Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

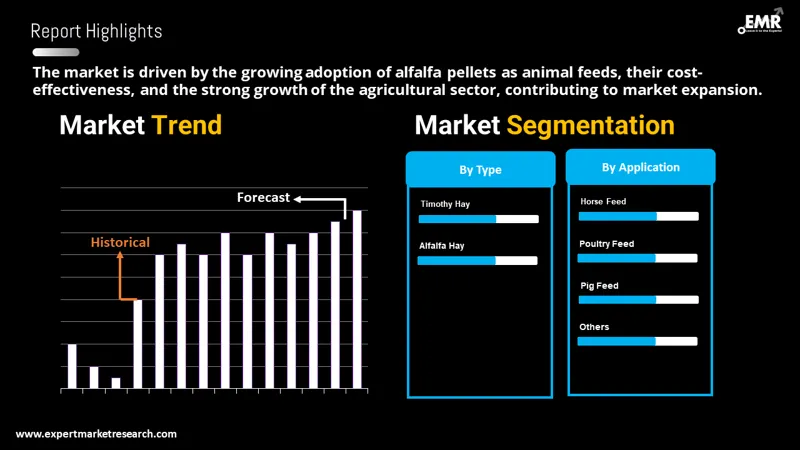

The global alfalfa pellets market size was valued at USD 467.94 Million in 2025. The industry is expected to grow at a CAGR of 4.90% during the forecast period of 2026-2035 to reach a value of USD 755.00 Million by 2035. The market growth is driven by continuous technological innovation in alfalfa breeding and genetic trait development, which enhances the efficiency and nutritional quality of pellet production.

Leading seed technology companies are focusing on traits that improve digestibility, drought tolerance, and protein retention, enabling pellet manufacturers to secure superior-quality feedstock. A key example is Cibus, Inc., which in June 2025 announced the successful completion of the United States FDA Plant Biotechnology Consultation for its altered lignin alfalfa trait developed in partnership with S&W Seed Company.

This milestone paves the way for the commercial release of alfalfa varieties that yield higher-quality forage ideal for pelletizing. Improved feedstock characteristics not only raise pellet nutritional value but also enhance processing efficiency and shelf life, strengthening the overall supply chain for animal feed producers worldwide, further boosting the alfalfa pellets market expansion.

Base Year

Historical Period

Forecast Period

According to the Food and Agriculture Organisation (FAO), poultry meat is predicted to account for 41% of all protein derived from meat sources globally in 2030.

Alfalfa pellets with about 17% crude protein provide animals with a nutritional value equivalent to mature alfalfa hay.

World milk production is projected to grow to 997 Mt by 2029.

Compound Annual Growth Rate

4.9%

Value in USD Million

2026-2035

*this image is indicative*

| Global Alfalfa Pellets Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical Period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | 467.94 |

| Market Size 2035 | USD Million | 755.00 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.90% |

| CAGR 2026-2035 - Market by Region | Latin America | 5.3% |

| CAGR 2026-2035 - Market by Country | Australia | 6.2% |

| CAGR 2026-2035 - Market by Country | Mexico | 5.7% |

| CAGR 2026-2035 - Market by Type | Timothy Hay | 5.9% |

| CAGR 2026-2035 - Market by Application | Horse Feed | 5.1% |

| Market Share by Country | Japan | 6.5% |

With expanding demand and exports across the alfalfa pellets market landscape, many producers have invested in larger pellet plants dedicated solely to alfalfa production. For example, on November 26, 2024, RICHI Machinery completed the installation of a 5 t/h alfalfa pellet plant in Mexico for regional feed operations. That shows a movement from small-scale into industrial-scale production, with enterprises taking advantage of the increasing demand both for feed and export.

Companies are launching alfalfa-based pellet or ingredient products targeting certain niche segments of the pet food or animal feed market. For instance, in October 2025, Leaft Foods released an “Alfalfa Protein Concentrate (APC)” ingredient intended for use in pet food, partnering with Meateor Pet Food Ingredients of New Zealand for United States distribution. This shows that companies are not just bulk-pellet producers but are shifting toward value-added alfalfa-based products and partnerships.

