5 Certifications

17.2.4 PCI Services

17.2.4.1 Company Overview

17.2.4.2 Product Portfolio

17.2.4.3 Demographic Reach and Achievements

17.2.4.4 Financial Summary

17.2.4.5 Certifications

17.2.5 Sharp Corporation

17.2.5.1 Company Overview

17.2.5.2 Product Portfolio

17.2.5.3 Demographic Reach and Achievements

17.2.5.4 Financial Summary

17.2.5.5 Certifications

17.2.6 Others

18 Key Trends and Developments in the Market

List of Key Figures and Tables

1. Global Pharmaceutical Contract Packaging Market: Key Industry Highlights, 2018 and 2032

2. Global Pharmaceutical Contract Packaging Historical Market: Breakup by Industry (USD Billion), 2018-2023

3. Global Pharmaceutical Contract Packaging Market Forecast: Breakup by Industry (USD Billion), 2024-2032

4. Global Pharmaceutical Contract Packaging Historical Market: Breakup by Type (USD Billion), 2018-2023

5. Global Pharmaceutical Contract Packaging Market Forecast: Breakup by Type (USD Billion), 2024-2032

6. Global Pharmaceutical Contract Packaging Historical Market: Breakup by Packaging (USD Billion), 2018-2023

7. Global Pharmaceutical Contract Packaging Market Forecast: Breakup by Packaging (USD Billion), 2024-2032

8. Global Pharmaceutical Contract Packaging Historical Market: Breakup by Region (USD Billion), 2018-2023

9. Global Pharmaceutical Contract Packaging Market Forecast: Breakup by Region (USD Billion), 2024-2032

10. United States Historical Price Trends and Forecast 2018-2032

11. Europe Historical Price Trends and Forecast 2018-2032

12. India Historical Price Trends and Forecast 2018-2032

13. China Historical Price Trends and Forecast 2018-2032

14. Global Pharmaceutical Contract Packaging Market Structure

In 2023, the pharmaceutical contract packaging market reached an approximate value of USD 24.18 billion.

The market is expected to grow at a CAGR of 7.5% between 2024 and 2032.

The market is estimated to witness a healthy growth in the forecast period of 2024-2032 to reach USD 46.21 billion by 2032.

The market is being driven by the growing use of intelligent labelling solutions, increasing R&D activities by key players, technological advancements and innovations, and rapid population growth.

Key trends aiding pharmaceutical contract packaging market expansion include the rising demand for sustainable and eco-friendly packaging solutions, stringent packaging regulations, and growing adoption of smart packaging technologies.

The major regions considered in the market are the United States, Europe, China, and India, among others.

Small molecule, biopharmaceutical, and vaccines are some of the leading industries in the market.

The significant packaging segments considered in the market report are plastic bottles, caps and closures, blister packs, prefilled syringes, and parenteral vials and ampoules.

The major types of pharmaceutical contract packaging are sterile and non-sterile.

Key players in the industry are Adelphi Healthcare Packaging, Almac Group, Berry Global Inc., PCI Services, and Sharp Corporation, among others.

The global pharmaceutical contract packaging market attained a value of about USD 24.18 billion in 2023 driven by the implementation stringent rules by regulatory agencies. Aided by the growing development of eco-friendly packaging and the adoption of smart labels, the market is expected to witness a further growth in the forecast period of 2024-2032, growing at a CAGR of 7.5%. The market is projected to reach USD 46.21 billion by 2032.

EMR’s meticulous research methodology delves deep into the industry, covering the macro and micro aspects of the industry. Based on packaging, the pharmaceutical contract packaging market can be segmented into plastic bottles, caps and closures, blister packs, prefilled syringes, and parenteral vials and ampoules, with plastic bottles accounting for the largest market share in the global pharmaceutical contract packaging market. On the basis of product type, the industry can be divided between sterile and non-sterile. Small molecule, biopharmaceutical, and vaccines are the major industries of pharmaceutical contract packaging. The major regional markets for pharmaceutical contract packaging are the United States, Europe, China, India, and others, with the United States accounting for the largest share of the market. The key players in the above industry include Adelphi Healthcare Packaging, Almac Group, Berry Global Inc., PCI Services, and Sharp Corporation, among others.

EMR’s research methodology uses a combination of cutting-edge analytical tools and the expertise of their highly accomplished team, thus, providing their customers with market insights that are accurate, actionable, and help them remain ahead of their competition.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.