Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Base Year

Historical Period

Forecast Period

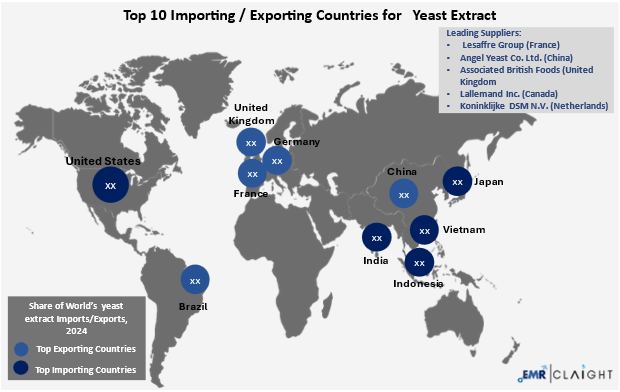

The EMR pricing report on Yeast Extract provides insights into the top 10 leading trading countries and regions.

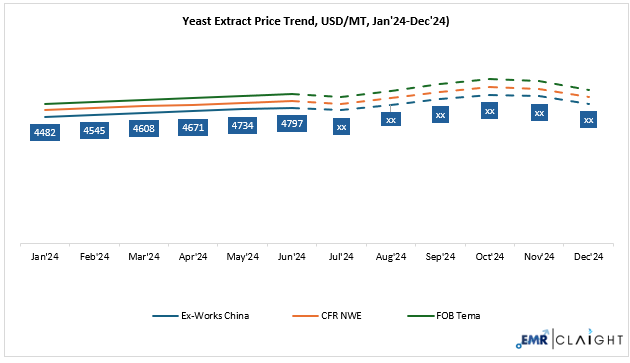

In 2024, global yeast extract prices rose sharply due to a surge in the cost of key fermentation feedstocks and persistent supply constraints, putting significant pressure on food manufacturers and impacting pricing across the savory snacks, instant noodles, and processed foods sectors. By Q1 2025, these extract prices began to stabilize as new fermentation capacity came online and raw material costs eased, offering some relief to ingredient buyers. Despite this, production remained resilient, with output in major Asian and European markets falling only 2–3%, which was better than anticipated and helped support overall market stability.

| Yeast Extract, Price (USD/TON) YoY Change, Ex-Works China | ||||

| Month | 2023 Price | 2024 Price | YoY Change | Expert Market Research Price Prediction for 2025 |

| October | 4940 USD/TON | 5260 USD/TON | + 6.48% | Prices are expected to remain stable, supported by easing input costs and steady production despite slight output declines. |

| November | 4770 USD/TON | 5200 USD/TON | + 9.02% | |

| December | 4820 USD/TON | 4930 USD/TON | + 2.28% | |

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

The rising cost of yeast extract and growing consumer demand for clean-label, sustainable ingredients are prompting food manufacturers to explore alternative flavor enhancers that preserve umami richness and functionality while reducing reliance on traditional extract. One emerging solution is nucleotide-based flavor enhancers, which use compounds such as IMP and GMP to deliver savory depth at lower inclusion rates. These ingredients enable a reduction in yeast extract usage by up to 30% in snack seasonings and from 1.5% to 1.0% in bouillon and soup formulations, helping manufacturers control costs and meet evolving consumer preferences.

Global yeast extract prices surged throughout 2024, driven by escalating costs of key fermentation feedstocks and ongoing supply chain disruptions. However, in March 2024, the release of improved production forecasts for the latter half of the year and early 2025 triggered a notable correction, with spot these extract prices in major Asian and European markets declining as market sentiment shifted from continued tightness to expectations of supply improvement. The updated supply outlook for 2025, supported by technological advances and capacity expansions in China and Europe, has further shifted market dynamics, signaling the potential for downward pressure on yeast extract prices in the near term. However, any renewed supply chain disruptions or unexpected demand surges could reverse this trend.

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

| Leading Exporting Countries | Leading Importing Countries | Major Suppliers |

| China | US | Lesaffre Group (France) |

| Brazil | Vietnam | Angel Yeast Co. Ltd. (China) |

| Germany | Indonesia | Associated British Foods (United Kingdom |

| France | India | Lallemand Inc. (Canada) |

| Netherlands | Belgium | Koninklijke DSM N.V. (Netherlands) |

| UK | UK | Ohly GmbH (Germany) |

| Belgium | Japan | Kerry group (Ireland) |

| Turkey | Russia | Mitsubishi Corporation Life Sciences (Japan) |

The recent imposition of new United States tariffs in 2025 on yeast extract imports from the Netherlands, one of the leading suppliers to the American market, has caused significant disruptions in the extract trade for yeast. A 20% tariff now applies to non-alcoholic preparations of these extract imported from the Netherlands, raising costs for United States food and beverage manufacturers who rely on these imports. The market is expected to experience fluctuating growth and continued volatility as companies navigate the combined impacts of tariff changes, persistent supply chain challenges, and shifting global demand.

Apart from tariff-related trade friction, the global industry for yeast extract is already grappling with supply chain and raw material challenges. Fluctuations in the prices of key agricultural commodities, such as molasses and corn, have increased production costs and created uncertainty for manufacturers. These disruptions are compounded by regulatory pressures and the need for significant investments in food safety and quality compliance, which further strain resources and affect operational efficiency. As a result, downstream food and beverage producers in the United States and Europe, who rely on consistent and high-quality extract imports, face ongoing logistical and sourcing difficulties. The long-term consequences include greater complexity in inventory management, less predictable price stability, and evolving trade relationships as companies seek to diversify sourcing and mitigate risks.

