Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Australia same day delivery market was valued to reach a market size of AUD 1201.11 Million in 2025. The industry is expected to grow at a CAGR of 8.14% during the forecast period of 2026-2035. The rising growth in e-commerce and advancements in last-mile logistics technology are aiding the market to attain a valuation of AUD 2626.92 Million by 2035.

Base Year

Historical Period

Forecast Period

The growing demand for convenience and immediacy is reshaping fulfillment strategies, with consumers increasingly expecting purchases to arrive at their doorstep quickly. Approx. 60% of customers prefer home delivery over alternatives like click-and-collect, creating a strong opportunity for retailers to expand.

As consumers increasingly seek convenience and better pricing amid cost-of-living pressures, online shopping continues to accelerate. In 2024, a record 9.8 million Australian households shopped online, up 2.3% year-on-year.

To improve delivery accessibility outside major cities, retailers are extending Same day services to regional areas. In December 2024, Bunnings partnered with Uber to roll out Same day delivery across 60+ non-metro stores in Australia.

Compound Annual Growth Rate

8.14%

Value in AUD Million

2026-2035

*this image is indicative*

Rising consumer preference for variety, value, and convenience is driving shoppers to explore multiple platforms. In 2024, Australians shopped online with an average of 16 different retailers, up from 9 in 2018, intensifying competition and raising expectations for faster, more reliable Same day delivery across a broader retail network. Rising demand for faster access in the food segment is fueling growth in rapid delivery services, thus increasing the demand of Australia same day delivery market. In June 2023, Our Cow launched same day delivery in the Sydney metro and aims to expand nationwide within 12 months to meet shifting consumer expectations in premium food delivery.

Rising demand for fast and contactless delivery has led to the launch of Google Wing’s drone delivery service in Melbourne in July 2024. Serving around 250,000 residents across 26 eastern suburbs, drones will deliver lightweight goods via the DoorDash app from Eastland Shopping Centre’s rooftop.

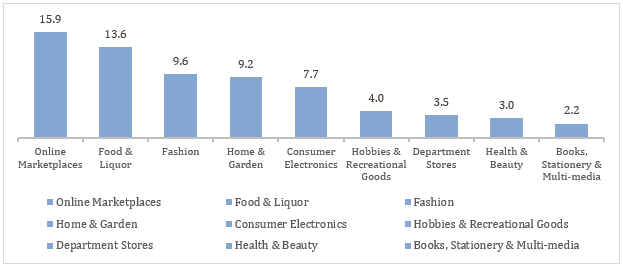

Figure: Category-Wise Online Retail Spending in Australia, 2024 (AUD Billion)

Online marketplaces generated AUD 15.9 billion in online sales in 2024, accounting for 23% of total e-commerce spend, the highest among all categories. Their popularity continues to rise, driven by consistently strong consumer experiences. This dominance signals rising delivery volumes through marketplace ecosystems, reinforcing the need for faster, more scalable fulfilment solutions, including same day delivery.

Shoppers are drawn to marketplaces for their low prices, wide variety of products and brands, and the availability of free shipping. These priorities are reshaping last-mile logistics, prompting platforms to focus on greater convenience and faster delivery. To stay competitive and retain customer loyalty, leading marketplaces are accelerating investments in same day delivery infrastructure and forging key logistics partnerships. Earlier dominated by platforms like eBay, Etsy, Redbubble, and Catch, the Australia same day delivery market has now shifted toward major players such as Amazon and Temu, reflecting changing consumer preferences and a trend toward consolidation.

Nearly 9 in 10 Australian retailers have significantly upgraded their shipping services, with a strong focus on faster delivery options. This momentum is set to continue into 2025, as 82% of retailers plan to expand their shipping offerings further to meet growing demand in the Australia same day delivery market. Furthermore, speed and reliability have become critical differentiators in online retail. Approx. 77% of shoppers expect full tracking transparency, while 57% expect a same day pickup for online orders, underlining the growing demand for faster and transparent delivery solutions.

