Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global automotive sunroof market was valued at USD 12.91 Billion in 2025. The industry is expected to grow at a CAGR of 6.90% during the forecast period of 2026-2035 to reach a value of USD 25.16 Billion by 2035. The market growth is significantly influenced by one of the major factors the demand for sustainable and lightweight roofing solutions, especially in the case of electric vehicles (EVs).

As the automakers are progressively shifting towards electric ones, the reduction of the vehicle weight and the improvement of the energy efficiency have become very important. This has surged demand in the automotive sunroof market. To keep up with the trend, suppliers are launching in the market advanced materials, such as bio-based polymers, recyclable composites, and thinner structural designs, that not only lower the total vehicle mass but also maintain its strength and safety.

At the same time, a project like the openable roof module for BEVs along with the “Greener Roof” idea presented by Webasto SE in April 2025 (at Auto Shanghai 2025), are turning the notion of sunroof systems into a perfect combination of luxury and energy-saving features. These kinds of solutions, besides the fact that they make the trips more pleasant, are in accordance with worldwide sustainability programs and also with the regulatory pressures that require the production of clean automotive components. Hence, the inclusion of eco-friendly, electrically-vehicle (EV) optimized sunroofs is speeding up the automotive sunroof market development.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6.9%

Value in USD Billion

2026-2035

*this image is indicative*

To stand out in highly competitive segments, automakers are loading new EVs with luxury comfort features that not only elevate the onboard experience but also differentiate models. One of the most notable changes has been the replacement of traditional roofs with sunroofs, especially in luxury electric vehicles. Noting this trend in the automotive sunroof market, Mercedes rolled out an AISIN-supplied panoramic sliding sunroof as standard equipment for the EQS and EQE SUVs starting March 2023. It emphasizes how Tier-1 suppliers are ramping their high-end roof systems to accommodate the escalating demand for electrification in the vehicle market.

Developers of sunroofs are broadening their factory portfolios in different hubs of the automotive world to keep up with the demand for their products worldwide. This plan also forces the company to reduce transportation costs and meet the regional production needs of the EV sector. In February 2023, Webasto inaugurated a new plant in Guanajuato, Mexico, thus strengthening its presence in the North American market. Although most of the work done at this plant will be e-mobility component production, it will still facilitate overall regional scaling, allowing Webasto to become a more efficient supplier of the latest roof systems in the automotive sunroof market.

Smart-glass sunroofs are a hot topic as OEMs look to ambient regulation and excellent passenger comfort. The help of electrochromic glazing results in lower HVAC load and at the same time raises the luxury level of the vehicle. One of the biggest breakthroughs to date was the announcement made by Mativ’s Argotec brand and Miru Smart Technologies about their joint development of a resource-saving TPU interlayer for dynamic electrochromic automotive windows in October 2024. The progress of such technology makes smart sunroofs more open to regular models, thus greatly speeding up the technology transfer process and the automotive sunroof market expansion.

To design interiors of next-generation EVs with large, curved panoramic roofs, OEMs are turning to the development of scalable smart-glass as a solution. In this regard, the sector made progress when Miru and Argotec unveiled a prototype of a curved electrochromic sunroof whose dimensions were 1.5 m × 1.6 m and one of the largest in the world in March 2025. Breakthroughs of this kind give evidence that smart glass technology is at a stage where it can be implemented in real-life size panoramic roofs thus making OEMs more confident in their decision to use adaptive-glass sunroof systems.

