Reports

Sale

Global Almond Ingredients Market Size, Share, Forecast: By Type: Whole Almonds, Almond Pieces, Almond Flour, Almond Milk, Others; By Application: Bakery and Confectionery, Milk Substitutes and Ice Creams, Nut and Seed Butters, RTE Cereals, Others; Regional Analysis; Market Dynamics: SWOT Analysis; Competitive Landscape; 2024-2032

Global Almond Ingredients Market Outlook

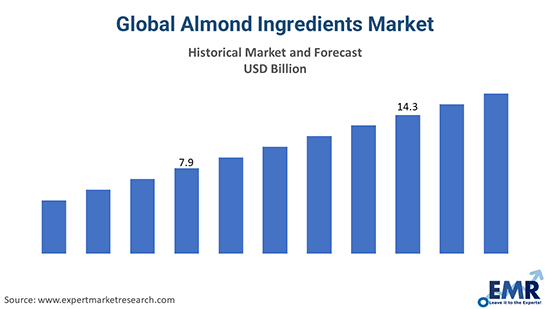

The global almond ingredients market size was valued at USD 12.40 billion in 2023. The market is further projected to grow at a CAGR of 10.5% between 2024 and 2032, reaching a value of USD 30.37 billion by 2032.

Key Takeaways

- California produces 80% of the global almond supply, making it the world’s largest grower of almonds.

- In 2022, the United States was the world's leading supplier of almonds and exported roughly 1.9 billion pounds to China, India, Spain, and the United Arab Emirates.

- About 162,000 metric tons of almonds were imported into India in 2021.

- The import value of in-shell almonds to Turkey amounted to about USD 35.6 million in 2022.

Almond ingredients are products derived from almonds, such as almond milk, almond flour, almond butter, almond oil, and almond protein. Almond ingredients are widely used in food and beverage, cosmetics, pharmaceuticals, and personal care industries, as they offer various health benefits, such as lowering cholesterol, improving skin health, and enhancing cognitive functions.

The almond ingredients market outlook is being influenced by several key factors, such as the increasing demand for plant-based products, the rising awareness of the nutritional value of almonds, the growing popularity of gluten-free and vegan diets, and the expanding applications of almond ingredients in various sectors.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Key Trends and Developments

Growing consumer preference for plant-based and gluten-free products and increasing awareness of the health benefits of almonds is driving the almond ingredients market growth

| Date | Company | Event |

| December 2023 | Blue Diamond | Introduced Almond Breeze Original Almond & Oat Blend, a beverage with almond and oat milk. It offers less sugar and fewer calories than regular milk, and 50% more calcium than dairy milk. |

| December 2023 | ADM | Acquired Revela Foods, a Wisconsin-based manufacturer of innovative dairy flavour ingredients for adding innovative enzyme technology to ADM’s portfolio. |

| March 2023 | Treehouse Almonds | Received the New Hope Regeneration and Sustainability Award alongside The Almond Project Partners. |

| April 2022 | Galaxy | Introduced a vegan white chocolate bar with a combination of creamy almond paste and rich cocoa butter. |

| Trends | Impact |

| Growing consumer preference for plant-based and gluten-free products | This leads to increasing demand for almond ingredients, which offer a high nutritional value and a versatile application in various food and beverage categories, such as almond milk, flour, and butter. |

| Increasing awareness of the health benefits of almonds | Almonds are rich in protein, fibre, healthy fats, vitamins, minerals, and antioxidants, which can help lower cholesterol, blood pressure, blood sugar, and inflammation. These health benefits attract health-conscious consumers. |

| Rising demand for clean label and organic products | Consumers are looking for products that are free from artificial additives, preservatives, pesticides, and GMOs. Almond ingredients can meet these expectations, as they are naturally derived and can be certified organic. |

| Innovation and new product development in the almond ingredients market | Almond ingredients are versatile and can be used in various forms, such as whole, sliced, diced, flour, milk, butter, oil, paste, and protein. They can also be used to create novel products, such as almond yoghurt, cheese, ice cream, and beverages that cater to the vegetarian and lactose-intolerant consumers. |

Global Almond Ingredients Market Trends

Almond is one of the nutritionally rich dry fruits as it contains carbohydrates, protein, vitamins, and other minerals. Almonds have positive health characteristics, and a large proportion of global population consumes them. For instance, almond milk is commonly consumed by people who are lactose intolerant and cannot consume regular milk. Furthermore, almond products are widely used in bakery, confectionery, sweets and bars, and ice creams, which has increased the almond ingredients market value.

