Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The aluminium extrusion market attained a volume of 24.68 MMT in 2025. The market is expected to grow at a CAGR of 5.00% during the forecast period of 2026-2035. By 2035, the market is expected to reach a volume of 40.20 MMT.

The strong popularity of electric vehicles (EVs) is boosting the growth of the aluminium extrusion market by creating demand for lightweight, strong, and thermally efficient materials. EV manufacturers are relying heavily on aluminium extrusions for components, such as battery enclosures, crash management systems, structural frames, motor housings, and cooling plates. According to industry reports, about 1.7 million electric vehicles were sold globally in March 2025. With rapid EV sales, the need for advanced, precision-engineered aluminium extrusions is expanding rapidly across the automotive value chain.

Sustainability and the recycling push are fostering the aluminium extrusion market development, as industries and governments are prioritizing low-carbon, eco-friendly materials. Aluminium is highly recyclable, making it ideal for circular economy models. Several companies are investing in low-carbon, recycled-content alloys for aligning with green building standards and carbon-neutral targets. In June 2024, BOAL introduced BOAL BLUE, a new line of extruded profiles made from low‑carbon aluminium and ≥50% recycled content for construction, solar, and greenhouses. With the tightening of environmental regulations, the demand for sustainably sourced aluminium extrusions will continue to grow in major sectors.

The shift to low-carbon energy sources due to energy-intensive production is favouring the aluminium extrusion industry growth. Smelters and extrusion plants are leveraging hydroelectric, wind, and solar power to decarbonize and meet sustainability goals. In July 2024, Hydro piloted the use of green hydrogen on casting furnaces at its newest recycling facility in Høyanger. As global focus shifts towards low-carbon energy sources, aluminium producers are significantly reducing their carbon footprints by integrating greener energy into their manufacturing processes. This transition is aligning with stricter environmental regulations and growing demand for sustainable materials, making low-carbon aluminium extrusions more attractive to industries.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5%

Value in MMT

2026-2035

*this image is indicative*

| Global Aluminium Extrusion Market Report Summary | Description | Value |

| Base Year | MMT | 2025 |

| Historical Period | MMT | 2019-2025 |

| Forecast Period | MMT | 2026-2035 |

| Market Size 2025 | MMT | 24.68 |

| Market Size 2035 | MMT | 40.20 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 5.00% |

| CAGR 2026-2035- Market by Region | Asia Pacific | 5.6% |

| CAGR 2026-2035 - Market by Country | India | 5.7% |

| CAGR 2026-2035 - Market by Country | China | 5.5% |

| CAGR 2026-2035 - Market by Product Type | Powder Coated | 5.8% |

| CAGR 2026-2035 - Market by Alloy Type | 6000 Series Aluminium Alloy | 6.4% |

| Market Share by Country 2025 | Brazil | 2.8% |

The aluminium extrusion market share is growing with the strong focus of automakers on reducing vehicle weight, improving fuel economy, and extending range. According to industry reports, the per-vehicle aluminium usage is likely to rise to 644 lb in battery-electric trucks by 2030. This can be attributed to higher usage in structural frames, battery enclosures, crash-management systems, and heat exchangers. Lightweight aluminium extrusions are also helping to lower weight and improve thermal management, emerging critical to modern vehicle design.

Urbanization and the rise in eco-friendly buildings are major forces driving the aluminium extrusion demand forecast. As per industry reports, 68% of the world population is estimated to live in urban areas by 2050. With the growing number of cities and sustainable building standards become the norm, aluminium has emerged as a material of choice for architects and developers due to its lightweight, corrosion-resistant, and fully recyclable properties. Urban infrastructure projects, such as metro stations, smart lighting systems, and high-rise towers, are further increasingly relying on aluminium for both structural and aesthetic elements.

Solar and wind infrastructure are driving the aluminium extrusion market for creating strong and sustained demand for lightweight, corrosion-resistant, and durable structural components. As per industry reports, India’s 500GW energy target is expected to be bolstered via aluminium extrusion by 2030 with the surge in solar frames, wind structures, and efficiency. In solar energy systems, extruded aluminium profiles are essential for mounting structures, panel frames, inverter housings, and sun-tracking systems. With strength-to-weight ratio, aluminium extrusions facilitate easy transport and installation, especially in large-scale solar farms. Rising usage in wind energy across internal tower ladders, platforms, nacelle components, and cooling systems is also adding to the market growth.

