Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Myasthenia gravis (MG) is a chronic autoimmune neuromuscular disorder characterized by fluctuating skeletal muscle weakness caused by impaired neuromuscular transmission. According to Fan Jiang et al., 2023, MG is a low-incidence disease, with an estimated global incidence of 0.3–2.8 per 100,000 person-years worldwide. According to the myasthenia gravis pipeline analysis by Expert Market Research, the therapeutic landscape is evolving rapidly, driven by targeted biologics, complement inhibitors, FcRn antagonists, and next-generation immunotherapies. The growing disease awareness, improved diagnostic rates, and unmet needs in refractory MG are increasing R&D focus. These factors are expected to support steady pipeline expansion and treatment innovation in the coming years.

Major companies involved in the myasthenia gravis pipeline analysis include Immunovant Sciences GmbH, ImmunAbs Inc., and others.

Leading drugs currently in the pipeline include IMVT-1402, IM-101, CNP-106, and others.

The pipeline is expanding rapidly, driven by innovative antibody therapies, targeted immunomodulators, and novel gene-based approaches. The increasing prevalence, advanced clinical trials, and rising investment are fueling significant growth in the coming years.

The Myasthenia Gravis Pipeline Analysis Report by Expert Market Research gives comprehensive insights into myasthenia gravis therapeutics currently undergoing clinical trials. It covers various aspects related to the details of each of these drugs under development for myasthenia gravis. The myasthenia gravis report assessment includes the analysis of over 100 pipeline drugs and 50+ companies. The myasthenia gravis pipeline landscape will include an analysis based on efficacy and safety measure outcomes published for the trials, including their adverse effects on patients suffering from the condition, and alignment with myasthenia gravis treatment guidelines to ensure optimal care practices.

The assessment part will include a detailed analysis of each drug, drug class, clinical studies, phase type, drug type, route of administration, and ongoing product development activities related to myasthenia gravis.

Read more about this report - Request a Free Sample

Myasthenia gravis is a rare, chronic autoimmune disorder that disrupts neuromuscular communication, causing fluctuating muscle weakness. It occurs when autoantibodies, particularly anti-acetylcholine receptor (AChR) and anti-muscle-specific tyrosine kinase (MuSK), impair signal transmission between nerves and muscles, affecting activities like breathing, speaking, and eye movement.

Myasthenia gravis treatments focus on symptom management and immune modulation, including acetylcholinesterase inhibitors, corticosteroids, immunosuppressants, plasma exchange, and novel targeted therapies that reduce autoantibody production. In December 2025, the FDA approved UPLIZNA® (inebilizumab-cdon) for adults with generalized Myasthenia Gravis who are positive for AChR or MuSK antibodies. The twice-yearly CD19-targeted B cell therapy demonstrated durable efficacy in the Phase 3 MINT trial, reducing steroid dependence and improving daily functioning, marking a significant advancement in the pipeline.

The epidemiology of myasthenia gravis highlights a growing patient base that is increasingly shaping therapeutic development. According to Fan Jiang et al., 2023, myasthenia gravis (MG) has a global incidence of 0.3–2.8 per 100,000 person-years. As per Amgen, approximately 85% of patients have the generalized form (gMG), with global prevalence of 2–36 cases per 100,000. Around 85% have antibodies against acetylcholine receptor (AChR), and 7% against MuSK. MG is more common in women aged 20–30 and men over 50. The growing patient population is driving pipeline development.

This section of the report covers the analysis of myasthenia gravis drug candidates based on several segmentations, including:

By Phase

The pipeline assessment report covers 50+ drug analyses based on phase:

