Reports

Sale

Global Styrenics Market Analysis, Share, Trends, Forecast: By Type: Polystyrene, Acrylonitrile Butadiene, Expanded Polystyrene, Styrene Butadiene Rubber, Unsaturated Polyester Resin, Others; By End Use: Automotive, Specialty Chemical, Packaging, Construction, Wind Energy, Others; Regional Analysis; Competitive Landscape; 2024-2032

Global Styrenics Market Outlook

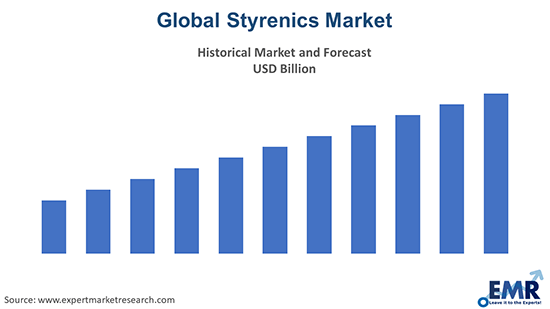

The global styrenics market size is projected to grow at a CAGR of 4% between 2024 and 2032. The market growth is driven by rapid urbanisation and growing product demand from diverse industries.

Key Takeaways

- Polystyrene is the most commonly used styrene polymer for medical use.

- There is a significant focus on developing sustainable and eco-friendly styrenic materials due to increasing environmental concerns.

- Styrenics are favoured in applications requiring materials that offer an optimal balance between stiffness and toughness.

Styrenics are thermoplastics that are derived from styrene and are extensively used in the automotive sector in high-gloss exterior products, including B-pillars, grilles for the front, mirrors for rear views, backlights, external panels, and trimming. For automotive applications, styrenics are also often adopted as a substitute for traditional plastics or synthetic elastomers.

One of the major factors driving the styrenics market growth is the increase in infrastructural developments in emerging economies. The rising demand for high-quality styrenics resins from end-use segments like wind energy, packaging, and automotive sectors is also boosting the overall market growth.

Styrenics are expected to witness a heightened demand from the medical devices sector due to their favourable properties like flexibility, versatility, chemical inertness, and other aesthetic and physical properties. Medical devices, including tubing, wires, IV spikes, containers, liquid delivery systems, and medical packaging, among others, use styrene polymers, and the most common polymers used in manufacturing medical devices and packaging are polystyrene, SAN, and styrene block polymers like SEBS and SBS. Thus, the growth of the medical sector is expected to aid the styrenics market development.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Key Trends and Developments

Increasing demand for sustainable solutions; rising utilisation in consumer goods; advancements in recycling technologies; and technological innovations in product development are the major trends impacting the styrenics market expansion

| Date | Company | Event |

| Jun 2022 | Fratelli Guzzini | Fratelli Guzzini, a renowned manufacturer of tableware and household appliances, selected a range of styrenic materials from Ineos Styrolution's NAS Eco line for its latest collection of drinkware products. |

| Aug 2022 | Styrenics Circular Solutions (SCS) | Styrenics Circular Solutions (SCS), a joint value chain initiative based in Brussels, joined forces with Styropek, a producer of expandable polystyrene. |

| May 2023 | Trinseo | Trinseo, the materials company headquartered in Wayne, PA, announced plans to reinitiate the sale process for its Styrenics division. |

| Jan 2024 | INEOS Styrolution | INEOS Styrolution, the leader in the field of styrenics, unveiled a new variant in its Zylar® series of MBS ("methyl methacrylate butadiene styrene") products which features an optimal mix of stiffness and toughness. |

| Trends | Impact |

| Increasing demand for sustainable solutions | There is a growing trend towards bio-based and recyclable styrenics to address environmental concerns. |

| Rising utilisation in consumer goods | There is an increasing trend of using styrenic materials in the production of consumer goods, such as household appliances, toys, and electronic casings. |

| Advancements in recycling technologies | The development and adoption of advanced recycling technologies for styrenic materials, especially polystyrene, are gaining momentum. |

| Technological innovations in product development | Market players are focusing on the development of new styrenic products with enhanced properties such as improved durability, chemical resistance, and flexibility. |

Styrenics Market Trends

The development and adoption of advanced recycling technologies for styrenic materials, particularly polystyrene, represents a crucial trend in making these materials more sustainable and environmentally friendly. For example, the chemical recycling process breaks down polystyrene into its monomers or other basic chemical components, which can then be reused to produce new polystyrene or other products and it can potentially allow for an infinite loop of recycling, significantly reducing waste.