The surging adoption of cutting-edge technologies, such as AI, IoT, automation, and real-time analytics is benefiting the aluminium extrusion market dynamics for transforming the extrusion operations. In April 2025, EAS Aluminium inaugurated its new facility featuring a fully automated extrusion line by incorporating Presezzi Extrusion technology. The integration of sensors and machine learning is helping plants in detecting faults while optimizing the parameters and reducing scrap. The deployment of smart manufacturing also boosts quality consistency, lowers downtime, and improves resource efficiency.

The growing efforts on new alloy developments for expanding applications is adding to the aluminium extrusion demand. Advanced alloy formulations offer improved strength, corrosion resistance, and thermal conductivity tailored to specific needs. In October 2024, Raffmetal launched a new range of Silval alloys, including the 6XXX, 3XXX, 5XXX, and 8XXX series for the extrusion and rolling sectors. This innovation is allowing manufacturers to design lighter, stronger, and more durable components for the automotive, aerospace, construction, and electronics sectors.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Aluminium Extrusion Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

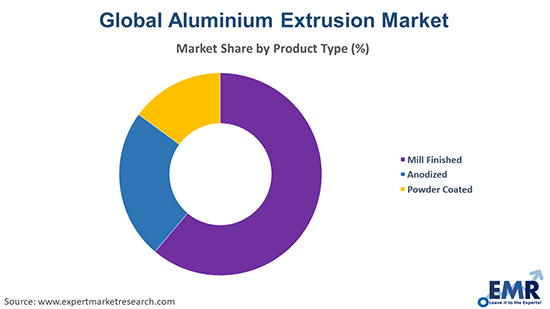

Market Breakup by Product Type

Key Insight: The powder coated segment dominates the aluminium extrusion market due to its versatility, durability, and wide aesthetic appeal. Powder-coated aluminium is extensively used in architectural applications, such as window frames, curtain walls, and facades to offer protection and appearance matter. The surge in high-rise buildings mainly is also driving the uptake of powder-coated finishes to withstand harsh weather and rendering color customization. In January 2025, Viva launched India’s first pre-coated, ready-to-install solid aluminium panels for providing fire-rated, durable, and aesthetic solutions for façades. Such instances are making the segment a preferred choice in both commercial and residential sectors.

Market Breakup by Alloy Type

Key Insight: The 6000 series leads the aluminium extrusion market expansion due to its excellent balance of strength, corrosion resistance, and extrudability. These alloys contain magnesium and silicon, allowing easy forming and high finish quality, driving wide usage in construction, transportation, and consumer products. In August 2023, Alba introduced the new 6060.HE aluminium alloy, a high-speed extrusion AA6060-grade billet for boosting extruder productivity in construction applications. The 6000 series is further supporting welding and machining, subsequently enhancing its versatility across industries.

Market Breakup by End Use

Key Insight: Building and construction is the largest segment in the aluminium extrusion market, driven by rapid urbanization along with the strong need for lightweight, corrosion-resistant structural materials. Aluminium extrusions are widely used in window frames, curtain walls, facades, roofing, and framing systems. In April 2025, Netherlands-based Alu Max unveiled its latest range of aluminium doors, sliding walls, window frames, and architectural façade cladding. The ease of fabrication, recyclability, and compatibility with modern architectural trends make aluminium extrusions indispensable in both commercial and residential infrastructure development globally.

Market Breakup by Region

Key Insight: Asia Pacific aluminium extrusion market revenue is growing with rapid industrialization, urban development, and large-scale manufacturing, mainly in China, India, and Japan. China accounts for significant global aluminium extrusion production, supported by massive infrastructure projects, railway expansion, and electric vehicle manufacturing. As per industry reports, China's aluminium extrusion exports totalled 990,800 MT in 2023, up from 42,800 MT year-on-year. India is also scaling up with companies like Hindalco and Jindal Aluminium investing in high-capacity extrusion plants for construction and transport. Strong demand, low production costs, and regional exports fuel dominance.

