Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Base Year

Historical Period

Forecast Period

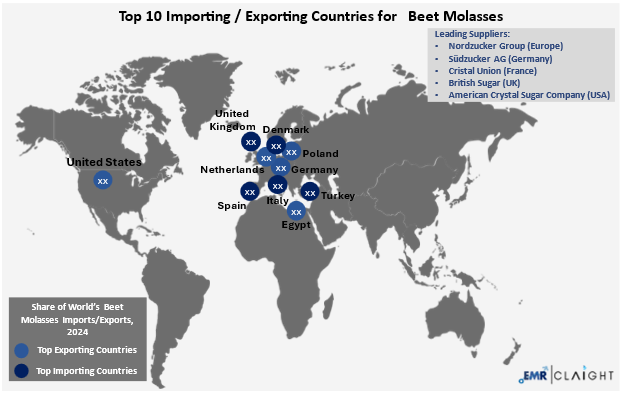

The EMR pricing report on Beet Molasses provides insights into the top 10 leading trading countries and regions.

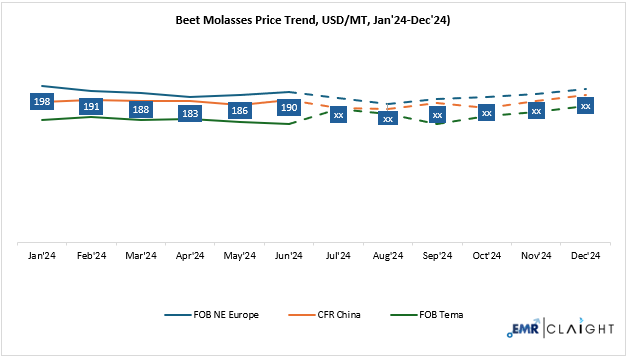

In 2024, beet molasses prices faced downward pressure largely due to an oversupply in the market. Strong sugar beet harvests across Europe, including countries like Poland, Hungary, Italy, Germany, and France, led to abundant production, while demand from key sectors such as bioethanol and animal feed remained modest. This surplus caused prices to decline by around 3%, creating a subdued market environment. However, in Q1 of 2025, prices began to stabilize as the market gradually absorbed the excess supply. Processing activity remained relatively strong, with only a slight 3-4% drop in volumes in major regions like Europe and Asia, which was better than expected and helped support the market.

| Beet Molasses, Price (USD/TON) YoY Change, FOB NE Europe | ||||

| Month | 2023 Price | 2024 Price | YoY Change | Expert Market Research Price Prediction for 2025 |

| October | 182 USD/TON | 184 USD/TON | + 1.1% | Prices are expected to remain stable, supported by resilient processing activity |

| November | 185 USD/TON | 187 USD/TON | + 1.1% | |

| December | 189 USD/TON | 193 USD/TON | + 2.1% | |

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

The steady demand for beet molasses in food, beverage, and biofuel industries provided some balance, easing pressure on manufacturers. Overall, while 2024 saw a price slump due to oversupply, early 2025 brought a more stable outlook with resilient processing and improving market conditions.

In 2024, beet molasses prices weakened due to an abundant supply resulting from strong sugar beet harvests in key producing regions, especially across Europe. Increased acreage and favourable growing conditions led to higher production volumes, while demand from sectors like bioethanol and animal feed remained moderate, creating an oversupplied market that weighed on prices. Despite this stabilisation, prices are expected to remain under pressure for some time due to continued ample supply and a gradual pace of consumption growth, although improving biofuel demand and tighter inventories could support some upward pressure later in the year.

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

| Leading Exporting Countries | Leading Importing Countries | Major Suppliers |

| Egypt | Belgium | Nordzucker Group (Europe) |

| Germany | Spain | Südzucker AG (Germany) |

| Poland | Turkey | Cristal Union (France) |

| Netherlands | UK | British Sugar (UK) |

| USA | Denmark | American Crystal Sugar Company (USA) |

| Belarus | Italy | Tereos (France) |

| Belize | France | Mitchells & Butlers plc (India) |

| Serbia | USA | KWS SAAT SE & Co. KGaA (Germany) |

In 2024, trade restrictions on beet molasses were tightened due to a mix of geopolitical tensions, government interventions, and supply challenges. The European Union restricted imports from Russia as part of ongoing sanctions, creating a supply gap and elevated prices in Europe. India, a major exporter, imposed a steep 50% export duty on molasses from January to boost domestic availability for ethanol production and manage concerns over reduced sugarcane yields. These measures, coupled with erratic weather and regulatory changes, limited global trade flows and made markets volatile. In early 2025, these trade hurdles remain, with fluctuating tariffs anticipated under new US policies, continuing export taxes in India, and supply chain challenges persisting, all contributing to an uncertain outlook for beet molasses trade.

Beyond tariffs, the industry faces deeper structural challenges. Adverse weather events in early 2025, including droughts in northern Europe, have reduced sugar beet yields and molasses output, while logistical and energy cost pressures have shortened processing campaigns. Export restrictions from Russia and Belarus further exacerbate supply tightness. These factors are creating bottlenecks that affect the entire supply chain, from farmers and processors to traders and end-users, which is leading to increased price volatility and complicating inventory planning. Manufacturers in the U.S. and Europe, who depend on consistent, high-volume imports, are particularly impacted by these disruptions.