Furthermore, the almond ingredients market expansion can be ascribed to the increasing snack food industry, the inclusion of health-based ingredients, the rising introduction of almond-based goods, associations, and organisations supporting the sector of almond ingredients, and technological advances allowing raw material trade.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Segmentation

Global Almond Ingredients Market Report and Forecast 2024-2032 offers a detailed analysis of the market based on the following segments:

| Market Breakup | Categories |

| Type | Whole Almonds, Almond Pieces, Almond Flour, Almond Milk, Others |

| Application | Bakery and Confectionery, Milk Substitutes and Ice Creams, Nut and Seed Butters, RTE Cereals, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Bakery and confectionery segment to hold the leading market share due to the rising demand for gluten-free, vegan, and organic bakery items

Bakeries and confectioneries are the largest and fastest-growing application segment of the global almond ingredients market. Almond ingredients are used to enhance the taste, texture, and appearance of various bakery and confectionery products, such as cakes, cookies, chocolates, candies, and bars. They also provide health benefits, such as high protein, fibre, vitamin E, and healthy fats, to the consumers of bakery and confectionery products. The rising demand for gluten-free, vegan, and organic bakery and confectionery products is driving the growth of this segment.

Milk substitutes and ice creams are another significant application in the almond ingredients market. Almond ingredients are used to produce dairy alternatives, such as almond milk, almond yoghurt, almond cheese, and almond ice cream, which cater to the growing vegan, lactose-intolerant, and health-conscious consumers. Almond milk is the most popular and widely consumed plant-based milk, as it offers a creamy texture, a nutty flavour, and a high nutritional value. It is also used as an ingredient in various beverages, such as coffee, tea, smoothies, and shakes.

According to almond ingredients market analysis, nut and seed butters are another important application that will gain traction in the forecast period. Almond ingredients are used to produce almond butter, which is a spreadable paste made from roasted or raw almonds. Almond butter is a rich source of protein, fibre, healthy fats, antioxidants, and minerals, and has a smooth and creamy texture. Almond butter is widely being used as a spread on bread, crackers, and muffins, as well as a dip for fruits, vegetables, and snacks, which can impact the overall almond ingredients market size.

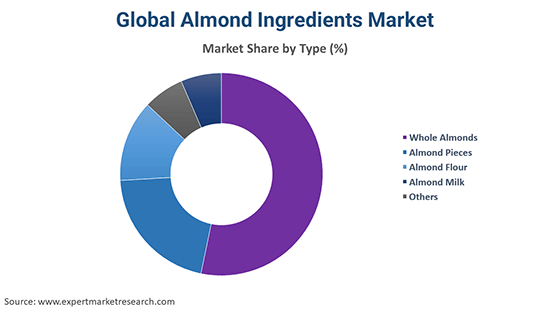

Whole almonds are high in demand due to growing preference for healthy snacks variants

Whole almonds are anticipated to lead the almond ingredients market share as whole almonds are consumed as snacks, or used as toppings, fillings, or coatings in various food products. Whole almonds are rich in protein, fibre, healthy fats, antioxidants, and minerals, and can help lower cholesterol, blood pressure, and blood sugar levels. The demand for whole almonds is expected to increase due to the growing preference for healthy and natural snacks, and the rising awareness of the nutritional benefits of almonds.

Almond pieces, on the other hand, are chopped or sliced almonds that are used as ingredients in various food products, such as bakeries, confectionery, cereals, bars, and spreads. Almond pieces add crunch, texture, flavour, and visual appeal to food products, and enhance their nutritional value. The demand for almond pieces is expected to increase due to the growing diversification of food products that incorporate almonds, and the increasing consumer preference for plant-based and gluten-free products.

