Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

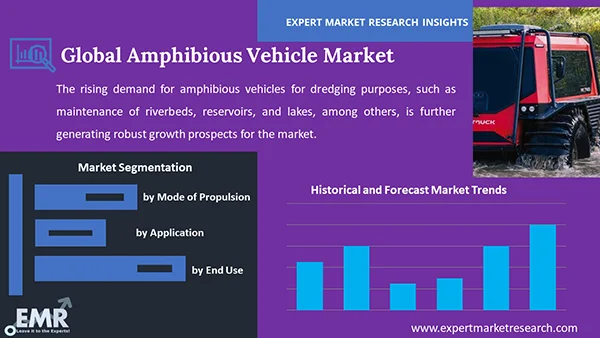

The global amphibious vehicle market size reached an approximate valuation of USD 3.75 Billion in 2025. Driven by increasing defence and commercial applications, the market is projected to expand at a CAGR of 8.40% during the forecast period of 2026-2035, attaining a value of around USD 8.40 Billion by 2035. North America is expected to dominate the market share due to advanced technological capabilities and high defence expenditure, strengthening the region’s position in the global amphibious vehicle market.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

8.4%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Amphibious vehicles are designed for seamless mobility across land, water, and even underwater defense (troops, goods), playing a crucial role in both defence and commercial purposes. In defence, they are used to transport troops, goods, and ammunition, while also supporting amphibious landing craft operations. Their design and development now focus on tackling adverse environmental conditions and enhancing water manoeuvrability. Key technological trends include lightweight engines, high-speed vehicles, and increased autonomy, making them suitable for inland waterways. In commercial applications, amphibious vehicles are increasingly used for transportation and excavation, with integration of advanced military systems also influencing innovation in both sectors. In December 2024, China launched the Type 076 amphibious assault ship Sichuan, designed for stealth special operations using unmanned systems. Equipped with an electromagnetic catapult and drones, it supports PLA missions and reflects strategic readiness for Taiwan-related conflict.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Rise in Deployment of Advanced Technology-Driven Amphibious Combat Vehicles (ACVs) for Marine Operations

The global amphibious vehicle market is witnessing significant advancements due to increasing demand for survivability, mobility, and improved battlefield performance. Modern Amphibious Combat Vehicles (ACVs) are being equipped with integrated systems to enhance command and control, situational awareness, and marine threat detection. These next-generation combat vehicles feature advanced technology such as CPU integration, remote telescoping turrets, fire control systems, and active protection systems that boost both offensive and defensive capabilities. Emphasis on counter survivability has led to smarter design innovations, enabling ACVs to adapt to evolving combat environments. The U.S. Marine Corps contract for state-of-the-art ACVs with upgraded weapons and M16 turret systems underlines growing investment in advanced battle vehicles. The integration of such technologies ensures superior performance in both land and marine operations, reinforcing the role of ACVs as a vital asset in future military strategies. These developments reflect a global shift towards highly responsive, intelligent amphibious systems. In November 2024, South Korea successfully launched a Gray Eagle STOL UAV from its Dokdo amphibious assault ship, marking the first ship-based operation of its kind. The demonstration showcased the UAV’s naval versatility, supporting Seoul’s evolving defence and unmanned aerial capabilities.

Rising Geopolitical Tensions Drive Increased Investment in Defence Systems

The global amphibious market is experiencing significant growth as nations strive to modernize defense systems and bolster border security in response to escalating terrorism worldwide. Countries such as the U.S., China, Saudi Arabia, and India are heavily investing in defense equipment and sophisticated weapons systems to enhance their defense industries. Procurements include all-terrain armoured vehicles and ACVs for troop transport, which are increasingly vital for both land and maritime industry operations. Amphibious Assault Vehicles (AAVs) are being favoured for their high speed and power, along with their reliability and adaptability in diverse environments, while carrying essential weapons and ammunition. H2O Amphibious Inc. launched its next-generation amphibious cars in February 2024, redefining mobility by combining land and water travel. Inspired by historical feats and technological progress, the company improved design, performance, and comfort. The new models marked a milestone in amphibious innovation, blending heritage with cutting-edge engineering.

