Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global advanced ceramic market size was valued at USD 117.97 Billion in 2025. The industry is expected to grow at a CAGR of 4.50% during the forecast period of 2026-2035 to reach a value of USD 183.20 Billion by 2035. The market growth is significantlyy influenced by the rising demand of high-performance materials in electronics and strategic portfolio expansions by some of the key market players.

In recent years, the growth of the global advanced ceramic market is influenced by the increased demand of materials that can resist extreme thermal, electrical and chemical environments especially in semiconductor fabrication and energy systems. Also, increasing number of medical implants and diagnostic equipment are being penetrated by increasing the use of precision-engineered ceramics due to their biocompatibility and durability.

Furthermore, glass ceramic composites and alumina powders significantly contribute to improving the mechanical strength, thermal properties, and durability of the devices or industrial components. These materials have been extensively used in consumer electronics, EVs, aerospace, and renewable energy systems, reflecting their multifunctionality in the new technologies of the future. Through the development of advanced ceramic formulations, companies not only satisfy the ever-changing performance demands but also extend their exposure in the global advanced ceramic market through acquisitions and collaborations in diverse end-use sectors.

For instance, in January 2025, Corning Incorporated collaborated with Samsung Electronics to launch Corning 2025 Gorilla Armor 2 on the Galaxy S25 Ultra, which offers mobile devices anti-reflective and high-strength glass ceramic. Similarly, in October 2024, Momentive Technologies also acquired the spherical alumina and silica businesses of Sibelco to bolster its thermal management offerings in electronics, EV applications, and renewable energy.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4.5%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Advanced Ceramic Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 117.97 |

| Market Size 2035 | USD Billion | 183.20 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.50% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 7.7% |

| CAGR 2026-2035 - Market by Country | India | 8.9% |

| CAGR 2026-2035 - Market by Country | China | 7.4% |

| CAGR 2026-2035 - Market by Class Type | Ceramic Matrix Composites | 7.5% |

| CAGR 2026-2035 - Market by End Use | Transportation | 7.6% |

| Market Share by Country 2025 | France | 3.0% |

Acquisitions and mergers enhance the materials portfolio and increase capabilities in high-growth ceramic subsegments, particularly bio ceramics that find medical and consumer use. This type of portfolio expansion helps companies to cater to wider markets and enhance their position in the competitive landscape of the global advanced ceramic market. For instance, in August 2025, Lionstead Applied Materials acquired Ceramat Private Limited, an orthopedics, oral care, pharmaceutical, and other bio-ceramics manufacturer, from Tata Steel Advanced Materials, making Ceramat a platform specifically to serve the needs of these markets with increasing demand.

The development of large-format slab production is speeding up the advanced ceramic market growth as the companies implement the next-generation technologies to make the products more efficient, precise, and sustainable. Through the combination of IoT-based smart manufacturing, automated quality control, and digital glazing, the manufacturers will be able to create high-quality and sophisticated designs with minimal material wastage. These types of innovations also increase the opportunities of their use in architecture, interior design, and commercial projects, and strengthen the energy-efficient operation. For instance, in May 2025 RAK Ceramics inaugurated their Continua+ PCR 2180 plant with the industry's first digital and sustainable manufacturing.

Partnerships between technology innovators and ceramics specialists drive the creation of materials and products to operate in extreme conditions and emerging technologies, making the products more relevant in the advanced ceramic market. This type of partnership is a combination of manufacturing skill and application-specific engineering that enhances the fast commercialization of advanced solutions. For instance, in September 2025, Kyocera Corporation and Kyoto Fusioneering Ltd. entered into a joint development agreement and formed a strategic alliance to jointly develop advanced ceramic materials in next-generation fusion energy plants using the strengths of both companies.

The advancement of immersive digital technologies and virtual space is accelerating innovation in the advanced ceramic market by allowing global firms and educational institutions access to cutting-edge research and development facilities. Companies are also able to de-risk new technologies and train and scale innovations faster by allowing them to develop products and processes on industrially relevant scales. For instance, in November 2025, the Staffordshire AMRICC Centre introduced its virtual tour application, demonstrating a high level of capabilities to the international audience.