Almond flour is a finely ground almond meal that is used as a substitute for wheat flour in various food products, such as bakery, confectionery, and pasta. Almond flour is gluten-free, low-carb, high-protein, and high-fibre, and can help improve blood lipid profiles, insulin sensitivity, and satiety. As per the almond ingredients market insights, demand for almond flour is expected to increase due to the growing consumer demand for gluten-free, low-carb, and keto-friendly products, and the increasing awareness of the health benefits of almond flour.

Almond milk is a plant-based beverage that is made from almonds and water, and sometimes enriched with vitamins and minerals. Almond milk is lactose-free, dairy-free, soy-free, and low-calorie, and can help reduce the risk of cardiovascular diseases, diabetes, and obesity. This segment may capture a significant almond ingredients market share in the forecast period as the demand for almond milk have increased due to the growing consumer preference for plant-based and vegan products, and the increasing availability and affordability of almond milk.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Competitive Landscape

Market players are incorporating almond ingredients into food products to cater to growing consumer demand, further increasing their acquisitions to enhance their product portfolio

| Company Name | Year Founded | Headquarters | Products/Services |

| Olam International Limited | 1989 | Singapore | Agricultural products, food ingredients, packaged foods, and sustainability solutions |

| Barry Callebaut Group | 1996 | Zurich, Switzerland | Cocoa and chocolate products, fillings, decorations, and services |

| Blue Diamond Growers | 1910 | California, United States | Almonds and almond-based products, such as snacks, beverages, and ingredients |

| Archer Daniels Midland Company | 1902 | Illinois, United States | Grains, oilseeds, animal feed, biofuels, food and beverage ingredients, and health and wellness products |

Other key players in the global almond ingredients market include Kind LLC, John B. Sanfilippo & Son, Inc., Borges Agricultural & Industrial Nuts, S.A., and Almondco Australia Ltd, among others.

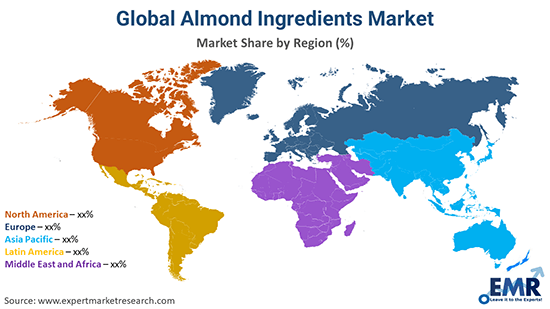

Global Almond Ingredients Market Analysis by Region

North America dominates the market as the region is the largest consumer, exporter, and producer of almonds and almond ingredients

North America has the largest market for almond ingredients and the region is expected to maintain its dominance throughout the forecast period, owing to the high consumption of almonds and almond products, especially in the United States. The US is the world's largest producer and exporter of almonds, and the largest consumer of almond ingredients. The US almond industry is also supported by the Almond Board of California, which promotes the research, innovation, and marketing of almonds and by-products. According to almond ingredients market report, the growing demand for almond ingredients in North America is attributed to the rising awareness about the health benefits of almonds, such as lowering cholesterol, improving heart health, and enhancing cognitive function.

Meanwhile, the increasing demand of almond ingredients in the Latin America region is influenced by global trends and innovations, such as the rising demand for natural, organic, vegan, and clean-label products. Brazil, Mexico, Argentina, and Chile are contributing to the growth of the Latin American almond ingredients market are as they have a large and growing population, a strong and diverse food and beverage industry, and a high consumption of nuts and dried fruits. Some of the key players operating in this region are Olam International, Savencia SA, and Blue Diamond Growers. In 2020, Olam International acquired a 100% stake in Chile-based Nutrifoods, a leading producer of almond ingredients, for USD 108 million, which enhanced Olam’s offerings in the almond market of Latin America.

