Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

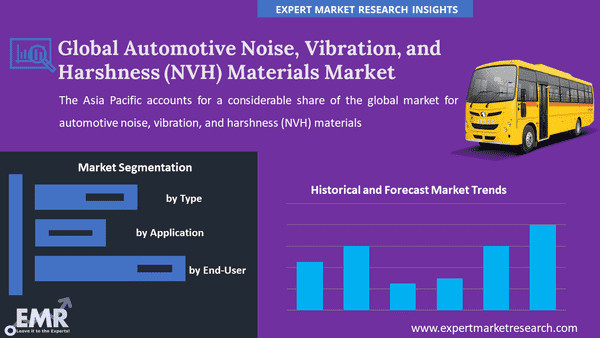

The global automotive noise, vibration, and harshness (NVH) materials market reached a value of about USD 16.98 Billion in 2025. The market is further expected to grow at a CAGR of 5.40% in the forecast period of 2026-2035 to reach nearly USD 28.73 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5.4%

Value in USD Billion

2026-2035

*this image is indicative*

The Asia Pacific accounts for a considerable share of the global market for automotive noise, vibration, and harshness (NVH) materials. This can be attributed to the expansion of manufacturing capacity and the rapid growth of the automobile industry in the region. In the Asia Pacific, China is one of the largest consumers of automotive NVH materials, which is significantly contributing to the growth of the market.

The rising population and the rising living standards are directly impacting the growth of the automobile sector positively, which is surging the utilisation of automotive NVH materials. Also, the easy availability of raw materials and low-cost labour are driving the region's automotive NVH materials market. The demand for automotive NVH materials in the Asia Pacific region is further expected to grow at the fastest rate, with the recent expansion activities by key players. With the rising demand for commercial vehicles and passenger cars owing to the increasing purchase power of consumers in the region, the market is expected to witness robust growth in the forecast period.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Noise, vibration, and harshness (NVH) materials in automobiles, particularly buses and cars, are materials that decrease undesired noise, vibrations, and harshness. As structure and airborne noises of vehicles can compromise their durability, NVH materials are used to reduce vibration and noise transmitted by various engine accessories such as steering wheels, cooling fans, the floor, and pedals.

Market Breakup by Type

Market Breakup by Application

Market Breakup by End-Use

Market Breakup by Region

The global market is being driven by rising demand for automotive NVH materials from the automotive industry due to stringent government mandates for quieter and safer cars. As lower NVH levels influence car-buying decisions, passenger vehicle manufacturers are extensively utilising automotive NVH materials. In addition, the growing demand for aftermarket services, including replacement parts, repairs and maintenance, accessorising, and customisation, is boosting the utilisation of auto parts and accessorising for soundproofing, which is expected to aid the market in the coming years.

As the use of commercial vehicles for logistics and transportation applications is increasing, the requirement for acoustic management and noise reduction in heavy vehicles is witnessing a surge. Rubbers offer excellent physical properties of high density, high heat, weather resistance, and vibration, absorbing properties, which make them an ideal NVH material. This, in turn, is anticipated to fuel the market growth. With the increasing focus of automotive manufacturers on acoustic management and noise reduction in passenger and commercial vehicles to improve fuel economy, reduce cabin noise, and increase durability, the demand for NVH materials is also predicted to grow. Moreover, the growing interest in automotive NVH materials in battery-powered light vehicles is expected to drive the growth of the market in the forecast period.

The report gives a detailed analysis of the following key players in the global automotive noise, vibration, and harshness (NVH) materials market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global automotive noise, vibration, and harshness (NVH) materials market attained a value of nearly USD 16.98 Billion.

The market is estimated to grow at a CAGR of 5.40% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach nearly USD 28.73 Billion by 2035.

The market is being driven by the increasing car ownership, the robust growth of the automotive sector, and the increasing focus on acoustic management and noise reduction of automobiles.

The introduction of various stringent government mandates regarding noise pollution from vehicles, the growing use of commercial vehicles for logistics and transportation, and the expanding market for the replacement of auto parts and accessorising for soundproofing are expected to propel the growth of the market.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The various types of automotive noise, vibration, and harshness (NVH) materials are rubbers, thermoplastic polymers, engineering resins, polypropylene, textile materials, fibreglass, mixed textile fibre, polyester fibre, textile materials (synthetic), and textile materials (cotton).

The major applications of automotive noise, vibration, and harshness (NVH) materials are absorption, insulation, insulator and absorber, damper, trunk module, floor module, wheel arches, cockpit module, roof module, engine casing and bonnet liners, and wheels.

The significant end-uses of automotive noise, vibration, and harshness (NVH) materials includes passenger vehicles, light commercial vehicles, and heavy commercial vehicles.

The major players in the industry are BASF SE, The DOW Chemical Company, 3M Company, Sumitomo Riko Company Limited, Covestro AG, Huntsman International LLC, Borgers SE & Co. KGaA, Bocholt, Eagle Industries Inc., and Roush Enterprises, Inc, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by End-Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share