Growing Demand for Amphibious Vehicles in Commercial Sectors Set to Drive Industry Expansion

The amphibious vehicle market is experiencing robust expansion, driven by market growth drivers such as the rise in commercial uses, including sports, mountain climbing, and surveillance. The integration of modern electronics, advanced technology, and cost-effective propulsion systems significantly enhances vehicle performance. Innovations like electric hydroplanes contribute to eco-efficiency, while designs offering superior endurance and durability support demanding missions. Key players like Eik Engineering Sdn Bhd, a leading all-terrain machine manufacturer, are at the forefront, particularly in Amphibious Excavators. Strategic cooperation among industry stakeholders continues to foster technological progress, further reinforcing the market’s positive trajectory and future potential. In April 2023, EIK Engineering’s amphibious excavators made a strong impact in Indonesia’s largest mining project. Four undercarriages were deployed successfully across 200,000 hectares. Their efficiency in harsh terrain and flooding highlighted EIK’s innovative design and leadership in the mining equipment sector.

Elevated Initial and Maintenance Costs of Amphibious Vehicles, Particularly in Defence Applications, May Hinder Market Expansion

The global amphibious vehicle market faces several challenges hindering its growth. Armored vehicles used in defense applications require complex equipment design to ensure compatibility on both land and water, leading to massive costs. Additionally, the specialised vehicle engines needed for amphibious operations further escalate expenses, limiting widespread adoption.

The amphibious vehicle market confronts several challenges impeding its growth. Expensive engines and additional costs associated with vehicle accessories such as safety devices and fire protection systems significantly increase the initial investment. In the defense sector, these vehicles are crucial for ship-to-shore transport of naval forces, necessitating high load capacities and specialised equipment design to ensure compatibility across land and water terrains. Moreover, living costs related to maintenance and the availability of spare parts further strain budgets, potentially hindering market expansion.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Increasing Demand for Marine-Based Applications is Expected to Drive Growth in the Defence Sector

Amphibious vehicles offer significant advantages in commercial applications. Their unique capability to operate seamlessly across land and water enhances versatility, enabling access to remote or otherwise inaccessible areas. This adaptability is particularly beneficial in sectors such as tourism, where amphibious vehicles provide unique experiences by combining land and water tours. In logistics, their ability to navigate diverse terrains facilitates efficient transportation, reducing the need for multiple transport modes and infrastructure investments. Poseidon AmphibWorks is developing the Trident LS-1, an electric amphibious vehicle that transitions seamlessly between land and water. Currently in pre-prototype phase, it aims to revolutionise transportation, recreation, and commercial sectors with its unique design and functionality.

In defence, amphibious vehicles are indispensable assets, offering strategic advantages in military operations. Their capacity to transition smoothly between land and water environments enhances operational flexibility, allowing for rapid deployment and manoeuvring across diverse terrains. This versatility is crucial for executing amphibious assaults, reconnaissance missions, and troop deployments in coastal and riverine areas. Moreover, their design facilitates efficient beach landings and river crossings, ensuring timely access to critical objectives. By reducing reliance on fixed infrastructure, amphibious vehicles provide military forces with the agility to operate in remote or challenging locations, thereby enhancing overall mission success rates.

Track-Based Propulsion Segment is Set to Dominate Due to its Superior Fuel Efficiency

Screw propellers are widely used in the global amphibious vehicle market due to their proven reliability and efficiency in water navigation. They offer strong thrust, making them ideal for operations requiring steady movement through water, including military and rescue missions. Their simple design ensures ease of maintenance and cost-effectiveness. Screw propellers also perform well in shallow waters, enhancing the versatility and operational range of amphibious vehicles across different terrains.

Water jet propulsion offers significant advantages in the global amphibious vehicle market, particularly in terms of manoeuvrability and safety. As it lacks exposed moving parts, it reduces the risk of damage from debris and injury to personnel. Water jets provide excellent control, allowing precise navigation in tight or hazardous environments. In January 2025, Marine Jet Power and Derecktor Shipyards launched the first hybrid waterjet passenger ferries in the U.S. for Chatham Area Transit, featuring advanced hybrid systems, enhanced efficiency, and sustainable design tailored for Savannah’s operational needs.

Surveillance and Rescue Segment to Command Significant Share Driven by Growing Border Security Concerns

In the global amphibious vehicle market, the surveillance and rescue segment offer significant benefits. These vehicles enhance operational reach by navigating both land and water, making them ideal for border patrol, disaster response, and emergency rescues. Equipped with advanced monitoring and life-saving systems, they improve situational awareness and enable swift, safe evacuations. Their versatility and reliability in challenging environments make them essential for defence forces and humanitarian missions worldwide. In June 2021, Iguana Yachts announced a civilian version of its Pro Interceptor RIB, promising the world’s fastest amphibious boat. Based on military tech, it offered 55-knot speeds, all-terrain access, and enhanced durability, redefining high-performance amphibious marine transport.

