Commodity Compass Newsletter Weeks 44–45, 2025

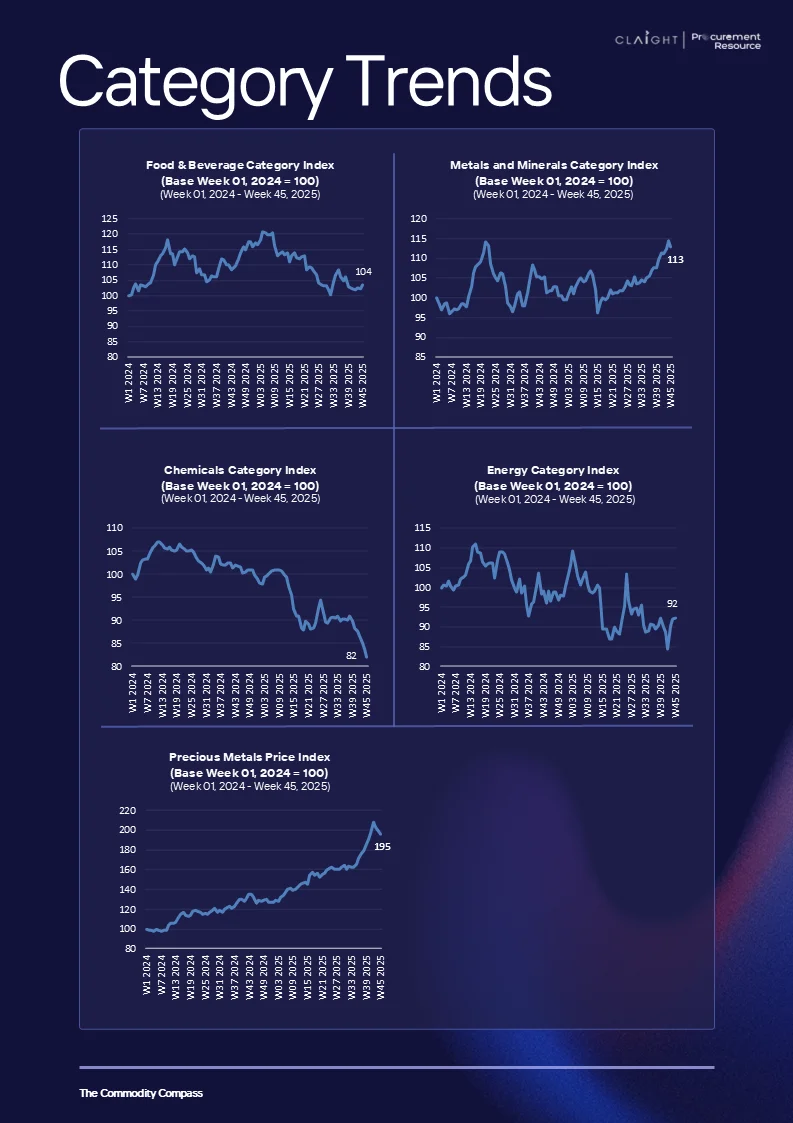

Global commodities through Weeks 44 and 45, 2025 depicted a variety of recoveries, gentle corrections, and areas of strength across the four sectors of food and beverages, metals and minerals, chemicals, precious metals and energy. The last two weeks of the cycle showed more demand clarity and selective price normalisation.

