Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The automotive connectors market attained a value of USD 7.20 Billion in 2025. The market is expected to grow at a CAGR of 6.40% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 13.39 Billion.

Autonomous vehicles depend heavily on sophisticated sensor networks and high-speed data transmission systems. Automotive connectors help support these systems by providing reliable, low-latency communication between cameras, LiDAR, radar, and control units. The rising investments in AV technology is fueling demand for connectors that combine data, signal, and power transmission with enhanced robustness to operate in complex environments.

The shift toward electric vehicles (EVs) is driving the automotive connectors market expansion. As per International Energy Agency, the global electric car sales surpassed 17 million in 2024. As governments worldwide push for lower emissions, demand for electric drivetrains and associated connectors grows rapidly, driving manufacturers to innovate durable, lightweight, and heat-resistant connector solutions that meet stringent safety and performance standards.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6.4%

Value in USD Billion

2026-2035

*this image is indicative*

Sustainability trends influence the adoption of recyclable and bio-based materials in manufacturing, adding to the automotive connectors industry value. Automotive companies are prioritizing eco-friendly components to reduce carbon footprint and support circular economy goals, driving innovation in connector materials that combine performance with sustainability. In April 2025, TE Connectivity and BASF developed an automotive connector that uses Ultramid Ccycled polyamide, incorporating pyrolysis oil derived from post‑consumer plastic waste.

Advanced Driver Assistance Systems (ADAS) technologies, such as lane-keeping, adaptive cruise control, and emergency braking require extensive electrical connectivity. This trend pushes demand for connectors that are compact, vibration-resistant, and capable of high-frequency signal transmission. The expansion of ADAS across vehicle segments drives connector innovations to meet diverse functionality while maintaining safety and durability. As vehicles become increasingly autonomous, ensuring real-time data transmission between sensors and control units without failure under harsh driving conditions.

Modern vehicles are becoming data-centric platforms with infotainment, telematics, and connectivity features, driving the automotive connectors demand. In April 2022, TE Connectivity unveiled its Generation Y 68P Sealed Hybrid Inline Connector, combining signal, power, and data connectivity in one unit. This requires connectors that support high-speed data transfer like USB 3.0, Ethernet, and fiber optics. The push for faster and more reliable in-car communication networks boosts the demand for connectors designed to handle large data volumes efficiently.

Smart connectors with embedded sensors and diagnostic capabilities enable real-time monitoring of connection health, temperature, and signal integrity. This trend enhances vehicle safety and maintenance efficiency, prompting automotive connector manufacturers to develop intelligent solutions that integrate seamlessly with vehicle networks and diagnostic systems. In October 2024, TE Connectivity introduced its MCON 1.2 NextGen and NextGen Plus sealed locking lance connector series.

Automotive manufacturers increasingly focus on reducing vehicle weight to improve fuel efficiency and reduce emissions. Lightweight connector materials and designs contribute to this goal by replacing traditional heavy components. The trend drives demand for connectors made from innovative plastics, alloys, and composite materials that maintain strength while reducing mass. Additionally, modular connector designs help streamline wiring architectures, further cutting down on weight and space while enhancing overall system efficiency.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Automotive Connectors Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Connection Type

Key Insight: Wire to board connection dominates the market due to their critical role in linking sensors, ECUs, displays, and control units to printed circuit boards (PCBs). These connectors support complex infotainment, ADAS, and EV battery management systems. In June 2024, KYOCERA AVX unveiled its 9169 000 Series wire to board card edge connectors for insulation displacement contacts (IDCs) and BeCu compression. As vehicles become more electronic and modular, wire-to-board connectors are crucial for zonal architecture and smart modules.

Market Breakup by Connector Type

Key Insight: PCB connectors are leading the automotive connectors industry, serving as the backbone for electronic control units (ECUs), sensors, and infotainment systems. They facilitate power and signal transfer from wiring harnesses to PCBs. Leading manufacturers offer PCB connectors optimized for compactness, durability, and signal integrity. In March 2024, Ennovi launched the Ennovi-Net automotive Ethernet connector, utilizing press-fit PCB pins to eliminate soldering.