As features for autonomous driving are being added at a rapid pace, the automotive sunroof market is witnessing strong demand for the installation of perception hardware. By integrating sensors into sunroof modules, the design of the car can be kept intact while the visibility and system performance are also improved. Hesai collaborated with Webasto in September 2023 for the integration of its AT128 long-range LiDAR into Webasto’s Roof Sensor Module for the future ADAS-enabled models. This cooperation is a step towards the industry's adoption of multifunctional roof systems as the next-generation platform for autonomous-ready vehicles.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

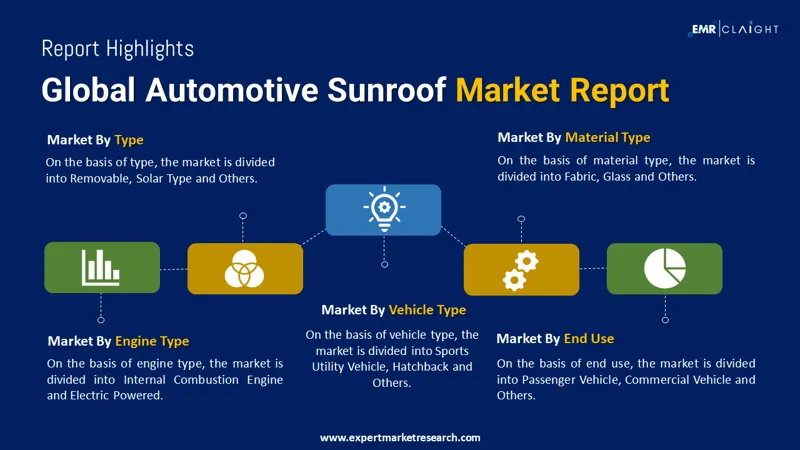

The EMR’s report titled “Global Automotive Sunroof Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insights: The built-in and pop-up roofs are still in high demand in the automotive sunroof market, owing to their widespread use in low-cost models, while panoramic and tilt-and-slide are mostly preferred in luxury and EV segments. Solar roofs and smart electrochromic designs seem to be successful as OEMs are paying more attention to sustainability and energy efficiency. At the same time, suppliers such as Webasto are not only broadening their range with the inclusion of top-mount sunroof modules for EVs but also indicating that there is continuous innovation going on in all roof types.

Market Breakup by Material Type

Key Insights: The automotive sunroof market includes fabric, glass, and other materials, each following separate trends. The trend towards lighter fabric roofs is still very much alive in the efficiency-focused segments, while glass roofs have taken over in terms of durability, clarity, as well as the mounting of smart/electrochromic glass. At the same time, other materials, for example, bio plastics and recycled composites, are becoming more popular as OEMs are committed to sustainability. Tier-1 players such as Webasto are not only conforming to but also challenging these limits: in September 2024, it launched its EcoPeak roof concept which comprises 80% of recycled or bio-based materials and also features integrated solar cells that decrease CO₂e by up to 50%.

Market Breakup by Engine Type

Key Insights: The automotive sunroof market comprises of oxygen-fueled internal combustion engines (ICE) and electric (EV) variants causing separate demand. ICE-powered cars typically lean towards conventional roof fashions like tilt-and-slide, pop-up, and built-in types which are mainly appreciated for ventilation and cost-effectiveness. EVs are creating the demand for panoramic glass, electrochromic smart roofs, and solar integrated modules to improve energy efficiency and cabin comfort. Tier-1 players such as Webasto, Inalfa, and Saint-Gobain are extremely researched and development intensive in creating lightweight and eco-friendly roofing that suits both ICE and EV platforms.

Market Breakup by Vehicle Type

Key Insights: The global automotive sunroof market spreads over arrays of premium cars, SUVs, hatchbacks, and other vehicles differing in trends. What luxury vehicles usually employ are panoramic and smart-glass roofs to embellish car and add new features, while large vehicles are contented with glass or modular panels to provide roomier cabins. Most hatchbacks are found to use economical tilt-and-slide or pop-up roofs, and various other segments engage with solar or lightweight modules. The Tier-1 players like Inalfa Roof Systems are adapting to changes in these segments by not only widening their panoramic and modular roof products but also by marking their 50-year milestone in sunroof production through innovation.

