Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global adhesive tapes market attained a value of USD 72.48 Billion in 2025 and is projected to expand at a CAGR of 5.10% through 2035. The market is further expected to achieve USD 119.19 Billion by 2035. Rising adoption of lightweight assemblies in EVs and industrial automation is accelerating demand for high-strength adhesive tapes that replace bolts and welds while improving production speed and long-term structural reliability.

The market observes an increasing number of manufacturers doubling down on engineered performance and precision bonding solutions for automotive, electronics, and industrial assembly. For example, in August 2022, 3M announced the debut of 3M VHB Extrudable Tape, a new manufacturing bonding solution that brings elevated levels of automation, simplicity, and sustainability across industries. This end-to-end bonding solution combines all the benefits of 3M VHB Tapes with the versatility of a liquid adhesive in a single contained footprint enabling usage on any scale, impacting the entire adhesive tapes market growth trajectory. This move signals how suppliers are strengthening their R&D pipelines to align tapes with advanced automation and miniaturization requirements.

At the same time, sustainability pressures are reshaping material engineering across the industry. Leading players are now adopting solvent-free manufacturing routes and bio-based acrylic chemistries to reduce Scope 3 emissions, while converters are introducing closed-loop liner recycling programs for packaging and logistics customers. In April 2024, tesa, the international manufacturer of innovative adhesive tapes and self-adhesive product solutions, launched tesa 4965 Original Next Gen, an improved version of one of its hero products, tesa 4965 Original, reshaping the adhesive tapes market trends and dynamics. Buyers are beginning to prioritize vendors who supply low-VOC tapes with lifecycle transparency, which is pushing adhesive formulators to publish digital material passports and environmental performance dashboards.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5.1%

Value in USD Billion

2026-2035

*this image is indicative*

Manufacturers are developing silicone and fluor-silicone tapes engineered to survive repeated thermal cycling, battery outgassing, and micro-contamination constraints on semiconductor lines. In April 2025, DataLase and TamperTech joined forces to introduce a tamper-evident tape technology. These tapes are now used for battery pack insulation, motor stator bonding and cleanroom masking where sub-micron particle control matters, accelerating heavy demand in the adhesive tapes market. OEMs in automotive and electronics are specifying tighter outgassing and ionic contamination limits, pushing tape formulators to adopt high-purity feedstocks and cleanroom fabrication.

Acrylic adhesives are being tuned for structural bonding, enabling OEMs to replace rivets and spot welds in lightweight composite and aluminum assemblies. These grades are engineered for UV and solvent resistance, and they are compatible with surface treatments used on composites and coatings. For example, Norbond F500 features a durable black closed-cell polyurethane foam and a high-performance acrylic adhesive system. Manufacturers are providing engineering support such as peel/shear modelling and test protocols to help design teams specify tapes as load-bearing joints. This trend in the adhesive tapes market is particularly strong in EV body-in-white, glazing systems and composite-heavy commercial vehicles.

Regulatory pushes and corporate Scope 3 commitments are turning recycled liners, bio-based adhesives and solvent-free coating processes into buyer checkboxes, not merely marketing claims. Large logistics customers and retail converters are demanding closed-loop liner take-back programs and recycled content thresholds. In August 2024, Shurtape Technologies, LLC introduced its Shurtape Recycled Series Packaging Tapes made with 90% Post-Consumer Recycled (PCR) Polyester, found in Polyethylene Terephthalate (PET) bottles and rigid containers. Tape makers are responding with solventless hot-melt adhesive lines, recycled-paper liners, and transparent environmental product declarations, driving the adhesive tapes market value. Those that combine performance parity with demonstrable circularity are achieving preferred-vendor status across appliance, packaging and retail accounts.

Tapes are being designed as functional subsystems. EMI shielding tapes with conductive layers, thermal interface tapes that replace greases, flame-retardant barrier tapes for aerospace, and micro-porous medical tapes that balance breathability with barrier performance. In April 2023, Lohmann presented two electrically conductive, single-sided adhesive foams for simple grounding or contacting of electronic components (for low currents), including in the fields of e-mobility, medical technology, printed electronics or smart homes, creating new adhesive tapes market opportunities. Suppliers are integrating carrier films, metalized foils and engineered adhesive chemistries to meet multi-functional specs.

