The Expert Market Research pricing report on Cement provides insights into the top 10 leading trading countries and regions.

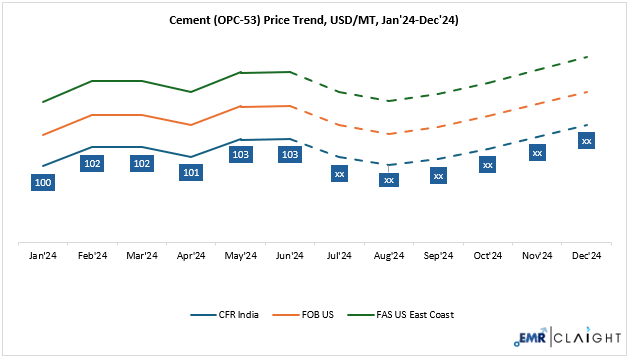

In 2024, Cement prices remained stable despite a declining consumption rate which was supported by low input costs and adjustments in pricing strategies. Market dynamics varied, where some regions experienced a price hike due to supply constraints while others faced downward pressure because of overcapacity and lowered demand. In Q1 2025, cement prices went up slightly, which helped balance out lower sales volumes. The U.S. saw slower construction activity, but lower energy costs helped keep production steady. In India, strong government spending on infrastructure supported higher cement demand.

| Cement (OPC-53) Price (USD/MT) YoY Change, CFR India |

| Month |

2023 Price |

2024 Price |

YoY Change |

Expert Market Research Price Prediction for 2025 |

| October |

106 USD/MT |

102 USD/MT |

- 3.5% |

Prices may see small rise, supported by infrastructure demand despite regional slowdowns |

| November |

101 USD/MT |

103 USD/MT |

+ 2.5% |

| December |

98 USD/MT |

105 USD/MT |

+ 6.5% |

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

Competitive markets with huge capacity expansion kept their prices low whereas areas with supply shortages and recovering construction activity saw a modest price increase. Additionally, industry stakeholders are showing increased focus on sustainable alternatives and are moving towards optimized construction materials which is also having an influence over pricing structures of cement since demand stand low in key regions such as China.

Cement Price Forecast

Global cement prices have remained stable in 2024 and were supported by lower input costs and stable pricing despite declining consumption. In 2025, export prices are expected to recover as market demand improves, particularly in seaborne trading markets. The US and Western Europe expect modest demand growth, which might lead to price stabilisation or increases. Due to the recession in real estate, prices in China have somewhat recovered but are still under pressure. India has a competitive market with cheap pricing because of its quick capacity expansion. Malaysia has experienced significant price rises, and more growth is anticipated, while Philippine producers face pricing issues due to growing imports. On the other hand, Bangladesh's poor demand may have an impact on price stability, and Vietnam may suffer from low pricing and overcapacity. Overall, overcapacity and geopolitical threats may keep prices competitive elsewhere, while lower interest rates and rebounding demand may encourage price hikes in other areas.

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

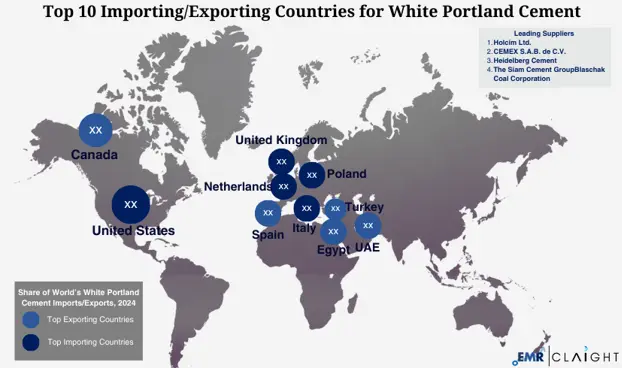

Global Trade and Supply Chain Implications

| Leading Exporting Countries |

Leading Importing Countries |

Major Suppliers |

| Turkey |

USA |

UltraTech Cement Limited (India) |

| Vietnam |

Israel |

Occidental Chemical Corporation (USA) |

| Canada |

France |

The Siam Cement Group (Thailand) |

| Germany |

Singapore |

Holcim Ltd. (Switzerland) |

| Spain |

Philippines |

Heidelberg Materials (Germany) |

| Greece |

Hong Kong |

China National Building Material Company (China) |

| Egypt |

Italy |

Anhui Conch Cement Company Ltd. (China) |

| China |

Hungary |

Votorantim Cimentos (Brazil) |

The demand for cement is expected to decline from 2024 to 2030 in many parts of the world. Although strong growth is anticipated in India, the Middle East, and Africa. Among these, Sub-Saharan Africa is estimated to experience a 77% increment in cement demand by 2030, while in India, the rising shift will be about 42%, and North America is estimated to experience 20%. On the other hand, markets in Turkey, China, and Europe are expected to struggle due to reduced construction activity and an overall decrease in demand. China known to the world’s largest cement consumer, has seen a demand drop sharply from 2.4 billion tons in 2020 to an estimated 1.8 billion tons in 2024, with a slowdown in urban development and real estate activity.