Market Breakup by System Type

Key Insight: Sealed connector systems are gaining popularity due to their ability to withstand harsh environments such as moisture, dust, and temperature extremes. These connectors are crucial for under-hood applications, engine compartments, lighting systems, and EV powertrains. With increasing vehicle electrification and complexity, the demand for rugged sealed connectors rises, especially in electric vehicles and commercial trucks, where reliability under extreme conditions is essential to maintain safety and system longevity.

Market Breakup by Vehicle Type

Key Insight: Passenger cars drive the automotive connector market development due to their sheer production volume and rapid adoption of advanced electronics and safety systems. Connectors are used extensively in powertrain, lighting, infotainment, and ADAS modules. In February 2025, Hirose launched its AU1 Series, a USB 3.2 / DisplayPort 1.4 compatible wire‑to‑board connector for automotive infotainment and passenger cabin interfaces. This continuous innovation focuses on miniaturization, weight reduction, and enhanced durability to meet evolving passenger car standards globally.

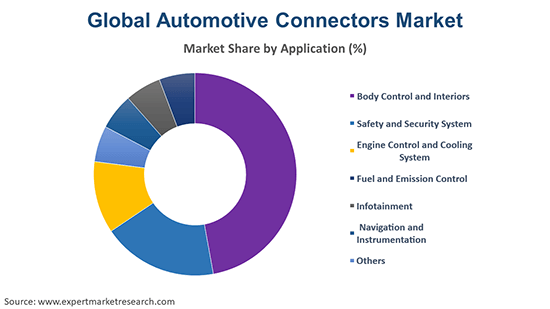

Market Breakup by Application

Key Insight: Body control and interior systems dominate connector usage due to the sheer number of electronic subsystems involved like lighting, HVAC, seat adjustment, window regulators, and interior ambient features. Passenger vehicles and EVs increasingly integrate comfort, personalization, and aesthetic elements, each requiring reliable connectors. Smart interiors and ambient lighting in premium vehicles especially push demand for wire-to-board and unsealed connectors, making this segment the largest by volume and usage across all vehicle types.

Market Breakup by Region

Key Insight: Asia Pacific leads the automotive connectors market, driven by large-scale vehicle production in China, Japan, South Korea, and India. As per China Association of Automobile Manufacturers, China produced 31.436 million vehicles in 2024. The region’s rapid adoption of EVs and advanced electronics accelerates demand for PCB and high-voltage connectors. Moreover, regional government policies promoting smart mobility, along with cost-effective manufacturing, keep Asia Pacific ahead in both volume and innovation.

Wire to Wire & Board to Board Connection to Drive Automotive Connector Demand

The wire to wire segment of the automotive connectors industry is essential in transmitting power and signals between wiring harnesses, playing a vital role in lighting, transmission systems, and engine compartments. These connectors offer flexibility and are ideal for spaces where PCB integration is not feasible. Their wide application across both low- and high-power areas maintains strong market relevance. The growing electrification of subsystems in EVs ensures continued demand for these connectors in power distribution and auxiliary systems.

Board to board connectors are used where multiple PCBs are integrated within a single module, such as infotainment systems, advanced ECUs, and digital clusters. These connectors are ideal for compact modules where internal board interconnectivity is critical. In November 2024, Advanced Interconnections Corp launched a new line of board‑to‑board connectors for automotive use. Increasing adoption of centralized and zonal architectures in vehicles is driving their future relevance, especially in high-end and autonomous vehicle platforms.

IC & RF Automotive Connectors to Gain Prominence

The IC (integrated circuit) segment of the automotive connectors market is critical for connecting microchips and processors within control units and infotainment systems. Their relevance has grown with the integration of AI chips and microcontrollers in ADAS, EV battery management, and infotainment platforms. These connectors allow for testing and stable chip communication. With autonomous vehicles requiring high-speed computing, demand for IC connectors is poised to rise.

