Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Base Year

Historical Period

Forecast Period

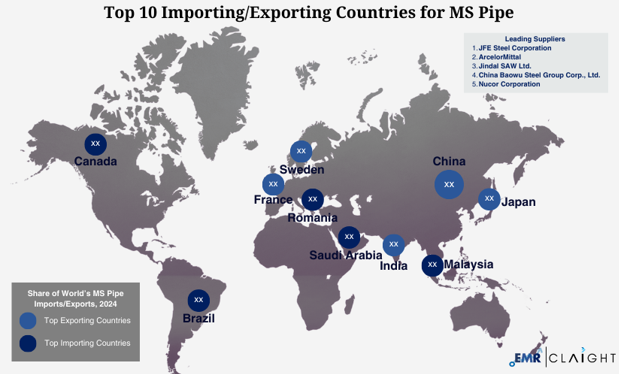

The Expert Market Research pricing report on MS Pipe provides insights into the top 10 leading trading countries and regions.

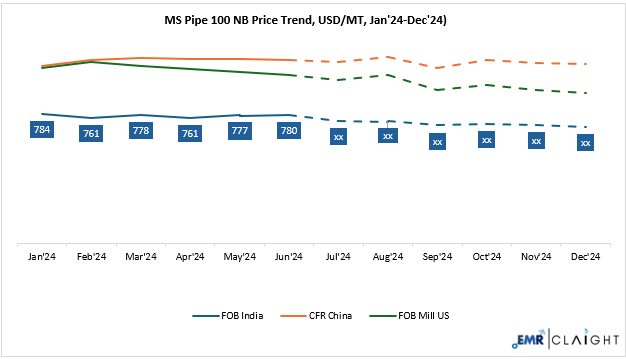

In 2024, Mild Steel (MS) pipe price trends fluctuated with global trade policies, shifting industrial trends, and global supply all impacting the prices. Major markets such as North America, Asia-Pacific, and Europe observed price changes, indicating the impact of the global business environment and dynamic economic climate. Global steel prices, including MS pipes, are expected to decline through Q1 and mid-2025 due to oversupply, weak demand (especially from China’s property sector), and a surge in Chinese steel exports. Additionally, reduced global capacity utilisation has intensified downward pressure on prices.

| MS Pipe 100 NB Price (USD/MT) YoY Change, FOB India | ||||

| Month | 2023 Price | 2024 Price | YoY Change | Expert Market Research Price Prediction for 2025 |

| October | 844 USD/MT | 724 USD/MT | - 14% | Prices show a mixed trend driven by global oversupply and regional demand fluctuations. |

| November | 850 USD/MT | 720 USD/MT | - 15% | |

| December | 825 USD/MT | 707 USD/MT | - 14% | |

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

In late 2024, MS pipe prices saw fluctuations across different regions with changes in the prices of mild steel. These were caused by changes in trade restrictions, shifts in global demand, and setbacks in steel production. Declining industrial demand for steel also affected the market. Price changes were also influenced by the rising costs of coal and iron ore, which are significant raw materials employed in the production of steel. Broader macroeconomic factors affecting MS pipe price forecast, such as global supply chain problems, trade policy, and inflation further impacted pricing dynamics.

In 2024, the prices of MS pipes fluctuated because of changes in the market outlook. In Europe, the cost of mild steel (which is used to make MS pipes) reached its highest point in February. After which the prices gradually returned to what they were at the start of the year. This pattern influenced the overall cost of MS pipes in the region. In late 2024, an increase in raw material prices followed by market uncertainty in Europe led to a price surge in MS Pipes. The announcement of China’s trade policies and rising costs of metallurgical materials also affected price trends during this time. While the USA and Europe saw price drops, a slight price increase was seen in China.

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

Looking ahead to 2025, price recovery of MS pipes is expected in some regions. In the US, steel demand is likely to grow with a rise in construction spending, driven by lower interest rates. This rise in demand would likely push prices for products like MS pipes higher. In China, both steel production and consumption are expected to grow. Despite concerns about overproduction in China, its impact on the MS pipe market is expected to be less significant.

| Leading Exporting Countries | Leading Importing Countries | Major Suppliers |

| France | Canada | Borusan Mannesmann Boru Sanayi ve Ticaret A.S (Turkey) |

| Sweden | Brazil | JFE Steel Corporation (Japan) |

| India | Romania | ArcelorMittalS.A.(Luxembourg) |

| China | Saudi Arabia | Jindal SAW Ltd. (India) |

| Japan | Malaysia | China Baowu Steel Group Corp., Ltd. (china) |

| South Korea | United States | Nippon & Sumitomo Stainless Steel Metal Corporation (NSSMC) (Japan) |

| Turkey | Germany | POSCO (South Korea) |

| Italy | Australia | Baosteel Group (China) |

Global MS (Mild Steel) pipe prices have been significantly influenced by key international trade policies and regulatory changes that have reshaped market dynamics and affected trade volumes. The relaxation or imposition of tariffs, anti-dumping duties, and shifting bilateral trade agreements have created uncertainties in global trade flows, directly impacting the pricing and availability of MS pipes. At the same time, increased production capacity across various countries, along with substantial investments in new manufacturing facilities and expansions of existing ones, have contributed to an oversupply in the market. This rising supply has exerted downward pressure on prices, especially in regions where demand growth has not kept pace with output.

