QR Code Payments Are Reshaping POS Strategy for Indian Businesses

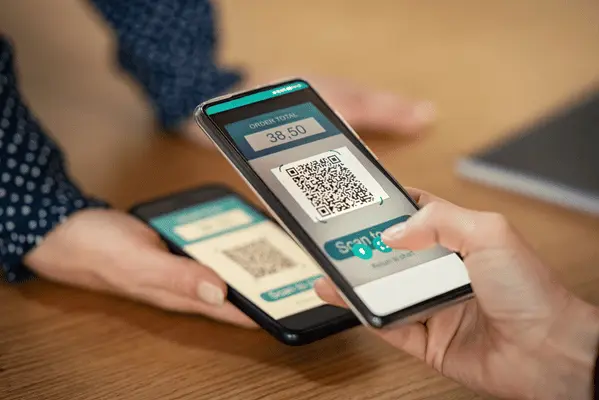

In the last five years, India's payments landscape has changed drastically. The emergence of UPI and mobile-first users has caused QR code-based payment methods to grow rapidly as a popular choice for everyday transactions, especially for small and mid-tier businesses.

As a result, retailers, service providers and payment aggregators are changing their traditional POS strategies and finding small, faster, cheaper and more flexible ways to pay for purchases.

The Appeal of QR Codes for Indian Merchants

For Indian merchants (dealers and sellers), QR code-based systems can also provide unique advantages that are not possible with traditional POS devices:

- No hardware costs

- Minimal setup time

- Integration with UPI and digital wallets

- Real-time transaction alerts on mobile devices

For small merchants, QR code-based systems entail that they can accept digital payment without using a card-swiping machine; whereas enterprise chains can access self-checkout, queue reduction, and app-based loyalty integration with QR codes.

UPI Has Changed the Economics of POS Deployment

UPI makes instant and no cost (for the time being) transactions possible, and QR codes have addressed some of the key adoption barriers. Merchants that were once hesitant to adopt digital transactions systems due to a monthly rental fee or cost of maintaining a card reader device, are now simply using QR stickers attached to apps like PhonePe, Patym, or Google Pay.

Even organised retailers are embedding QR codes at self-checkout points, kiosks, and counter payments stations for a frictionless payment experience.

QR Codes Are Complementing POS Solutions

QR systems are generally best for low-ticket or mobile-first transactions, but POS terminals are still better at:

- Accepting international cards

- Offering EMI or loyalty redemption

- Providing itemised receipts or GST integration

Currently, businesses are investing in hybrid models that provide a flexible option by utilising a combination of QR payments and traditional POS software to reduce checkout friction.

For deeper insight into device adoption trends and merchant segments, view our India POS Device Market

QR Code Payment Models Are Redefining What POS Means in India

The future of point-of-sale in India will not be solely hardware based either. The growth of QR code payments has opened up digital acceptance to millions of merchants and is forcing traditional providers to update their business models. The businesses that will succeed in the market will be the ones offering options instead of just machines.

Share