Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Astrocytoma is a primary brain tumor arising from astrocytes, encompassing low- to high-grade subtypes, including diffuse astrocytomas and glioblastomas. In the United States, non-glioblastoma astrocytomas account for approximately 18.8% of all gliomas, with an annual glioma incidence of 6.0 per 100,000 population. Current treatment primarily involves surgery, radiotherapy, and chemotherapy, while novel therapies are emerging. Expert Market Research’s astrocytoma pipeline analysis highlights ongoing clinical development, including targeted IDH inhibitors, CAR T-cell therapies, and immunotherapies aimed at improving patient outcomes.

Major companies involved in the astrocytoma pipeline analysis include Novartis, Neonc Technologies, Inc., and others.

Leading drugs currently in the pipeline include M032, Pembrolizumab, and others.

The astrocytoma pipeline is driven by IDH mutation-targeted therapies, precision immunotherapies, and CAR T-cell approaches, addressing unmet needs in low- and mid-grade tumors. Advances in molecular diagnostics and regulatory incentives for orphan indications further accelerate development, fostering innovative, mutation-specific treatment options and expanding clinical trial opportunities.

The Astrocytoma Pipeline Analysis Report by Expert Market Research gives comprehensive insights into astrocytoma therapeutics currently undergoing clinical trials. It covers various aspects related to the details of each of these drugs under development for astrocytoma. The astrocytoma report assessment includes the analysis of over 100 pipeline drugs and 50+ companies. The astrocytoma pipeline landscape will include an analysis based on efficacy and safety measure outcomes published for the trials, including their adverse effects on patients suffering from the condition, and alignment with astrocytoma treatment guidelines to ensure optimal care practices.

The assessment part will include a detailed analysis of each drug, drug class, clinical studies, phase type, drug type, route of administration, and ongoing product development activities related to astrocytoma.

Read more about this report - Request a Free Sample

Astrocytoma is a type of primary brain tumor arising from astrocytes, with grades ranging from low‑grade to highly aggressive glioblastomas. Disease management and prognosis vary widely depending on tumor grade, molecular profile, and anatomical location.

Astrocytoma treatment traditionally involves surgical resection, often followed by radiotherapy and chemotherapy based on tumor grade and resectability. In a major advancement in August 2024, vorasidenib (Voranigo) received approval from the U.S. Food and Drug Administration for the treatment of Grade 2 astrocytoma and oligodendroglioma harboring susceptible IDH1 or IDH2 mutations following surgery. This approval marked the first systemic targeted therapy for these tumors, demonstrating significantly prolonged progression-free survival compared with placebo and signaling a shift toward mutation-guided, precision-based treatment approaches in astrocytoma care.

Astrocytomas represent a significant subset of primary brain and spinal cord tumors in the United States. According to the American Cancer Society, approximately 25,400 malignant CNS tumors will be diagnosed in 2024, with around 18,760 deaths anticipated. The annual incidence of glioma is 6.0 per 100,000 population, with 18.8% classified as non-glioblastoma astrocytomas, highlighting their contribution to overall glioma burden. Analysis of the CBTRUS 2019 data shows that 19% of adult-type diffuse gliomas were IDH1-mutant astrocytomas. Brain and other nervous system tumors remain the leading cause of cancer death in children and adolescents under 20, emphasizing the clinical relevance of astrocytomas.

This section of the report covers the analysis of astrocytoma drug candidates based on several segmentations, including:

By Phase

The pipeline assessment report covers 50+ drug analyses based on phase:

