Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Relapsed AML is when leukemia cells recur after remission, whereas refractory AML is when patients do not get full remission following two courses of induction treatment. Allogeneic stem cell transplantation is the sole potentially curative treatment option. Other treatment options include salvage chemotherapy (e.g., FLAG-mitoxantrone regimens), targeted treatments such as FLT3 inhibitors (gilteritinib) or IDH inhibitors (ivosidenib/enasidenib). With survival frequently defined in months and a poor prognosis, individualized approaches based on genetic abnormalities found at recurrence are crucial. The relapsed/refractory acute myeloid leukemia pipeline analysis by Expert Market Research focuses on various treatment options for this disease.

Major companies involved in the relapsed/refractory acute myeloid leukemia pipeline analysis include AbbVie Inc., Daiichi Sankyo, and Celgene, among others.

Leading drugs currently in the pipeline include Azacitidine, Quizartinib, others.

Increased investment in research and development, along with regulatory support, is accelerating clinical trials and new treatment approvals.

The Relapsed/Refractory Acute Myeloid Leukemia Pipeline Analysis Report by Expert Market Research gives comprehensive insights into relapsed/refractory acute myeloid leukemia therapeutics currently undergoing clinical trials. It covers various aspects related to the details of each of these drugs under development for relapsed/refractory acute myeloid leukemia. The relapsed/refractory acute myeloid leukemia report assessment includes the analysis of over 15 pipeline drugs and 10+ companies. The relapsed/refractory acute myeloid leukemia therapeutics pipeline landscape will include an analysis based on efficacy and safety measure outcomes published for the trials, including their adverse effects on patients suffering from the condition, and alignment with relapsed/refractory acute myeloid leukemia therapeutics treatment guidelines to ensure optimal care practices.

The assessment part will include a detailed analysis of each drug, drug class, clinical studies, phase type, drug type, route of administration, and ongoing product development activities related to relapsed/refractory acute myeloid leukemia.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Relapsed/refractory AML is caused by clonal evolution of leukemia stem cells with accumulating genetic alterations, leading to treatment resistance. Important survival-promoting strategies include epigenetic changes (TET2, IDH1/2), secondary mutations (e.g., FLT3-ITD, RAS, TP53), and dysregulated signaling pathways (FLT3, RAS/MAPK). By using drug efflux pumps to avoid chemotherapy, these cells take advantage of the bone marrow's protective milieu. Targeted therapies are made more difficult by the fact that relapse frequently involves different mutations from the original disease. Refractory cases are supported by persistent leukemia stem cells that can self-renew.

Targeted therapies such as FLT3 inhibitors (gilteritinib) or IDH inhibitors (ivosidenib/enasidenib), salvage chemotherapy (e.g., FLAG, MEC regimens), and allogeneic stem cell transplantation—the sole curative option—are the mainstays of treatment for relapsed or refractory AML. Less rigorous regimens (azacitidine/decitabine ± venetoclax) may be administered to elderly or fragile individuals. When compared to alternative salvage treatments, CLAG-M exhibits higher remission rates. To improve results, clinical trials investigating new drugs and triplet treatments (such as AZA/VEN) are essential.

Relapse rates in people under 60 years of age range from 35% to 80%, and they are much greater in older patients with relapsed/refractory acute myeloid leukemia (AML). Within the first year, up to 57% of AML patients may die, relapse after remission, or develop primary refractory illness. About 62% of relapsed/refractory AML patients in clinical cohorts have relapsed, while 38% have refractory instances. The primary cause of death from AML is still relapse.

This section of the report covers the analysis of relapsed/refractory acute myeloid leukemia drug candidates based on several segmentations, including:

By Phase

By Drug Class

By Route of Administration

The report covers phase I, phase II, phase III, phase IV, and early-phase drugs. The coverage includes an in-depth analysis of each drug across these phases. According to EMR analysis, in the relapsed/refractory acute myeloid leukemia pipeline, maximum candidates are concentrated in Phase I with 67% of the projects followed by Phase II with 27% of candidates. Rest of the candidates are in Phase III with 6%. Thus, demonstrating a broad spectrum of development stages and diverse progress toward potential treatments.