North America benefits from robust defence spending, advanced research and development capabilities, and a strong presence of leading defence manufacturers. The region frequently deploys amphibious vehicles for military operations, disaster response, and border security. Additionally, vast coastlines, inland waterways, and flood-prone areas further drive the demand for such vehicles. According to the Department of Defense, the agency had access to USD 1.39 trillion in budgetary resources, accounting for 9.7% of the United States federal budget for the 2025 financial year.

Europe benefits from increasing defence collaborations, cross-border security initiatives, and a heightened focus on humanitarian missions. Countries like the UK, France, and Germany invest in amphibious vehicles for both civil and military use, including flood response and coastal patrol. With rising interest in eco-tourism and sustainable mobility, Europe also explores amphibious vehicles for commercial applications. Strong manufacturing capabilities and innovation hubs enhance the development of advanced, multi-purpose amphibious platforms.

Asia Pacific benefits from rising military expenditure, increasing geopolitical tensions, and frequent natural disasters, particularly in coastal and island nations. Countries such as China, India, South Korea, and Japan are investing in amphibious technology for both defence and rescue operations. In December 2024, ST Engineering and Kazakhstan Paramount Engineering (KPE) partnered to produce an 8×8 amphibious armoured vehicle for Kazakhstan's military. The collaboration includes design and production using ST's Terrex platform, ensuring the vehicle meets Kazakhstan's specific terrain and operational requirements.

Latin America benefits from diverse geography, including rainforests, rivers, and long coastlines, which necessitate versatile mobility solutions like amphibious vehicles. These vehicles are increasingly used for disaster response, especially in flood-prone areas, and for reaching remote communities. Governments are recognising their value in national security, search and rescue, and border surveillance. The gradual modernisation of defence forces and infrastructure development also supports the adoption of amphibious technologies across the region.

The Middle East and Africa benefit from rising investments in defence and security amid regional conflicts and border protection needs. Amphibious vehicles offer tactical advantages across deserts, rivers, and coastal terrains. They are also valuable for humanitarian aid in conflict zones and during natural disasters. In February 2025, BAE Systems showcased its Amphibious Combat Vehicle (ACV) at IDEX in the UAE, marking its international debut. The ACV, designed for rugged terrains, features multiple variants, offering flexibility, mobility, and enhanced operational effectiveness for military forces globally.

Companies Prioritise Mergers, Acquisitions, and Partnerships to Strengthen Competitive Advantage

The amphibious vehicle market features several prominent companies that drive innovation and development within the sector. These key players, such as BAE Systems, ST Engineering, and Iguana Yachts, are known for their advanced technologies and diverse product offerings. Their expertise spans military, commercial, and rescue applications, catering to diverse needs across various terrains. As demand for versatile, all-terrain vehicles grows, these companies continue to lead in delivering cutting-edge amphibious solutions.

Amphibious vehicles are vehicles that are capable of operating on both land as well as on a water body. These vehicles are generally available as water jets, track-based vehicles, and screw propellers and are most widely used in commercial and military applications.

Market Breakup by Mode of Propulsion

Market Breakup by Application

Market Breakup by Platform

Market Breakup by Region

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global market for amphibious vehicles attained a value of approximately USD 3.75 Billion in 2025.

The market is projected to grow at a CAGR of 8.40% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of around USD 8.40 Billion by 2035.

Key drivers included military modernisation, disaster response needs, technological advancements, and increasing investment in amphibious capabilities by armed forces globally.

The key amphibious vehicle market trends include increasing development of inland waterways, technological advancements, and rising popularity of automatic amphibious vehicles.

The major regional markets for amphibious vehicle are North America, Latin America, the Asia Pacific, Europe, and the Middle East and Africa.

The various modes of propulsions of amphibious vehicles in the market are water-jet, track-based, and screw propellers.

The significant applications of amphibious vehicles are surveillance and rescue, water sports, water transportation, and excavation.

The leading platform of amphibious vehicles in the market are defence and commercial.

The major players in the market, according to the report, are BAE Systems plc, EIK Engineering Sdn Bhd, General Dynamics Corporation, Hitachi Construction Machinery Co., Ltd., Lockheed Martin Corporation, Marsh Buggies Incorporated, Wetland Equipment Company, Wilco Manufacturing LLC, Science Applications International Corporation, Rheinmetall AG, Griffon Hoverwork Ltd. (GHL), and Iveco Defense Vehicles, among others.

Based on the platform, the defense segment is expected to lead the market over the forecast period.

The amphibious vehicle market was expected to grow steadily, driven by rising defence spending and demand for multi-terrain mobility solutions.

North America accounted for the largest market share due to strong military demand, advanced defence infrastructure, and continuous research and development efforts.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Mode of Propulsion |

|

| Breakup by Application |

|

| Breakup by Platform |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share