Europe almond ingredients market is expected to witness a moderate growth rate in the coming years due to the high consumption of almonds, especially in Spain, Germany, France, Italy, and the UK. Almonds are a traditional ingredient in European cuisine, as they are used in various dishes, such as marzipan, nougat, macarons, and almond croissants. The almond ingredients market in Europe is also driven by the growing adoption of almond ingredients by food manufacturers and restaurants, who are seeking to offer differentiated products, such as almond milk, almond butter, and almond protein, to their customers. In 2020, Bredabest launched a new product line of almond ingredients, called Bredabest Organic, which was certified organic by the European Union. It offers a range of almond products, such as almond flour, almond paste, and almond butter.

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Snapshot

6.1 Global

6.2 Regional

7 Opportunities and Challenges in the Market

8 Global Almond Ingredients Market Analysis

8.1 Key Industry Highlights

8.2 Global Almond Ingredients Historical Market (2018-2023)

8.3 Global Almond Ingredients Market Forecast (2024-2032)

8.4 Global Almond Ingredients Market by Type

8.4.1 Whole Almonds

8.4.1.1 Historical Trend (2018-2023)

8.4.1.2 Forecast Trend (2024-2032)

8.4.2 Almond Pieces

8.4.2.1 Historical Trend (2018-2023)

8.4.2.2 Forecast Trend (2024-2032)

8.4.3 Almond Flour

8.4.3.1 Historical Trend (2018-2023)

8.4.3.2 Forecast Trend (2024-2032)

8.4.4 Almond Milk

8.4.4.1 Historical Trend (2018-2023)

8.4.4.2 Forecast Trend (2024-2032)

8.4.5 Others

8.5 Global Almond Ingredients Market by Application

8.5.1 Bakery and Confectionery

8.5.1.1 Historical Trend (2018-2023)

8.5.1.2 Forecast Trend (2024-2032)

8.5.2 Milk Substitutes and Ice Creams

8.5.2.1 Historical Trend (2018-2023)

8.5.2.2 Forecast Trend (2024-2032)

8.5.3 Nut and Seed Butters

8.5.3.1 Historical Trend (2018-2023)

8.5.3.2 Forecast Trend (2024-2032)

8.5.4 RTE Cereals

8.5.4.1 Historical Trend (2018-2023)

8.5.4.2 Forecast Trend (2024-2032)

8.5.5 Others

8.6 Global Almond Ingredients Market by Region

8.6.1 North America

8.6.1.1 Historical Trend (2018-2023)

8.6.1.2 Forecast Trend (2024-2032)

8.6.2 Europe

8.6.2.1 Historical Trend (2018-2023)

8.6.2.2 Forecast Trend (2024-2032)

8.6.3 Asia Pacific

8.6.3.1 Historical Trend (2018-2023)

8.6.3.2 Forecast Trend (2024-2032)

8.6.4 Latin America

8.6.4.1 Historical Trend (2018-2023)

8.6.4.2 Forecast Trend (2024-2032)

8.6.5 Middle East and Africa

8.6.5.1 Historical Trend (2018-2023)

8.6.5.2 Forecast Trend (2024-2032)

9 North America Almond Ingredients Market Analysis

9.1 United States of America

9.1.1 Historical Trend (2018-2023)

9.1.2 Forecast Trend (2024-2032)

9.2 Canada

9.2.1 Historical Trend (2018-2023)

9.2.2 Forecast Trend (2024-2032)

10 Europe Almond Ingredients Market Analysis

10.1 United Kingdom

10.1.1 Historical Trend (2018-2023)

10.1.2 Forecast Trend (2024-2032)

10.2 Germany

10.2.1 Historical Trend (2018-2023)

10.2.2 Forecast Trend (2024-2032)

10.3 France

10.3.1 Historical Trend (2018-2023)

10.3.2 Forecast Trend (2024-2032)

10.4 Italy

10.4.1 Historical Trend (2018-2023)

10.4.2 Forecast Trend (2024-2032)

10.5 Others

11 Asia Pacific Almond Ingredients Market Analysis

11.1 China

11.1.1 Historical Trend (2018-2023)

11.1.2 Forecast Trend (2024-2032)

11.2 Japan

11.2.1 Historical Trend (2018-2023)

11.2.2 Forecast Trend (2024-2032)

11.3 India

11.3.1 Historical Trend (2018-2023)

11.3.2 Forecast Trend (2024-2032)

11.4 ASEAN

11.4.1 Historical Trend (2018-2023)

11.4.2 Forecast Trend (2024-2032)

11.5 Australia

11.5.2 Historical Trend (2018-2023)

11.5.2 Forecast Trend (2024-2032)

11.6 Others

