Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Base Year

Historical Period

Forecast Period

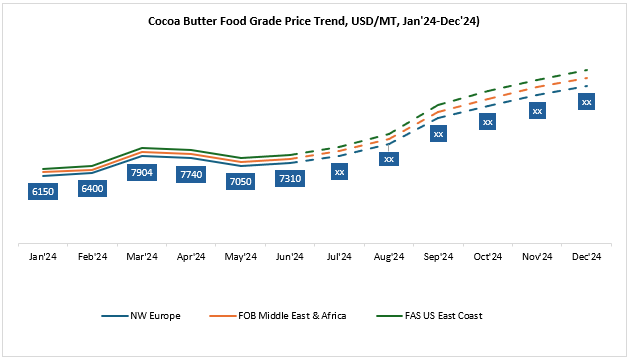

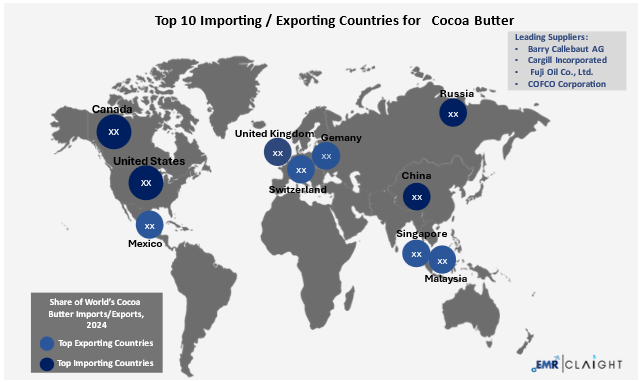

The EMR pricing report on Cocoa Butter provides insights into the top 10 leading trading countries and regions.

Cocoa butter prices showed regional disparities across the top 10 cocoa-producing and trading countries in late 2024, driven by raw bean availability, processing capacity, and shifting trade routes. West African nations, particularly Côte d'Ivoire and Ghana, led supply but faced reduced yields and logistical issues, pushing prices up. While local processors had better access to feedstock, meeting steady export demand remained a challenge. By early 2025, these supply pressures intensified, reinforcing West Africa’s role as a global price-setter despite infrastructure and financing hurdles.

| Cocoa Butter Food Grade Price (USD/MT) YoY Change, NW Europe | ||||

| Month | 2023 Price | 2024 Price | YoY Change | Expert Market Research Price Prediction for 2025 |

| October | 5820 USD/MT | 12530 USD/MT | + 115% | Prices may stay high in 2025 due to the rising demand from the chocolate industry. |

| November | 5954 USD/MT | 13500 USD/MT | + 127% | |

| December | 6044 USD/MT | 14300 USD/MT | + 137% | |

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

In Europe, major hubs like the Netherlands and Germany saw production costs rise due to tight bean supply and high energy prices, weakening their export edge. The U.S. market remained relatively stable, supported by steady chocolate demand and diversified sourcing, though rising import costs compressed margins. In Southeast Asia, Indonesia and Malaysia attempted to boost output but faced limitations due to bean quality and strong competition from West Africa. Latin America showed mixed trends, Brazil saw slight price increases from internal supply issues, while Ecuador benefited from steady demand and higher grindings. By mid-2025, rising global chocolate demand continued to drive price pressure, with West Africa’s supply conditions remaining the key influence on global cocoa butter markets.

In 2024, the global cocoa butter market experienced significant price surges, primarily driven by reduced cocoa bean yields in West Africa due to unfavourable weather and crop diseases. This supply-side pressure, coupled with strong demand from the chocolate, confectionery, and personal care industries, intensified cost volatility across major markets. In Europe, chocolate manufacturers contended with high input costs, while Asia saw steady demand from both food and cosmetic sectors, despite limited processing capacity. North America managed pricing pressures through strategic sourcing and inventory management, though elevated import costs remained a concern.