Besides, growing research and development activities by key players are leading to the launch of new products in the market. In January 2024, INEOS Styrolution, a global leader in styrenics, announced the introduction of a new product in its Zylar® series, known as MBS ("methyl methacrylate butadiene styrene"). This latest innovation, designed to provide an ideal balance between stiffness and toughness, marks a significant advancement in the realm of styrenic materials. The development of Zylar® EX350 reflects INEOS Styrolution's commitment to meet the evolving needs of end-use sectors that demand materials offering both durability and flexibility. The unique properties of this new MBS variant open up a wide range of applications, from automotive components and medical devices to consumer goods and packaging solutions.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Segmentation

“Styrenics Market Report and Forecast 2024-2032” offers a detailed analysis of the market based on the following segments:

| Market Breakup | Categories |

| Type | Polystyrene, Acrylonitrile Butadiene, Expanded Polystyrene, Styrene Butadiene Rubber, Unsaturated Polyester Resin, Others |

| End Use | Automotive, Specialty Chemical, Packaging, Construction, Wind Energy, Consumer Goods, Marine Accessories, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

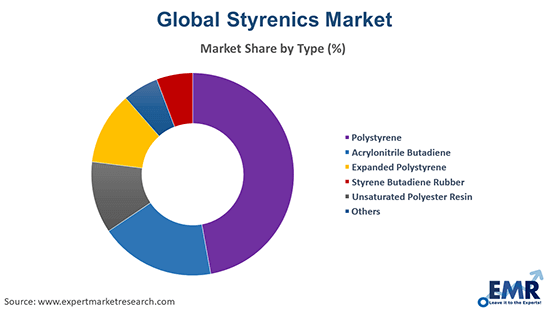

Polystyrene accounts for a major styrenics market share owing to its increased demand from various end use sectors due to its favourable properties

Polystyrene holds the highest share, primarily due to its widespread use in packaging, construction, and consumer goods. Polystyrene's growth is particularly notable in the packaging sector, where it is used extensively due to its lightweight, insulating, and protective properties. Its applications range from food packaging, including containers and cutlery, to protective packaging for consumer electronics and appliances. The automotive and construction sectors also contribute to the demand for polystyrene, utilising it for parts, insulation, and various other applications due to its ease of moulding and durability.

Following polystyrene, the acrylonitrile butadiene styrene (ABS) segment is the second-highest in the styrenics market. ABS is highly valued for its toughness, aesthetic qualities, and superior mechanical properties, which make it suitable for use in automotive components, consumer electronics, and household appliances. Moreover, its ability to be coloured and its excellent surface finish options further enhance its application scope.

The packaging sector maintains its dominance in the styrenics market due to the growing product usage in disposable and protective packaging

In the packaging sector, polystyrene and its derivatives are widely preferred due to their lightweight, durable nature, and insulating properties, to make solutions ranging from disposable food containers to protective packaging for electronics and consumer goods. Also, the demand in this segment is driven by the global expansion of the retail sector, with consumers increasingly demanding sustainable packaging solutions that offer safety and convenience.

Meanwhile, the construction sector is expected to witness robust growth in the coming years. Styrenic materials, particularly expanded polystyrene (EPS) and acrylonitrile butadiene styrene (ABS), are used extensively in building and construction applications due to their excellent insulation properties, strength-to-weight ratio, and versatility. EPS is commonly used in insulation panels, concrete blocks, and roofing materials, contributing to energy efficiency and sustainability in modern building practices.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Competitive Landscape

The market players are increasing their collaboration and research and development activities to gain a competitive edge in the styrenics market

| Company | Founding Year | Headquarters | Specialities |

| Chevron Phillips Chemical Company LP | 2000 | Texas, United States | Production of ethylene, propylene, polyethylene, alpha-olefins, polyalphaolefins, and aromatic compounds |

| Trinseo S.A. | 2010 | Pennsylvania, United States | Manufacture of a wide range of materials including Acrylonitrile Butadiene Styrene (ABS), polystyrene, polycarbonate, and latex binders |

| Hanwha Group | 1952 | Seoul, South Korea | Sustainable development, including renewable energy initiatives like solar and wind energy, and efforts in hydrogen technology |

| Ineos Group | 2000 | Texas, United States | Manufacture of petrochemicals, speciality chemicals, and oil products |

Other major players in the styrenics market include BASF SE, and NOVA Chemicals, Inc., among others. The players are focusing on a variety of strategies to cater to increasing demand across the automotive, construction, and food processing sectors.

