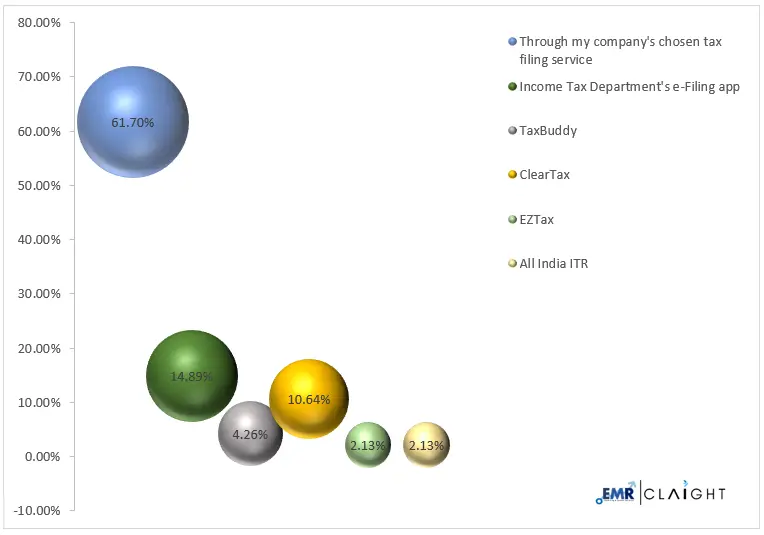

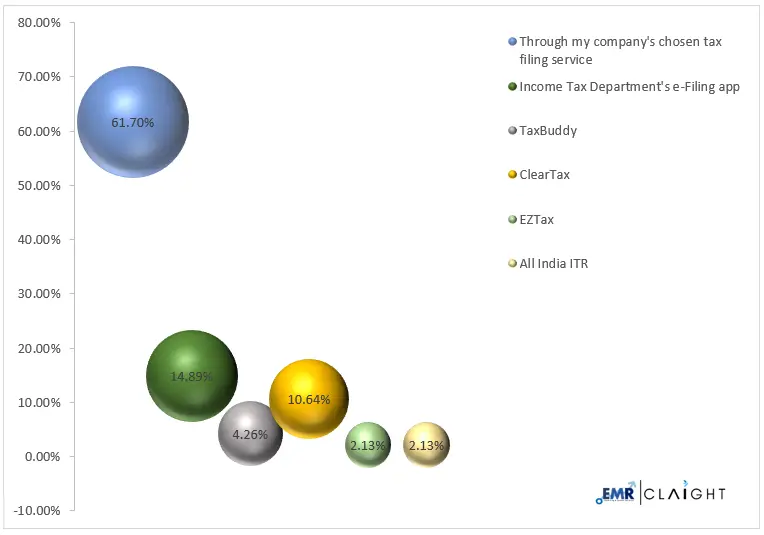

In a recent survey conducted by the expert market research, it was revealed that more than 61% of the total participants preferred to file their taxes using the company’s chosen financial service due to the expertise that comes along with it, which still hasn’t been mastered by fintech apps.

Tax filing is an annual task which approaches the income earners with various issues of accuracy and security. For such a complex activity, it is noticed that consumers invest their trust more in individuals holding required knowledge and skills rather than an AI based app, with no personal touch.

Tax Filing Preferences Of Working Professionals

Similar insights were drawn in a study conducted by the Expert market research across 25 cities to understand how people file their taxes and which apps they usually use.

The study revealed that 61.70% of the total respondents prefer to pay their taxes through the tax filing service being offered by the company they are working in. the second most used method remains the Income tax department’s e-filling app, being the choice of 14.89% of the respondents. One app closely following this is ClearTax being used by 10.64% of the participants. The remaining go for other apps available in the market namely TaxBuddy, EZTax and All india ITR with 4.26%, 2.13% and 2.13% respectively. This clearly indicates that despite the wide range of apps available to make this complex process easier in the market, people still opt for the filing system being offered at their company.

While tax preparation apps promise convenience and efficiency, they are yet to gain the trust of the masses who have the fear of making mistakes along with the confusion that comes with rapidly changing laws and customs. This makes them stick to the traditional methods of filing their taxes.

How Do People File Their Taxes

For instance, users have reported their concerns regarding safety and accuracy. They face issues such as software failure, the creation of unseen errors and a slow tedious process in tax paying apps.

Thus, it is noticed that people still trust their companies in tax filing due to the familiarity and trust in these services offer along with a sense of security that many users find reassuring. Additionally, the complexities of tax laws can be a hectic task which leads to them favouring professional guidance. This professional guidance is usually also sought from Chartered accountants who stay updated with all the latest regulations and keep their clients well informed and compliant with their support the whole year. People still trust these personalized services over e-filing apps.

Our study also offers the analysis of other necessary factors to study consumer behaviours regarding tax preparation, fintech apps, frequency of using these apps and the variety liked by them the most to offer targeted support to these companies.

Share