Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The anionic surfactants market attained a value of USD 24.73 Billion in 2025. The market is expected to grow at a CAGR of 5.80% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 43.46 Billion.

Growing disposable incomes, urbanization, and changing lifestyles have boosted the consumption of home cleaning and personal care products. According to the United Nations, 68% of the world's population is likely to reside in urban areas by the year 2050. Anionic surfactants are important ingredients in products like shampoos, body washes, laundry detergents, and surface cleaners because of their good foaming and cleaning capability. As people look for efficient, easy-to-use hygiene products, the market for these surfactants grows proportionately.

Increasing awareness among consumers regarding skin sensitivity, allergies, and long-term consequences fuels the anionic surfactants market growth. Conventional anionic surfactants such as sodium lauryl sulfate have a drying or irritating effect, so there is interest in milder alternatives like sodium lauryl ether sulfate or sulfate-free preparations. This trend compels manufacturers to reinvent and re-formulate products to reconcile cleansing efficacy with skin gentleness. Satisfying mildness requirements increases product appeal to consumers of sensitive skin and widens market accessibility, particularly in personal care categories such as baby care or dermatological products.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5.8%

Value in USD Billion

2026-2035

*this image is indicative*

The anionic surfactants industry is driven by global regulatory bodies, particularly in Europe and North America, imposing strict guidelines on biodegradability, aquatic toxicity, and chemical composition. Regulations restrict the use of harmful or persistent substances to protect ecosystems and human health. Manufacturers must reformulate products to comply, often requiring investment in cleaner, biodegradable alternatives. Compliance also drives the development of sustainable, environmentally friendly surfactants that meet regulatory and consumer expectations, thereby shaping product development and market dynamics.

Advancements, such as enzymatic synthesis, continuous flow reactors, and fermentation processes improve production efficiency, reduce waste, and enable creation of novel surfactants with enhanced properties. These technologies allow manufacturers to tailor surfactant performance, combining cleansing efficacy with mildness or multifunctionality. In August 2023, BASF partnered with United Kingdom-based Holiferm to expand its biobased surfactant portfolio using fermentation processes. The adoption of cutting-edge manufacturing technologies also supports scalability, cost reduction, and eco-friendliness, helping companies meet evolving the anionic surfactants market demands and regulatory requirements.

Consumers increasingly prefer products with natural, bio-based ingredients due to health and environmental concerns. This trend influences the surfactants market, where demand for bio-derived anionic surfactants made from renewable sources like plant oils and sugars is rising. In March 2022, BASF introduced Plantapon® Soy, a bio-based anionic surfactant derived from non-GMO soy protein and coconut oil. This surfactant is COSMOS-approved, vegan, and readily biodegradable, making it suitable for natural and mild skin and hair cleansing products. The shift also aligns with corporate sustainability goals and regulatory incentives.

Consumer and regulatory focus on environmental impact emphasizes biodegradability and the use of certified “green” ingredients, boosting the anionic surfactants market trends. Surfactants that readily break down in natural environments reduce aquatic toxicity and pollution. Certifications such as COSMOS, ECOCERT, and USDA Organic provide independent validation of sustainability claims, boosting consumer trust. This driver encourages manufacturers to develop and promote surfactants meeting these standards, differentiating products and appealing to environmentally conscious buyers.

To maintain competitiveness and accelerate innovation, many surfactant producers engage in mergers, acquisitions, and strategic partnerships. These alliances enable access to new technologies, raw materials, markets, and expertise. In January 2025, Kao Chemicals partnered with ChemServ to distribute its sustainable specialty surfactants across the United States Midwest for personal and home care. The dynamic competitive landscape drives continuous improvement and responsiveness to shifting market and regulatory demands, benefiting manufacturers and customers.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Anionic Surfactants Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insight: Linear alkylbenzene sulphonate (LAS) is widely used in household and industrial detergents. Derived from linear alkylbenzene, LAS offers excellent cleaning and foaming properties, making it the surfactant of choice for laundry powders, liquid detergents, and dishwashing products. Its affordability and high biodegradability further drive its adoption. The segment benefits from strong demand in developing regions where traditional powder detergents remain prevalent, emerging dominant in the anionic surfactants market.