Synergies among forage producers, feed manufacturers, and distributors are on the rise to promote the use of pellet products in an efficient manner, contributing to the sustained growth of the alfalfa pellets market. As demonstrated In September 2023, Andy by Anderson Hay and Heinold Feeds announced a strategic partnership to create custom alfalfa-based feed pellets for young rabbits. Such moves bolster distribution channels and product innovation, strengthening the pellet sector's growth.

Companies are adapting production and logistics in line with the export markets, including denser pellet formats and tailor-made packaging for shipping. For example, in July 2024, a Bulgarian company was supplying organic alfalfa pellets under a supplier agreement for both Turkey and Greece, emphasizing ease of storage and transportation. This is further evidence that the producers are aligning their output to trade-friendly pellet formats to facilitate wider adoption internationally.

Producers in Asia and elsewhere are deploying pellet plants locally to serve both feed and fuel markets, capturing growth in those geographies. A project in northern Kazakhstan was announced in August 2025 by Salar Farm LLP (supported by Soltustik Social Business Corporation) to build an alfalfa-processing plant (drying, baling, pelletising) with an investment of USD 9 million, producing 60,000 t/year. Regional investments such as these expand the production base and offer new opportunities in the alfalfa pellets market by opening new supply locations.

Market participants are improving the quality of pellets, with increased protein and organic certification, and new launches of premium pellet products for value-sensitive niches in place of bulk feed. The "Organic Alfalfa Pellets" offered by the company Standlee are certified organic, non-GMO, and articulated for horses and goats. This targeted launch demonstrates how producers are investing in branded, quality-differentiated pellet products; it helps raise margins and lures value-added feed customers beyond the commodity channels.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Alfalfa Pellets Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insights: The market splits into Timothy Hay and Alfalfa Hay, each propelled by distinct feed needs and innovation strategies. In the Timothy Hay segment, companies such as Poulin Grain are producing high fiber, low moisture timothy pellets grown in Alberta and bundled with custom forage analysis services. Meanwhile, in the Alfalfa Hay segment, firms like Fresco Overseas are exporting ultra-dried alfalfa hay pellets with 2–3% moisture to global feed markets. The rising global livestock demand, advanced pellet processing and dehydration innovations, along with the increasing use of low-cost production regions to serve international trade flows, are fueling growth.

Market Breakup by Application

Key Insights: The global alfalfa pellets market is segmented into meat/dairy animal feed, horse feed, poultry feed, and pig feed. In meat and dairy, companies are enhancing protein content and pellet digestibility to boost milk and meat yields. For horse feed, firms focus on high-fiber, palatable pellets supporting gut health and stamina. Poultry and pig feed segments are driven by rapid growth and feed conversion efficiency, prompting innovations in fortified, moisture-controlled pellets. Across all segments, companies are adopting advanced dehydration, pelletizing, and automated production systems while scaling distribution and forming strategic partnerships to meet global demand.

Market Breakup by Region

Key Insights: The alfalfa pellets market revenue across North America, Europe, Asia Pacific, Latin America, and Middle East & Africa is mainly driven by regional livestock demand and feed trade. In North America, companies like Mendota Agriculture are acquiring processing firms to consolidate supply. European players such as Nafosa optimize pellet production and export via logistics hubs. In Asia Pacific and Latin America, firms are expanding their capacity to serve growing livestock sectors and export markets. Middle East & Africa growth is supported by import-orientated partnerships, exemplified by Bulgarian exporters seeking agreements for Turkey and Greece.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

By type, Timothy Hay gains notable traction

The demand for Timothy Hay is driven by increasing demand for fibre-rich, low-protein forage suitable for equines and small pets such as rabbits and guinea pigs. Companies in the alfalfa pellets industry are focusing on improving hay quality, sustainability, and freshness through advanced harvesting and storage techniques. In August 2024, High Desert Feed promoted its freshly stacked Timothy Hay, highlighting farm-grown, additive-free forage tailored for small pets’ digestive health. Similarly, United Kingdom-based Newhay invested in advanced drying and dust-extraction systems to ensure high-palatability hay with minimal mould formation, catering to the premium pet food market. These initiatives reflect a broader industry trend of enhancing product consistency, sustainability, and logistics efficiency to meet the evolving needs of domestic and export consumers seeking high-quality natural feed.