RF (radio frequency) connectors are gaining importance with the rise of connected vehicles, V2X communication, GPS, and satellite radio. In April 2024, Samtec released a set of edge launch RF connectors with slim bodies for future high bandwidth vehicle electronics. Used to transmit high-frequency signals, these connectors ensure clear communication between antennas, control units, and displays. Their current dominance is moderate but rising rapidly with the advancement of connected and autonomous vehicle technologies that depend heavily on reliable RF signal transmission.

Thriving Adoption of Unsealed Automotive Connectors

Unsealed automotive connectors industry share is growing as they essential for infotainment, interior lighting, and sensor networks. They offer easier assembly, cost-effectiveness, and support high-speed data transmission in environments less exposed to contaminants. Molex’s PicoBlade and Hirose’s board-to-board connectors are examples widely used in infotainment and telematics modules. Unsealed connectors continue to grow as vehicle interiors become more connected and integrated, especially with increasing digital and infotainment features.

High Automotive Connectors Usage in Commercial Vehicles & Electric Vehicles

Commercial vehicles, including trucks and buses, have robust connector needs due to their heavy-duty operating conditions and longer life cycles. Connectors here must withstand extreme vibration, temperature swings, and environmental exposure. TE Connectivity’s AMPSEAL series and Amphenol’s heavy-duty connectors are popular choices in this segment. Commercial vehicles’ demand for high-reliability sealed connectors in powertrain, lighting, and telematics supports steady market growth.

The electric vehicle segment of the automotive connectors market is growing rapidly and demands specialized connectors for battery management, high-voltage power delivery, and sensor integration. As EV adoption expands globally, the automotive connector market is expected to shift significantly toward high-performance EV-compatible connectors, making this the fastest-growing segment despite its current smaller size. In May 2025, JAE launched its MY05 Series connectors, rated for 1,000 V, tailored for EV battery management systems.

Safety and Security & Engine Control and Cooling Systems to Favor Automotive Connectors

Safety systems rely on fast, vibration-resistant connectors to ensure real-time performance. With ADAS technologies and autonomous braking becoming standard, this segment’s demand continues to surge. Connectors in this category must meet rigorous safety certifications and function flawlessly under extreme conditions. As vehicles adopt Level 2 and 3 autonomy, the complexity and number of safety connectors will only grow.

The engine control and cooling systems segment of the automotive connectors market includes ECUs, ignition systems, and cooling fans, which are core components in ICE and hybrid vehicles. Though EVs reduce internal combustion needs, thermal management systems in EVs still require robust connector networks. Connectors here face high heat and vibration, making sealed, rugged solutions essential. As automakers optimize combustion systems and introduce hybrid powertrains, engine control connector demand remains stable.

Europe & North America to Lead Automotive Connectors Deployment

Europe is a hub for high-performance and luxury vehicles, pushing strong demand for advanced connector technologies, especially in infotainment, ADAS, and EV applications. Stricter environmental regulations also spur demand for connectors in emission control and EV powertrains. The region is transitioning rapidly to electrification, with strong government backing, making it a leader in EV connector standards. Europe remains a premium, innovation-focused automotive connectors market with high per-unit connector value.

North America maintains strong demand for connectors in both ICE and EV platforms. The focus on pickup trucks and SUVs necessitates rugged, high-amperage connectors, especially for lighting, safety, and power distribution. Leading suppliers are offering innovations in modular and high-voltage connector designs. In December 2023, Amphenol upgraded its SURLOK Plus connector to handle 1500V DC, enabling higher voltage capacity. With the growth of EV makers, North America is seeing increased demand for EV battery and charging connectors.