By Drug Class

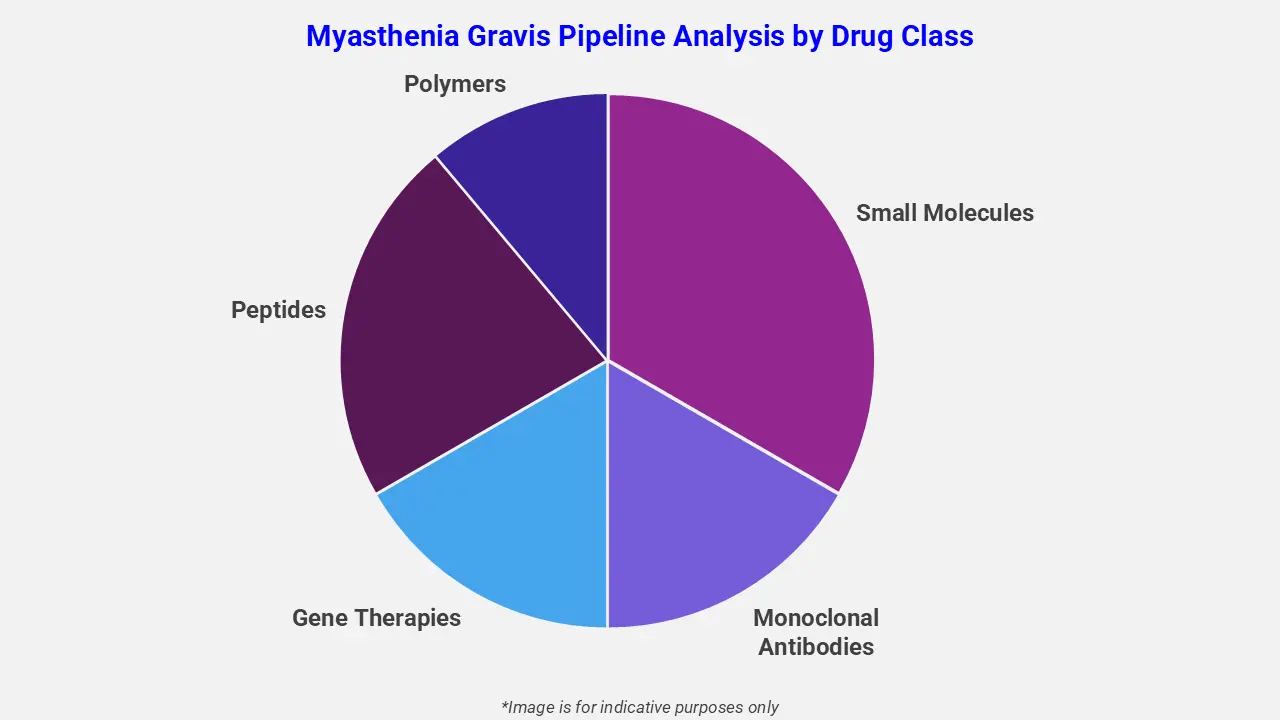

The myasthenia gravis pipeline analysis report covers 50+ drug analyses based on drug classes:

By Route of Administration

The pipeline assessment report covers 50+ drug analyses based on the route of administration:

The report covers phase I, phase II, phase III, phase IV, and early-phase drugs. The coverage includes an in-depth analysis of each drug across these phases. According to EMR analysis, phase III, with 40%, covers a major share of the total myasthenia gravis clinical trials, reflecting strong late-stage development and high potential for near-term market impact. Phase II accounts for 27%, indicating promising mid-stage candidates. This balanced pipeline suggests continued innovation and growth opportunities in the myasthenia gravis market.

The drug molecule categories covered under the myasthenia gravis pipeline analysis include small molecules, monoclonal antibodies, gene therapies, peptides, and polymers. The myasthenia gravis report provides a comparative analysis of the drug classes for each drug in various phases of clinical trials for myasthenia gravis. Complement-targeted therapies are emerging as promising treatment options for generalized myasthenia gravis. For instance, cemdisiran, an investigational small interfering RNA (siRNA) that inhibits complement factor 5 (C5), is under evaluation as a monotherapy with quarterly subcutaneous dosing. Additionally, the combination therapy cemdi-poze, pairing cemdisiran with the C5 antibody pozelimab, is being investigated to enhance complement inhibition and improve patient outcomes in daily functioning.

The EMR report for the myasthenia gravis pipeline covers the profile of key companies involved in clinical trials and their drugs under development. It provides a detailed myasthenia gravis therapeutic assessment, analyzing the competitive dynamics of the clinical trial landscape. Below is the list of a few players involved in myasthenia gravis clinical trials:

This section covers the detailed analysis of each drug under multiple phases, including phase I, phase II, phase III, phase IV, and emerging drugs for myasthenia gravis. It includes product description, trial ID, study type, drug class, mode of administration, and recruitment status of myasthenia gravis drug candidates.

IMVT-1402 is being developed by Immunovant Sciences GmbH as a potentially best-in-class anti-FcRn monoclonal antibody for treating mild to severe generalized myasthenia gravis. This Phase 3, multicenter, randomized, placebo-controlled, double-blind study is assessing the efficacy, safety, and tolerability of IMVT-1402 in adult participants. The drug is designed to inhibit the neonatal Fc receptor (FcRn), thereby reducing pathogenic autoantibodies that cause muscle weakness in myasthenia gravis. Administered via subcutaneous injection, IMVT-1402 aims to provide deeper and more durable clinical responses. The study is recruiting 231 participants and is expected to be completed by December 2028.

IM-101 is a humanized monoclonal antibody targeting complement C5, designed to inhibit complement-mediated damage in patients with myasthenia gravis. Sponsored by ImmunAbs Inc., this Phase 1b/2 study aims to evaluate the safety, tolerability, pharmacokinetics, pharmacodynamics, and preliminary efficacy of IM-101 in adult participants with generalized (gMG) and ocular Myasthenia Gravis (oMG). The trial is examining multiple ascending doses administered intravenously to determine the optimal dose regimen for both AChR antibody-positive and -negative participants. IM-101 works by reducing serum-free C5 concentrations, thereby preventing complement activation and improving neuromuscular transmission. The study is expected to be completed by June 2028.

CNP-106, sponsored by COUR Pharmaceutical Development Company, Inc., is currently undergoing a Phase 1b/2a first-in-human clinical trial to evaluate its safety, tolerability, pharmacodynamics, and efficacy in subjects with generalized myasthenia gravis (gMG). This biodegradable nanoparticle encapsulates acetylcholine receptors (AChR) and is designed to reduce pathogenic AChR antibodies and T cell populations, thereby improving muscle function. The study is examining multiple ascending doses over 222 days, with participants aged 18–75. Administered via intravenous infusion, CNP-106 targets both AChR and MuSK-mediated gMG to address autoimmune-driven muscle weakness.

*Please note that this is only a partial list; the complete list of drugs will be available in the full report.*

The Myasthenia Gravis Pipeline Analysis Report provides a strategic overview of the latest and future landscape of treatments for myasthenia gravis. It provides necessary information for making informed investment decisions along with research, development, and strategic planning efforts. The stakeholders will benefit from the essential insights into myasthenia gravis collaborations, regulatory environments, and potential growth opportunities.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

|

Scope of the Report |

Details |

|

Drug Pipeline by Clinical Trial Phase |

|

|

Route of Administration |

|

|

Drug Classes |

|

|

Leading Sponsors Covered |

|

|

Geographies Covered |

|

Mini Report

One User

USD 1,999

USD 1,799

tax inclusive*

Single User License

One User

USD 3,099

USD 2,789

tax inclusive*

Five User License

Five User

USD 4,599

USD 3,909

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share