Despite weaker global demand, the European market is expected to maintain a gross margin expansion which is primarily driven by higher cement prices and reduced fuel costs. Price adjustments have made it simpler for manufacturers to maintain profitability despite the declining consumption rate. However, because of the free-market dynamics and competitive forces, prices have decreased in various regions of the world, particularly in emerging economies. These disparities explain the regional challenges within the cement industry with some markets benefiting from price resilience, while others facing a downward trend in profitability.

Feedstock Analysis

The aluminosilicate market was under adverse pressure in late 2024 because of the declining demand in construction activity and the cement industry, especially in Asia and Europe. Low-cost imports in some areas and a halt in construction activity caused aluminosilicate prices to drop, which in turn affected cement prices. But by early 2025, the market was beginning to recover, this change was boosted by a slow recovery in construction activities and supply shortages that raised the price of raw materials. The strong demand forecast for cement indicates that supply chain factors and construction demand have a direct impact on overall pricing trends, with fluctuations in aluminosilicate prices highlighting its key role in cement manufacturing.

Demand and Supply Outlook for Cement

By 2050, global cement demand is expected to decline from the past years because of the changing market trends and rising shift towards sustainable materials. In some nations, the slowing rate of new urban development due to plateauing population growth has already started to affect demand. For instance, in China, cement consumption has significantly reduced, from 2.4 billion tonnes per annum in 2020 to an estimated 1.8 billion tonnes per annum in 2024. Despite these multiple large expansions in development, global cement consumption is expected to rebound only modestly, with growth ranging between 1% and 2%. Econometric market analysis also suggests that continued volatility in upstream raw materials and policy variables will remain key influencers of cement pricing through 2025.

| Report Features |

Coverage - Detail Report Annual Subscription |

| Product Name |

Cement |

| HS Code |

252310, 252321 |

| Grade |

OPC, PPC |

| Contract Size & Packaging Details |

50 Kg Bag |

| Report Coverage |

Price Forecasting and Historical Analysis: Monthly historical prices (2021-2024), short- and long-term price forecasts (2025-2026), scenario forecasts (most probable, optimistic, pessimistic) |

| Regional and Grade-wise Market Breakdown: The top 10 countries in terms of production, consumption, export, and import, regional insights (USA, North West Europe, China, India, South East Asia, Brazil, Mexico, South Africa, Nigeria, GCC, Japan, South Korea, etc.). |

| Grade Wise Price Trends with Incoterms: Variation in price by product grade and specifications, and Incoterms. |

| Price Drivers and Cost Structure: Feedstock correlations, production costs, market competition, government policies, economic factors |

| Supply and Demand Analysis: Regional supply-demand analysis (North America, Europe, Asia Pacific, etc.), company-level and grade-level supply-demand, plant shutdown, expansion, force majeure, details |

| Trade Balance Analysis: Historical deficit and surplus countries, net importers and exporters, Product movement, Supply Chain, Freight, Duties and Taxes |

| Production Cost Breakdown: Direct and indirect cost breakdowns: raw material, labour, processing, packaging, overhead, R&D, taxes |

| Profitability Assessment: Profit margin evaluations |

| Industry News and Macroeconomic Context: Geopolitical events, policy updates, GDP, inflation, exchange rates, and their impact on coal prices |

| Data Overview: Macroeconomic Impact, Supply-Demand, Government/Industry Inputs, Custom Insights |

| Currency |

USD (Data can also be provided in the local currency) |

| Customization Scope |

The report can also be customised based on the requirements of the customer |

| Post-Sale Analyst Support |

Till the end of the subscription |

| Data Access |

Lifetime Access, Visualisation |

| Delivery Format |

PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Gain a competitive edge with Expert Market Research's comprehensive price forecasting reports. Dive deep into the latest market dynamics and price outlook for your specific materials, ensuring you stay ahead of the curve with actionable insights and strategic foresight.

What Our Reports Include:

Historical Price Data and Analysis:

- In-depth review of prices (including feedstock) over the past 5 years.

- Visualisations and trend analysis to identify historical patterns and seasonality.

Supply and Demand Analysis:

- Detailed industry analysis of current supply and demand trends, along with projections for how these dynamics are expected to evolve during the forecast period.

- Insights from our extensive supplier and trader network, government websites, industry bodies, and global trade data.

Latest Industry News:

- Up-to-date information on recent developments and geopolitical events.

- Analysis of how these events are likely to impact future prices.

Key Macroeconomic Indicators:

- Evaluation of economic indicators such as GDP growth, inflation rates, and PMI.

- Insights into how these indicators affect prices.

Price Outlook:

- Forecasted price trend analysis for cement for the next 2 years using statistical modelling and fundamental & technical price analysis.

- Scenario analysis and potential price fluctuations.

Why Choose Our Reports?

- Accurate Data: Our reports are based on reliable data sources, including primary interviews, government websites, and industry bodies.

- Comprehensive Insights: We offer a holistic view of the market, considering all factors related to demand, supply, macroeconomic environment, and input costs.

- Timely Updates: Reports are updated monthly, with options for quarterly or semi-annual subscriptions.

- Expert Support: Our team of analysts is available for consultations and customised requirements.

Key Benefits:

- Informed Procurement Decisions: Gain insights on when to buy and how to negotiate better, mitigating the impact of price volatility.

- Competitive Advantage: Leverage our robust and time-tested forecasting methodology to stay ahead in the market.

- Actionable Insights: Make better market decisions with detailed market forecasts and analysis.