Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global aviation gasoline (avgas) market size reached a value of nearly USD 2.44 Billion in 2025. It is projected to grow at a CAGR of 4.30% between 2026 and 2035 to attain around USD 3.72 Billion by 2035.

Base Year

Historical Period

Forecast Period

The General Aviation Manufacturers Association (GAMA) reported an increase in sales of piston-engine aircraft from 1,503 in 2019 to 1,718 in 2022.

Royal Dutch Shell Plc, TotalEnergies, and Exxon Mobil Corporation are a few of the major companies in the market.

The demand for aviation gasoline will be driven by the increased need for small piston aircraft for various sporting activities, such as aerobatics, air racing, gliding, and other activities.

Compound Annual Growth Rate

4.3%

Value in USD Billion

2026-2035

*this image is indicative*

Aviation fuel, an exclusive type of fuel, is generally used to energise an aircraft. This fuel is petroleum-based and is of higher quality than the regular fuels used in rail transport and road transport, among others.

The increase in investment by governments, the introduction of new flight routes, increased fleet sizes, and high demand for gasoline from emerging economies are likely to augment the market growth. In 2022, the U.S. as a whole produced 4,051 thousand barrels of aviation gasoline, with specific quantities produced in the Midwest, Indiana-Illinois-Kentucky refining district, and the Minnesota-Wisconsin-North Dakota-South Dakota refining district.

Some of the factors driving the aviation gasoline (avgas) market growth are the growing demand for business aviation aircraft by a growing number of high-net-worth individuals and increasing interest in sustainable aviation fuels due to stricter environmental regulations regarding air quality and greenhouse gas emissions.

Increasing government investments in aircraft infrastructure; new flight routes; advances in engine technology; increased fleet sizes; and growing demand for sustainable aviation fuel support the aviation gasoline (avgas) market growth.

| Date | Company | Details |

| January 2024 | Shell plc | signed a long-term contract with Air Europa to provide AeroShell engine oils, greases, and fluids for the airline’s Boeing 737 and 787 Dreamliner aircraft. |

| October 2023 | Repsol | finalised an agreement to divest its oil and gas assets in Canada to Peyto for USD 468 million for production expansion. |

| June 2023 | Indian Oil Corp | announced plans to establish an 80,000 tonnes sustainable aviation fuel plant in Haryana in collaboration with LanzaJet. |

| December 2022 | TotalEnergies | Air France-KLM and TotalEnergies have entered into a Memorandum of Understanding (MoU), under which TotalEnergies will supply over one million cubic meters or 800,000 tonnes of Sustainable Aviation Fuel (SAF) to Air France-KLM Group airlines over a decade, starting in 2023. |

| Trends | Impact |

| Advancements in engine technology and fuel efficiency | Companies developing fuels with better performance characteristics, such as higher energy density or reduced emissions, aid the market growth. |

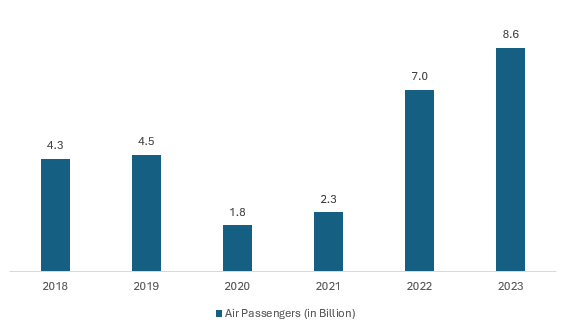

| Increasing air passengers | In December 2023, revenue passenger-kilometres (RPKs) across the aviation sector witnessed a year-over-year (YoY) growth of 25.3%. |

| Sustainable aviation fuel | There is a growing demand for environmentally friendly aviation gas as a result of stricter laws governing greenhouse gas emissions and air quality. |

| Investments in aviation infrastructure | Large-scale investments in big data and artificial intelligence (AI) can be considered as a promising means of boosting sustainability, efficiency, and safety of aircraft. |

| Growing demand for small aircrafts | The increased demand for business aviation aircraft by a growing number of high-net-worth individuals is likely to augment the global market growth. |

By 2036, the aviation sector is projected to contribute USD 1.5 trillion GDP to the world economy. Over 200,000 aircraft a day are anticipated to take off and land worldwide by the middle of the 2030s. Such factors are expected to boost the demand for aviation fuel.