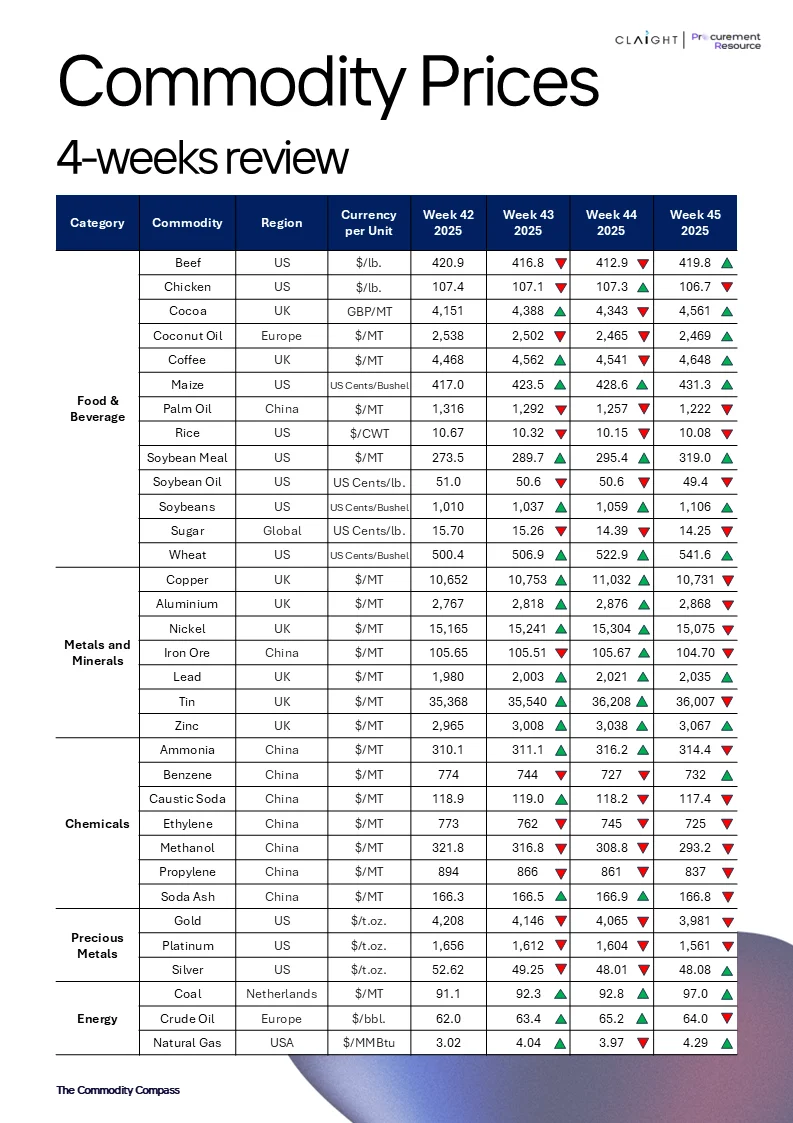

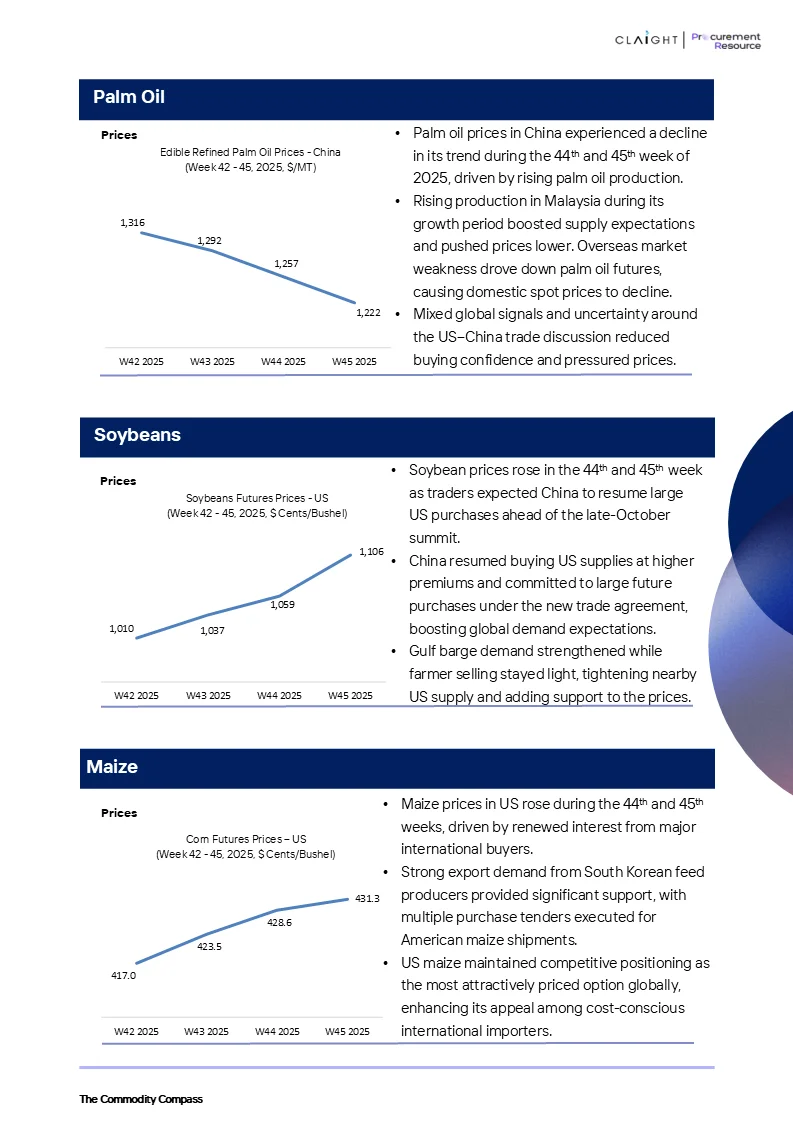

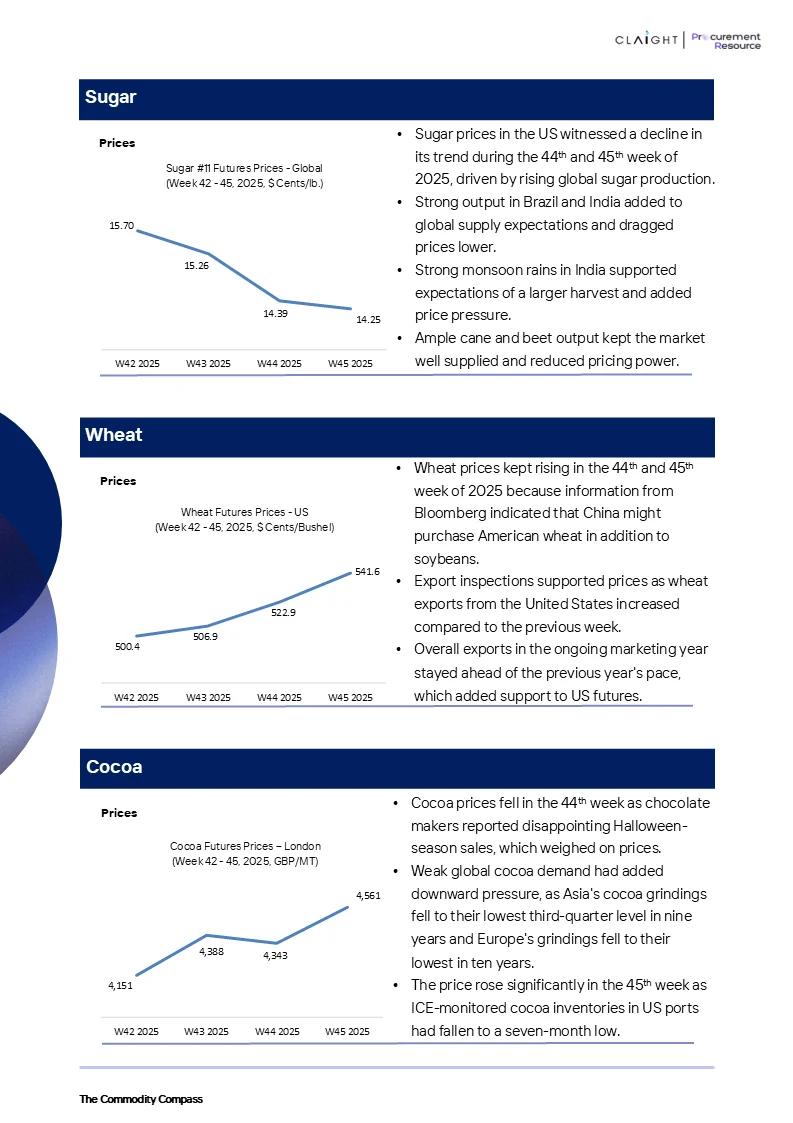

In food and beverage markets, US beef turned around late in the week, going from $412.9/lb in Week 44 to $419.8/lb in Week 45. The price of chicken in the United States stayed almost constant, with a minor change from $107.3/lb to $106.7/lb. UK cocoa moved up from GBP 4,363/MT to 4,561/MT, while Europe coconut oil went down from $2,469/MT to $2,456/MT. UK coffee was at $4,648/MT in week 45 from being at $4,541/MT in week 44. US maize was more expensive in Week 45 as it went up