Key players in the automotive connectors industry are leveraging a mix of innovation, collaboration, and localization to stay competitive in a fast-evolving industry. A primary strategy involves heavy investment in research and development to design advanced connectors that support high-voltage EV systems, high-speed data transmission, and enhanced environmental resistance. These innovations aim to meet the growing demands of electric, autonomous, and connected vehicles. Strategic partnerships with OEMs, Tier 1 suppliers, and tech firms are also crucial, enabling co-development of solutions tailored to next-generation automotive platforms.

In addition, companies are expanding their manufacturing footprint in key regions to strengthen supply chain resilience and meet regional demand efficiently. Standardization is another focus area, with manufacturers ensuring compliance with international automotive standards and aligning with emerging connector formats for EVs. Sustainability also plays a growing role, with companies adopting eco-friendly materials and lightweight designs to support overall vehicle efficiency and environmental goals.

Founded in 2007 and headquartered in Schaffhausen, Switzerland, TE Connectivity is a global leader in connectors and sensors. Known for its rugged, high-performance automotive solutions, TE has pioneered innovations in high-voltage EV connectors, autonomous vehicle systems, and data connectivity for safer, smarter, and more efficient transportation.

Established in 1941 and based in Tokyo, Japan, Yazaki Corporation is one of the world’s largest producers of wire harnesses and automotive connectors. Renowned for its focus on sustainability and innovation, Yazaki continues to lead in power distribution systems, hybrid vehicle solutions, and global supply chain excellence across the automotive sector.

Founded in 1938 and headquartered in Lisle, the United States, Molex is a major innovator in electronic interconnect solutions. The company has developed cutting-edge products like high-speed MX-DaSH hybrid connectors, supporting data, power, and signal transmission in compact automotive designs, especially for EVs, ADAS, and next-generation mobility systems.

Formed in 1897 and headquartered in Osaka, Japan, Sumitomo Electric specializes in wiring harnesses and connectors, pioneering lightweight and high-voltage solutions for electric vehicles. The firm is contributing significantly to the advancement of environmentally conscious transport systems.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the automotive connectors market are Dell Technologies Inc, Fujitsu Limited, and Hitachi, Ltd, among others.

Discover the latest Automotive Connectors Market trends 2026 with our in-depth, data-driven report. Gain insights into growth projections, technological advancements, and top regional markets. Download a free sample now to explore key players, strategic developments, and industry forecasts that help you stay ahead in this competitive landscape. Get your automotive connectors market sample report today!

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 6.40% between 2026 and 2035.

Key strategies driving the market include investing in advanced technologies like high-speed and high-voltage connectors, expanding product portfolios for EVs and ADAS, forming strategic partnerships, focusing on lightweight and sustainable materials, enhancing customization, and strengthening global supply chains to meet growing automotive electrification and connectivity demands.

The shift towards hybrid vehicles, technological advancements and innovations, and growing inclusion of Advanced Driver Assistant Systems (ADAS) in commercial vehicles are the key trends fuelling the market.

The major regions in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The leading connection types in the market are wire to wire connection, wire to board connection, and board to board connection.

The significant connector types in the market include PCB connectors, IC connectors, RF connectors, and fibre optic connectors, among others.

Sealed connector system and unsealed connector system are the dominant system types in the market.

The leading vehicle types are passenger cars, commercial vehicles, and electric vehicles.

The various applications of automotive connectors are body control and interiors, safety and security system, engine control and cooling system, fuel and emission control, infotainment, and navigation and instrumentation, among others.

The key players in the market report include TE Connectivity, Yazaki Corporation, Molex Incorporated, and Sumitomo Electric Industries Ltd., among others.

In 2025, the market reached an approximate value of USD 7.20 Billion.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 13.39 Billion by 2035.

Asia Pacific leads the market, driven by large-scale vehicle production in China, Japan, South Korea, and India.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Connection Type |

|

| Breakup by Connector Type |

|

| Breakup by System Type |

|

| Breakup by Vehicle Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share