The growing impulse-driven, platform-based shopping is accelerating the demand for quicker delivery. In Australia, social commerce reached AUD 4.9 billion in 2024 and is projected to grow to AUD 8 billion by 2029, creating strong momentum for same day delivery as consumers expect instant gratification from in-app purchases.

Australia same day delivery market development is driven by widespread adoption of online shopping, expansion of delivery fleet, investments in same day delivery infrastructure, and the development of a range of delivery options and pricing models.

Online shopping has become a mainstream habit across Australia, with 8 in 10 households making online purchases in 2023. This surge reflects a lasting transformation in retail preferences, accelerated by convenience, broader product access, and flexible delivery options. The growing reliance on e-commerce is driving businesses to optimise logistics, invest in faster delivery solutions, and enhance digital infrastructure. As online purchasing continues to rise, retailers are under increasing pressure to meet expectations for seamless shopping-to-doorstep experiences.

Companies and brands increasingly prioritise sustainability by transitioning to electric delivery fleets, aiming to cut emissions and improve operational efficiency. This transformation supports long-term environmental goals while meeting consumer demand for faster, cleaner deliveries. In August 2024, Australia Post rolled out 175 advanced electric motorbikes, highlighting its push toward safer, greener, and more innovative logistics.

Expanding parcel locker networks creates a valuable opportunity to streamline same day delivery by reducing failed delivery attempts and increasing drop-off efficiency. With Australia Post now operating 773 parcel locker banks across 693 locations and recording a 32% year-on-year increase in locker deliveries, the shift toward self-service collection supports faster fulfillment, improves delivery reliability, and eases pressure on last-mile logistics, key factors in scaling same day delivery operations across both urban and suburban areas.

Rising consumer demand for flexible delivery solutions has prompted businesses to expand their service offerings and pricing models. These enhancements include multiple same day delivery windows, curbside pickup, buy online, pick up in-store (BOPIS), and varied delivery fee structures. By diversifying delivery options, companies can better meet customer preferences while strengthening their competitive position in the growing and dynamic market.

Key companies in Australia same day delivery market report are deploying smart technologies to improve their service offerings. Real-time GPS tracking, driver location updates, and delivery status visibility boost transparency for senders and recipients. Further, intuitive proof of delivery captures recipient’s signature, or leaves a photo to show where and how the delivery was completed, shared in real-time with the sender.

The adoption of automation and artificial intelligence (AI) in warehouses and inventory management systems is also shaping the industry. These systems are becoming increasingly automated, streamlining order processing and fulfilment. Additionally, AI-powered tools can help forecast demand, optimise delivery schedules, and predict potential delays or disruptions to the delivery process.

Companies are focusing on reducing their carbon footprint by adopting sustainable practices. Businesses offering same day delivery services are taking a proactive approach to minimise their environmental impact by adopting sustainable delivery practices, prioritising eco-friendly packaging solutions, leveraging technology, and data analytics. Practices such as route optimisation and the adoption of electric vehicles help companies lower their carbon footprint. In August 2024, Australia Post introduced 175 electric motorbikes to improve customer experience and reduce fossil fuel use, while enabling access to routes previously difficult for three-wheel electric vehicles.

Urban areas in Australia provide an opportunity for same day deliveries. Same day delivery is particularly viable and increasingly popular in urban centres such as Sydney, Melbourne, and Brisbane, where high population density and developed infrastructure support efficient logistics, supporting the Australia same day delivery market expansion. In 2023, 87% of Australia's population resided in urban areas, up from 86% in 2019. With the national population projected to reach 30 million by 2030, a substantial portion of this growth is expected to occur in urban regions, further reinforcing the demand and feasibility of same day delivery services.