Furthermore, in the forecast period, the demand for aviation gasoline is likely to be driven by the increased need for small-piston aircraft for various sporting activities, such as aerobatics, air racing, gliding, and other activities. Stricter emissions standards to reduce emissions of greenhouse gases and improve sustainability are anticipated to drive the development and adoption of cleaner fuel alternatives like unleaded avgas in the forecast period.

Figure: Total Number of Air Passengers Globally (in Billion), 2019-2025

Global Aviation Gasoline (Avgas) Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by End Use

Market Breakup by Region

By end use, the commercial sector is expected to dominate the aviation gasoline (avgas) market share in the coming years

The commercial sector accounts for the largest market share. The growth in the number of piston-engine aircraft, including new purchases and fleet expansions, drives the demand for avgas.

It can be anticipated that emerging markets like China will witness an exponential growth rate of approximately 145% in the Chinese fleet by 2041. This signifies a substantial increase in the demand for aircraft across various segments, including piston planes.

Aviation growth in established markets such as Europe and the USA is expected to grow by 79% & 42% respectively by 2041. Private aircraft are gaining popularity due to the trend of individuals opting for private planes for personal and recreational purposes rather than business travel. Notably, July 2021 recorded the highest number of private flights, totalling 12,345 flights. North America dominates the private aircraft market with around 60% market share.

Major players in the aviation gasoline (avgas) market are increasing their collaboration, partnership, and research and development activities to gain a competitive edge

| Company Name | Year Founded | Headquarters | Products/Services |

| Royal Dutch Shell Plc | 1907 | England | Offers fuel additive, aviation gas, shell water detector, civil jet fuel, military jet fuel, and others. |

| Indian Oil Corporation Limited | 1959 | India | Offers bulk industrial fuels, aviation fuel, AVGAS 100 LL etc. |

| Exxon Mobil Corporation | 1866 | USA | Offers synthetic base stocks such as Esterex™ esters, SpectraSyn Elite™ mPAO, SpectraSyn™ Hi Vis PAO etc. |

| TotalEnergies | 1924 | France | JET A-1, Avgas 100LL, Avgas UL91 and Sustainable Fuel Aviation (SAF) |

Other key players in the aviation gasoline (avgas) market include Phillips 66 COMPANY, and Repsol.

North America is anticipated to hold a dominant position in the aviation gasoline (avgas) market due to the presence of significant players in the region. The growth of the defence sector in the US and Canada, fuelled by increased government investments, has significantly contributed to the demand for small aircraft and helicopters in the defence sector in the region. In FY 2023, the U.S. government allocated USD 816.7 billion to the defence sector.

The Europe aviation gasoline (avgas) market is being driven by the growing demand for small piston aircraft due to the flourishing tourism sector. As more visitors from different countries flock to Europe for sightseeing and other leisure activities, there is a noticeable uptick in the number of small planes being used for such purposes. The European Union (EU) has proposed a mandate for the use of Sustainable Aviation Fuel to increase from 2% in 2025 to 63% in 2050. Such measures are likely to lead to significant developments in achieving sustainable aviation biofuels during the forecast period.

The Asia Pacific also holds a significant aviation gasoline (avgas) market share. The region, which includes China, India, and others is currently experiencing significant economic growth. This growth has led to a rise in air travel and tourism demand, which, in turn, has resulted in higher consumption of aviation gasoline. In 2022, the total number of air passengers reached 3.4 billion and the number is expected to increase significantly by 2035.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market value was nearly USD 2.44 Billion.

The market is projected to grow at a CAGR of 4.30% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach around USD 3.72 Billion by 2035.

The major drivers include increasing government investments, increased fleet sizes, and growing demand for small aircrafts.

The key trends include growing demand for sustainable aviation fuel, advancements in engine technology and fuel efficiency, and investments in aviation infrastructure.

Major end uses of aviation gas include private, commercial, and defence, among others.

The major players in the market include Royal Dutch Shell Plc, Indian Oil Corporation Limited, Exxon Mobil Corporation, TotalEnergies, Phillips 66 COMPANY, and Repsol.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share