12 Latin America Almond Ingredients Market Analysis

12.1 Brazil

12.1.1 Historical Trend (2018-2023)

12.1.2 Forecast Trend (2024-2032)

12.2 Argentina

12.2.1 Historical Trend (2018-2023)

12.2.2 Forecast Trend (2024-2032)

12.3 Mexico

12.3.1 Historical Trend (2018-2023)

12.3.2 Forecast Trend (2024-2032)

12.4 Others

13 Middle East and Africa Almond Ingredients Market Analysis

13.1 Saudi Arabia

13.1.1 Historical Trend (2018-2023)

13.1.2 Forecast Trend (2024-2032)

13.2 United Arab Emirates

13.2.1 Historical Trend (2018-2023)

13.2.2 Forecast Trend (2024-2032)

13.3 Nigeria

13.3.1 Historical Trend (2018-2023)

13.3.2 Forecast Trend (2024-2032)

13.4 South Africa

13.4.1 Historical Trend (2018-2023)

13.4.2 Forecast Trend (2024-2032)

13.5 Others

14 Market Dynamics

14.1 SWOT Analysis

14.1.1 Strengths

14.1.2 Weaknesses

14.1.3 Opportunities

14.1.4 Threats

14.2 Porter’s Five Forces Analysis

14.2.1 Supplier’s Power

14.2.2 Buyer’s Power

14.2.3 Threat of New Entrants

14.2.4 Degree of Rivalry

14.2.5 Threat of Substitutes

14.3 Key Indicators for Demand

14.4 Key Indicators for Price

15 Value Chain Analysis

16 Competitive Landscape

16.1 Market Structure

16.2 Company Profiles

16.2.1 Olam International Limited

16.2.1.1 Company Overview

16.2.1.2 Product Portfolio

16.2.1.3 Demographic Reach and Achievements

16.2.1.4 Certifications

16.2.2 Barry Callebaut Group

16.2.2.1 Company Overview

16.2.2.2 Product Portfolio

16.2.2.3 Demographic Reach and Achievements

16.2.2.4 Certifications

16.2.3 Blue Diamond Growers

16.2.3.1 Company Overview

16.2.3.2 Product Portfolio

16.2.3.3 Demographic Reach and Achievements

16.2.3.4 Certifications

16.2.4 Kind LLC

16.2.4.1 Company Overview

16.2.4.2 Product Portfolio

16.2.4.3 Demographic Reach and Achievements

16.2.4.4 Certifications

16.2.5 Archer Daniels Midland Company (NYSE: ADM)

16.2.5.1 Company Overview

16.2.5.2 Product Portfolio

16.2.5.3 Demographic Reach and Achievements

16.2.5.4 Certifications

16.2.6 John B. Sanfilippo & Son, Inc.

16.2.6.1 Company Overview

16.2.6.2 Product Portfolio

16.2.6.3 Demographic Reach and Achievements

16.2.6.4 Certifications

16.2.7 Borges Agricultural & Industrial Nuts, S.A.

16.2.7.1 Company Overview

16.2.7.2 Product Portfolio

16.2.7.3 Demographic Reach and Achievements

16.2.7.4 Certifications

16.2.8 Almondco Australia Ltd

16.2.8.1 Company Overview

16.2.8.2 Product Portfolio

16.2.8.3 Demographic Reach and Achievements

16.2.8.4 Certifications

16.2.8 Others

17 Key Trends and Developments in the Market

List of Key Figures and Tables

1. Global Almond Ingredients Market: Key Industry Highlights, 2018 and 2032

2. Global Almond Ingredients Historical Market: Breakup by Type (USD Billion), 2018-2023

3. Global Almond Ingredients Market Forecast: Breakup by Type (USD Billion), 2024-2032

4. Global Almond Ingredients Historical Market: Breakup by Application (USD Billion), 2018-2023

5. Global Almond Ingredients Market Forecast: Breakup by Application (USD Billion), 2024-2032

6. Global Almond Ingredients Historical Market: Breakup by Region (USD Billion), 2018-2023

7. Global Almond Ingredients Market Forecast: Breakup by Region (USD Billion), 2024-2032

8. North America Almond Ingredients Historical Market: Breakup by Country (USD Billion), 2018-2023

9. North America Almond Ingredients Market Forecast: Breakup by Country (USD Billion), 2024-2032

10. Europe Almond Ingredients Historical Market: Breakup by Country (USD Billion), 2018-2023

11. Europe Almond Ingredients Market Forecast: Breakup by Country (USD Billion), 2024-2032

12. Asia Pacific Almond Ingredients Historical Market: Breakup by Country (USD Billion), 2018-2023

13. Asia Pacific Almond Ingredients Market Forecast: Breakup by Country (USD Billion), 2024-2032

