Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global ball bearing market was valued at USD 43.65 Billion in 2025. The industry is expected to grow at a CAGR of 4.50% during the forecast period of 2026-2035. The market growth is mainly due to the increasing use of electric vehicles (EVs). Greater miniaturization of the components of electric motor, drive, and battery parts of EVs makes it necessary to operate under higher demands for efficiency and torque, resulting in agradual demand for high-performance and durable ball bearings. In turn, all these factors have resulted in the market attaining a valuation of USD 67.79 Billion by 2035.

Base Year

Historical Period

Forecast Period

The world wind capacity is expected to triple by 2030 as per the recet study published by International Renewable Energy Agency (IRENA), which signals an increased demand worldwide for reliable, high-performance bearings used in turbines. With the rise of renewable energy, ball bearing market companies can therefore capitalize on this trend by bringing out specialized bearing products designed for renewable energies applications, which are high on durability and energy efficiency enhancement.

The automotive sector remains a major consumer of ball bearings for the emergence of electric vehicle (EV). As per the reports of European Commission, EV sales have shown significant growth in the EU. Over 2 million electric cars in 2023. The shift to EVs, characterized by the highly efficient motors, drivetrains, and other car component set bearings, represents the largest market expansion opportunity for ball bearing manufacturers.

Growing investment on automation and robotics has been heavily made by Middle East and Africa (MEA) government in order to diversify their respective economies. Vision 2030 of Saudi Arabia is an example. An increase in demand for high-precision ball bearings is expected to be driven in advanced manufacturing and automation as these are highly accurate components employed in robotics, conveyors, and automated machinery. Therefore, companies in the ball bearing market can target opportunities by producing specialized products, boosting the global ball bearing market growth.

Compound Annual Growth Rate

4.5%

Value in USD Billion

2026-2035

*this image is indicative*

The global bearing market is greatly influenced by the manufacturing and industrial domains including automotive, aerospace, industrial machinery, and renewable energies. A ball bearing, also recognized as an anti-friction part, is a type of rolling-element that has two ring-like tracks with small, freely rotating metal balls between them. Such metal balls provide smooth and low friction by carrying both axial and radial loads. Ball bearings are easy to maintain and, thus, are reliable in service due to their simple nature. Hence, the demand for clean, high-performance, and durable bearings that can withstand extreme conditions and improve operational efficiency leads to an expanding bearing market.

The growing electric vehicle adoption in the global automotive industry for bespoke EV-dedicated bearings tailored for engines, drivetrains, and battery systems are mainly contributing to the ball bearing market growth. Moreover, the aircraft sector uses advanced ball bearings for engines, landing gears, and many other critical systems, which demand precision and reliability. Furthermore, the fast growth of industrial automation and robotics has raised the need for sophisticated bearings in machinery, conveyors, and whole implementations. Technological developments in bearing materials and production processes-particularly recent advances like those in ceramics and hybrid bearings also are expected to augment the ball bearing market revenue. Further, the rapid industrialization and infrastructure development process in emerging economies has resulted in a high demand for ball bearings.

The global ball bearing market is anticipated to grow by large strides mainly due to rapid technological improvements in automotive development, with its electric vehicle (EV) population continually expanding. The electric vehicle uses bearers uniquely designed for the motor, the drivetrain, and the battery systems, where these bearings are required to ensure high performance and efficiency standards. As nations strive to achieve better public transport for reduced emissions, the EV demand and eventually advanced ball bearings solely made for electric vehicle traction drives and other vehicle-related components are bound to increase.

Another key niche driving the ball bearing market growth also falls under the advanced industrial automation and robotic industries. Development in manufacturing at both large and small scale coming from the industry 4.0 technologies require ensured precision. Ball bearings have caused a decrease in friction in these automatic systems and increased speeds and precision to the system. Besides, industries are joining the bandwagon to automate production processing lines for higher productivity and reduced labour costs. Such trends will lead to a growing demand for highly technical bearings in robotics that are mounted on automatically rolling equipment.

The key trends in the global ball bearing market include technological advancements in bearing materials, increasing demand for automation and smart manufacturing, sustainability and green technologies, customization and demand for specialized bearings.

Ceramic and hybrid bearings are the notable materials that the current ball bearing market is focusing on. These are better by comparison to the steel bearings. These materials can be considered best as they are durable; are wear-resistant and with higher efficiencies. Industries requesting bearings for tougher conditions like extreme temperatures and heavy load pressures are thus seeing the continuous growth of the demand for these new-performance enhancements.

The rising trend of automation and smart manufacturing is positively impacting the ball bearing market growth. Industries have increasingly embarked on industrial revolution technologies like automation and Industry 4.0. Manufacturers are increasingly innovating and creating more dependable, high-performance bearings that can adequately improve the efficiency of automated systems for quicker production speeds, less downtime, and higher precision.