Tape suppliers are bundling digital tools such as dispensing heads, vision-guided placement, and material passports that link lot-level QC data to installed panels to lower placement defects on high-speed lines, boosting the adhesive tapes market. In June 2025, Cyklop introduced a new Diamond recyclable paper tape dispenser to complement its extensive portfolio of packaging solutions and services. Robotic applicators and predictive-dispense algorithms are reducing waste and improving laydown precision, especially in electronics and medical device production.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Adhesive Tapes Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Resin Type

Key Insight: Acrylic resins currently dominate the adhesive tapes market dynamics through its combination of structural potential and environmental resilience. Silicone is growing popular in thermal- and cleanroom-critical applications. Rubber remains key for high-tack temporary masking and packaging while specialty chemistries (fluoro, polyurethane) serve niche requirements like chemical resistance and medical compatibility.

Market Breakup by Material

Key Insight: Material groups as considered in the market report include paper, polyvinyl chloride, polypropylene and others. Polypropylene leads the adhesive tapes market due to durability and cost-effectiveness. Paper is gaining share for recyclable packaging needs, on the other hand, PVC serves niche demands where chemical resistance and film formability are needed. Specialty materials like foils and nonwovens deliver thermal or structural functionality. Companies that can offer matched adhesive-film systems and help customers with end-of-life routing (recycling or composting) are gaining preference in procurement and retail programs.

Market Breakup by Technology

Key Insight: Hot-melt account for the largest share of the adhesive tapes market revenue for industrial throughput and solvent-free processing. Water-based systems are rapidly growing due to sustainability and low-VOC advantages. Solvent-based remains for very high-performance and specialty tapes where performance margins require solvent chemistries and other technologies (reactive, UV-curable) are used in niche assemblies like electronics. Tape makers are balancing regulatory pressures, line-capex and end-use performance.

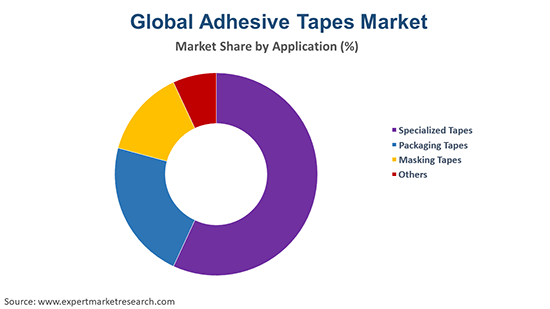

Market Breakup by Application

Key Insight: Packaging delivers volume and operational requirements. Specialized tapes are growing their shares in the market due to functional substitution across electronics, aerospace and medical applications. Masking is steady with advanced polymer coatings needed for high-temperature paint lines and other categories such as floor marking, protective films serve niche industrial workflows.

Market Breakup by Region

Key Insight: The adhesive tapes market in Asia Pacific holds the leading position due to manufacturing scale and OEM proximity. Europe boasts significant growth owing to premium and sustainability-driven demand. North America demands automation-ready tapes with strong medical and aerospace requirements. Latin America and Middle East and Africa are developing markets where packaging and industrial tapes are growing with logistics and construction.

By resin type, acrylic resins dominate the market thanks to structural bonding and broad environmental tolerance

Acrylic resins lead because they combine broad substrate compatibility, ageing stability and the potential to be engineered into structural grades. Modern acrylic tapes are formulated with controlled glass transition temperatures, reactive monomers and crosslinking strategies to deliver high shear strength, creep resistance and UV resilience. This makes them attractive for bonding metal, glass and composite body panels in automotive, as well as for glazing and architectural laminates. In November 2023, EPS launched EPS 2133, an all-acrylic polymer made without APEO surfactants that can be formulated for permanent and removable pressure-sensitive adhesive applications.