14. Latin America Almond Ingredients Historical Market: Breakup by Country (USD Billion), 2018-2023

15. Latin America Almond Ingredients Market Forecast: Breakup by Country (USD Billion), 2024-2032

16. Middle East and Africa Almond Ingredients Historical Market: Breakup by Country (USD Billion), 2018-2023

17. Middle East and Africa Almond Ingredients Market Forecast: Breakup by Country (USD Billion), 2024-2032

18. Global Almond Ingredients Market Structure

In 2023, the almond ingredients market reached an approximate value of USD 12.40 billion.

The market is expected to grow at a CAGR of 10.5% between 2024 and 2032.

The market is estimated to witness a healthy growth in the forecast period of 2024-2032 to reach USD 30.37 billion by 2032.

The major drivers of the market include the growing snacking culture, new product developments, growing consumer preference for plant-based and gluten-free products.

Key trends aiding almond ingredients market expansion include increasing inclusion of healthy ingredients in food, increasing awareness of the health benefits of almonds, and the rising demand for lactose-free food.

Almonds offer various health benefits such as managing weight due to their low carbohydrate content and high protein, healthy fats, and fibre content. They also boost bone health as they contain essential nutrients like calcium, magnesium, and vitamin K. Additionally, almonds may help in reducing heart disease risk by improving lipid levels.

The major regions in the market are North America, Latin America, Europe, the Middle East and Africa, and Asia Pacific.

The leading types of almond ingredients in the market are whole almonds, almond pieces, almond flour, and almond milk, among others.

The significant applications of almond ingredients are bakery and confectionery, milk substitutes and ice creams, nut and seed butters, and RTE cereals, among others.

Key players in the market are Olam International Limited, Barry Callebaut Group, Blue Diamond Growers, Kind LLC, Archer Daniels Midland Company, John B. Sanfilippo & Son, Inc., Borges Agricultural & Industrial Nuts, S.A., and Almondco Australia Ltd, among others.

The global almond ingredients market attained a value of USD 12.40 billion in 2023, driven by the growing snack food industry. Aided by the increasing inclusion of health-based ingredients in food, the market is expected to witness a further growth in the forecast period of 2024-2032, growing at a CAGR of 10.5%. The market is projected to reach USD 30.37 billion by 2032.

EMR’s meticulous research methodology delves deep into the market, covering the macro and micro aspects of the industry. Based on type, the almond ingredients industry can be segmented into whole almonds, almond pieces, almond flour, almond milk, and others. On the basis of application, the almond ingredients market is divided into bakery and confectionery, milk substitutes and ice creams, nut and seed butters, RTE cereals, and others. The major regional markets for almond ingredients are North America, Latin America, Europe, the Middle East and Africa, and the Asia Pacific. The key players in the above market include Olam International Limited, Barry Callebaut Group, Blue Diamond Growers, Kanegrade Ltd, Archer Daniels Midland Company (NYSE: ADM), John B. Sanfilippo & Son, Inc., Borges Agricultural & Industrial Nuts, S.A., and Almondco Australia Ltd, among others.

EMR’s research methodology uses a combination of cutting-edge analytical tools and the expertise of their highly accomplished team, thus, providing their customers with market insights that are accurate, actionable, and help them remain ahead of their competition.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.