| CAGR 2026-2035 - Market by | Type |

| Timothy Hay | 5.9% |

| Alfalfa Hay | XX% |

Meanwhile, alfalfa pellets are witnessing proactive innovations from industry players targeting feed quality and global competitiveness. Firms are enhancing protein retention, fibre digestibility, and pellet density using advanced dehydration and compaction technologies. In 2023, Hindustan Animal Feeds launched Alfalfa Hay Pellets with optimized moisture and fibre content for export markets, addressing international demand for nutrient-dense feed. In addition, the ongoing implementation of traceable sourcing, integrating automated pellet lines, and developing region-specific formulations to improve feed efficiency is leading to the alfalfa pellets market expansion into the premium and high-demand global markets.

By application, the demand for meat/dairy animal feed remains strong

The growth of the meat and dairy feed applications is resulting from the surge in dairy herd size and demand for high protein forage to support greater milk and meat output. For example, in India, the “in milk” bovine population rose to 111.76 million in 2023-2024, up by 32.9% since 2013-2014. To meet this scale, market players are deploying advanced dehydration and pelletising technologies to preserve protein and fiber content, improve digestibility and consistency, and strengthen supply chains for dairy producers. These strategies enable manufacturers to deliver nutritionally superior pellets that support higher productivity in meat and dairy operations, further boosting alfalfa pellets market revenue.

| CAGR 2026-2035 - Market by | Application |

| Horse Feed | 5.1% |

| Meat/Dairy Animal Feed | 4.8% |

| Poultry Feed | XX% |

| Pig Feed | XX% |

The horse feed category is expanding as equine owners increasingly seek high-fiber, palatable, and digestible pellets to maintain gut health and stamina. Companies are responding by developing premium, nutrient-balanced products with enhanced texture and shelf life. A relevant example is Standlee Premium Products, which offers organic alfalfa pellets certified for non-GMO and high-protein content, tailored for equines. This focus on quality differentiation and feed customization allows market players to capture premium segments while promoting better animal health and performance, driving overall market growth.

By Region, North America registers robust market growth

Growth in the North American region is driven by its large-scale livestock industry and advanced feed processing infrastructure. Producers are scaling up dehydration and pellet manufacturing lines to meet demand for consistent, high-quality alfalfa feed. For instance, in 2023 , Anderson Hay & Grain Co. launched a high-density bale format for export optimization, reducing shipment volume by around 28%. Their move reflects broader regional trends which includes well-established cultivation, robust logistics and a major share in global alfalfa pellet production support strong market positioning.

| CAGR 2026-2035 - Market by | Country |

| Australia | 6.2% |

| Mexico | 5.7% |

| Netherlands | 5.3% |

| Italy | 5.2% |

| Saudi Arabia | 5.2% |

| USA | XX% |

| Canada | XX% |

| Germany | XX% |

| France | XX% |

| Japan | 4.8% |

| China | 0.0% |

| India | 0.0% |

| Brazil | 0.0% |

Asia Pacific holds a significant position in the alfalfa pellets market value, propelled by rapid livestock growth, rising meat and dairy consumption and increasing import-driven feed demand. In 2024, China alone produced 3.2 million tons of lucerne (alfalfa) meal and pellets, which roughly accounts for 40 % of the region’s volume. To capitalise, companies are investing in regional processing hubs, forming export linkages and optimizing pellet formats for large-scale feed use. These strategies are fulfilling the region’s operational scale-up needs and unlocking premium feed opportunities.

Figure: Top 10 Milk Producing Countries in the World, 2023

| Milk Producing Country | Milk Production (Tonnes) |

| India | 208,984,430 |

| United States | 102,654,516 |

| Pakistan | 65,785,000 |

| China | 41, 245,664 |

| Brazil | 36,663,708 |

| Germany | 33,188,890 |

| Russia | 32,333,278 |

| France | 25,834,800 |

| Turkey | 23,200,306 |

| New Zealand | 21,886,376 |

Leading alfalfa pellets market players are investing heavily in technology and process innovation to improve feed quality, sustainability, and scalability. Firms like Harlan Feed, Gruppo Carli, and Al Dahra Group are adopting advanced dehydration, pelleting, and nutrient preservation technologies to produce high-protein, dust-free pellets suitable for dairy, poultry, and equine sectors. These innovations cater to the rising global demand for efficient, long-lasting animal feed.