Silicone-based adhesives observe fast-paced growth in the adhesive tapes market in high-spec sectors like electronics, heat management and medical devices due to their exceptional thermal stability and low-outgassing profiles. Unlike acrylics, silicones maintain bond integrity across wide temperature ranges and are compatible with high-temperature sterilization processes, making them well-suited for battery insulation tapes and semiconductor process masking. Growth in this resin category is driven by demand for thermal interface materials and conformal masking products in fabs and EV battery lines.

By material, polypropylene-backed tapes lead due to low cost and chemical resistance advantages

Polypropylene-backed tapes dominate the market value across packaging, general-purpose sealing and many industrial uses because the film combines low cost, high chemical resistance and easy die-cutting. Polypropylene carriers offer excellent moisture resistance and are compatible with hot-melt and acrylic coatings, making them a staple for logistics and industrial bundling applications. In March 2025, Magis launched the first bi-oriented adhesive tape made from 100% recycled polypropylene.

As per the adhesive tapes market revenue, paper-backed tapes are the fastest-growing material subsegment in sustainability-conscious packaging and labeling, driven by recyclability and consumer-packaged-goods transitions away from plastic-lined tapes. Kraft paper carriers with water-based acrylic adhesives provide acceptable performance for many shipping and retail sealing applications while enabling easier cardboard recycling. Specialty paper tapes are also being engineered with reinforced fibers, moisture barriers and improved liner-release systems to match mechanical performance demands.

By technology, hot-melt-based systems register the largest market share owing to solvent-free, high-throughput industrial coating lines

Hot-melt-based adhesive technologies dominate industrial tape production because they enable solvent-free lines, rapid coat weights and scalable output while meeting low-VOC and energy-efficiency targets. Hot-melt systems support a broad range of carriers, from PP films to foams, and can be tailored for tack, shear and temperature resistance by modifying polymer blends. In October 2025, BioBond Adhesives announced its entry into the hot melt market with the introduction of its BioMelt Pressure Sensitive Adhesive product offerings for labels, tape and many industrial and consumer markets. Industrial manufacturers favor hot-melt for its clean processing and tight coat-weight control, which reduces waste on high-speed slitting lines, opening up new adhesive tapes market opportunities.

Water-based adhesive technologies are gaining ground due to tightening solvent emissions regulations and buyers’ sustainability targets. Waterborne acrylic dispersions enable low-VOC coatings and improved recyclability for packaging tapes and paper-backed systems. Advances in polymer stabilization and drying technology have improved initial tack and shear profiles to approach solvent-based performance without the environmental burden.

Packaging tapes dominate due to volume, logistics needs, and recyclable-material demand

Packaging tapes remain the biggest volume engine in the adhesive tapes market because e-commerce, parcel logistics and retail merchandising create massive, recurring demand. Retailers and 3PLs are asking for tapes that are fully recyclable with corrugate, have low-temperature adhesion for cold-chain parcels, and carry printable surfaces for brand messaging or QR-based traceability. In January 2024, Monta added a new paper tape, featuring a natural rubber adhesive and backing reportedly sourced from sustainable forestry to its Greenline range to streamline transition into mono-material, recyclable packaging solutions. Tape makers are responding with paper-backed waterborne-acrylic systems and PP film constructions engineered for automated case-sealing machines and high-speed dispensers.

Specialized tapes such as EMI shielding, thermal interface, flame-retardant, and ultra-clean assembly tapes are propelling the adhesive tapes market expansion because end users are substituting multi-component joints with single-source functional tapes. Electronics manufacturers are specifying low-outgassing, thermo-conductive tapes for chip packaging and battery assembly. Aerospace and rail customers want certified fire-barrier tapes that meet FAR and EN standards. Medical device makers need sterile, breathable adhesive films with validated skin-compatibility.

Asia Pacific clocks in the dominant position in the market owing to manufacturing scale and integrated supply chains

Asia Pacific dominates the adhesive tapes market because it combines major converting capacity, integrated film and resin supply, and concentrated electronics and automotive manufacturing hubs. Countries with large industrial parks host converters that can offer rapid custom slitting, co-extrusion and low-cost pilot runs, shortening qualification cycles for OEMs.