The advanced ceramic market is growing due to increasing demands of ultra-precision, small-volume, and high-performance ceramics. Firms are also investing in the services of OEM companies that can satisfy the high tolerance, thermal, and chemical resistance of semiconductors, aerospace, medical devices, and electric vehicles. Manufacturers such as Mingrui Ceramic facilitate the market expansion by providing not only green machining, post-sintering accuracy, and end-to-end assembling of components, but also making sure that the quality is met, thus making them the enablers of the growth of the marketplace.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Advanced Ceramic Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

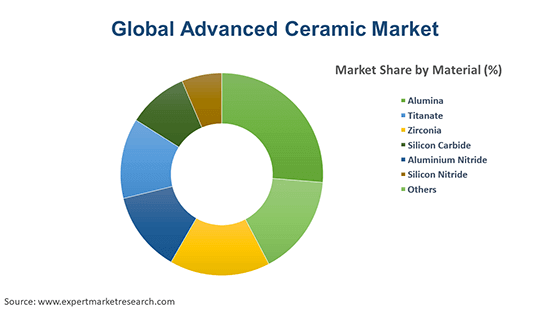

Market Breakup by Material

Key Insights: In terms of materials, the advanced ceramics market scope comprises alumina, titanate, zirconia, silicon carbide, aluminum nitride, silicon nitride, and others. The demand in each category is driven by customized material innovations across sectors. HYCal line of alumina products developed by Alteo helps to increase the dielectric strength and reliability of electronic and industrial applications, whereas KYOCERA exhibits fine ceramic semiconductor products and automotive and ignition components and markets them at industry forums. CeramTec manufactures zirconia and alumina for use in the medical and automotive industries, whereas Materion Corporation produces silicon carbide and silicon nitride for use in aerospace and military.

Market Breakup by Class Type

Key Insights: Based on class type, the advanced ceramics market includes monolithic ceramics, ceramic coatings, ceramic matrix composites (CMCs), and others, reflecting the scope of the advanced ceramics products. Major manufacturers such as KYOCERA Corporation produce monolithic ceramic substrates and semiconductor components, whereas Saint Gobain and Morgan Advanced Materials provide ceramic coatings and CMCs in the high-temperature engines and thermal barriers. The specialty companies combine additive manufacturing and hybrid materials to broaden the category of other class types, dealing with wear-resistant components and structural solutions.

Market Breakup by End Use

Key Insights: In terms of end-use, the advanced ceramics market caters to the needs across sectors such as industrial, transportation, electrical and electronics, defense and security, medical applications, chemical, and others. Market players focus on the development of solutions for specific needs. Materion Corporation is a supplier of zirconia and alumina ceramics to aerospace, defense, and electronics. KYOCERA develops fine ceramic components in the transportation and EV sector, and medical implants and surgery ceramics of CeramTec exemplify healthcare development. Wear-resistant ceramic filters and seals from Saint Gobain and CoorsTek are applied in industrial and chemical segments and are used to emphasize the wide end-use penetration.

Market Breakup by Region

Key Insights: The advanced ceramics market landscape includes Asia Pacific, North America, Europe, Latin America, and the Middle East and Africa, offering varied opportunities regionally. Asia Pacific is the leader in terms of excellent electronics and automotive production, with such companies as KYOCERA developing increased production capacity of advanced ceramics in Japan. The Materion Corporation and 3M have R&D and innovation centers in North America, with CeramTec GmbH in Europe helping to serve automotive, industrial, and medical markets worldwide. The new Latin America and Middle East markets need ceramics, which can be used in infrastructure, energy, and defense.