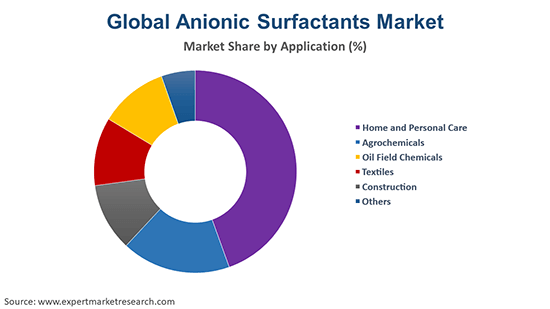

Market Breakup by Application

Key Insight: The home and personal care sector is witnessing higher adoption of anionic surfactants in formulating products like laundry detergents, dishwashing liquids, shampoos, soaps, body washes, and toothpaste. In April 2025, Henkel introduced concentrated formulas for its all®, Persil®, and Snuggle® liquid laundry products, enhancing surfactant efficiency per load. Additionally, eco-conscious consumers are pushing the industry toward bio-based and mild surfactant alternatives, promoting innovation in sulfate-free and concentrated personal care formulations.

Market Breakup by Region

Key Insight: Asia Pacific is the most dominant regional anionic surfactants market, driven by rapid urbanization, industrialization, and growing consumer awareness about personal hygiene. As per Asian Development Bank, over 55% of Asia’s population will be urban by 2030. China, India, Japan, and Southeast Asian nations contribute significantly to demand, especially in home care and personal care sectors. The rising middle class and increasing disposable incomes fuel consumption of detergents, shampoos, and other surfactant-based products. Additionally, expanding agrochemical and textile industries further boost market growth.

Alcohol Ether Sulphates / Fatty Alcohol Sulphates to Gain Popularity

Alcohol ether sulphates (AES) and fatty alcohol sulphates (FAS) are dominant players in the anionic surfactants industry because of increasing personal care and household cleaning uses. AES are extensively used in shampoos, face washes, and body cleansers because they are mild and yet effective foaming agents. FAS, on the other hand, are stronger cleaning agents and are often used in toothpaste, soaps, and dishwashing soaps. The versatility and compatibility of AES/FAS with other ingredients make AES/FAS a prime growth segment.

Alkyl sulphates and ether sulphates find applications in industrial as well as personal care products due to their effective cleansing, emulsifying, and foaming properties. Sodium lauryl sulfate (SLS), for instance, is a widely used alkyl sulfate. Growing demand for economical surfactants in liquid cleaners, industrial cleaners, and personal care products has maintained this segment robust with new growth opportunities to industry players. For example, Jiangsu Youyang Pharmaceutical manufactures 45,000 tons of sodium lauryl sulfate annually.

Surging Anionic Surfactants Applications in Agrochemicals & Oil Field Chemicals

The anionic surfactants industry is extremely important in agrochemical formulations as dispersants, wetting agents, and emulsifiers. Pressure from regulatory demands for greener agrochemicals is also fueling the adoption of bio-derived and biodegradable surfactants. The segment is still important because of formulation technology improvements and growing food security issues across the globe. Excessive demand for eco-friendly agriculture practices is also fueling innovation and uptake of green surfactant solutions in crop protection chemicals.

In oil and gas operations, anionic surfactants are used in enhanced oil recovery (EOR), drilling fluids, and demulsifiers. As global energy demands persist and oil recovery from mature wells becomes critical, the demand for high-performance surfactants in oilfield applications continues to rise. In 2024, research studies developed ternary mixed surfactant systems composed of anionic surfactants and nonionic alkanolamide surfactants, showing enhanced oil recovery performance in hypersaline reservoirs.

Europe & North America to Drive Huge Anionic Surfactants Demand

Europe holds a significant anionic surfactants market share, characterized by strong regulatory frameworks emphasizing sustainability and environmental safety. The region has a mature personal care and household cleaning industry with a growing preference for green and bio-based surfactants. Strict regulations on chemical usage and biodegradability drive innovation toward eco-friendly surfactants. Germany, France, and the United Kingdom lead the regional market with a focus on premium, sustainable products.