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

Looking into 2025, cocoa butter prices are expected to remain elevated, supported by ongoing demand and slow recovery in bean production. Sustainability regulations, climate-related uncertainties, and stricter traceability requirements are likely to add to production and compliance costs. While producing countries are investing in resilient agricultural practices and infrastructure improvements, their impact will gradually improve. Meanwhile, industry players are exploring plant-based and synthetic alternatives to cocoa butter, although widespread adoption may face limitations due to consumer preferences and production scalability.

| Leading Exporting Countries | Leading Importing Countries | Major Suppliers |

| Switzerland | Russia | Barry Callebaut AG (Switzerland) |

| Malaysia | United States | Cargill Incorporated (U.S.) |

| Singapore | Netherlands | Archer Daniels Midland Company (ADM) (U.S.) |

| Germany | China | AAK (Sweden) |

| Mexico | United Kingdom | Fuji Oil Co., Ltd. (Japan) |

| United States | Germany | Ecom Agro-industrial Corp. (U.S.) |

| India | Canada | Louis Dreyfus Company (France) |

| China | Japan | COFCO Corporation (China) |

In late 2024, global cocoa butter trade faced intensifying disruptions due to deepening supply shortages in West Africa and rising regulatory pressures in importing regions. Poor harvests across Côte d'Ivoire and Ghana, attributed to persistent fungal diseases and below-average rainfall, led to one of the tightest bean supply environments in over a decade. As a result, both countries introduced stricter export licensing and temporarily prioritized local cocoa grinding operations to boost domestic value addition. This policy shift strained international supply, particularly for processors in Europe and North America who rely heavily on raw bean imports for cocoa butter extraction. European importers scrambled to secure limited volumes ahead of the EU’s full enforcement of its deforestation-free supply chain law in early 2025, leading to port congestion in hubs like Antwerp and Rotterdam and rising insurance and compliance costs.

Meanwhile, in early 2025, Asian cocoa processors, especially in Indonesia, faced acute bean shortages, despite growing demand from regional buyers in China and India. Currency depreciation and high shipping costs further complicated procurement from West Africa, pushing smaller players out of the market. In the U.S., cocoa butter importers faced compounded pressure from global price inflation and shipping route bottlenecks, including congestion at the Panama Canal and inconsistent vessel schedules from the Gulf of Guinea. To mitigate these risks, major multinationals have accelerated investments in traceable, origin-based grinding facilities and digital platforms for real-time supply chain monitoring. While these efforts may improve long-term resilience, short-term volatility remains high, with global cocoa butter trade increasingly defined by regulatory fragmentation, climate stress, and intense competition for ethically sourced inputs.

In late 2024 and early 2025, the cost of cocoa butter production was overwhelmingly driven by dramatic increases in cocoa bean prices, the primary raw material input. This spike in bean prices sharply inflated input costs for processors globally. Premium fermented beans, which yield superior-quality cocoa butter, remained scarce, exacerbating cost pressures and threatening supply continuity.

Region-specific dynamics further compounded challenges: West African processors managed costs better through local sourcing and government interventions aimed at stabilising domestic markets. In contrast, European and Asian processors bore the full brunt of elevated procurement costs, worsened by high shipping costs and energy prices. They increasingly resorted to lower-grade or mixed feedstocks, though this often compromised the product quality. The sustained spike in bean costs has nudged industry players toward upstream integration, investing in farmer training and efficient extraction technologies to insulate margins during volatile supply cycles.

In late 2024 and early 2025, global demand for cocoa butter remained steady despite the upward pressure on prices. Key end-use sectors, including confectionery, cosmetics, and pharmaceuticals, continued to drive consumption, particularly in North America, Europe, and Asia. While demand in some emerging markets showed a cautious downturn due to elevated costs, premium chocolate producers and personal care brands maintained their reliance on high-quality cocoa butter. In Asia, especially in countries like China and India, the upward trend in consumer demand for premium and wellness-oriented products provided additional support to market stability. However, cost-conscious manufacturers in certain regions began exploring alternatives, such as cocoa butter equivalents, for less quality-sensitive applications.