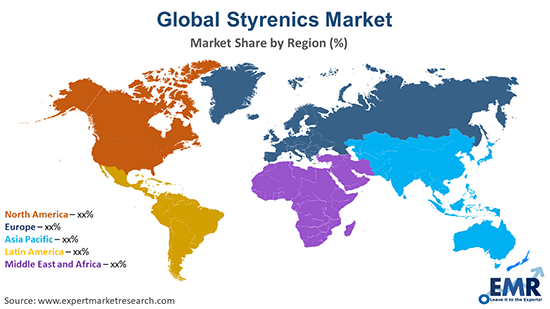

Styrenics Market Analysis by Region

Due to the fast growth of the building and packaging sectors in the Asia Pacific, the region has emerged as the leading market for styrenics. Emerging economies within the region, like India and China, present lucrative growth prospects due to the growing construction, automotive, and packaging sectors within these countries. With the wind energy market expected to benefit from policy measures supporting renewable energy installation, the market is expected to grow at a healthy pace in the coming years.

Over the forecast period, North America and Europe are expected to report modest growth in styrenics market due to market saturation. Most of the market growth is expected to stem from emerging regions due to the growing manufacturing, packaging, and consumer goods sectors, presenting opportunities for market players to invest in product development and technology innovations.

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Snapshot

6.1 Global

6.2 Regional

7 Opportunities and Challenges in the Market

8 Global Styrenics Market Analysis

8.1 Key Industry Highlights

8.2 Global Styrenics Historical Market (2018-2023)

8.3 Global Styrenics Market Forecast (2024-2032)

8.4 Global Styrenics Market by Type

8.4.1 Polystyrene

8.4.1.1 Historical Trend (2018-2023)

8.4.1.2 Forecast Trend (2024-2032)

8.4.2 Acrylonitrile Butadiene

8.4.2.1 Historical Trend (2018-2023)

8.4.2.2 Forecast Trend (2024-2032)

8.4.3 Expanded Polystyrene

8.4.3.1 Historical Trend (2018-2023)

8.4.3.2 Forecast Trend (2024-2032)

8.4.4 Styrene Butadiene Rubber

8.4.4.1 Historical Trend (2018-2023)

8.4.4.2 Forecast Trend (2024-2032)

8.4.5 Unsaturated Polyester Resin

8.4.5.1 Historical Trend (2018-2023)

8.4.5.2 Forecast Trend (2024-2032)

8.4.6 Others

8.5 Global Styrenics Market by End Use

8.5.1 Automotive

8.5.1.1 Historical Trend (2018-2023)

8.5.1.2 Forecast Trend (2024-2032)

8.5.2 Specialty Chemical

8.5.2.1 Historical Trend (2018-2023)

8.5.2.2 Forecast Trend (2024-2032)

8.5.3 Packaging

8.5.3.1 Historical Trend (2018-2023)

8.5.3.2 Forecast Trend (2024-2032)

8.5.4 Construction

8.5.4.1 Historical Trend (2018-2023)

8.5.4.2 Forecast Trend (2024-2032)

8.5.5 Wind Energy

8.5.5.1 Historical Trend (2018-2023)

8.5.5.2 Forecast Trend (2024-2032)

8.5.6 Consumer Goods

8.5.6.1 Historical Trend (2018-2023)

8.5.6.2 Forecast Trend (2024-2032)

8.5.7 Marine Accessories

8.5.7.1 Historical Trend (2018-2023)

8.5.7.2 Forecast Trend (2024-2032)

8.5.8 Others

8.6 Global Styrenics Market by Region

8.6.1 North America

8.6.1.1 Historical Trend (2018-2023)

8.6.1.2 Forecast Trend (2024-2032)

8.6.2 Europe

8.6.2.1 Historical Trend (2018-2023)

8.6.2.2 Forecast Trend (2024-2032)

8.6.3 Asia Pacific

8.6.3.1 Historical Trend (2018-2023)

8.6.3.2 Forecast Trend (2024-2032)

8.6.4 Latin America

8.6.4.1 Historical Trend (2018-2023)

8.6.4.2 Forecast Trend (2024-2032)

8.6.5 Middle East and Africa

8.6.5.1 Historical Trend (2018-2023)

8.6.5.2 Forecast Trend (2024-2032)

9 North America Styrenics Market Analysis

9.1 United States of America

9.1.1 Historical Trend (2018-2023)

9.1.2 Forecast Trend (2024-2032)

9.2 Canada

9.2.1 Historical Trend (2018-2023)

9.2.2 Forecast Trend (2024-2032)

10 Europe Styrenics Market Analysis

10.1 United Kingdom

10.1.1 Historical Trend (2018-2023)

10.1.2 Forecast Trend (2024-2032)

10.2 Germany

10.2.1 Historical Trend (2018-2023)

10.2.2 Forecast Trend (2024-2032)

10.3 France

10.3.1 Historical Trend (2018-2023)

10.3.2 Forecast Trend (2024-2032)

10.4 Italy

10.4.1 Historical Trend (2018-2023)

10.4.2 Forecast Trend (2024-2032)

10.5 Others

11 Asia Pacific Styrenics Market Analysis

11.1 China

11.1.1 Historical Trend (2018-2023)

11.1.2 Forecast Trend (2024-2032)