Beet molasses is a byproduct derived from the processing of sugar beets, which are grown primarily in temperate regions such as Europe, North America, and parts of Asia. The sugar beets are harvested and then washed to remove dirt and impurities before being sliced into thin strips called Cossettes. These Cossettes undergo extraction in hot water to dissolve the sugar content, producing raw juice. The juice is then purified, concentrated, and crystallised to extract sugar. What remains after the sugar crystals are removed is a thick, dark syrup known as beet molasses. This molasses contains residual sugars, minerals, and other organic compounds, making it a valuable feedstock for animal feed, bioethanol production, and various food applications. Recent fluctuations in sugar beet harvests, influenced by weather conditions and geopolitical factors, have affected the availability and cost of beet molasses. Oversupply in some regions has put downward pressure on prices, while export restrictions and energy costs have tightened supply elsewhere, impacting overall market dynamics.

In recent months of 2025, the beet molasses market is experiencing notable fluctuations as supply-side challenges persist alongside cautious demand. Production in key European regions has been affected by unfavourable weather conditions, including droughts and irregular rainfall, which have reduced sugar beet yields and molasses output. Additionally, export restrictions from major suppliers such as Russia and Belarus have further tightened global availability. Despite these constraints, some producers have maintained steady processing levels, helping to partially ease supply pressures.

On the demand side, growth remains moderate. While sectors like bioethanol and animal feed continue to rely heavily on beet molasses, high input costs and trade uncertainties have tempered purchasing activity. The combination of supply disruptions and cautious consumer behaviour is contributing to a market environment marked by volatility and unpredictability. Although supply may improve as weather conditions stabilise and trade flows normalise, ongoing risks related to production variability and geopolitical factors suggest that the beet molasses market will remain unsettled throughout 2025.

| Report Features | Coverage - Detail Report Annual Subscription |

| Product Name | Beet Molasses |

| Report Coverage | Price Forecasting and Historical Analysis: Monthly historical prices (2021-2024), short- and long-term price forecasts (2025-2026), scenario forecasts (most probable, optimistic, pessimistic) |

| Regional and Grade-wise Market Breakdown: The top 10 countries in terms of production, consumption, export, and import, regional insights (USA, North West Europe, China, India, South East Asia, Brazil, Mexico, South Africa, Nigeria, GCC, Japan, South Korea, etc.). | |

| Grade Wise Price Trends with Incoterms: Variation in price by product grade and specifications, and Incoterms. | |

| Price Drivers and Cost Structure: Feedstock correlations, production costs, market competition, government policies, economic factors | |

| Supply and Demand Analysis: Regional supply-demand analysis (North America, Europe, Asia Pacific, etc.), company-level and grade-level supply-demand, plant shutdown, expansion, force majeure, details | |

| Trade Balance Analysis: Historical deficit and surplus countries, net importers and exporters, Product movement, Supply Chain, Freight, Duties and Taxes | |

| Production Cost Breakdown: Direct and indirect cost breakdowns: raw material, labour, processing, packaging, overhead, R&D, taxes | |

| Profitability Assessment: Profit margin evaluations | |

| Industry News and Macroeconomic Context: Geopolitical events, policy updates, GDP, inflation, exchange rates, and their impact on coal prices | |

| Data Overview: Macroeconomic Impact, Supply-Demand, Government/Industry Inputs, Custom Insights | |

| Currency | USD (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customised based on the requirements of the customer |

| Post-Sale Analyst Support | Till the end of the subscription |

| Data Access | Lifetime Access, Visualisation |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Gain a competitive edge with EMR's comprehensive price forecasting reports. Dive deep into the latest market dynamics and price outlook for your specific materials, ensuring you stay ahead of the curve with actionable insights and strategic foresight.

Our reports cover a wide range of commodities, including chemicals (including speciality chemicals), metals, agricultural ingredients, and energy. Each report focuses on a specific commodity to provide detailed insights.

Our reports are updated monthly to provide the most current data and insights. Users can also subscribe to quarterly or semi-annual updates based on their needs.

We source our data through primary interviews with our supplier and trader network, government websites, industry bodies, and world trade data, ensuring accuracy and reliability.

Yes, we offer custom reports tailored to your specific needs. Please contact our support team for more information.

Our reports provide critical insights that help you anticipate market trends, optimize procurement strategies, and make informed investment decisions. This leads to better negotiation and timing in purchases, thereby reducing the impact of price volatility.

Clients can receive analyst support to answer specific questions related to the reports. Additionally, we offer services like risk management, category intelligence, should-cost models, and trade data analytics as part of our extended suite of offerings.

Basic Report -

One Time

Basic Report -

Annual Subscription

Detailed Report -

One Time

Detailed Report -

Annual Subscription

Basic Report -

One Time

USD 799

tax inclusive*

Basic Report -

Annual Subscription

USD 3,499

tax inclusive*

Detailed Report -

One Time

USD 4,299

tax inclusive*

Detailed Report -

Annual Subscription

USD 7,999

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City,1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

United States

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

United States (Head Office)

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City, 1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

Share