Europe is the fastest-growing region boasting premium and sustainable adhesive tape demand as OEMs and regulators push low-carbon materials, recyclability and high-spec functional tapes. European buyers are prioritizing solvent-free coatings, recycled liners, and environmental product declarations. They are also early adopters of advanced functional tapes for EV battery insulation and thermal management. The region’s strong automotive, aerospace and medical device clusters are commissioning more certified, small-batch specialized tapes, creating growth for converters able to provide validated test data and certified supply chains.

The global market is consolidating around suppliers who can offer material-system solutions plus process support. Key focus areas for adhesive tapes market players include sustainability such as recyclable liners, bio-based adhesives, functional integration with thermal, EMI, flame-retardant tapes, and digital-enabled supply. Converters that invest in cleanroom coating lines and automated dispensing hardware are being qualified by electronics and medical OEMs where contamination or precision placement matters. Opportunities can be found in offering certified application packages which reduce OEM qualification time and lower total cost of ownership.

Niche adhesive tape companies can prosper by specializing in ultra-clean or certified high-temperature tapes, while large incumbents are scaling sustainable product portfolios and global slitting footprints. For new entrants, co-development with OEMs, regional near-shoring, and offering end-of-life solutions (liner take-back) are key differentiators in bids.

3M Co, established in 1902 and headquartered in Minnesota, United States, is a global leader in adhesive tapes offering a broad portfolio from consumer to high-performance industrial tapes. The company supports OEMs with engineering services, on-site testing rigs and validated dispensing systems to shorten qualification cycles for electronics, automotive and aerospace customers.

Founded in 1887 and headquartered in the United States, H.B. Fuller Company supplies adhesives and tape coatings with emphasis on custom adhesive formulations and application engineering. Fuller is investing in waterborne and reactive hot-melt technologies to meet customers seeking lower VOC footprints.

Established in 1934 and headquartered in Tokyo, Japan, LINTEC Corporation is a specialist in functional films and adhesive tapes for electronics, automotive and office automation markets. LINTEC focuses on engineered carriers and high-purity coating processes for low-contamination applications and is expanding capabilities in thermal management tapes and conductive adhesive laminates.

Berry Global Inc., established in 1967 and headquartered in Evansville, Indiana, is a major film and converting business producing tape carriers, protective films and packaging tapes. Berry is leveraging its global film extrusion scale to offer tailored carrier substrates and is investing in recycled-content film lines and closed-loop liner programs.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other prominent players in the market include Nitto Denko Corporation, Bostik Inc., and Sika AG, among others.

Unlock the latest insights with our adhesive tapes market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 72.48 Billion.

The market is projected to grow at a CAGR of 5.10% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 119.19 Billion by 2035.

Companies are developing recyclable liners, launching bio-based adhesives, integrating dispensing solutions, expanding regional converting hubs, and offering engineered tape-system packages to win OEM approvals.

The key trends guiding the market are increasing construction projects, rapid urbanisation in developing countries, and surging manufacturing activities in the Asia Pacific region.

The major regions in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The various resin types considered in the market report include silicone, acrylic, and rubber, among others.

Paper, polyvinyl chloride, and polypropylene, among others, are the various materials considered in the market report.

The significant technologies of adhesive tapes considered in the market report are water-based, hot-melt-based, and solvent-based, among others.

The several applications of adhesive tapes include specialised tapes, packaging tapes, and masking tapes, among others.

The key players in the market include 3M Co., H.B. Fuller Company, LINTEC Corporation, Berry Global Inc., Nitto Denko Corporation, Bostik Inc., and Sika AG, among others.

Balancing high-performance specs with recyclability, managing volatile resin and film costs, scaling cleanroom conversion, meeting regional regulations, and shortening OEM qualification cycles are the industry’s main commercial pressures.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Resin Type |

|

| Breakup by Material |

|

| Breakup by Technology |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share