from 426.4 to 431.3 cents/bushel. The price of Palm Oil in China was reduced from $1,257/MT to $1,222/MT. US rice also became less expensive, going from $10.32/CWT to $10.08/CWT. The price of soybean meal increased from $297.9/MT to $319.0/MT. Meanwhile, US soybean oil was a bit more expensive at 49.9 cents/lb, but soybeans went from 1,059 to 1,106 cents/bushel. The price of sugar was lowered from 14.59 to 14.25 cents/lb in week 45.

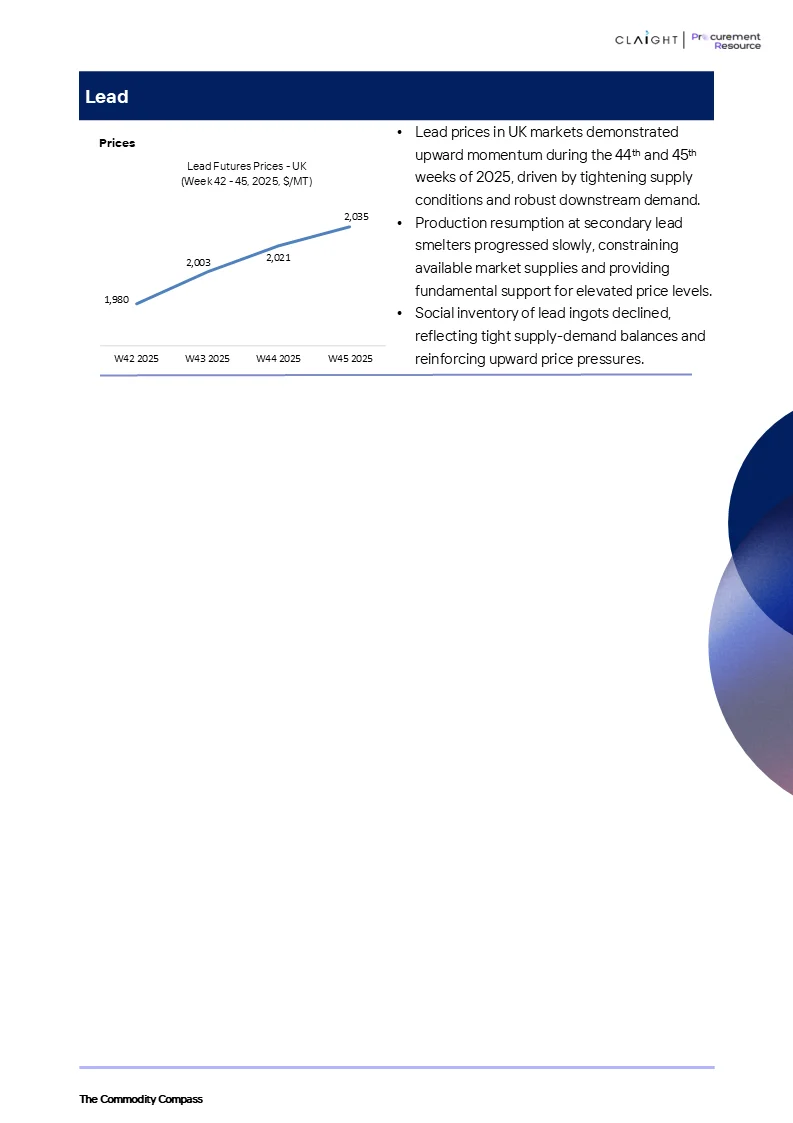

There was a stronger trend overall in metals and minerals to be firm. US wheat gained 18.7 cents/bushel, going from 522.9 to 541.6 cents/bushel in week 45. After a few days of strength, UK copper slipped a bit from $11,021/MT to $10,731/MT. Aluminium lost a little bit of its strength and went from $2,876/MT to $2,868/MT. The decline of UK nickel was negligible as it moved from being $15,304/MT in week 44 to $15,075/MT in week 45. We see a very slight decrease in price for China iron ore, moving from $105.21/MT to $104.70/MT. Lead took a slightly upward trend as it went up from being $2,021/MT in week 44 to $2,035/MT in week 45. Tin's value increased from $36,026/MT to $36,057/MT. Zinc was more firm at $3,067/MT than at $3,038/MT.