Sustainability is the buzzing trend that is influencing the ball bearing market dynamics. environmentally sustainable products are becoming the focus, and ball bearings are not exceptional to this trend. Companies offering environmentally friendly and energy-efficient bearings during production with zero wastage are expected to reap considerable profit margins. Their product focus lies mostly on the carbon footprint that is most emphasized in industries, such as automotive and renewable energy, for which the need for such lightweight and resilient bearings is gaining more market space. The increasing development of greener technology such as electric-vehicle and wind-turbine technology is one such example.

The ball bearing market is gradually shifting toward producing personalized and purpose-specific bearings that cater to the aerospace, automotive, and related industries. These sectors demand bearings that precisely fit their purposes, allowing the supplier companies to deliver solutions with customized features. High performance and resilient bearings are getting designed to fulfill the various conditions of use in a particular environmental condition. In addition, endurance, load, and speed are some of the characteristics of bespoke products are growing in demand in specific fields like medical equipment, robotics, and advanced machinery, which require specialized bearings.

The global market for ball bearings is predicted to open up huge growth opportunities with escalating demand of highly efficient renewable energy, especially in water or wind. As the market sees a rapid shift towards sustainable energy sources, the need for high-quality bearings in wind turbines is growing. Bearings play a vital role in the proper operation of turbine blades and motors. Manufacturers who specifically cater to wind energy applications through their unyielding and high-performance bearing products can explore this segment with ball bearing solutions that can improve the life and credibility of turbines and align with the growing adoption of green energy.

The ball bearing market further experiences growth opportunities in the aerospace and defense sectors. Expanding growth in the air travel business and in defense technologies offers more use of precise, high-performance bearings in engines, landing gear, and other critical systems in aircraft. Aerospace being an industry that calls for bearings performing at limits during temperature, pressure, and speed can open up new possibilities for growth. Companies manufacturing lightweight, high-efficiency bearings for these purposes are in good position to meet the demand in the growing world of commercial and defense-related aviation.

The market for ball bearings is driven by the rapid advancements of automation and robotics in industrial applications. Increase of the automation in these industries leads to efficiency in production as well as decreases in the operational costs. Industries using robotics for manufacturing processes, need bearings fitting in for high precision in their robotic arms, conveyors, and automated devices that would operate with less friction. As automation continues to expand into manufacturing and logistics companies, the demand for these products expands the robot's competencies in automated equipment.

The concept of renewable energy power sources has resulted in significant growth in the ball bearing market, mainly fueled by the wind power industry. The high-quality bearing must be in place before the wind turbines can produce any energy, and rigorous conditions make this necessary. With investments being realized in renewable energy infrastructure by the world governments and companies fighting against global warming, the number of bearings required in such specializations have been continuously increasing in demand. This simply means that manufacturers, who can substitute with extremely strong and advanced bearings that undergo constant higher loads and very harsh conditions, are able to prosper from this new consumer segment growth.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Ball Bearing Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

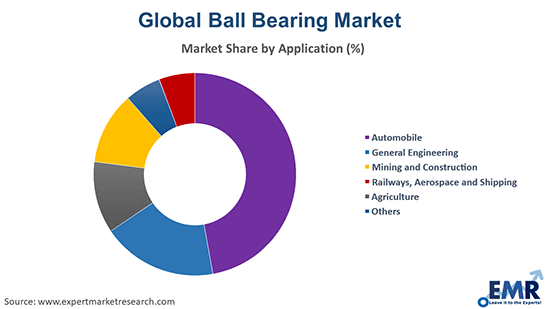

Market Breakup by Application

Market Breakup by Region

Market Insights by Application

Different applications across various sectors have collectively driven the ball bearing market growth. For example, in the automotive sector, electric vehicles (EVs), and advanced automobile systems require high-performance bearings. The same is the situation with respect to general engineering, where machines and instruments require durable bearings for smooth operation. The energy sector deals with the requirements of heavy construction equipment, thereby resulting in demand for strong ball bearings. Railways adapt ball bearings for the smooth and secure functioning of trains. Aerospace requires light, high-precision bearings for engine and avionics use. Shipping delivers much needed corrosion-free bearings for marine equipment, while agriculture places large and heavy demands on bearings ideally in agricultural machinery like farm tractors, thus improving the overall productivity.

North America Ball Bearing Market Opportunities

The North America ball bearing market brings many significant opportunities because of the growth in electric vehicles including industrial automation and renewable energy which further goes on to generate increased demand for specialized bearings in electric motors, drivetrains, and battery systems. It has largely been the growth of automation and smart manufacturing industries like automotive and robotics that have driven the call for high-performance ball bearings. The wind power that is responsible for mostly renewable energies is also contributing and extending the growth of the market, by demanding long-lasting and efficient bearings in turbines. These trends hold a strong demand for innovative, sustainable bearing solutions across many sectors in North America.

