Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global barium titanate market size was valued at USD 1.89 Billion in 2025. The industry is expected to grow at a CAGR of 5.50% during the forecast period of 2026-2035 to reach a value of USD 3.23 Billion by 2035. The market is witnessing significant growth driven by strategic joint ventures and co-development collaborations between leading material suppliers and electronic component manufacturers.

Rising demand for multilayer ceramic capacitors in compact electronics, as well as the increased use of piezoelectric ceramics in precision sensing applications, are driving the global barium titanate market. Additionally, advancements in high-purity barium titanate (BaTiO₃) formulations and electronic component downsizing are allowing for greater integration across automotive, medical, and industrial systems.

Several partnerships focusing on securing consistent raw material supply, increasing production capacity, and improving product quality are critical for meeting the rising demand for high-performance applications such as multilayer ceramic capacitors (MLCCs), sensors, automotive electronics, and new photonic devices. Companies in the barium titanate market landscape that share information and resources can accelerate their research and development efforts, bring to market high-purity BaTiO powders with excellent dielectric characteristics, and ensure supply chains are stable enough to service global end markets. Besides that, such collaborations make it possible to introduce new formulations faster, especially for lead-free and environmentally friendly applications, thus facilitating the continued competitiveness of BaTiO as a principal functional ceramic material. For instance, in September 2023, MF Material Co., Ltd. established a joint venture between Murata Manufacturing, Ishihara Sangyo Kaisha, and Fuji Titanium Industry. The joint venture aims to improve product quality as well as boost output through the construction of a new factory. This is a perfect example of how partnerships at various levels strategically boost the barium titanate market development.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5.5%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Barium Titanate Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 1.89 |

| Market Size 2035 | USD Billion | 3.23 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 5.50% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 6.7% |

| CAGR 2026-2035 - Market by Country | India | 6.9% |

| CAGR 2026-2035 - Market by Country | Saudi Arabia | 6.6% |

| CAGR 2026-2035 - Market by Application | Capacitors | 6.8% |

| Market Share by Country 2025 | India | 3.9% |

Due to the increased awareness regarding environmental issues, the demand for lead-free BaTiO piezoceramics in the electronics and medical device fields has significantly increased. These technologies allow the industries to comply with the regulations on sustainability while still maintaining an excellent level of performance of sensors and actuators, thereby fueling growth in the barium titanate market. For instance, CeramTec GmbH in February 2025 introduced a proprietary bismuth sodium titanate barium titanate (BNT BT) piezoceramic, intended mainly for high performance in ultrasonic and medical applications. This example of a product shows how changes in BaTiO technology are paving the way for safer, sustainable, environmentally friendly substitutes that are even capable of meeting the challenge from environmental regulations worldwide.

Trade fairs and industry exhibitions play a crucial role in spreading awareness and increasing the usage of BaTiO-based materials in the field of high-end electronics. To cite an instance, CeramTec GmbH took the opportunity to display its lead, free BNT BT piezoceramics in October 2024 at the Electronica trade fair in Munich, where the company highlighted its suitability for ultrasonic and industrial sensors. Such events provide a platform for companies to showcase their products in real-life situations, obtain feedback from the industry, and establish BaTiO potential beyond the traditional capacitor markets, hence contributing to the barium titanate market growth.

Environmental regulations together with sustainability goals are speeding up the transition towards lead-free piezoelectric materials, thus boosting the demand in the barium titanate industry for applications in automotive, industrial, and consumer electronics applications. Companies like CeramTec, PI Ceramic, and TDK are broadening their lead, free ceramic lines in order to facilitate production of sensors, actuators, and vibration control systems. In order to meet RoHS and REACH regulations and provide the same level of performance as conventional leaded materials, these producers are refining their BaTiO-based compositions. The changeover to lead-free materials is thus persuading OEMs to re-engineer their components based on BaTiO, which, in turn, is strengthening the material's role in next-gen piezoelectric systems.

BaTiO's superior dielectric and piezoelectric qualities lead to its increased use in ultrasonic devices and precision sensors. In recent years, it has been seen that material suppliers, including Kyocera, CeramTec, and Murata Manufacturing, have expanded their assistance to include industrial automation, flow measurement, proximity sensing, and medical imaging. These firms have been adjusting ceramic formulations for increased sensitivity and thermal stability to allow a wider range of applications beyond just MLCCs. Given that smart factories, healthcare diagnostics, and automotive safety systems are being globally scaled up, the use of BaTiO in high-end sensing applications continues to grow, thus gradually becoming a major factor in the overall barium titanate market expansion.

Changes in the levels of key BaTiO precursors, especially barium carbonate and titanium dioxide, are influencing buying and manufacturing strategies of the entire barium titanate market value chain. Sakai Chemical, Nippon Chemical Industrial, and Solvay, as the leading producers, are increasing upstream integration and developing long-term sourcing agreements, with the primary goal of ensuring stable input costs and a continuous supply of high-quality resources. Meanwhile, ceramic makers are expanding their supplier networks and channeling funds to improve process efficiency to cope with market fluctuations. These supply-side measures allow for steady BaTiO production. Thus, companies can also leverage these opportunities in the barium titanate industry to satisfy the increasing demands of the electronics and energy sectors.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Barium Titanate Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