11.2 Japan

11.2.1 Historical Trend (2018-2023)

11.2.2 Forecast Trend (2024-2032)

11.3 India

11.3.1 Historical Trend (2018-2023)

11.3.2 Forecast Trend (2024-2032)

11.4 ASEAN

11.4.1 Historical Trend (2018-2023)

11.4.2 Forecast Trend (2024-2032)

11.5 Australia

11.5.1 Historical Trend (2018-2023)

11.5.2 Forecast Trend (2024-2032)

11.6 Others

12 Latin America Styrenics Market Analysis

12.1 Brazil

12.1.1 Historical Trend (2018-2023)

12.1.2 Forecast Trend (2024-2032)

12.2 Argentina

12.2.1 Historical Trend (2018-2023)

12.2.2 Forecast Trend (2024-2032)

12.3 Mexico

12.3.1 Historical Trend (2018-2023)

12.3.2 Forecast Trend (2024-2032)

12.4 Others

13 Middle East and Africa Styrenics Market Analysis

13.1 Saudi Arabia

13.1.1 Historical Trend (2018-2023)

13.1.2 Forecast Trend (2024-2032)

13.2 United Arab Emirates

13.2.1 Historical Trend (2018-2023)

13.2.2 Forecast Trend (2024-2032)

13.3 Nigeria

13.3.1 Historical Trend (2018-2023)

13.3.2 Forecast Trend (2024-2032)

13.4 South Africa

13.4.1 Historical Trend (2018-2023)

13.4.2 Forecast Trend (2024-2032)

13.5 Others

14 Market Dynamics

14.1 SWOT Analysis

14.1.1 Strengths

14.1.2 Weaknesses

14.1.3 Opportunities

14.1.4 Threats

14.2 Porter’s Five Forces Analysis

14.2.1 Supplier’s Power

14.2.2 Buyer’s Power

14.2.3 Threat of New Entrants

14.2.4 Degree of Rivalry

14.2.5 Threat of Substitutes

14.3 Key Indicators for Demand

14.4 Key Indicators for Price

15 Value Chain Analysis

16 Price Analysis

16.1 North America Historical Price Trends (2018-2023) & Forecast (2024-2032)

16.2 Europe Historical Price Trends (2018-2023) & Forecast (2024-2032)

16.3 Asia Pacific Historical Price Trends (2018-2023) & Forecast (2024-2032)

16.4 Latin America Historical Price Trends (2018-2023) & Forecast (2024-2032)

16.5 Middle East & Africa Historical Price Trends (2018-2023) & Forecast (2024-2032)

17 Manufacturing Process

17.1 Overview

17.2 Detailed Process Flow

17.3 Operation Involved

18 Competitive Landscape

18.1 Market Structure

18.2 Company Profiles

18.2.1 Chevron Phillips Chemical Company LP

18.2.1.1 Company Overview

18.2.1.2 Product Portfolio

18.2.1.3 Demographic Reach and Achievements

18.2.1.4 Certifications

18.2.2 Trinseo S.A.

18.2.2.1 Company Overview

18.2.2.2 Product Portfolio

18.2.2.3 Demographic Reach and Achievements

18.2.2.4 Certifications

18.2.3 Hanwha Group

18.2.3.1 Company Overview

18.2.3.2 Product Portfolio

18.2.3.3 Demographic Reach and Achievements

18.2.3.4 Certifications

18.2.4 Ineos Group

18.2.4.1 Company Overview

18.2.4.2 Product Portfolio

18.2.4.3 Demographic Reach and Achievements

18.2.4.4 Certifications

18.2.5 BASF SE

18.2.5.1 Company Overview

18.2.5.2 Product Portfolio

18.2.5.3 Demographic Reach and Achievements

18.2.5.4 Certifications

18.2.6 NOVA Chemicals, Inc.

18.2.6.1 Company Overview

18.2.6.2 Product Portfolio

18.2.6.3 Demographic Reach and Achievements

18.2.6.4 Certifications

18.2.7 Others

19 Key Trends and Developments in the Market

Additional Customisations Available

1 Project Requirements and Cost Analysis

1.1 Land, Location, and Site Development

1.2 Construction

1.3 Plant Machinery

1.4 Raw Material

1.5 Packaging

1.6 Transportation

1.7 Utilities

1.8 Manpower

1.9 Other Capital Investment

List of Key Figures and Tables

1. Global Styrenics Market: Key Industry Highlights, 2018 and 2032

2. Global Styrenics Historical Market: Breakup by Type (USD Million), 2018-2023

3. Global Styrenics Market Forecast: Breakup by Type (USD Million), 2024-2032

4. Global Styrenics Historical Market: Breakup by End Use (USD Million), 2018-2023

5. Global Styrenics Market Forecast: Breakup by End Use (USD Million), 2024-2032

6. Global Styrenics Historical Market: Breakup by Region (USD Million), 2018-2023