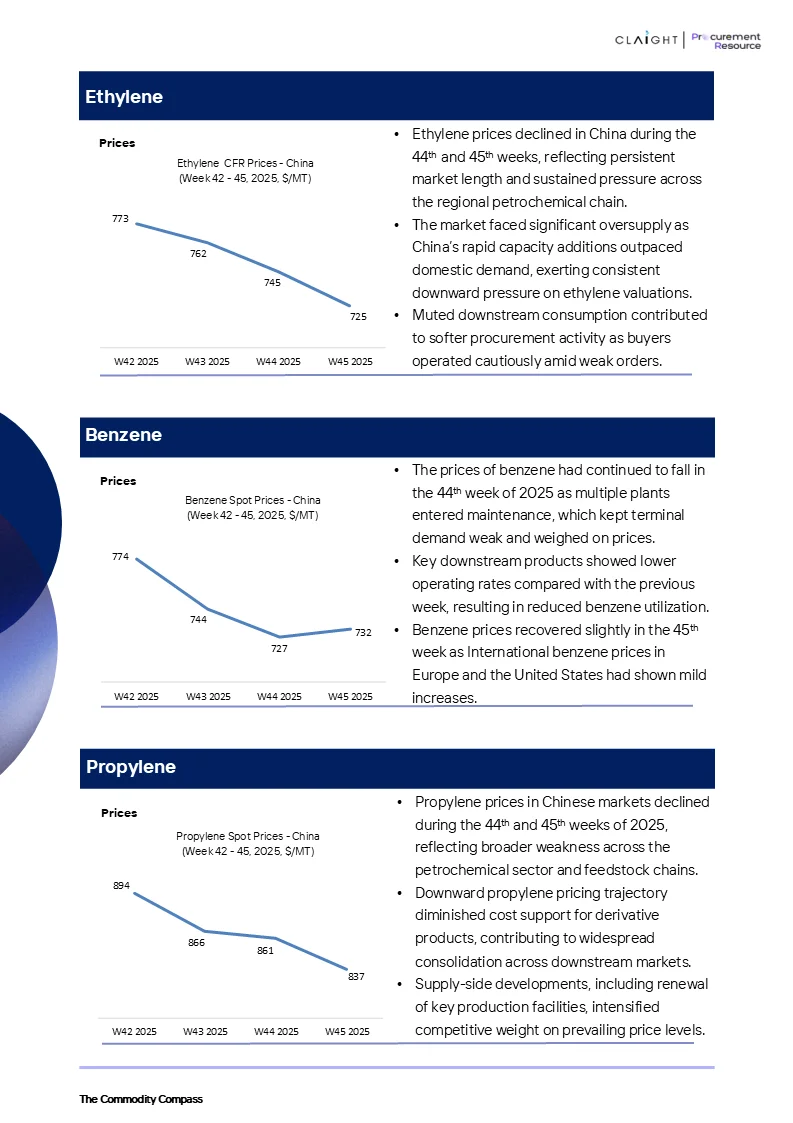

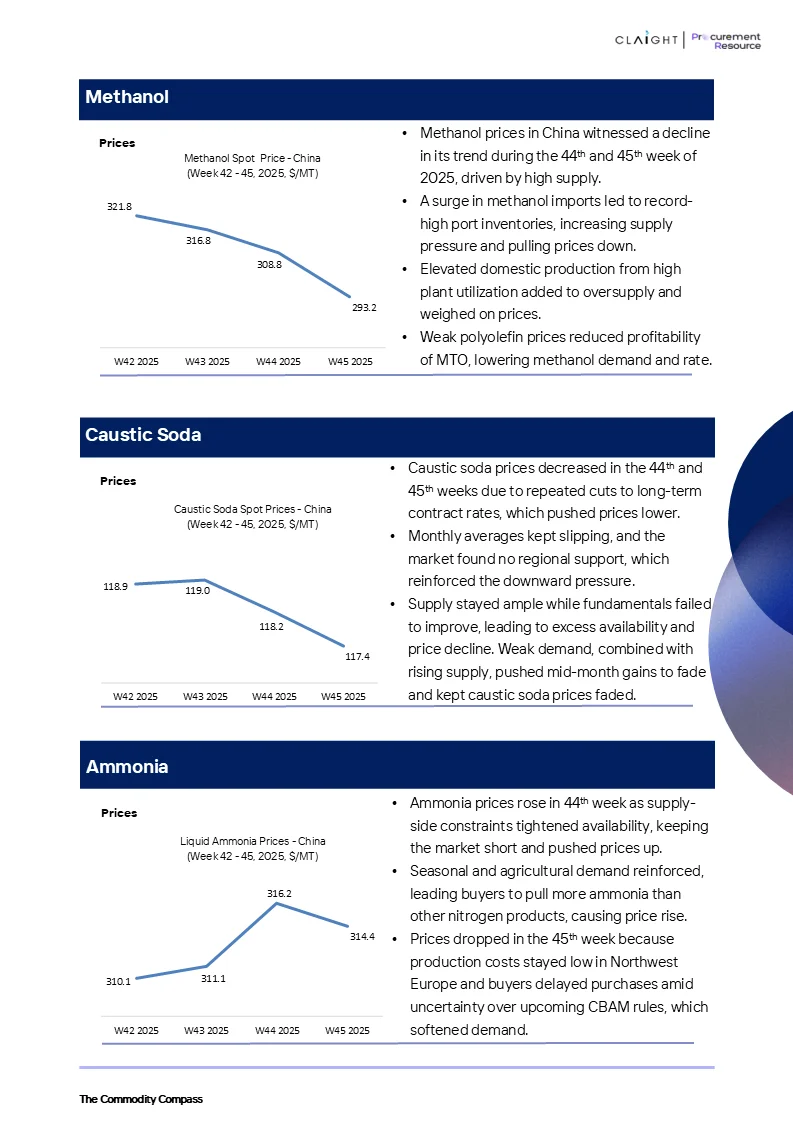

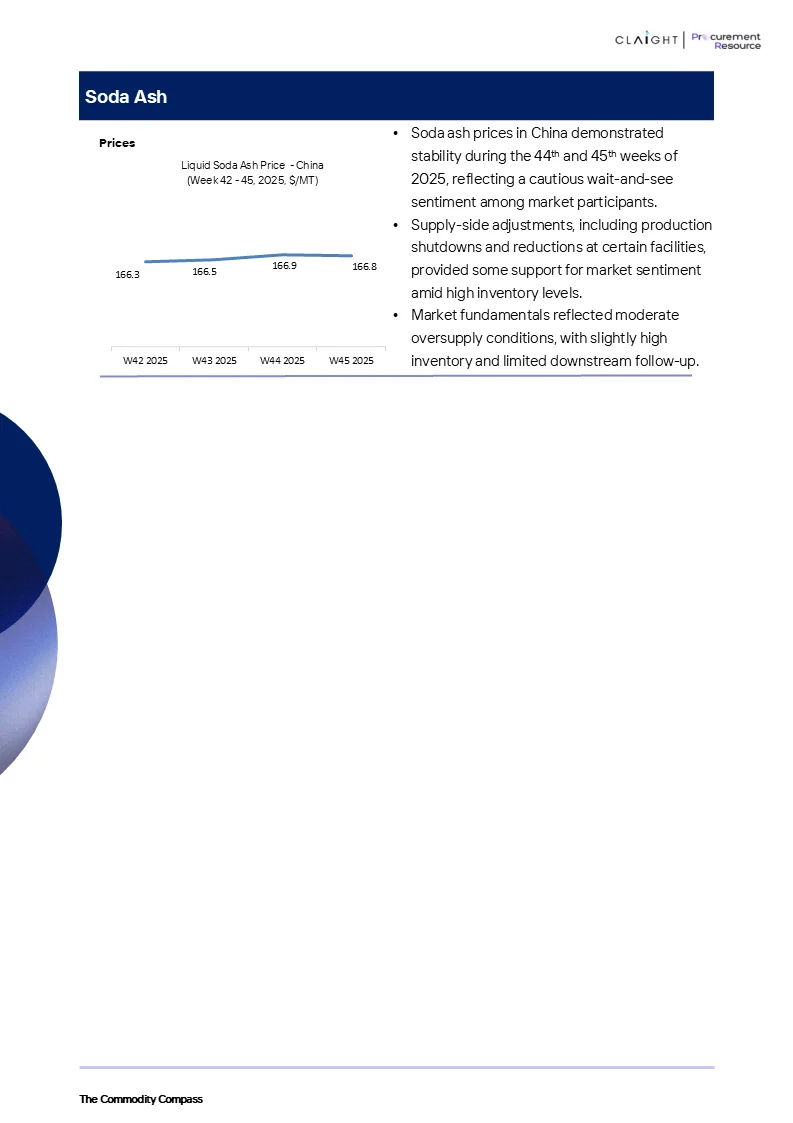

Chemical markets mostly moved with lower price trends in week 45 when compared to the prices in week 44. China ammonia dropped a bit from $316.2/MT to $314.4/MT. Benzene was lowered slightly from $727/MT to $732/MT. Caustic soda also decreased from $118.2/MT to $117.4/MT. Ethylene also shifted from $745/MT in week 44 to $725/MT in week 45. Methanol dropped from $308.8/MT to $293.2/MT. Propylene also reduced from $861/MT to $837/MT. Soda ash was almost unchanged at $166.9/MT and $166.8/MT, respectively.