On the supply side, cocoa butter availability experienced a pronounced decline due to unfavourable harvest conditions in major producing regions across West Africa. Disruptions in the main crop season contributed to a broader reduction in global bean supplies, putting downward pressure on processing volumes. The origin of cocoa grinding in Latin America and Southeast Asia saw a marginal increase, but these gains were insufficient to balance the overall supply deficit. As inventories dwindled, market participants faced challenges meeting consistent demand. Looking ahead, the cocoa butter market is expected to remain under upward pricing pressure through the first half of 2025, with only a potential easing if mid-crop harvests improve and processing infrastructure expands in alternative sourcing regions.

| Report Features | Coverage - Detail Report Annual Subscription |

| Product Name | Cocoa Butter |

| Report Coverage | Price Forecasting and Historical Analysis: Monthly historical prices (2021-2024), short- and long-term price forecasts (2025-2026), scenario forecasts (most probable, optimistic, pessimistic) |

| Regional and Grade-wise Market Breakdown: The top 10 countries in terms of production, consumption, export, and import, regional insights (USA, North West Europe, China, India, South East Asia, Brazil, Mexico, South Africa, Nigeria, GCC, Japan, South Korea, etc.). | |

| Grade Wise Price Trends with Incoterms: Variation in price by product grade and specifications, and Incoterms. | |

| Price Drivers and Cost Structure: Feedstock correlations, production costs, market competition, government policies, economic factors | |

| Supply and Demand Analysis: Regional supply-demand analysis (North America, Europe, Asia Pacific, etc.), company-level and grade-level supply-demand, plant shutdown, expansion, force majeure, details | |

| Trade Balance Analysis: Historical deficit and surplus countries, net importers and exporters, Product movement, Supply Chain, Freight, Duties and Taxes | |

| Production Cost Breakdown: Direct and indirect cost breakdowns: raw material, labour, processing, packaging, overhead, R&D, taxes | |

| Profitability Assessment: Profit margin evaluations | |

| Industry News and Macroeconomic Context: Geopolitical events, policy updates, GDP, inflation, exchange rates, and their impact on coal prices | |

| Data Overview: Macroeconomic Impact, Supply-Demand, Government/Industry Inputs, Custom Insights | |

| Currency | USD (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customised based on the requirements of the customer |

| Post-Sale Analyst Support | Till the end of the subscription |

| Data Access | Lifetime Access, Visualisation |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Gain a competitive edge with EMR's comprehensive price forecasting reports. Dive deep into the latest market dynamics and price outlook for your specific materials, ensuring you stay ahead of the curve with actionable insights and strategic foresight.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Our reports cover a wide range of commodities, including chemicals (including speciality chemicals), metals, agricultural ingredients, and energy. Each report focuses on a specific commodity to provide detailed insights.

Our reports are updated monthly to provide the most current data and insights. Users can also subscribe to quarterly or semi-annual updates based on their needs.

We source our data through primary interviews with our supplier and trader network, government websites, industry bodies, and world trade data, ensuring accuracy and reliability.

Yes, we offer custom reports tailored to your specific needs. Please contact our support team for more information.

Our reports provide critical insights that help you anticipate market trends, optimize procurement strategies, and make informed investment decisions. This leads to better negotiation and timing in purchases, thereby reducing the impact of price volatility.

Clients can receive analyst support to answer specific questions related to the reports. Additionally, we offer services like risk management, category intelligence, should-cost models, and trade data analytics as part of our extended suite of offerings.

Basic Report -

One Time

Basic Report -

Annual Subscription

Detailed Report -

One Time

Detailed Report -

Annual Subscription

Basic Report -

One Time

USD 799

tax inclusive*

Basic Report -

Annual Subscription

USD 3,499

tax inclusive*

Detailed Report -

One Time

USD 4,299

tax inclusive*

Detailed Report -

Annual Subscription

USD 7,999

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share