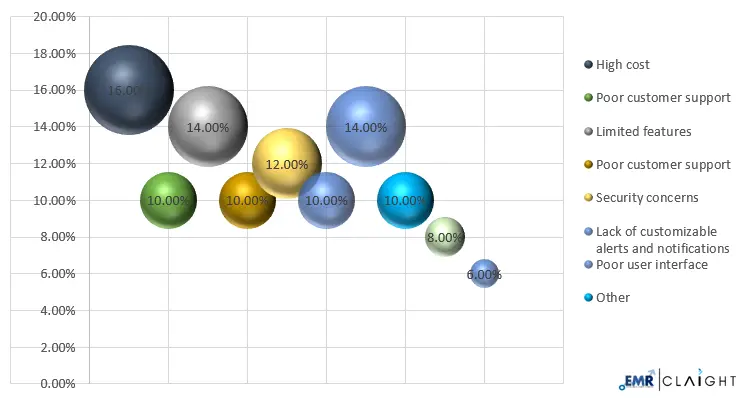

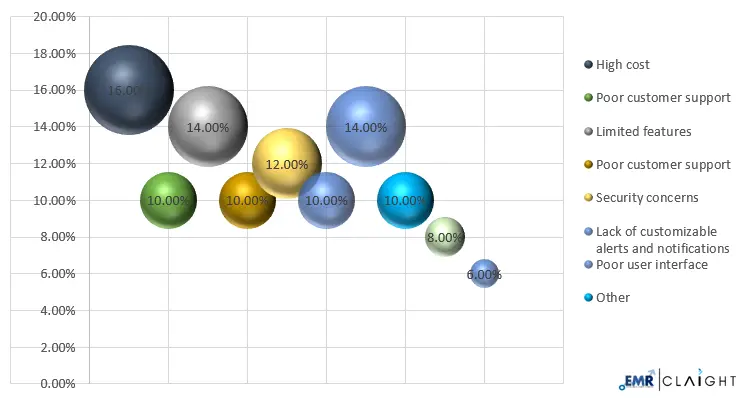

A recent study conducted by the Expert market research revealed that 16% of the total respondents are reluctant to use fintech apps due to the high costs which comes along with these apps in the form of subscription and transaction fees. Other prevalent issues remain poor user interface, security concerns and limited set of features.

With the finance industry undergoing a rapid digital revolution, fintech apps are at the forefront of this development. Despite their potential to simply the complex tasks, there is still a significant number of users reluctant to fully trust them in managing their finances, due to various challenges they face.

Unsatisfactory Characteristics of Fintech Apps

To understand this, a study was conducted by Expert market research covering over 50000 respondents to understand what challenges the users of personal finance apps are facing, to help the developers of these apps redefine them.

The findings of the study revealed that for 16% of the total respondents, the high cost that comes along with these apps is an issue. 14% of the participants are bothered by the poor interface that these apps offer, with another 14% who dislike the limited features in their software. 12% of the users face security concerns with finance apps. 10% respondents have admitted to poor customer support in case they face any issue. Some other prevalent challenges of fintech apps include lack of personalized and customizable alerts and notifications, limited integration with other financial accounts and difficulty in using and understanding the software.

Most personal finance apps function on a subscription-based model to access the premium features being offered by it, making the app less attractive to the ones on a tight budget. Apart from this there are also in-app purchases and hidden costs which makes people reluctant in using these apps. Such costs may include hidden transaction fees, extra payment to unlock additional resources. This restricts their access to financial products and services, leading to dissatisfaction.

Issues Faced While Using Fintech Apps

In addition to this poor user experience also makes the app difficult to navigate through for beginners and hinders their ability to make an informed decision. Security is another major concern for the users due to lack of transparency and a history of data breaches in these apps. Many personal finance apps don’t cater to the specific needs of different users, rather gives the generic suggestions and advice to all at once. This may not resonate with the users who use these apps for targeted purposes such as managing home loans, budgeting, etc. Our study delves further in the positive and negative aspects of these apps, understanding what is preferred by the users.

Addressing these issues requires the companies to follow a multifaceted approach which is focused on enhancing the user experience by providing solutions to their issues. Our study further elaborates on these concerns and consumer behavior on different personal finance apps which can help businesses to gain insights and improve the UI to meet the need of the consumers.