Same day delivery typically incurs higher costs than standard shipping, presenting a challenge for retailers aiming to absorb these expenses without transferring them to customers, hindering the Australia same day delivery market growth. As consumer expectations for faster and more convenient delivery continue to rise, managing these costs effectively is essential to maintaining demand and customer satisfaction. Furthermore, establishing an efficient same day delivery system demands significant investment in advanced logistics infrastructure, which is both time-intensive and costly. This contributes directly to the higher pricing of same day delivery services.

“Australia Same Day Delivery Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

On the basis of service, the market can be divided into the following:

On the basis of mode of transportation, the market is segmented into the following:

By application, the market is segmented into the following:

By end use, the market is segmented into the following:

Based on region, the market can be segregated into:

Market Analysis by Service

As per the Australia same day delivery market analysis, rising demand from both regional and metro areas is accelerating growth in Australia's domestic same day delivery segment as consumers seek faster, more convenient options. To capitalise on this opportunity, in December 2024, Bunnings' collaborated with Uber and offered same day delivery across regional and metropolitan areas, addressing consumer needs during peak holiday seasons.

Cross-border demand for Australian goods, especially from China is boosting the Australia same day delivery market opportunities. Key players such as DHL Australia and Team Global Express among others are tapping this with 24/7 global next-flight-out services, 60-minute pickup, door-to-door delivery, and secure handling.

Market Analysis by Mode of Transportation

Steady growth in non-bulk road freight highlights the increasing reliance on road transport for time-sensitive deliveries across Australia’s urban and regional networks. The non-bulk freight has grown by approximately 2% annually since 2011-12 on the road in Australia. Approx. 165.5 billion tkm of non-bulk freight was moved in 2022-23, rising from 127.9 billion tkm in 2011-12. In August 2024, Amazon Australia announced free same day delivery on more than one million products within Sydney, reflecting an increasing growth of roadway transportation in the Australia same day delivery market.

Air transportation is playing a key role in strengthening the same day delivery market in Australia by facilitating faster international and domestic deliveries to meet the growing demands of e-commerce and consumer expectations for quicker shipping. There’s growing opportunity for innovative air delivery solutions in Australia, with developments like drone-based logistics gaining traction to meet faster shipping demands. Australia is witnessing a surge in drone delivery trials. Moreover, Wing Aviation has expanded in Melbourne, with Australia’s Civil Aviation Safety Association (CASA) approving its operations since 2019.

Market Analysis by Application

Increasing online spending is fueling the retail and e-commerce growth in Australia. Furthermore, the convenience of faster delivery drives the Australia same day delivery market. In December 2024, retail turnover in Australia reached AUD 36.99 billion, marking a 4.6% increase compared to December 2023. Simultaneously, in 2024, 9.8 million Australian households spent over AUD 69 billion online, setting a new e-commerce record. In February 2025, Costco launched same day delivery services for items like groceries and essentials via DoorDash platform.

Priority mail remains essential for time-sensitive items like legal documents, and government communications. Its reliability and tracking features make it a preferred choice for urgent, high-security correspondence. Key players like DHL Australia provide urgent same day delivery solutions through services such as Sprintline (road) and Jetline (air). These offerings include pickup within 60 minutes, 24/7 door-to-door delivery, and real-time tracking. They also handle high-value shipments with secure options, covering both domestic and international needs.

Annually, over 330 million prescriptions are written in Australia, highlighting significant demand for timely access to medications and a large untapped space for same day delivery services. To capture this opportunity, key players in Australia same day delivery market are expanding their logistics capabilities, partnering with pharmacies, and leveraging digital health platforms to scale rapid fulfilment across urban and regional areas. For instance, in October 2021, HealthEngine announced a partnership with Chemist2U to offer same day prescription delivery, allowing over 3.6 million users to order medicines online via app or website.

Market Analysis by End Use

Rising customer demand for fast delivery, coupled with the continued expansion of the e-commerce sector, is expected to drive significant growth in the B2C segment. Furthermore, as online shopping grows and competition among retailers intensifies, same day delivery has become a crucial strategy for businesses aiming to meet evolving consumer expectations. To tap into the growing Australia same day delivery market, in August 2024, Amazon Australia launched Prime Free Same Day Delivery in Sydney, making the service accessible to over 90% of the city’s population.