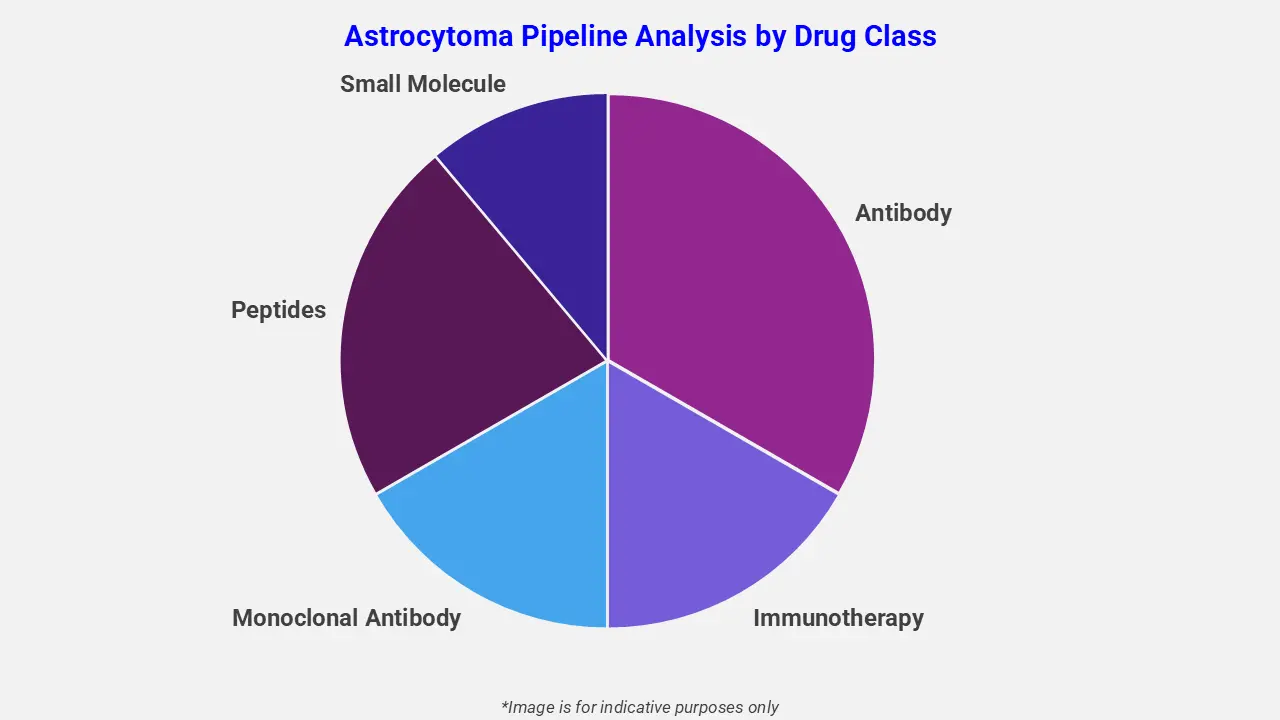

By Drug Class

The astrocytoma pipeline analysis report covers 50+ drug analyses based on drug classes:

By Route of Administration

The pipeline assessment report covers 50+ drug analyses based on the route of administration:

The report covers phase I, phase II, phase III, phase IV, and early-phase drugs. The coverage includes an in-depth analysis of each drug across these phases. According to EMR analysis, phase II covers a major share of the total astrocytoma clinical trials. Overall, 44% of trials are in phase II, followed by 43% in phase I, 7% in phase III, This distribution highlights the current focus on early and mid-stage clinical development for novel astrocytoma therapies.

The drug molecule categories covered under the astrocytoma pipeline analysis include antibody, immunotherapy, monoclonal antibody, peptides, small molecule. The astrocytoma report provides a comparative analysis of the drug classes for each drug in various phases of clinical trials for astrocytoma. For instance, in October 2025, the MB-101 IL‑13Rα2–targeted CAR T‑cell therapy received U.S. FDA orphan drug designation for recurrent diffuse and anaplastic astrocytoma and glioblastoma. This status provides development incentives, including trial-cost credits and post-approval market exclusivity for these rare brain tumors.

The EMR report for the astrocytoma pipeline covers the profile of key companies involved in clinical trials and their drugs under development. It provides a detailed astrocytoma therapeutic assessment, analyzing the competitive dynamics of the clinical trial landscape. Below is the list of a few players involved in astrocytoma clinical trials:

This section covers the detailed analysis of each drug under multiple phases, including phase I, phase II, phase III, phase IV, and emerging drugs for astrocytoma. It includes product description, trial ID, study type, drug class, mode of administration, and recruitment status of astrocytoma drug candidates.

NEO212 is a novel oral conjugated chemotherapy agent combining the standard‑of‑care alkylator Temozolomide (TMZ) with perillyl alcohol (POH). The conjugate is designed to enhance blood–brain barrier penetration and increase cytotoxicity in gliomas and astrocytomas. Preclinical studies demonstrated that NEO212 blocks tumor‑associated endothelial‑to‑mesenchymal transition (reducing invasiveness and angiogenesis) and kills tumor cells more effectively than TMZ alone. The developer, NeOnc Technologies Holdings, Inc., advanced NEO212 into Phase I trials by 2024, and the U.S. FDA authorized progression to Phase II in September 2025, reflecting promising early‑safety and delivery data.

M032 is an oncolytic HSV‑1 virus engineered to selectively replicate in tumor cells and express IL‑12, promoting direct oncolysis and anti-tumor immunity. Pembrolizumab, a PD-1 checkpoint inhibitor, restores immune surveillance by blocking tumor-mediated immune evasion. Clinical trials are exploring their combination in recurrent or progressive high-grade gliomas, including anaplastic astrocytoma, to enhance anti-tumor responses. U.S. academic centers are leading Phase I/II studies assessing safety, tolerability, and efficacy, highlighting the potential of immunovirotherapy in astrocytoma treatment.

ONC206 is a small‑molecule imipridone and a chemically optimized analog of the investigational drug ONC201. It functions as a selective antagonist of dopamine D2‑like receptors (DRD2/3/4) and as an agonist of mitochondrial protease ClpP, triggering mitochondrial dysfunction, integrated stress response, and cancer‑cell apoptosis. Preclinical data show ONC206 potently inhibits proliferation and induces cell death in glioma and other tumor models, with superior potency compared to ONC201. The developer, Chimerix (now part of Jazz Pharma), is currently conducting Phase I dose‑escalation trials in recurrent primary CNS tumors, including high-grade gliomas, underlining ONC206’s potential in astrocytoma treatment.

*Please note that this is only a partial list; the complete list of drugs will be available in the full report.*

The Astrocytoma Pipeline Analysis Report provides a strategic overview of the latest and future landscape of treatments for astrocytoma. It provides necessary information for making informed investment decisions along with research, development, and strategic planning efforts. The stakeholders will benefit from the essential insights into astrocytoma collaborations, regulatory environments, and potential growth opportunities.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

|

Scope of the Report |

Details |

|

Drug Pipeline by Clinical Trial Phase |

|

|

Route of Administration |

|

|

Drug Classes |

|

|

Leading Sponsors Covered |

|

|

Geographies Covered |

|

Mini Report

One User

USD 1,999

USD 1,799

tax inclusive*

Single User License

One User

USD 3,099

USD 2,789

tax inclusive*

Five User License

Five User

USD 4,599

USD 3,909

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share