By material, alumina drives growth across high-performance applications

The alumina advanced ceramics market is growing because of the surging demand for high performance and precision components in medical, electronic and industrial industries. The expanding use of additive manufacturing and new processing methods is providing manufacturers with the capability of producing components with a high level of mechanical strength, wear resistance, and aesthetic quality. To cite an instance, in March 2025, LithaBite alumina made by 3D-printing technology was introduced by Lithoz to support 3D-printed translucent orthodontic bracket design at IDS 2025, demonstrating new developments in the field of dental ceramics and additive manufacturing.

Besides this, the carbide ceramics are also witnessing notable growth in the advanced ceramics market because of increased demand for high-performance material in the mechanical engineering, oil and gas, and power industries. In January 2026, researchers at the South Ural State University, in partnership with OOO “NPO SilKaM” announced a reaction-bonded silicon carbide (RBSC) technology, which made it possible to manufacture wear-resistant, heat-tolerant, and corrosion-resistant parts. This breakthrough supports import substitution, enhances domestic production capacity, and advances the use of complex ceramic solutions in industrial activities.

By class type, monolithic ceramics witness notable demand driven by industrial and refractory applications

The monolith advanced ceramic market is witnessing booming sales due to increased demand by the iron and steel industry as well as the industrial sector in regard to high-performance refractory materials. The manufacturers are working on newer manufacturing technologies and sustainable processes to increase their efficiency, durability, and thermal resistance. For instance, in December 2024, Vesuvius opened new Indian monolithic manufacturing sites in Visakhapatnam, which raised manufacturing capacity and solidified the company as a major supplier of monolithic ceramics in the global market.

Furthermore, the advanced ceramic market sees a steady increase in demand for ceramic coating, which is attributable to its durability and good performance in preserving automotive sector surfaces. Adoption of scratch- and corrosion-resistant coatings is growing in various locations due to increased awareness of vehicle care, adverse weather conditions, and the need for durability. In line with this trend, 3M introduced its Ceramic Coating in India, which offers a hydrophobic surface and durability of paint, which supports innovation and growth in the Asian-Pacific automotive aftermarket.

By end-use, the industrial category shows notable growth owing to high-performance ceramic solutions

The industrial category demonstrates significant growth in the advanced ceramic market as organizations such as Vesuvius, Saint-Gobain, and Morgan Advanced Materials are concentrating on increasing the production level and creating the high-performance ceramic parts in the heavy machines, furnaces, and process equipment. These companies are also investing in the production of highly monolithic and alumina-based ceramics to make them more durable, corrosive, and heat resistant. Research and development are also focused on energy-saving production techniques and environmentally friendly materials, allowing industrial users to improve efficiency, lower maintenance costs, and extend equipment lifespan.

On the other hand, the transport sector is also showing immense interest in the use of ceramics, accounting for a considerable share of the advanced ceramic market. Companies such as Murata, 3M, and Lithoz have come up with automotive, aerospace, and rail solutions. Firms are focusing on lightweight, hardened, and thermally resistant engines, brakes, and coatings. New investments in high-performance alumina and silicon carbide parts, as well as enhanced ceramic coating, are driving improvements in fuel efficiency, safety, and performance. The other goal of research and development is to meet more demanding regulatory standards and changing material needs in transportation systems, further boosting the adoption of advanced ceramic in the transport sector.

By Region, Asia Pacific leads the market growth driven by advanced electronics research and development

The presence of the fast-growing electronics market in the Asia Pacific has surged the demand in the advanced ceramic market, resulting from the growing investments in high-performance components, innovation, and talent building. Firms are working on enhancing production capacity, increasing the pace of research and development, and providing advanced solutions to the intense regional and global demand of high-density and multi-functional electronic modules. In line with this trend, in February 2026, Murata Manufacturing finished a new Ceramic Capacitor R&D Center in Fukui, Japan, and announced a completion ceremony to be held in February 2026, further consolidating its technological dominance in the region.

