The global buy now pay later market was valued at approximately USD 10.22 Billion in 2025 and is expected to grow at a CAGR of 27.60% during 2026–2035, reaching around USD 116.94 Billion by 2035. As per the analysis by Expert Market Research, the market is expected to be driven by rising convenience offered by buy now pay later solutions.

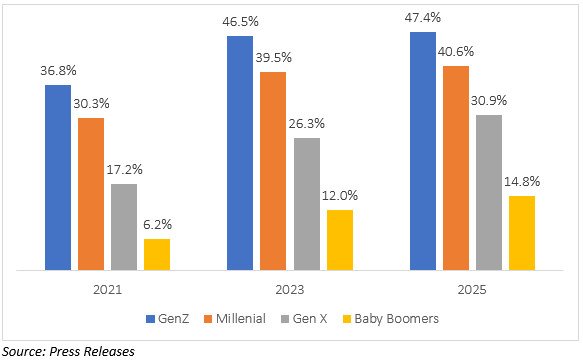

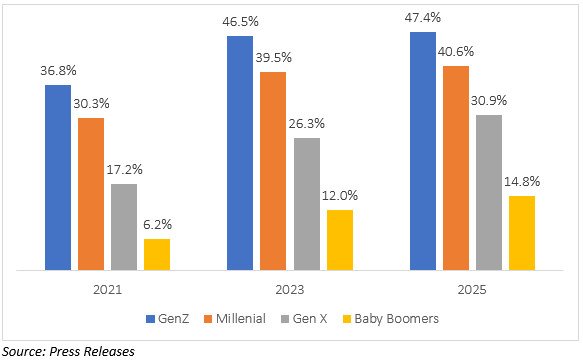

Buy now pay later (BNPL) allows customers to make purchases without needing to pay the entire cost during checkout. It is a short-term finance solution that splits the purchase cost into equal instalments which can be paid later. An expanding Gen Z and Millennial population is increasing the adoption of Buy Now, Pay Later. BNPL provides the younger generations with the benefits of better transparency, immediacy, and improved customer experience. The integration of BNPL options into online shopping platforms has enhanced consumer’s shopping experience, helping users to make instant purchases without any upfront payment.

Figure: BNPL Users by Generation (2021-2025)

By incorporating digital currencies into their platforms, BNPL solution producers can cater to users who increasingly use cryptocurrencies for digital payments. Additionally, the adoption of strategic measures such as acquisition and partnerships can help market players make their financial system more accessible for small merchants, further extending their market outreach and propelling the buy now pay later market growth.

Buy now, pay later (BNPL) firms are increasingly looking to drive profits and are turning toward a subscription model to generate reliable revenue. For instance, in January 2024, Klarna Inc., a provider of BNPL services launched Klarna Plus, a subscription program charging USD 7.99 per month. The solution waives service fees on the company’s One Time Card, provides exclusive discounts at select merchants and doubles rewards points. The subscription-based model is aimed to enhance the shopping experience and deepen the company's engagement with its 37 million customers in the United States. Other companies that have explored the subscription-based buy now pay later model include AfterPay Limited and Affirm Holdings Inc.

Top Buy Now Pay Later Companies in the World:

1. Affirm Holdings Inc.

| Headquarters: |

California, United States |

| Establishment: |

2012 |

| Website: |

https://investors.affirm.com/ |

Affirm delivers financial products for digital and mobile-first commerce. Its products are aimed at making it easier for consumers to spend with confidence and responsibly. Additionally, financial products make it easier for merchants to expand their growth and sales. As of September 30, 2023, Affirm, had over 16.9 million active consumers and over USD 21 billion gross merchandise volume.

2. Klarna Inc.

| Headquarters: |

Stockholm, Sweden |

| Establishment: |

2005 |

| Website: |

https://www.klarna.com/ |

Around 150 million customers use Klarna’s flexible payment options. Its platforms offer fast checkout and a safe shopping experience to customers at its more than 20,000 partner stores. Brands using Klarna’s buy now pay later platform include Nike, Instacart, Valentino, Versace, Boden, Fenty Beauty, Sephora, and Wish, among others. Klarna witnesses 2 million transactions daily. The company’s financial platform is live in 45 countries globally.