Market Breakup by End Use

Key Insights: Passenger vehicles account for a substantial share of the automotive sunroof market, owing to the increasing use of panoramic, electrochromic, and smart-glass roofs because of their comfort, aesthetics, and energy efficiency. Among commercial vehicles such as vans and buses, the need for lightweight, modular, and durable roofs to improve ventilation and passenger experience is on the rise. On the contrary, the focus of other vehicles, e.g., recreational and specialty models, is on developing flexible and energy-efficient roof designs. Major Tier 1 suppliers like Inteva Products, CIE Automotive, Aisin Seiki, Magna International, and Edscha are equally committed to these objectives through increased investment in research and development, expanded manufacturing capabilities, and the creation of segment-specific roof solutions.

Market Breakup by Region

Key Insights: The North America automotive sunroof market profits from a combination of luxury SUVs and state-of-the-art panoramic roofs, while Europe spearheads the move towards light, eco-friendly, and solar-powered solutions. Asia-Pacific volume is the main driver behind the region allowing for the charging up of the electric vehicle battery foci and local innovation. Latin America and the Middle East & Africa remain behind in the curve but gradually warm up to panoramic and modular designs. Suppliers such as Magna, Aisin Seiki, CIE Automotive, and Inteva Products are active in these areas with their R&D and production capabilities spreading. For instance, in March 2024, AGC Automotive Europe introduced a photovoltaic panoramic “VIPV” sunroof combining energy efficiency with modern design.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

By type, panoramic sunroofs register notable growth

Panoramic roofs are now one of the main characteristics of what luxury and premium cars are. They not only give an expansive view to the passengers but also increase the natural light and generally improve the cabin's attractiveness. In July 2023, Saint-Gobain Sekurit supplied a huge and lightweight glass panoramic roof for Volvo EX90 that included UV-filtering technology and acoustic insulation. This innovation gives car manufacturers a chance to improve the travel experience without weakening the structural part thus satisfying the demand for comfort and aesthetic sophistication at the same time.

Tilt-and-slide sunroofs are still the most preferred type of roof in mid- to upper-segment vehicles because they are very practical and can be used both for ventilation and for completely opening the car to the fresh air. In May 2024, Magna International unveiled a new-generation tilt-and-slide sunroof module for Volkswagen ID.5 electric crossover, which features a built-in rain sensor and a lightweight aluminum frame. By offering users more airflow and convenience, the tilt-and-slide solution continue to witness notable preference in the automotive sunroof market, as a way for car manufacturers to reach their goals of providing a roof option that is both cost-efficient and of high value, attractive to eco-conscious and comfort-oriented buyers.

By material type, Fabric gains higher preference

Fabric solar roofs are usually made of polyester or nylon. They are still quite attractive because they reduce the total weight of the car, thus making it more efficient and stable. This trend is mainly fueled by the demand for lightweight and luxurious roof solutions, and it is very noticeable in EVs. On the other hand, material innovators are making fabric roofs more functional. Covestro merged its stretchable TPU film with fabric and electronics to fashion a prototype roll-up sunroof shade that includes heating and LED lighting while being a solar shield.

Among the different types of solar roofs, those made of glass remain the most popular in the automotive sunroof market, as they are durable, transparent, and provide better comfort to passengers. The trend is mainly towards the usage of smart and electrochromic glass that allows dynamic light control, UV protection, and thermal insulation, thus becoming very interesting for EVs and luxury cars. In June 2024, AGC Automotive Europe introduced a new laminated panoramic glass sunroof for the high-end EVs with the features of integrated acoustic insulation and light-tinting technology. This breakthrough is a demonstration of how OEMs and suppliers are not only improving the passenger experience but also making the glass roofs more energy-efficient with the inclusion of smart features.

By engine type, ICE powered vehicles show significant uptake

Vehicles with internal combustion engines (ICE) are the reason why there is still a strong demand for conventional sunroof systems, most notably for such types as tilt and slide, pop-up, and built in. These perform functions like airing and styling without any substantial impact on the vehicle's performance or price. First-tier suppliers are upgrading the sunroof units in ICE vehicles with more lightweight mechanisms and less complicated designs in order to keep the cost and weight at a low level. As an instance, Webasto is providing a glass roof that can be opened for the new Kia EV3, although it is mainly an electric vehicle, the same module design principle is used for the ICE versions in the range. Such a situation requires modular manufacturing that can be done across both ICE and EV lines, which is likely to positively influence the automotive sunroof market growth.