7. Global Styrenics Market Forecast: Breakup by Region (USD Million), 2024-2032

8. North America Styrenics Historical Market: Breakup by Country (USD Million), 2018-2023

9. North America Styrenics Market Forecast: Breakup by Country (USD Million), 2024-2032

10. Europe Styrenics Historical Market: Breakup by Country (USD Million), 2018-2023

11. Europe Styrenics Market Forecast: Breakup by Country (USD Million), 2024-2032

12. Asia Pacific Styrenics Historical Market: Breakup by Country (USD Million), 2018-2023

13. Asia Pacific Styrenics Market Forecast: Breakup by Country (USD Million), 2024-2032

14. Latin America Styrenics Historical Market: Breakup by Country (USD Million), 2018-2023

15. Latin America Styrenics Market Forecast: Breakup by Country (USD Million), 2024-2032

16. Middle East and Africa Styrenics Historical Market: Breakup by Country (USD Million), 2018-2023

17. Middle East and Africa Styrenics Market Forecast: Breakup by Country (USD Million), 2024-2032

18. North America Historical Price Trends and Forecast 2018-2032

19. Europe Historical Price Trends and Forecast 2018-2032

20. Asia Pacific Historical Price Trends and Forecast 2018-2032

21. Latin America Historical Price Trends and Forecast 2018-2032

22. Middle East and Africa Historical Price Trends and Forecast 2018-2032

23. Global Styrenics Market Structure

The market is projected to grow at a CAGR of 4% between 2024 and 2032.

The major market drivers include the growing packaging and building sectors, the introduction of favourable government initiatives aimed at boosting wind energy, and the surging investments in new product development by key players.

The key trends guiding the market growth include the surging infrastructural development, the rising demand for high-quality styrenics in major end-use sectors, and the growing utilisation of styrenics in the medical device sector owing to their favourable properties.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The different types of styrenics include polystyrene, acrylonitrile butadiene, expanded polystyrene, styrene butadiene rubber, and unsaturated polyester resin, among others.

The major end uses of styrenics are automotive, speciality chemical, packaging, construction, wind energy, consumer goods, and marine accessories, among others.

The major players in the market are Chevron Phillips Chemical Company LP, Trinseo S.A., Hanwha Group, Ineos Group, BASF SE, and NOVA Chemicals, Inc., among others.

The global styrenics market is being driven by rising demand from the end-use sectors. Aided by the growing technological advancements, the market is expected to witness a moderate growth in the forecast period of 2024-2032, growing at a CAGR of 4%.

EMR’s meticulous research methodology delves deep into the market, covering the macro and micro aspects of the industry. By type, the industry is segmented into polystyrene, acrylonitrile butadiene, expanded polystyrene, styrene butadiene rubber, and unsaturated polyester resin, among others. Based on end use, the industry is divided into automotive, specialty chemical, packaging, construction, wind energy, consumer goods, and marine accessories, among others. The major regional markets for styrenics are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa, with the Asia Pacific accounting for the largest share of the market. The key players in the above market include Chevron Phillips Chemical Company LP, Trinseo S.A., Hanwha Group, Ineos Group, BASF SE, and NOVA Chemicals, Inc., among others.

EMR’s research methodology uses a combination of cutting-edge analytical tools and the expertise of their highly accomplished team, thus, providing their customers with market insights that are accurate, actionable, and help them remain ahead of their competition.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.