3. Splitit Payments, Ltd.

| Headquarters: |

Georgia, United States |

| Establishment: |

2008 |

| Website: |

https://www.splitit.com/ |

Splitit’s merchant-branded Installments-as-a-Service platform facilitates Buy Now, Pay Later (BNPL) for customers and merchants. The company uses a single network application programming interface (API) to provide BNPL services at the point of sale for card networks, issuers, and acquirers. Its advanced platform also solves the challenges businesses face with legacy BNPL platforms. The company serves several markets, including home and furniture, jewellery, automotive, education, and sports and outdoors.

4. Sezzle Inc.

| Headquarters: |

Minnesota, United States |

| Establishment: |

2017 |

| Website: |

https://sezzle.com/ |

Sezzle is a payments company with a robust digital payment platform. The platform provides consumers with a flexible alternative to the traditional credit system, increasing their convenience. As of September 30, 2023, Sezzle had 2.6 million active consumers, USD 1.7 billion underlying merchant sales, 210,000 active subscribers, and 30,000 active merchants. The company’s instalment payment platform also offers subscription-based service for shoppers.

5. Perpay Inc.

| Headquarters: |

Pennsylvania, United States |

| Establishment: |

2017 |

| Website: |

https://perpay.com/ |

Perpay is a fintech firm revolutionising how people pay for purchases. It offers a cutting-edge alternative to traditional payment methods with its buy now, pay later platform. The company's platform allows automatic payments from consumer’s paychecks, making it easy for them to build positive credit history. The company’s partner firms include JP Morgan Chase & Co., First Round, and Experian.

6. Zip Co, Ltd.

| Headquarters: |

Sydney, Australia |

| Establishment: |

2013 |

| Website: |

https://zip.co/ |

Zip is a renowned digital financial services company. It provides fair and seamless solutions for shoppers. Its core markets are Australia, New Zealand, and the United States of America. Zip provides consumers with flexibility, allowing them to pay at their convenience. It allows consumers to align their repayments to suit their pay cycle and pay either weekly, fortnightly, or monthly.

7. PayPal Holdings, Inc.

| Headquarters: |

California, United States |

| Establishment: |

1998 |

| Website: |

https://www.paypal.com/ |

PayPal Holdings, Inc. is a prominent company in the digital payment landscape. The company connects people and businesses in over 200 markets across the globe. As of 2022, the company had 435 million active consumer and merchant accounts that made 22.3 billion payment transactions. It offers its buy now pay later customers the “Pay in 4” or “Pay monthly” option while providing them the flexibility of making small or large purchases from USD 30 to USD 10,000.

8. AfterPay Limited

| Headquarters: |

Victoria, Australia |

| Establishment: |

2014 |

| Website: |

https://corporate.afterpay.com/ |

Afterpay has hundreds of thousands of merchant partners and millions of customers using its platform across Australia, the United States, Canada, New Zealand, and the United Kingdom, where the platform is called Clearpay. Afterpay empowers customers to access the things they require while providing them with financial wellness and control. It splits by payments in four, for both online and in-store purchases.

9. HSBC Group

| Headquarters: |

London, United Kingdom |

| Establishment: |

1865 |

| Website: |

https://www.hsbc.com/ |

HSBC is one of the major banking and financial services organisations in the world. It serves around 39 million customers, globally. It has a presence in over 62 countries. The company allows its BNPL customers to pay in three ways, including an interest-free period between 14 and 30 days, in instalments, or as a normal loan payment.

10. Payl8r

| Headquarters: |

United Kingdom |

| Establishment: |

2016 |

| Website: |

https://www.payl8r.com/ |

Payl8r is a financial company offering customers a modern, flexible, and convenient method of paying for goods. The company’s payment solutions plugin to major e-commerce platforms, such as Shopify, WordPress, WIX, WooCommerce, and Opencart, among others. Additionally, the company can create a customised solution as per the needs of the user.

Share