| CAGR 2026-2035- Market by | Region |

| Asia Pacific | 5.6% |

| Latin America | 5.4% |

| North America | XX% |

| Europe | XX% |

| Middle East and Africa | XX% |

Surging Preference for Anodized & Mill Finished Aluminium Extrusion

The anodized aluminium extrusion demand growth can be attributed to its large usage for enhancing the corrosion resistance and surface hardness whilst maintaining a metallic appearance. This electrochemical process thickens the natural oxide layer on the aluminium surface, making it ideal for applications requiring a sleek, modern look. Anodized aluminium is also commonly incorporated in electronic devices, architectural cladding, and interior design elements. For example, Apple's use of anodized aluminium in its MacBook line reflects the segment's value in premium consumer products. Anodizing further remains a popular choice where durability and an upscale, metallic finish are important.

The mill finished segment in the aluminium extrusion industry refers to extrusions left untreated after the extrusion process for giving them a raw and unfinished appearance. Mill finish is typically used in industrial and hidden structural applications, such as internal frames, supports, or temporary structures, further driving innovations in the market. In April 2024, HAI opened a new extrusion centre in Romania, in partnership with Presezzi Extrusion Group. This high-capacity mill works on sustainable and efficient mill-finished profile production for meeting European standards in quality and eco-responsibility.

5000 & 7000 Series Aluminium Alloys to Garner Popularity

The 5000 series aluminium alloy segment in the aluminium extrusion market offers high strength and excellent corrosion resistance, especially in marine and industrial environments. Alloys like 5052 and 5083 are ideal for applications requiring structural durability and seawater resistance. they are still widely used in specialized extrusions for shipbuilding, automotive panels, and military applications. For example, 5083 alloy is used in the construction of naval vessels and truck bodies where corrosion resistance is critical. While more commonly rolled or sheet-formed, certain grades are extruded for structural parts needing weldability and fatigue resistance.

The 7000 series aluminium alloy is gaining traction in the aluminium extrusion industry for its exceptional strength, achieved through zinc and magnesium content, with alloys like 7075 commonly used in aerospace and defence. This alloy is used in mainstream extrusion due to its superior mechanical properties. In December 2024, Maan Aluminium expanded its Madhya Pradesh facility by launching a new extrusion line to enable the production of high-strength 7000-series profiles for aerospace and defence components. Advanced coatings and precise engineering are also expanding the role of 7000 series in niche structural applications.

Thriving Aluminium Extrusion Demand in Transportation & Machinery and Equipment

Transportation is recording performance in the aluminium extrusion due to increasing demand for lightweight and fuel-efficient materials. Aluminium extrusions are used in railcars, buses, aircraft, trailers, and electric vehicles for structural frames, roof rails, bumpers, and battery enclosures. Bullet train manufacturers have been incorporating high-strength 5000 and 7000-series extrusions for both speed and safety. For instance, in September 2023, Hindalco partnered with Italy’s Metra SpA to develop high-precision aluminium extrusions for high-speed and metro train coaches in India. The growing push toward electrification, coupled with stringent emission norms, is also driving the process adoption in the global transportation industry.

Aluminium extrusions are vital in industrial machinery for building frames, conveyors, automation systems, and protective enclosures. With their high strength-to-weight ratio, customizability, and corrosion resistance, these components are ideal for manufacturing equipment and robotics. T-slot extrusions, made from 6061 or 6063 alloys, are extensively used in modular machine assembly lines. For example, packaging and CNC machines are deploying extruded aluminium structures for their lightweight yet stable properties. This segment is further steadily growing as industries are automating and demanding flexible, durable materials in both production and operational environments.

Expanding Aluminium Extrusion Application in Europe & North America

Europe holds a significant share in the aluminium extrusion market with a strong focus on sustainability, energy efficiency, and high-end architectural and automotive applications. The region is largely prioritizing environmentally friendly production with advanced recycling and green energy inputs. Notably, Germany and France are key markets for aluminium, driving significant usage in high-speed rail and electric mobility. Stringent regulations are further promoting lightweight, low-emission materials across the region, boosts aluminium extrusion uptake in automotive and building segments.

North America aluminium extrusion market value is set to rise with the thriving aerospace, defence, and construction sectors in the United States and Canada. Key players, such as Kaiser Aluminum and Bonnell Aluminium are serving niche markets with precise specifications and value-added finishes. The presence of well-established infrastructure and the surging investments in electric vehicles are also driving the regional market growth. In April 2024, Honda unveiled a CAD 15 billion investment to build a fully integrated EV value chain at Alliston, Ontario, adding to aluminium extrusion demand.