Meanwhile, the North America advanced ceramic market growth is being driven by the increasing demand for high-performance ceramic components in energy, chemicals, and biofuels. Business corporations are increasing their manufacturing capacities and developing state-of-the-art facilities to satisfy the changing industrial demands. To cite an instance, in February 2025, Saint-Gobain Ceramics declared the construction of a new NorPro factory in Wheatfield, New York, which strengthens technological leadership and expansion of the regional capacity.

| CAGR 2026-2035 - Market by | Country |

| India | 8.9% |

| China | 7.4% |

| Canada | 6.2% |

| Germany | 5.5% |

| Italy | 4.7% |

| USA | XX% |

| UK | XX% |

| France | XX% |

| Japan | 4.6% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

The global advanced ceramic market players are actively investing in advanced manufacturing technologies and application-specific research and development to produce high-performance ceramic materials, which can be used in electronics as well as the healthcare, energy, and automotive industries. Besides that, many advanced ceramic companies are extending their global production footprints and upgrading their technical capabilities to ensure supply reliability, facilitate shorter innovation cycles, and meet changing customer needs thus, gaining competitiveness in both mature and emerging markets.

Moreover, top OEMs in the global advanced ceramic market are looking at strategic partnerships, acquisitions, and collaborative development programs as a means of broadening their product portfolio and entering high-growth areas such as bio ceramics and thermal management. Meanwhile, sustainability efforts and localization of production have been mutually beneficial in these respects and have enabled the companies to bring down their costs, enhance the efficiency of materials usage, and cater more effectively to the demand patterns of individual regions.

3M Co., established in 1902 and headquartered in St. Paul, Minnesota, is a global diversified technology company delivering advanced materials and ceramic-based solutions across electronics, healthcare, and industrial markets. The company leverages strong research and development capabilities to develop high-performance ceramic components that support next-generation manufacturing and engineering applications.

KYOCERA Corporation, established in 1959 and headquartered in Kyoto, Japan, is a leading provider in the advanced ceramic market, serving sectors such as electronics, automotive, and medical devices. The company is recognized for its expertise in fine ceramics and its focus on innovation-driven material solutions for high-growth industries.

Corning Incorporated, a company established in 1851 and based in Corning, New York, is a leading manufacturer of specialty glass and advanced ceramic materials for markets such as consumer electronics, life sciences, and telecommunications. Corning, with its rich heritage in materials science, is still at the forefront in creating high-performance ceramic products that are in line with the ever-changing global technology needs.

Materion Corporation, a company established in 1931, based in Mayfield Heights, Ohio, is a supplier of advanced engineered materials, which include technical ceramics for aerospace, semiconductor, and industrial sectors. The company is focused on precision manufacturing and material innovation so that it can offer products for end-use environments that are complex and require the highest level of reliability.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market include CoorsTek Inc. and International Ceramics Inc., among others.

Explore the latest trends shaping the Global Advanced Ceramic Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on global advanced ceramic market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 4.50% between 2026 and 2035.

Key strategies driving the market include product innovation, strategic partnerships with OEMs, capacity expansions, and acquisitions to strengthen material portfolios. Companies are also investing in research and development and developing application-specific ceramics for electronics, healthcare, energy, and automotive sectors.

The key trends guiding the growth of the market include the growing technological advancements, and the rising use in defence and aerospace industries.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading materials in the market are alumina, titanate, zirconia, silicon carbide, aluminium nitride, and silicon nitride, among others.

The major class types in the market are monolithic ceramics, ceramic coatings, and ceramic matrix composites, among others.

The significant end uses in the market are industrial, transportation, electrical and electronics, defence and security, medical, and chemical, among others.

The key players in the market include 3M Co., KYOCERA Corporation, Corning Incorporated, Materion Corporation, CoorsTek Inc., and International Ceramics Inc., among others.

In 2025, the global advanced ceramic market reached an approximate value of USD 117.97 Billion.

Major challenges that the global advanced ceramic market players face include high manufacturing costs, raw material price volatility, complex production processes, and long qualification cycles. Intense competition and the need for continuous innovation also pressure margins.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Material |

|

| Breakup by Class Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share