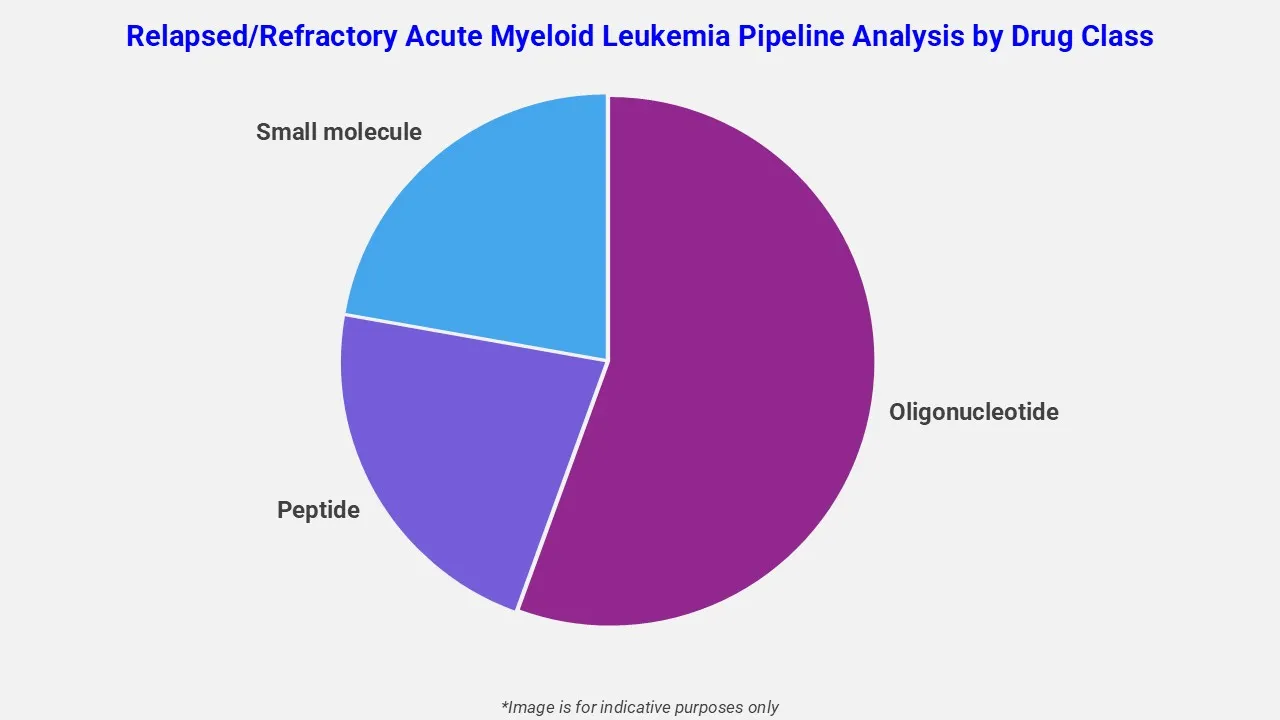

The drug molecule categories covered under the relapsed/refractory acute myeloid leukemia pipeline analysis include oligonucleotide, peptide and small molecules. The relapsed/refractory acute myeloid leukemia report provides a comparative analysis of the drug classes for each drug in various phases of clinical trials for relapsed/refractory acute myeloid leukemia.

The EMR report for the relapsed/refractory acute myeloid leukemia pipeline analysis covers the profile of key companies involved in clinical trials and their drugs under development. Below is the list of a few players involved in relapsed/refractory acute myeloid leukemia clinical trials:

This section covers the detailed analysis of each drug under multiple phases, including phase I, phase II, phase III, phase IV, and emerging drugs for relapsed/refractory acute myeloid leukemia. It includes product description, trial ID, study type, drug class, mode of administration, and recruitment status of relapsed/refractory acute myeloid leukemia drug candidates.

In a Phase 1 clinical trial, azacitidine, which was created by AbbVie, is presently being assessed for individuals with relapsed or refractory acute myeloid leukemia (AML). This ongoing, late Phase 1 trial examines the safety, tolerability, and initial effectiveness of azacitidine when combined with the selective BET inhibitor ABBV-744. The goal of this trial is to increase the usage of the hypomethylating drug azacitidine, which is currently licensed for various hematologic malignancies, by focusing on resistant AML cases. In patients with few other treatment options, the trial reflects AbbVie's approach to expanding treatment options for hard-to-treat AML by investigating innovative combination medications.

Quizartinib is a selective FLT3 inhibitor that was created by Daiichi Sankyo to target FLT3-ITD mutations, which are frequently present in acute myeloid leukemia (AML). In previous trials, it improved survival outcomes for patients with relapsed or refractory AML, demonstrating encouraging findings. In a late Phase 1 clinical trial, quizartinib is presently being assessed in conjunction with the MDM2 inhibitor milademetan. Patients with relapsed or refractory AML, including those who are not candidates for intense chemotherapy, are the focus of this study. By concurrently blocking FLT3 and upsetting the MDM2-p53 pathway, the combination seeks to increase treatment efficacy and potentially overcome resistance and response rates.

*Please note that this is only a partial list; the complete list of drugs will be available in the full report.*

Acute Myeloid Leukemia Market Report and Forecast

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

|

Scope of the Report |

Details |

|

Drug Pipeline by Clinical Trial Phase |

|

|

Route of Administration |

|

|

Drug Classes |

|

|

Leading Sponsors Covered |

|

|

Geographies Covered |

|

Mini Report

One User

USD 1,999

USD 1,799

tax inclusive*

Single User License

One User

USD 3,099

USD 2,789

tax inclusive*

Five User License

Five User

USD 4,599

USD 3,909

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share