Key players operating in the aluminium extrusion market are employing strategies that focus on innovation, capacity expansion, sustainability, and strategic partnerships. Companies are increasingly investing in advanced extrusion technologies to improve product quality, precision, and customization. Lightweight, high-strength aluminium products tailored for the automotive, aerospace, and construction sectors are witnessing high demand, further prompting research & development initiatives focused on alloy development and extrusion process efficiency. Sustainability is urging firms to incorporate more recycled aluminium and adopt energy-efficient practices to reduce carbon footprints.

Moreover, vertical integration, such as the acquisition of raw material suppliers and downstream fabrication units is enhancing supply chain resilience and cost control. Geographic expansion via establishment of new plants and joint ventures in emerging markets is allowing companies to serve the growing regional demand and mitigate supply chain risks. Strategic collaborations with OEMs and infrastructure firms are helping to secure long-term contracts and co-develop innovative solutions. Digitalization and smart manufacturing practices are also gaining traction to boost productivity and minimize waste.

Founded in 1927 and headquartered in Illinois, the United States, W.W. Grainger, Inc. is a leading industrial supply distributor, offering a broad range of maintenance, repair, and operating products. The company’s offerings include safety gear, lighting, tools, motors, and inventory management solutions for businesses across industries.

Orange Aluminium, founded in 2007 and headquartered in California in the United States, specializes in supplying aluminium extrusions, primarily serving manufacturers, fabricators, and design professionals. The company’s catalogue features a wide selection of stock extrusions, including angles, channels, bars, and custom-cut profiles tailored for industrial, architectural, and commercial applications.

Norsk Hydro ASA, headquartered in Oslo, Norway, and founded in 1905, is a global leader in aluminium production for delivering extrusion services, rolled products, and energy solutions. The company provides sustainable aluminium-based solutions for automotive, construction, packaging, and electronics, with a strong focus on circular economy principles.

Aluminium Extrusion Company, founded in 1959 and headquartered in Hamilton, New Zealand, specializes in custom aluminium extrusion services for supplying high-quality profiles to transport, construction, marine, and electrical industries. The company also offers design assistance, machining, and finishing solutions.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Unlock crucial insights into the future of the aluminium industry—download your free sample report on aluminium extrusion market trends 2026 today. Stay ahead with expert forecasts, in-depth analysis, and strategic data to navigate emerging opportunities. Perfect for manufacturers, investors, and stakeholders seeking a competitive edge in the evolving aluminium extrusion market.

South Korea Aluminium Market

Philippines Aluminium Market

Australia Aluminium Market

Vietnam Aluminium Market

Canada Aluminium Market

Mexico Aluminium Market

Brazil Aluminium Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate volume of 24.68 MMT.

The market is projected to grow at a CAGR of 5.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about 40.20 MMT by 2035.

The key strategies driving the market include technological innovation, sustainable production practices, and increased use of recycled aluminium. Companies are expanding capacity, forming strategic partnerships, and entering new markets to meet demand from automotive, construction, and aerospace sectors. Customization, lightweight solutions, and digital manufacturing are also critical growth enablers.

The key trends guiding the market include increasing investments in infrastructural development activities and the introduction of favourable government initiatives to boost the use of aluminium extrusions in building integrated photovoltaics (BIPVs).

The major regional markets of aluminium extrusion are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The various product types of aluminium extrusion include mill finished, anodised, and powder coated.

The major alloy types considered in the market report include 1000 series aluminium alloy, 2000 series aluminium alloy, 3000 series aluminium alloy, 5000 series aluminium alloy, 6000 series aluminium alloy, and 7000 series aluminium alloy.

The significant end uses of aluminium extrusion are building and construction, transportation, machinery and equipment, consumer durables, and electrical, among others.

The key players in the market report include W.W. Grainger, Inc., Orange Aluminium Extrusions Stock, Norsk Hydro ASA, and Aluminium Extrusion Company, among others.

Building and construction dominates the market, driven by rapid urbanization along with the strong need for lightweight, corrosion-resistant structural materials.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Alloy Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share