In a case of electric vehicles (EVs), the presence of a sunroof is beyond mere beautification as it significantly contributes to heat management, energy-saving, and the uniqueness of the design. The EVs are rapidly adopting the features of the panoramic, switchable glazing, or even a complete solar roof that aids in the reduction of the HVAC loads and extensibility of the mileage. Webasto unveiled its "Infinity Roof" on Mhindra's BE 6 and XEV 9e in March 2025, thus, incorporating an enormous panoramic glass panel with ambient lighting and switchable glazing. This is indicative of a larger pattern: suppliers are customizing the roof systems for EVs to offer the perfect union of style, utility, and eco-friendliness.

By vehicle type, Premium Cars dominate in terms of adoption and usage

The luxury automotive class substantially contributes to the automotive sunroof market revenue, attributed to the ongoing advancements such as sophisticated roof modules, like switchable and opacifying glass that adjusts to the sun and the atmosphere. Solarbay, the opacifying panoramic roof made transparent with PDLC (polymer dispersed liquid crystal) technology that darkens in nine electrically controlled segments, was jointly developed by Renault and Saint Gobain Sekurit and revealed in February 2024. The Tier-1 suppliers are progressively introducing such smart-glass roofs as a solution to combine luxury comfort with energy-efficient thermal management.

The rise of SUV has led to a soaring demand for advanced automotive sunroof market that merge space, energy efficiency, and design. The first trends to be named are giant transparent modules, modular panels, and even energy-generating roofs. At Auto Shanghai 2025, Webasto presented a new transparent, cross strut-free, openable roof module for EVs that was especially created to release the space under the battery for the floor. This step shows how roof-system suppliers are customizing their products to fulfill the structural and functional requirements of modern SUVs, particularly electric ones, that are different.

By end-use, passenger vehicle maintains noteworthy market interest

Automotive manufacturers in the passenger vehicle domain are progressively opting for panoramic as well as dual-pane sunroofs that augment the interior of the vehicle in terms of comfort, light, and aesthetics. The increasing usage of electric vehicles and hybrids is the main factor behind the rising demand for energy-efficient roof systems that can include features such as smart glass, ambient lighting, and ventilation. To meet the expectations of consumers for a luxurious experience and at the same time be in line with the ongoing trends in the automotive sunroof market and vehicle design, suppliers are coming up with innovative lightweight and eco-friendly roof modules.

Commercial vehicles such as buses and vans are going through a technological transformation in their roof systems which, in addition to the conventional ventilation, have the capability of sustainable power generation. Vidurglass, among others, is a company that offers photovoltaic sunroofs for commercial vehicles, by using tempered or laminated glazing which not only allows the generation of clean energy but also provides natural lighting. This innovation is a mirror of the increasing demand of fleet operators for environmentally-friendly, energy-efficient roof modules that are supportive of both the comfort and green operations.

By region, Asia Pacific is experiencing notable demand

With the Asia-Pacific region leading the way in rapid electric vehicle (EV) adoption and large-scale vehicle production, the area is becoming a major growth source for sunroofs. Local suppliers are ramping up production with cost-competitive roof modules, such as modular panoramic systems and lightweight glass, to meet the demand for passenger cars and SUVs. For instance, CIE Automotive is expanding their roof-systems plant (multi-panel sunroofs and shading) in Asia to benefit from both volume and technological innovation.

In Europe, the demand for spacious, practical, and premium electric SUVs is significantly contributing to the evolution of automotive sunroof market development. BYD's all-electric SEAL U, for instance, which was launched in February 2024, is a vehicle that focuses on comfort, openness of the cabin, and high-tech interiors, thus attracting family-oriented buyers who are looking for both utility and luxury. European OEMs and Tier 1 suppliers are therefore turning to the use of panoramic and dual-pane sunroofs to elevate the passenger experience as well as to a range of features like intelligent cockpits, ambient lighting, and advanced connectivity, thus mirroring the region's increasing emphasis on comfort, technology, and a premium feel in EVs.