Europe Ball Bearing Market Trends

The Europe ball bearing market can be characterized by several trends, such as the current growing demand for high-performance bearings via electric vehicles (EVs), renewable energy, and automation. Nowadays, electricity certainly generates special demands for bearings in electric motors and drivetrains. Moreover, with the industrial automation process, including increased investments in current industrial robotics, optimal and powerful ball bearings are necessary for most manufacturing processes. Renewables, particularly wind energy, are also essential elements because the turbines must have high-quality bearings in order to operate optimally. These changes will lead to innovation in the market and extend it across diverse industrial sectors across Europe.

Asia Pacific Ball Bearing Market Outlook

The Asia Pacific is the major market for ball bearings, accounting for the largest ball bearing market share. Significant nations, including China, India, Japan, Korea, Taiwan, and Indonesia, are adding to the expansion of the Asia Pacific market for ball bearings. End-user segments in the region that rely heavily on ball bearings are experiencing growth due to factors like the existence of favourable government policies, growing disposable incomes, rapid urbanization, as well as the rising living standards. This, in effect, will drive the growth of the industry in this region. In addition, growing investment in end-user sectors would also improve the growth prospects of the Asia Pacific industry.

Latin America Ball Bearing Market Dynamics

A growing vehicle industry, industrial activity, and also the development of energy sites has been among the reasons for the growth of the Latin America ball bearing market. Automobile industries are gradually moving towards electric vehicles (EVs), the specific bearings are highly desired for EV motors and drive train applications. Also, due to higher industrial automation and infrastructure developments, there is a burgeoning demand for precision bearings as well. Alongside wind and solar power, however, the process for increased use of renewable energy in the region leads to the massive increase in GDP which, in turn, has resulted in ahigh demand for bearings of the highest quality for increased robustness and yielding high levels.

Middle East and Africa Ball Bearing Market Growth

The Middle East and Africa ball bearing market growth has been driven by automobile, oil and gas, construction, and renewable energy. Increased automotive industry production, particularly in terms of electric vehicles that align well with the increasing trend of greener technology requires specialized bearings. Similarly, the construction and infrastructure projects further expand the sphere of the market. Further, installations in the wind power sector, bearings are even more powerfully demanded in huge quantities for longevity in turbines.

NTN, Timken, Schaeffler, and Jtekt are among the main ball bearing market players that are focusing on the product quality, innovation, and great customer service by offering an extensive list of bearings for different market segments. Small-scale ball bearing companies are increasingly specializing their products to cater to different industries including automotive, aerospace, and industrial applications, driving new technological advancements and market expansion.

NTN Bearing Inc., founded in 1918, is dedicated to producing high-quality bearing products that are specially designed to cater automotive, industrial, and aerospace applications. Amongst its array of products are ball bearings, roller bearings, and custom solutions.

Established in 1899, in the United States, The Timken Company specializes in power transmission systems and bearings. The company produces extreme-performance, durable bearings for industries like automotive, aerospace, and energy and emphasizes on innovative designs and customer support.

Founded in 1946, Schaeffler Group is known for designing and innovatively manufacturing high-end ball bearings for automotive, industrial, and aerospace applications. The company offers highly effective energy-saving and long-lasting bearing solutions for this diversity of applications worldwide.

Jtekt Corporati, created in 2006, has gained recognition for advanced bearing solutions to automotive, industrial, and precision equipment markets. The high-productivity firm draws much attention from industrial innovators and creators of the highest quality solutions designed for optimal performance-custom ball bearings, roller bearings, and precision components.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the ball bearing market report are SKF, among others.

Emerging startups in the ball bearing market aim to improve performance by using advanced materials, such as ceramics and carbon fiber, and integrating intelligent technologies to predict maintenance. These ventures would instigate energy-saving, as well as durable and long-lasting, new customized bearing solutions for important sectors such as renewable energy, electric vehicles, and industrial automation.

Shenzhen Inovance Technology is an emerging startup based in China. The company is involved in producing innovative bearing solutions and makes an attempt for the modern applications in industrial automation, robotics and electric vehicles by proposing increased efficiency and less power consumption.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the ball bearing market reached an approximate value of USD 43.65 Billion.

The market is projected to grow at a CAGR of 4.50% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 67.79 Billion by 2035.

The major drivers of the market are growing use of ceramic balls in applications requiring high-grade electrical insulation, rising disposable incomes, rapid urbanisation, growing living standards, and increasing investments in rail and aerospace industries.

The increasing generation of wind power, favourable policies by various governments, and the growing electrification of vehicles are expected to be key trends guiding the growth of the market.

The major regions in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

Various applications of ball bearings in the market are automobile, general engineering, mining and construction, railways, aerospace, and shipping, and agriculture, among others.

The key players in the global ball bearing market are NTN Bearing Corporation, The Timken Company, Schaeffler Group, Jtekt Corporation, and SKF, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share