Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global automotive fuel cell market attained a value of approximately USD 5.45 Billion in 2025. The market is further expected to grow in the forecast period of 2026-2035 at a CAGR of 51.40%, reaching a value of around USD 344.87 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

51.4%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Automotive Fuel Cell Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 5.45 |

| Market Size 2035 | USD Billion | 344.87 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 51.40% |

| CAGR 2026-2035 - Market by Region | North America | 59.2% |

| CAGR 2026-2035 - Market by Country | USA | 60.4% |

| CAGR 2026-2035 - Market by Country | Germany | 57.8% |

| CAGR 2026-2035 - Market by Component | Fuel Stack | 58.1% |

| CAGR 2026-2035 - Market by Vehicle Type | Passenger Cars | 56.5% |

| Market Share by Country 2025 | Germany | 6.4% |

A fuel cell is a device that converts chemical energy of a fuel into electrical energy using electrochemical reactions. Automotive fuel cells are used to provide power to the vehicle’s electric motor and generally use a solid electrolyte with low temperature conducting hydrogen ions. Although similar to batteries, automotive fuel cells do not require charging and help reduce vehicle emissions and control environmental problems.

As per the automotive fuel cell market dynamics and trends, benefits associated with the use of automotive fuel cells such as fast refuelling, zero air pollutants, noiseless operation, high driving range, and zero greenhouse gas emissions, among other factors, are increasing the demand for the automotive fuel cells globally.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Governments worldwide are taking initiatives to improve the supply of hydrogen and overcome the challenges such as leakage and durability, among other issues. Increasing demand for hydrogen is leading to improvements in the supply chain, thereby supporting the growth of the automotive fuel cell market.

The demand for various vehicles, including passenger cars, trucks, and buses is growing globally. With increasing populations, urbanisation, rising disposable incomes, and improvements in road infrastructure, the heightened demand for automobiles is anticipated to fuel the market for automotive fuel cells.

Honda will begin manufacturing hydrogen-powered vehicles in the United States in 2024, with a new hydrogen variant of the CR-V. This aligns with Honda's goal to phase out combustion engines by 2040. The hydrogen-powered CR-V will offer a blend of plug-in and hydrogen fuel cell capabilities, providing flexibility for daily commutes and longer drives and boosting the automotive fuel cell demand. Honda's investment reflects its dedication to making hydrogen an accessible and sustainable energy source for American consumers, despite challenges such as limited fueling infrastructure.

Total sales of passenger vehicles in India rose from 3,069,523 to 3,890,114 units. The sales of passenger cars grew from 1,467,039 to 1,747,376 units, utility vehicles increased from 1,489,219 to 2,003,718 units, and van sales went up from 113,265 to 139,020 units during the fiscal year 2022-23, in comparison to the prior year, which contributed to the growth of the automotive fuel cell industry. In the commercial vehicle segment, overall sales experienced an increase from 716,566 to 962,468 units. The sales of medium and heavy commercial vehicles rose from 240,577 to 359,003 units, while light commercial vehicle sales increased from 475,989 to 603,465 units in the fiscal year 2022-23, compared to the previous year, which boosted the demand for fuel cells.

As per the automotive fuel cell industry analysis, the EV sector continues to experience strong growth in the global market. In 2023, global EV sales reached nearly 14 million, representing 18% of all vehicles sold, and this number is expected to climb to approximately 17 million in 2024. By region, EVs are forecasted to make up nearly 45% of new car sales in China, 25% in Europe, and over 11% in the U.S. Key drivers include price drops in battery production, greater model variety, and ongoing government incentives, though some countries have begun to phase out subsidies.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

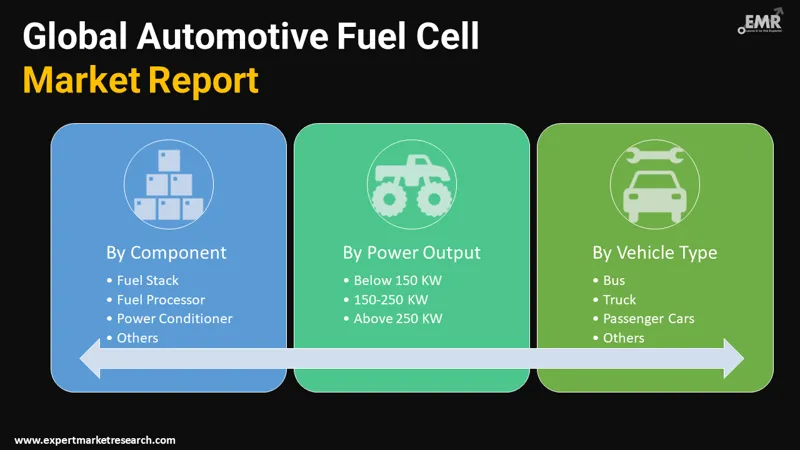

The EMR’s report titled “Automotive Fuel Cell Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Market Breakup by Component

