In today’s vibrant market of fragrances, where choices abound from luxury to budget-friendly options, Gen Z’s preferences provide fascinating insights into how brands stack up in their daily lives. The latest study by Expert Market Research conducted across PAN India with 85,000 respondents meticulously examines the Gen Z consumer preferences, shedding light on the intriguing dynamics of perfume and deodorant usage among young consumers.

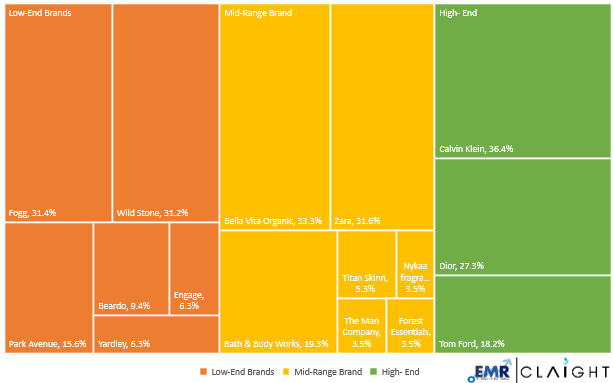

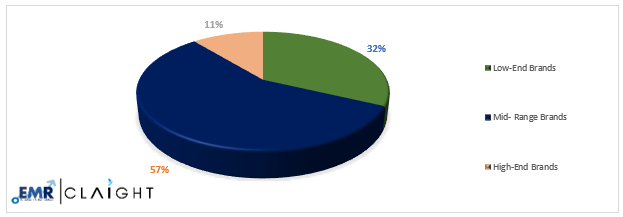

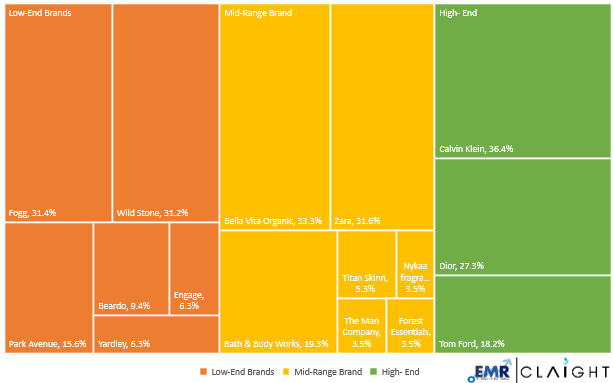

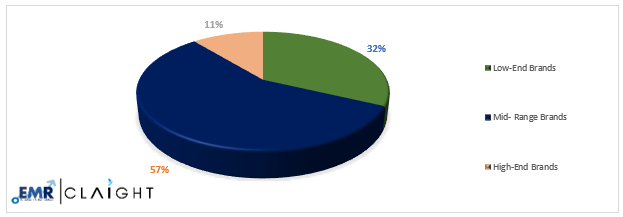

Expert Market Research case study categorizes fragrances into three main tiers, which are low-end, mid-range, and high-end brands, each attracting a distinct segment of the Gen Z demographic. The low-end brands, comprising choices like Fogg (31.4%) and Wild Stone (31.2%), collectively hold a 32% share of the market. These brands like Fogg and Wild stone are also widely used by men and are particularly appealing to the younger population due to their affordability and accessibility, making them a go-to for everyday use.

Fragrances Into Three Main Tiers Low End Mid Range And High End Brands

Mid-range brands are dominating the landscape of young perfume users with a significant 57% market share. Bella Vita Organic leads the segment with 33.3%, followed closely by Zara at 31.6%. The popularity of mid-range brands suggests a preference for products that offer a balance between quality and cost-effectiveness as this caters to their lifestyle aspirations of Gen Z without breaking the bank.

High-end brands like Calvin Klein (36.4%) and Dior (27.3%) capture a smaller but yet notable, 11% of the of the Gen Z market. The less frequented premium brands by Gen Z due to higher prices, represents a niche of young consumers who prioritize premium quality and brand prestige in their fragrance choices. As there are consumers who wish to own premium brands and consider it status symbol.

The Case review by expert market research looks at the prevailing trend among Gen Z indicates a clear tilt towards mid-range brands. The premium shift can be attributed to their growing interest in personal grooming, the need for smelling good and fashion, coupled with a sensible approach to budgeting. Mid- Range Brands like Bath & Body Works and Zara not only offer aesthetically pleasing products but also fragrances that resonate with the youthful, trendy, and socially aware persona of Gen Z consumers.

The Prevailing Trend Among Gen-Z Indicates A Clear Tilt Towards Mid Range Brands

The appeal of organic and artisanal options like Bella Vita Organic and Forest Essentials highlights a broader movement towards sustainability and ethical consumerism, factors that are increasingly influencing purchasing decisions among younger shoppers.

The insight from our study looks into various consumer preferences and behavioural patterns which are highly important for fragrance brands aiming to capture or expand their reach within the Gen Z demographic. The strong inclination towards mid-range brands underscores the importance of value for money in the decision-making process. The consumer study sheds light on the steady interest in high-end fragrances, despite their smaller market share as this suggests that there is substantial potential for luxury brands to tap into this segment by aligning with the values and expectations of young consumers.

The study delves into fragrance preferences among Gen Z and further reveals a complex interplay of affordability, brand loyalty, and the pursuit of quality. For market players, understanding these nuances is key to crafting strategies that resonate with this influential consumer group.

Share