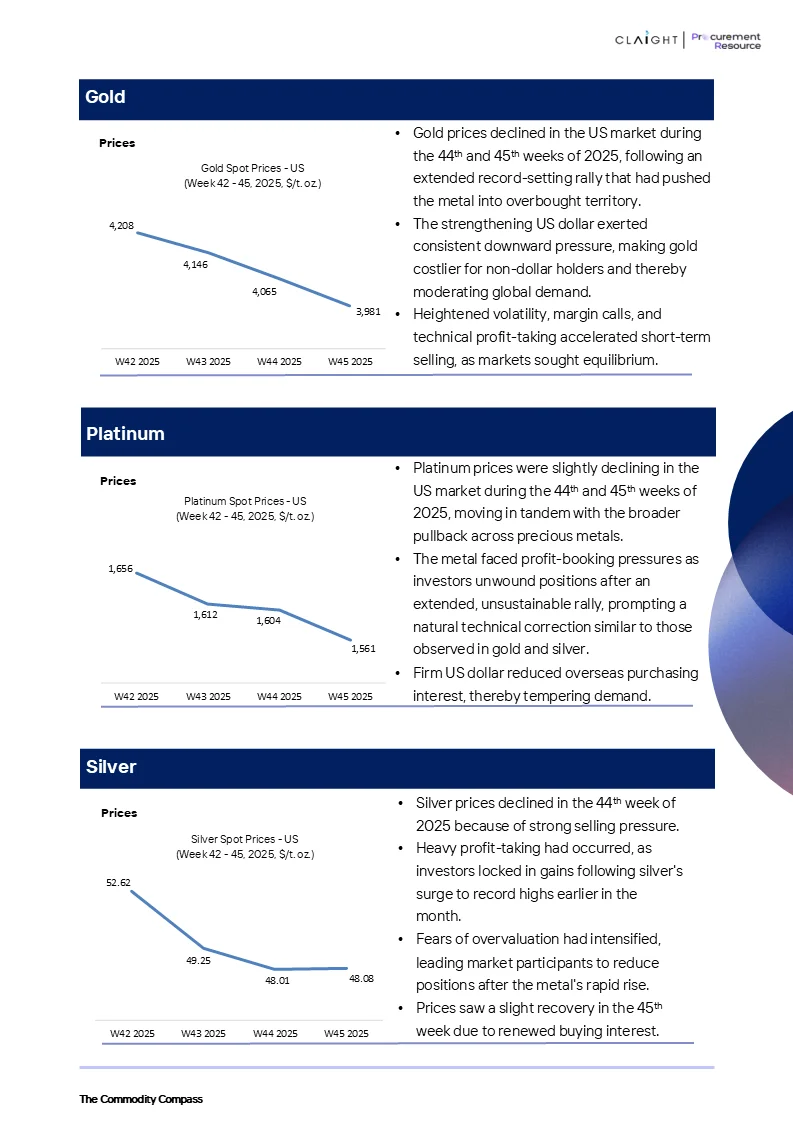

Precious metals were mostly weakening in terms of prices. Gold shifted negatively from $4,065/oz to $3,981/oz in week 45. Platinum too took a downward trend from $1,604/oz to $1,561/oz. Silver was at $48.01/oz in Week 44 and then at $48.08/oz in Week 45 after stabilising.

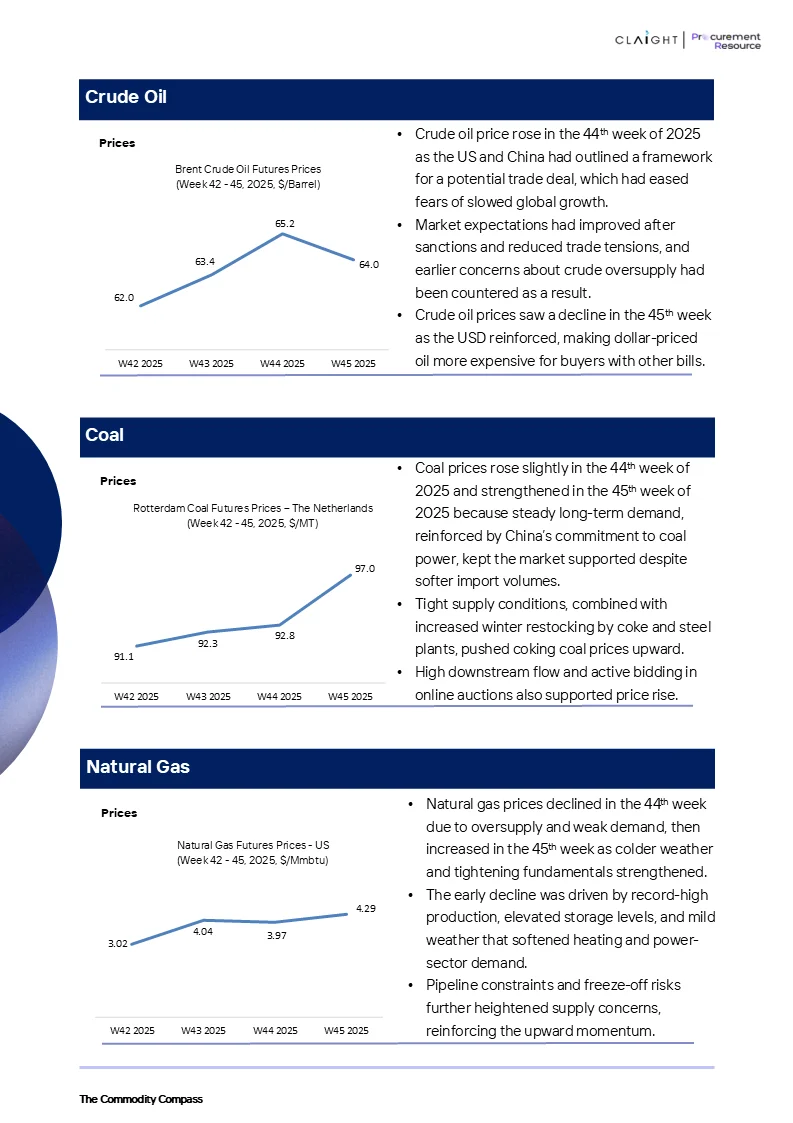

The energy markets revealed moderate tendencies. Coal in the Netherlands went up from $92.8/MT to $97.0/MT. European crude was almost the same $65.2/bbl to $64.0/bbl. US natural gas went up from $3.97 to $4.29/MMBtu.

Overall, the two weeks of 44 and 45 were a mix of selective recovery of the agri and energy commodities coupled with the continuation of the downtrend of chemicals and precious metals.