Top automotive sunroof market players are massively investing in the research and development departments to come up with lighter, eco-friendly, and technically more advanced roof systems. One effect of improvement on Webasto Group and Yachiyo Industry Co., Ltd. is the focus on panoramic and electrochromic sunroofs for internal combustion engine (ICE) as well as electric vehicles, combining ambient lighting, smart glass, and better thermal insulation not only for passenger comfort but also for energy-saving.

Market players, next paragraph, are additionally engaging in collaboration strategies and expanding their territories to be able to serve the increasing demand worldwide better. A good example of the joint efforts between CIE Automotive S.A. and Automotive Sunroof-Customcraft (ASC) Inc. is the elevation of production capabilities and the supply of OEMs in Europe, North America, and the Asia Pacific region. These initiatives consist of modular sunroof platforms, dual-pane designs, and the seamless integration of autonomous driving sensors, thus maintaining high quality and giving a competitive edge in the automotive sunroof market.

Originated in 1901 and living it up in Stockdorf, Germany, the Webasto group is the global pace-setter when it comes to roof and heating systems in cars. Their specialty lies in the light and eco-friendly roofing systems for passenger cars and electric vehicles (EVs), be it panoramic, convertible, or sunroof systems.

Founded back in 1947 and situated in Tokyo, Japan, Yachiyo Industry Co., Ltd. is an innovative developer of high-quality automotive parts such as sunroof, seat, and safety systems. The company's sunroof is designed to be elegant, comfortable for the passenger, and electronically friendly with smart vehicles.

From the heart of Bilbao, Spain, and founding date 1996, CIE Automotive S.A. is a multinational supplier in the global automotive sunroof market that is very comprehensive regarding the components portfolio in the automotive industry. They are into production of car roof systems with the inclusion of panoramic and tilt-and-slide sunroofs, where they drop weight and focus on sustainability.

With its foundation in 1986 in Auburn Hills, Michigan, United States of America (USA), ASC Inc. is a leading company that is both a designer and a manufacturer of advanced sunroof and roof systems. The firm is a global leader in premium and mainstream vehicles offering fully integrated panoramic and modular roof solutions.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market include AISIN SEIKI Co., Ltd., among others.

Explore the latest trends shaping the Global Automotive Sunroof Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on global automotive sunroof market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 6.90% between 2026 and 2035.

Key strategies driving the market include product innovation in panoramic and smart-glass sunroofs, expansion of regional manufacturing capacities, collaborations between Tier-1 suppliers and OEMs, and integration of advanced technologies like electrochromic glass, ambient lighting, and ADAS-ready roof systems.

Increasing demand for passenger comfort and convenience and increase in demand for luxury automobiles are the key industry trends propelling the market's growth.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

By type, the market is divided into built-in, tilt and slide, pop-up, panoramic, top mount, removable, and solar type, among others.

Based on material type, the market is categorised into fabric and glass, among others.

By engine type, the market is bifurcated into internal combustion engine and electric powered.

The market is divided based on vehicle type into premium cars, sports utility vehicle, and hatchback, among others.

On the basis of end-use, the market is segmented into passenger vehicle and commercial vehicle, among others.

The key players in the market include Webasto Group, Yachiyo Industry Co., Ltd., CIE Automotive S.A., Automotive Sunroof-Customcraft (ASC) Inc., AISIN SEIKI Co., Ltd., and several other regional and global manufacturers.

In 2025, the global automotive sunroof market reached an approximate value of USD 12.91 Billion.

Major challenges that the automotive sunroof market face includes high production costs of advanced sunroof systems, technical complexity in integrating smart and multifunctional roofs, stringent safety and regulatory requirements, and slower adoption in cost-sensitive vehicle segments.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Material Type |

|

| Breakup by Engine Type |

|

| Breakup by Vehicle Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share