Geopolitical developments in key manufacturing regions have further intensified market pressures. For instance, China's sharp increase in steel exports has driven down global steel prices, creating a highly competitive environment that challenges domestic producers in markets such as Europe and Australia. These countries face difficulties in maintaining profitability amidst cheaper imported alternatives. Meanwhile, the United States' continued reliance on Chinese steel has disrupted traditional trade patterns and introduced greater volatility in MS pipe pricing analysis. This complex interplay of oversupply, geopolitical influence, and shifting trade alliances continues to shape the competitive landscape of the global MS pipe industry.

The change in prices of iron ore and coking coal impacts the prices of mild steel pipes. As raw material is needed for steel manufacturing, changes in the price of iron ore affect the manufacturing cost of MS products.

Iron ore prices in 2024 saw fluctuation owing to changes caused due to shifts in worldwide demand and supply chain disruptions. Meanwhile, coking coal prices fluctuated owing to changes in international trade policy due to political instability and supply shortages. Both the increase in iron ore and coal prices directly fuelled MS pipe production costs. Shortages in supplies and regulations, such as China's export bans, have further impacted the availability and price of MS pipes. The increased dependence on scrap steel for production has also seen a rise in demand, resulting in MS pipe price fluctuations.

In 2025, MS pipe is expected to see moderate price growth and movements, as the industry is expected to benefit from global fiscal policies and monetary measures aimed at stabilising market conditions. The expansion of industries like construction, water management, and chemicals could lead to heightened demand because increased urbanisation and population growth are among the main factors driving the rising demand for MS pipes. Econometric market analysis also suggests that the demand for steel pipes would also increase due to the need for additional infrastructure and the rapid development of cities. Furthermore, technological advancements would increase production efficiency and provide affordable solutions that would fuel market expansion. On the other hand, volatile raw material prices, more stringent environmental laws, and geopolitical events would affect pricing patterns and demand forecast.

| Report Features | Coverage - Detail Report Annual Subscription |

| Product Name | MS Pipe |

| Report Coverage | Price Forecasting and Historical Analysis: Monthly historical prices (2021-2024), short- and long-term price forecasts (2025-2026), scenario forecasts (most probable, optimistic, pessimistic) |

| Regional and Grade-wise Market Breakdown: The top 10 countries in terms of production, consumption, export, and import, regional insights (USA, North West Europe, China, India, South East Asia, Brazil, Mexico, South Africa, Nigeria, GCC, Japan, South Korea, etc.). | |

| Grade Wise Price Trends with Incoterms: Variation in price by product grade and specifications, and Incoterms. | |

| Price Drivers and Cost Structure: Feedstock correlations, production costs, market competition, government policies, economic factors | |

| Supply and Demand Analysis: Regional supply-demand analysis (North America, Europe, Asia Pacific, etc.), company-level and grade-level supply-demand, plant shutdown, expansion, force majeure, details | |

| Trade Balance Analysis: Historical deficit and surplus countries, net importers and exporters, Product movement, Supply Chain, Freight, Duties and Taxes | |

| Production Cost Breakdown: Direct and indirect cost breakdowns: raw material, labour, processing, packaging, overhead, R&D, taxes | |

| Profitability Assessment: Profit margin evaluations | |

| Industry News and Macroeconomic Context: Geopolitical events, policy updates, GDP, inflation, exchange rates, and their impact on coal prices | |

| Data Overview: Macroeconomic Impact, Supply-Demand, Government/Industry Inputs, Custom Insights | |

| Currency | USD (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customised based on the requirements of the customer |

| Post-Sale Analyst Support | Till the end of the subscription |

| Data Access | Lifetime Access, Visualisation |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Gain a competitive edge with Expert Market Research's comprehensive price forecasting reports. Dive deep into the latest market dynamics and price outlook for your specific materials, ensuring you stay ahead of the curve with actionable insights and strategic foresight.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Our market research reports cover a wide range of commodities, including chemicals (including speciality chemicals), metals, agricultural ingredients, and energy. Each report focuses on a specific commodity to provide detailed insights.

Our reports are updated monthly to provide the most current data and insights. Users can also subscribe to quarterly or semi-annual updates based on their needs.

We source our data through primary interviews with our supplier and trader network, government websites, industry bodies, and world trade data, ensuring accuracy and reliability.

Yes, we offer custom reports tailored to your specific needs. Please contact our support team for more information.

Our reports provide critical insights that help you anticipate market trends, optimize procurement strategies, and make informed investment decisions. This leads to better negotiation and timing in purchases, thereby reducing the impact of price volatility.

Clients can receive analyst support to answer specific questions related to the reports. Additionally, we offer services like risk management, category intelligence, should-cost models, and trade data analytics as part of our extended suite of offerings.

Basic Report -

One Time

Basic Report -

Annual Subscription

Detailed Report -

One Time

Detailed Report -

Annual Subscription

Basic Report -

One Time

USD 799

tax inclusive*

Basic Report -

Annual Subscription

USD 3,499

tax inclusive*

Detailed Report -

One Time

USD 4,299

tax inclusive*

Detailed Report -

Annual Subscription

USD 7,999

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share