Market players are also pursuing strategic expansions and partnerships to strengthen their global footprint and secure consistent raw material supply. Many alfalfa pellets companies are collaborating with regional farmers and adopting sustainable cultivation practices to ensure traceable and eco-friendly alfalfa production. Through product diversification, export-oriented growth, and investments in R&D, these players are enhancing their competitiveness while addressing the growing emphasis on sustainable and nutrient-rich feed solutions worldwide.

Al Dahra Group, a global leader in the agribusiness sector, was founded in 1995 and is based out of Abu Dhabi, United Arab Emirates. Al Dahra Group, through its vast network of farms and production facilities, which extends to over 20 countries, is a key player in the international trade of alfalfa pellets. This trade is mainly a result of the company's focus on sustainability and advanced technology for cultivation and processing.

Nafosa, which was established in 1940 and has its headquarters in Zaragoza, Spain, is counted amongst the major producers and exporters of dehydrated alfalfa and forage products in Europe. The company, with its state-of-the-art dehydration plants and global distribution network, provides livestock industries with high-quality products throughout Europe, Asia, and the Middle East, while taking efforts to solidify its position in the alfalfa pellets market.

Gruppo Carli, a prominent name in the field of high-quality forage production and export, was established in 1960 and is headquartered in Ravenna, Italy. The company is well known for its vertically integrated structure, eco-friendly farming methods, and revolutionary dehydration process that guarantees the highest feeding value of its products.

Harlan Feed, a United States-based top-tier producer of alfalfa pellets and other forage-based animal feeds, was founded in 1985 and is headquartered in Galt, California. The company aims at quality consistency through the use of state-of-the-art pelletizing techniques coupled with strict quality control measures. Harlan Feed, with its solid regional distribution network and enduring partnerships in the dairy and equine industries, has been able to position itself as a reliable, sustainable, and customer-oriented innovative brand in the animal nutrition sector.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market include Manzanola Feeds, LLC, Daurio Brothers Alfalfa Company, Sacate Pellet Mills, Inc., and AJD Agro Ltd., among others.

Explore the latest trends shaping the Global Alfalfa Pellets Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on global alfalfa pellets market trends 2026.

Organic And Specialty Animal Feeds

Regional Animal Feed Demand and Nutrition

Forage Processing And Pelletizing Technology

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global alfalfa pellets market reached an approximate value of USD 467.94 Million.

The market is projected to grow at a CAGR of 4.90% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 755.00 Million by 2035.

Alfalfa pellets refer to fodder that are made from ground alfalfa hay and are typically used in animal feeds. They contain extensive amounts of proteins, minerals, and vitamins, and are an excellent source of nitrogen. It Is also high in fibre and is considered an ideal feed choice for various livestock and poultry animals.

Key strategies driving the market include technological innovations in alfalfa breeding and pellet processing, product diversification into high-value feed segments, strategic partnerships across the supply chain, regional capacity expansion, and premiumisation of feedstock for enhanced nutritional quality.

Key trends aiding market expansion include the growing use of alfalfa pellets in poultry feed, the rising cultivation of alfalfa hay, the demand for organic feed, and the rising consumption of animal protein.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Based on type, the market can be divided into alfalfa hay and timothy hay.

The significant applications in the market are meat/dairy animal feed, horse feed, poultry feed, and pig feed.

The key players in the market include Al Dahra Group, Navarra Aragonesa De Forrajes, S.A.U. (Nafosa), Gruppo Carli, Harlan Feed, Manzanola Feeds, LLC, Daurio Brothers Alfalfa Company, Sacate Pellet Mills, Inc., and AJD Agro Ltd., among others.

North America holds the largest share of the global alfalfa pellets market, driven by its large-scale livestock industry, advanced feed processing infrastructure, and well-established supply chains.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share