Yeast extract is produced from baker’s or brewer’s yeast, which is grown on carbohydrate-rich raw materials such as molasses or corn syrup, typically sourced from sugarcane or corn crops cultivated in temperate and tropical regions. The production process begins with fermentation, where the yeast is cultivated in large tanks under controlled temperature and oxygen levels to promote optimal growth. Following fermentation, the yeast undergoes autolysis, a natural breakdown process in which the yeast’s own enzymes digest the cell contents, releasing proteins, amino acids, vitamins, and minerals into a solution. This mixture is then separated by centrifugation to remove the insoluble cell walls, leaving behind a flavorful yeast extract. Finally, the extract is concentrated and dried, usually by spray drying, to produce a powder or paste suitable for various food applications. Recent increases in the prices of molasses and other carbohydrate feedstocks have made these extract more expensive, which in turn has raised the cost of savory foods and seasonings.

In 2024, yeast extract supply improved as producers in China and Europe expanded capacity and optimized fermentation, helping to ease the price pressures seen in the previous year. Global demand remained steady, with consumption estimated at around 220,000 tons and market value reaching approximately USD 7.8 billion, as food and beverage manufacturers continued to use yeast extract for its clean-label and flavour, enhancing properties, though some adjusted formulations to manage higher input costs.

Looking ahead to 2025, the market for these extracts is expected to continue its upward trend, with global demand projected to rise further as bakery, convenience foods, and plant-based products drive consumption. The market is anticipated to maintain stable supply conditions, supported by ongoing investments in production technology and raw material sourcing. By 2033, the global yeast extract market is forecast to reach USD 13.9 billion, reflecting sustained growth in both food and non-food applications. However, any unexpected disruptions in feedstock availability or production could still lead to renewed price volatility.

| Report Features | Coverage - Detail Report Annual Subscription |

| Product Name | Yeast Extract |

| Report Coverage | Price Forecasting and Historical Analysis: Monthly historical prices (2021-2024), short- and long-term price forecasts (2025-2026), scenario forecasts (most probable, optimistic, pessimistic) |

| Regional and Grade-wise Market Breakdown: The top 10 countries in terms of production, consumption, export, and import, regional insights (USA, North West Europe, China, India, South East Asia, Brazil, Mexico, South Africa, Nigeria, GCC, Japan, South Korea, etc.). | |

| Grade Wise Price Trends with Incoterms: Variation in price by product grade and specifications, and Incoterms. | |

| Price Drivers and Cost Structure: Feedstock correlations, production costs, market competition, government policies, economic factors | |

| Supply and Demand Analysis: Regional supply-demand analysis (North America, Europe, Asia Pacific, etc.), company-level and grade-level supply-demand, plant shutdown, expansion, force majeure, details | |

| Trade Balance Analysis: Historical deficit and surplus countries, net importers and exporters, Product movement, Supply Chain, Freight, Duties and Taxes | |

| Production Cost Breakdown: Direct and indirect cost breakdowns: raw material, labour, processing, packaging, overhead, R&D, taxes | |

| Profitability Assessment: Profit margin evaluations | |

| Industry News and Macroeconomic Context: Geopolitical events, policy updates, GDP, inflation, exchange rates, and their impact on coal prices | |

| Data Overview: Macroeconomic Impact, Supply-Demand, Government/Industry Inputs, Custom Insights | |

| Currency | USD (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customised based on the requirements of the customer |

| Post-Sale Analyst Support | Till the end of the subscription |

| Data Access | Lifetime Access, Visualisation |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Gain a competitive edge with EMR's comprehensive price forecasting reports. Dive deep into the latest market dynamics and price outlook for your specific materials, ensuring you stay ahead of the curve with actionable insights and strategic foresight.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Our reports cover a wide range of commodities, including chemicals (including speciality chemicals), metals, agricultural ingredients, and energy. Each report focuses on a specific commodity to provide detailed insights.

Our reports are updated monthly to provide the most current data and insights. Users can also subscribe to quarterly or semi-annual updates based on their needs.

We source our data through primary interviews with our supplier and trader network, government websites, industry bodies, and world trade data, ensuring accuracy and reliability.

Yes, we offer custom reports tailored to your specific needs. Please contact our support team for more information.

Our reports provide critical insights that help you anticipate market trends, optimize procurement strategies, and make informed investment decisions. This leads to better negotiation and timing in purchases, thereby reducing the impact of price volatility.

Clients can receive analyst support to answer specific questions related to the reports. Additionally, we offer services like risk management, category intelligence, should-cost models, and trade data analytics as part of our extended suite of offerings.

Basic Report -

One Time

Basic Report -

Annual Subscription

Detailed Report -

One Time

Detailed Report -

Annual Subscription

Basic Report -

One Time

USD 799

tax inclusive*

Basic Report -

Annual Subscription

USD 3,499

tax inclusive*

Detailed Report -

One Time

USD 4,299

tax inclusive*

Detailed Report -

Annual Subscription

USD 7,999

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share