North America market is driven primarily by demand in household cleaning, personal care, and oilfield chemicals. Growing end-user demand is prompting manufacturers to innovate and boost production. In June 2025, Stepan Company increased its annual alpha olefin sulfonates (AOS) production capacity by 25%, enhancing supply for eco-friendly formulations. The region, thus, benefits from strong industrial sectors like oil and gas, agrochemicals, and textiles, supporting specialized surfactant applications.

Leading players in the anionic surfactants market are employing a range of key strategies to strengthen their market presence and drive growth. Companies are investing in research & development to launch eco-friendly and biodegradable surfactants to meet rising environmental and regulatory demands. Strategic partnerships and collaborations with raw material suppliers, end-use industries, and research institutions are also common to enhance supply chain efficiency and accelerate product development. Geographic expansion into emerging markets is driven by increasing demand in personal care, household cleaning, and industrial applications.

Companies also engage in mergers and acquisitions to expand their product portfolios and gain access to new customer bases and technologies. Digitalization and automation in manufacturing processes are being adopted to improve efficiency, reduce costs, and maintain product quality. Additionally, players emphasize sustainability by sourcing renewable raw materials and adopting green manufacturing practices. Strong branding and customer engagement strategies, including customized product offerings and technical support, are also vital to building long-term client relationships and securing a competitive edge in the market.

Established in 1865, BASF SE is headquartered in Ludwigshafen, Germany and has pioneered developments in sustainable agriculture, battery materials, and carbon management. Its innovations span high-performance materials and chemical production efficiency, reinforcing its leadership in industrial solutions and environmental responsibility.

Founded in 1995 and based in Muttenz, Switzerland, Clariant Ltd. is known for innovations in catalysis, bio-based additives, and sustainable pigments. It has gained recognition for promoting circular economy practices and offering customized solutions across industries like personal care, agriculture, and industrial manufacturing.

Evonik Industries AG, headquartered in Essen, Germany and founded in 2007, has been at the forefront of developing smart materials, animal nutrition solutions, and sustainable mobility technologies. Evonik is widely acknowledged for integrating innovation and sustainability, significantly contributing to resource-efficient chemical production worldwide.

Established in 1925, Croda International PLC is headquartered in Snaith, United Kingdom. It has earned a reputation for delivering high-performance ingredients for the life sciences and consumer care markets. Croda stands out for its commitment to green chemistry, developing bio-based products that support health, beauty, and environmental sustainability initiatives.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the anionic surfactants market include Kao Corporation, and Galaxy Surfactants Limited, among others.

Download your free sample report today to explore the latest anionic surfactants market trends 2026, including growth drivers, emerging opportunities, and competitive landscape insights. Stay ahead with expert analysis on sustainability innovations and regional market forecasts. Don’t miss this essential resource to inform your strategic decisions and maximize your market potential!

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 5.80% between 2026 and 2035.

Key strategies driving the market include product innovation with eco-friendly formulations, expansion into emerging markets, strategic partnerships, and mergers. Companies focus on sustainable sourcing, advanced manufacturing technologies, and strong customer engagement to enhance competitiveness, meet regulatory demands, and address growing applications in personal care, detergents, and industrial sectors.

The key market trends of the anionic surfactants market are the increasing investments by various governments across the globe in key downstream industries and the growing need for greener and sustainable surfactants.

The major regions in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The major product types are linear alkylbenzene sulphonate, lignosulphonates, alcohol ether sulphates/fatty alcohol sulphates, alkyl sulphates/ether sulphates, sarcosinate, phosphate esters, and alkyl naphthalene sulphonates, among others.

The significant applications in the market are home and personal care, agrochemicals, oil field chemicals, textiles, and construction, among others.

Anionic surfactants are dibasic acid salts that are amphiphilic in nature.

The key players in the market report include BASF SE, Clariant Ltd., Evonik Industries AG, Croda International PLC, Kao Corporation, and Galaxy Surfactants Limited, among others.

In 2025, the market reached an approximate value of USD 24.73 Billion.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 43.46 Billion by 2035.

Asia Pacific is the most dominant regional segment, driven by rapid urbanization, industrialization, and growing consumer awareness about personal hygiene.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Scope of the Report Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share