Market Breakup by Power Output

Market Breakup by Vehicle Type

Market Breakup by Region

Passenger car vehicle types are anticipated to hold a sizable portion of the automotive fuel cell market share and grow at a CAGR of 56.5% in the forecast period owing to the growing demand for personal mobility and high adoption rate by a number of consumers. Increasing urbanisation, development of road infrastructure, and rising disposable incomes are surging the sale of passenger cars. Automotive fuel cells provide efficiency, extended driving range, and decrease greenhouse gas emissions which further enhance their demand among end users. The low operational costs and hassle-free operations of passenger cars with automotive fuel cells are also augmenting their demand.

The Asia Pacific is expected to account for a significant share of the global automotive fuel cell market during the forecast period. India, China, and Japan are expected to grow at CAGRs of 53.9%, 55.0%, and 51.7% between 2026 and 2035. This can be attributed to the rising demand for private transportation and buses as well as the considerable manufacturing base for vehicle production. Within the Asia Pacific, countries such as Japan, South Korea, and China are anticipated to bolster the regional market for automotive fuel cells.

| CAGR 2026-2035 - Market by | Country |

| USA | 60.4% |

| Germany | 57.8% |

| UK | 56.1% |

| China | 55.0% |

| India | 53.9% |

| Canada | XX% |

| France | XX% |

| Italy | XX% |

| Japan | 51.7% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Meanwhile, in Europe, the market for automotive fuel cells is expected to grow significantly due to the high adoption rate of technology. Germany and the UK are expected to have CAGRs of 57.8% and 56.1% in the forecast period. Manufacturers of vehicles are focussing more on the research and development of the components used in the vehicles, increasing the demand for automotive fuel cells. The rising popularity of luxury vehicles and high-premium vehicles in countries such as the United Kingdom and Germany is also fuelling the automotive fuel cell market in Europe.

Ballard Power Systems Inc., founded in 1979, has its headquarters in British Columbia, Canada. The company focuses on providing clean energy and fuel cell solutions by developing and manufacturing proton exchange membrane fuel cell products. They serve heavy duty motive markets along with other markets including engineering services, portable power, and material handling, among others.

Ceres Power Holdings plc is a fuel cell technology and engineering company which was established in 2004 and is headquartered in West Sussex, United Kingdom. The company develops power generation and hydrogen technologies which help in tackling climate change. They have developed electrolysers for green hydrogen and fuel cells for power generation.

Robert Bosch GmbH was founded in 1886 and has its headquarters located in Baden-Württemberg, Germany. A multinational engineering company, Robert Bosch offers consumers home appliances, auto spare parts, and other industrial and business products. They focus on meeting people’s requirements in the future by identifying the global megatrends now.

Plug Power Inc

Toyota Motor Corporation

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global market for automotive fuel cells reached a value of approximately USD 5.45 Billion in 2025.

The market is expected to grow at a CAGR of 51.40% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach around USD 344.87 Billion by 2035.

Increasing concerns towards the environment, rising demand for hydrogen fuel stations, and noiseless operation of the automotive fuel cells are the major market drivers.

The key automotive fuel cell market trends include fast refuelling capability, zero gas emissions, various initiatives to improve hydrogen infrastructure, and stringent guidelines by regulatory bodies.

The regional markets for automotive fuel cells are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The various types in the market for automotive fuel cells are passenger cars, bus, light commercial vehicles, and trucks.

The key market players, according to the report, are Ballard Power Systems Inc., Ceres Power Holdings plc, Robert Bosch GmbH, Plug Power Inc., and Toyota Motor Corporation, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Component |

|

| Breakup by Power Output |

|

| Breakup by Vehicle Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share