Same day delivery services in the B2B sector facilitate efficient inventory management by ensuring the rapid movement of critical supplies between warehouses and retail locations. Additionally, the growing B2B e-commerce sector, due to increasing adoption of AI, which enhances operational efficiency, is also fueling demand for faster logistics and same day delivery services to meet business buyer expectations.

Facility expansions across New South Wales (NSW) are set to boost Australia same day delivery market growth by improving logistics and reducing delivery times. For example, in October 2024, Coles opened its second advanced Customer Fulfilment Centre in Wetherill Park, offering Same day delivery with extended cut-off times. Furthermore, in June 2023, Northern NSW-based meat delivery subscription startup, Our Cow launched same day delivery for the Sydney metro, aiming to expand the service to all Australian capital cities within the next 12 months.

Due to the rising number of e-commerce activities, the transport and logistics sector is expanding in Victoria, leading to fast delivery services. In 2024, online shopping in Victoria increased by 2.3%, with Point Cook in Victoria leading in purchase volume. This surge is driving demand for same day delivery services, as businesses seek to meet consumer expectations for faster fulfillment. At the same time, Fraser Rise ranked as the top suburb in Victoria in terms of the growth in online shopping in 2024.

According to the 2024 report by Australia Post, Queensland's online purchases increased by 4.3% year-over-year in 2023, positioning it among the top-performing states in the country. Additionally, Wing’s partnership with DoorDash, in April 2023, to launch drone delivery in Ipswich reflects the growing demand for faster and more efficient delivery solutions to meet the rising consumer expectations for instant access to goods.

The Australia same day delivery market is highly competitive, with providers striving to differentiate themselves through service quality and pricing. Key competitive factors also include delivery frequency, reliability, speed, real-time package tracking, and geographic coverage.

Zoom2u Technologies Limited, founded in 2014, is an Australian-owned delivery platform offering fast, reliable same day delivery by connecting customers with local independent couriers. It operates two main businesses: Zoom2u, a marketplace used across major Australian cities by thousands for Same day delivery, and Locate2u, a global SaaS platform.

Founded in 2014, Go People Pty Ltd. is a trusted Australian company offering reliable, flexible, and cost-effective same day and next-day delivery services. Committed to excellence, it enhances the customer delivery experience through advanced technologies, including real-time tracking and effective communication between drivers, recipients, and businesses, ensuring prompt and transparent delivery solutions across various industries.

Established in 1993, PACK & SEND Holdings Pty Ltd., a subsidiary of Fortidia, is Australia’s leading and most recognised courier and freight delivery reseller. The company consolidates services from the world’s top parcel and freight carriers into one accessible platform, enabling customers to manage all logistics needs efficiently.

DTDC Australia Pty Ltd. is a trusted logistics provider offering efficient and reliable shipping solutions for businesses and individuals. With a strong commitment to customer satisfaction, DTDC delivers a wide range of services including express parcel delivery, e-commerce logistics, freight transport, and international mail solutions.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the Australia same day delivery market are Australia Post Group, Team Global Express Pty Ltd., and Direct Couriers Pty Ltd., among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the Australia same day delivery market reached an approximate value of AUD 1201.11 Million.

The market is projected to grow at a CAGR of 8.14% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around AUD 2626.92 Million by 2035.

The same day delivery market is categorised according to the service, which includes international and domestic.

The key players are Zoom2u Pty Ltd., Go People, PACK & SEND Holdings Pty Ltd, DTDC Australia Pty Ltd., Australia Post Group, Team Global Express Pty Ltd., and Direct Couriers Pty Ltd. among others.

Based on transportation, the market is divided into airways, roadways, railways and intermodal.

The market is broken down into New South Wales, Victoria, Queensland, Australian Capital Territory, Western Australia, and others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Service |

|

| Breakup by Mode of Transportation |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share