Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

PARP inhibitors represent a rapidly advancing targeted therapy class within oncology, driven by precision medicine approaches. The prevalence of BRCA1/2 mutations and homologous recombination deficiency across breast, ovarian, prostate, and pancreatic cancers defines a sizable, biomarker-selected patient pool globally. According to PARP inhibitors pipeline analysis by Expert Market Research, increasing molecular testing rates and expansion into earlier disease settings are broadening the eligible population, thereby supporting sustained clinical development and differentiated pipeline growth across multiple solid tumor indications.

Major companies involved in the PARP inhibitors pipeline analysis include Artios Pharma Ltd, MOMA Therapeutics, and others.

Leading drugs currently in the pipeline include NMS-03305293, Niraparib, and others.

The PARP inhibitors pipeline is driven by expanding synthetic lethality applications beyond BRCA mutations, increasing biomarker-guided trial designs, and combination strategies with immuno-oncology and DDR agents. Advancements in resistance profiling and precision patient stratification are accelerating differentiated asset development and pipeline diversification.

The PARP Inhibitors Pipeline Analysis Report by Expert Market Research gives comprehensive insights into PARP inhibitors therapeutics currently undergoing clinical trials. It covers various aspects related to the details of each of these drugs under development for PARP inhibitors. The PARP inhibitors report assessment includes the analysis of over 100 pipeline drugs and 50+ companies. The PARP inhibitors pipeline landscape will include an analysis based on efficacy and safety measure outcomes published for the trials, including their adverse effects on patients suffering from the condition, and alignment with PARP inhibitors treatment guidelines to ensure optimal care practices.

The assessment part will include a detailed analysis of each drug, drug class, clinical studies, phase type, drug type, route of administration, and ongoing product development activities related to PARP inhibitors.

Read more about this report - Request a Free Sample

The PARP inhibitors pipeline outlook reflects a maturing yet expanding therapeutic class targeting DNA damage repair–deficient cancers. These agents are typically used in BRCA-mutated or homologous recombination–deficient tumors, either as monotherapy or in combination with chemotherapy, hormonal therapy, or immuno-oncology agents.

BRCA-mutated cancer treatment with PARP inhibitors is shifting toward earlier-stage intervention and more precisely defined biomarker-driven populations. This shift is reinforced by regulatory momentum; in January 2025, the FDA approved olaparib (Lynparza) as adjuvant therapy for high-risk, early-stage, HER2-negative, germline BRCA-mutated breast cancer following chemotherapy, significantly improving invasive disease-free survival and reducing recurrence risk.

PARP inhibitors target cancers with homologous recombination repair (HRR) defects, especially BRCA1/2-mutated tumors, changing treatment paradigms in breast and ovarian cancers. Germline BRCA mutations occur in 3-6% of breast cancer patients, with somatic BRCA mutations adding another 7-9% prevalence in tumors. BRCA-associated cancers represent a key eligible population for PARP inhibitor therapy globally. Beyond breast and ovarian cancer, PARP inhibitors are investigated in prostate, pancreatic, and other malignancies with DNA repair deficiencies. Biomarker prevalence influences eligible patient pools, such as 20-25% of ovarian cancer patients with BRCA mutations and a larger proportion with HRD-positive tumors assessed for treatment suitability.

This section of the report covers the analysis of PARP inhibitors drug candidates based on several segmentations, including:

By Phase

The pipeline assessment report covers 50+ drug analyses based on phase:

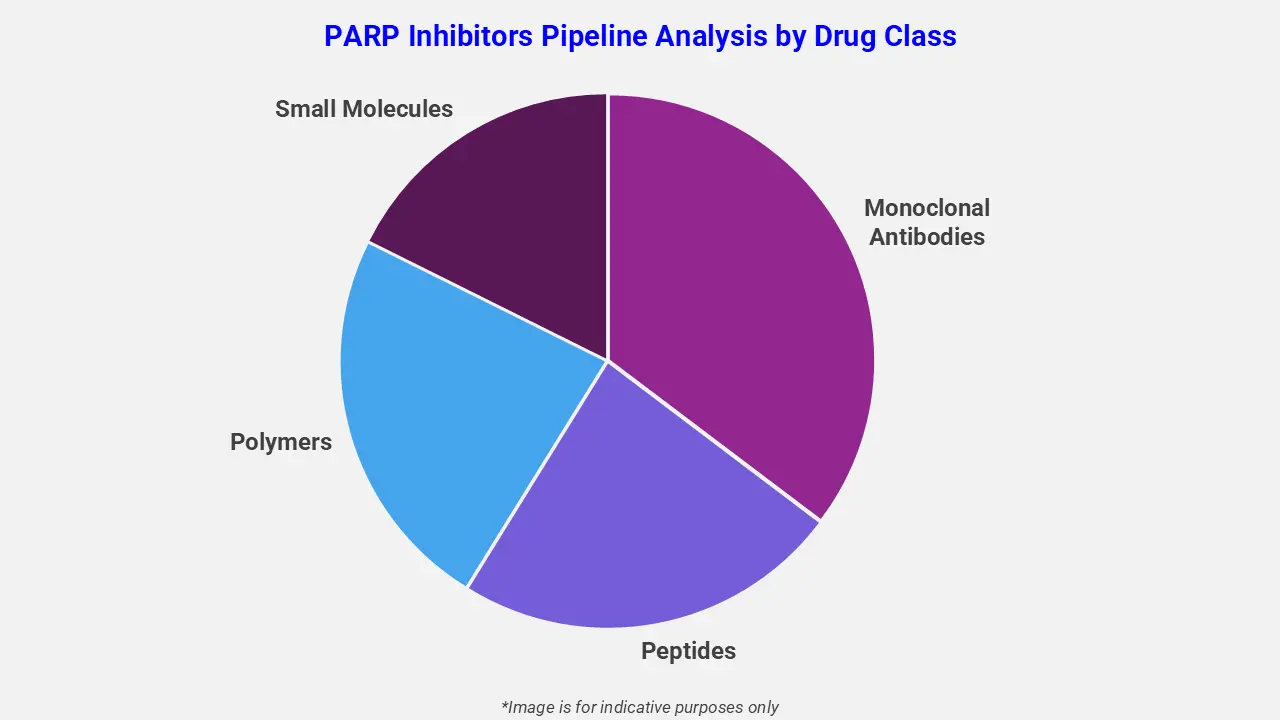

By Drug Class

The PARP inhibitors pipeline analysis report covers 50+ drug analyses based on drug classes:

By Route of Administration

The pipeline assessment report covers 50+ drug analyses based on the route of administration:

The report covers phase I, phase II, phase III, phase IV, and early-phase drugs. The coverage includes an in-depth analysis of each drug across these phases. According to EMR analysis, phase II covers a major share of the total PARP inhibitors clinical trials. The report evaluates clinical trials across phase I (31%), phase II (59%), and phase III (9%). Overall, this distribution highlights a strong concentration of mid-stage development, reflecting continued optimization and expansion of PARP inhibitor therapies across oncology indications.

The drug molecule categories covered under the PARP inhibitors pipeline analysis include monoclonal antibodies, peptides, polymers, and small molecules. The PARP inhibitors report provides a comparative analysis of the drug classes for each drug in various phases of clinical trials for PARP Inhibitors. In December 2025, the FDA granted regular approval to rucaparib (Rubraca) for adults with BRCA-mutated metastatic castration-resistant prostate cancer (mCRPC) who progressed after androgen receptor-directed therapy but have not received chemotherapy. This decision converts its earlier accelerated approval and reflects data from the TRITON3 trial showing significantly improved radiographic progression-free survival versus physician’s choice, offering a targeted option ahead of chemotherapy for eligible patients.

The EMR report for the PARP Inhibitors pipeline covers the profile of key companies involved in clinical trials and their drugs under development. It provides a detailed PARP inhibitors therapeutic assessment, analyzing the competitive dynamics of the clinical trial landscape. Below is the list of a few players involved in PARP inhibitors clinical trials:

This section covers the detailed analysis of each drug under multiple phases, including phase I, phase II, phase III, phase IV, and emerging drugs for PARP inhibitors. It includes product description, trial ID, study type, drug class, mode of administration, and recruitment status of PARP inhibitors drug candidates.

NMS-03305293 is a next-generation, selective PARP1 inhibitor belonging to the DNA damage response (DDR) drug class, developed for oncology indications. It works by selectively inhibiting PARP1-mediated DNA repair while sparing PARP2, aiming to enhance antitumor activity with improved tolerability. The compound is designed to exploit synthetic lethality in homologous recombination–deficient tumors. Its development is led by Nerviano Medical Sciences, an oncology-focused research organization with strong expertise in precision cancer therapeutics.

ZEN003694 is an oral, small-molecule BET bromodomain inhibitor targeting epigenetic regulation in cancer. It inhibits BET proteins, particularly BRD4, disrupting transcription of oncogenic drivers such as MYC and impairing tumor cell proliferation. The drug is being evaluated both as monotherapy and in combination regimens to overcome resistance mechanisms. ZEN003694 is developed by Zenith Epigenetics, a clinical-stage biotechnology company specializing in epigenetic therapies for genetically and transcriptionally driven cancers.

IMP9064 is a highly selective PARP1 inhibitor within the DNA damage repair inhibitor class, designed to enhance antitumor efficacy while reducing hematologic toxicity associated with broader PARP inhibition. It functions by blocking PARP1-dependent DNA repair, inducing synthetic lethality in tumors with homologous recombination deficiencies. The candidate is being advanced by Impact Therapeutics, a China-based oncology company focused on innovative small molecules targeting DDR pathways and precision-driven cancer treatments.

*Please note that this is only a partial list; the complete list of drugs will be available in the full report.*

The PARP Inhibitors Pipeline Analysis Report provides a strategic overview of the latest and future landscape of treatments for PARP Inhibitors. It provides necessary information for making informed investment decisions along with research, development, and strategic planning efforts. The stakeholders will benefit from the essential insights into PARP Inhibitors collaborations, regulatory environments, and potential growth opportunities.

Proton Pump Inhibitors (PPIs) Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

|

Scope of the Report |

Details |

|

Drug Pipeline by Clinical Trial Phase |

|

|

Route of Administration |

|

|

Drug Classes |

|

|

Leading Sponsors Covered |

|

|

Geographies Covered |

|

Mini Report

One User

USD 1,999

USD 1,799

tax inclusive*

Single User License

One User

USD 3,099

USD 2,789

tax inclusive*

Five User License

Five User

USD 4,599

USD 3,909

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share