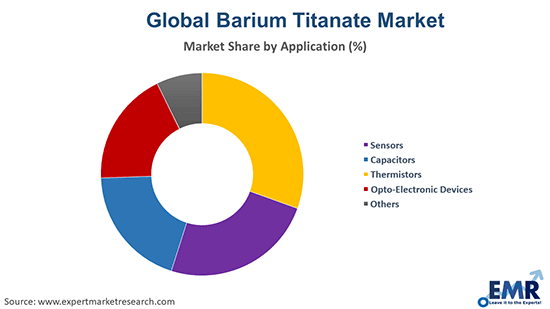

Market Breakup by Application

Key Insights: In terms of application, the barium titanate market scope comprises sensors, capacitors, thermistors, optoelectronic devices, and a few other areas, such as actuators and piezoelectric components. Capacitors continue to lead because of BaTiO's extraordinarily high dielectric constant, which lends support to MLCCs used in consumer electronics, automotive systems, and telecom equipment. In addition, sensors as well as thermistors make use of piezoelectric and temperature-sensitive properties of BaTiO, which are applied respectively in industrial automation and automotive platforms. Leading material suppliers are progressing nanoscale powders and customized compositions to elevate performance in all application sectors, thus backing up the market demand expansion.

Market Breakup by Region

Key Insights: Regionally, the global barium titanate market landscape includes Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa, which are the main regions with different growth patterns. Asia Pacific is at the forefront because of strong electronic and automotive manufacturing, while North America has an advantage from innovation ecosystems and semiconductor demand. Europe's growth is related to the increase in EVs and the incorporation of sensors in automotive systems. Meanwhile, Latin America and the Middle East & Africa are showing new interest through infrastructure investments and industrial automation, and together they are broadening the global footprint of BaTiO technologies.

| CAGR 2026-2035 - Market by | Region |

| Asia Pacific | 6.7% |

| Europe | 5.4% |

| North America | XX% |

| Latin America | XX% |

| Middle East and Africa | XX% |

By applications, sensors show robust growth owing to precision and miniaturization demands

Barium titanate-based sensors amass notable revenue in the barium titanate market due to their piezoelectric capabilities, which allow for high-precision measurements in industrial automation, automotive safety systems, and medical devices. Murata Manufacturing, CeramTec, and TDK are creating specialized BaTiO₃ formulations to improve sensitivity and thermal stability. Adoption is being driven by the growing demand for smart factories and self-driving cars. Increasing research and development investments for miniaturized and high-performance sensor components are boosting the industry, as companies work with OEMs to expand application-specific designs.

| CAGR 2026-2035 - Market by | Application |

| Capacitors | 6.8% |

| Sensors | 6.4% |

| Thermistors | XX% |

| Opto-Electronic Devices | XX% |

| Others | XX% |

Opto-electronic devices are gaining notable traction in the global barium titanate market as BaTiO₃ is increasingly utilized in photodetectors, light modulators, and advanced display systems due to its high electro-optic and dielectric properties. Companies are expanding technological capabilities to meet growing demand for precision optical components. For instance, the merger of Radiant Vision Systems with Konica Minolta Sensing Americas, effective April 2026, creates a broader portfolio for imaging and display measurement solutions, supporting the development of next-generation photonics and display devices, and indirectly driving the adoption of BaTiO₃-based materials in these high-performance applications.

By region, North America leads the market growth, fueled by electronics innovation and EV adoption

Electronics innovation, semiconductor manufacturing, and EV adoption are the three main sectors propelling growth in the North America barium titanate market. TDK, Murata, and Ferro are some of the companies that focus on high-purity BaTiO powders and lead-free piezo materials that are used for capacitors, sensors, and thermistors. The automotive and industrial automation sectors are projected to be the primary buyers for these items. To that purpose, new factories are being developed, partnerships are being forged, and line extensions are being implemented throughout the United States and Canada. The region also benefits from superior industrial infrastructure and strong research and development networks, which facilitate materials development and local production.

The barium titanate market observes significant growth in the Asia Pacific, largely controlled by the electronics manufacturing hubs in China, Japan, and South Korea. The main players in the region, such as Murata and Taiyo Yuden, are ramping up measures to increase the production of MLCCs, sensors, and lead-free piezoceramics. Investments in research and development and production technology are largely motivated by the rapid growth in the markets of smartphones, EVs, industrial automation, and consumer electronics. On top of that, regional governments are also implementing policies that support the development of advanced materials, which, in turn, is giving the market a further boost.

| CAGR 2026-2035 - Market by | Country |

| India | 6.9% |

| Saudi Arabia | 6.6% |

| China | 6.5% |

| UK | 6.2% |

| Mexico | 5.9% |

| USA | XX% |

| Canada | 5.7% |

| France | XX% |

| Italy | XX% |

| Japan | XX% |

| Australia | XX% |

| Brazil | XX% |

| Germany | 5.2% |

Major barium titanate market players are trying to strengthen their positions by capacity expansions, process optimization, and investments in the production of high-purity and nano-grade barium titanate. Manufacturers are changing their synthesis methods to improve particle size control and dielectric performance, while also increasing quality assurance to meet the stringent electronics standards. The strategic sourcing of raw materials and vertical integration are some of the ways that stabilize supply chains and support consistent output.

At the same time, barium titanate companies are focusing their efforts on product-driven innovation by partnering with electronics OEMs and research institutions for the development of customized BaTiO formulations. They are broadening the product range while emphasizing features such as thermal stability, energy efficiency, and lead-free compatibility for capacitors, sensors, and actuators. Also, companies are consolidating their regional presence and technical support services in the barium titanate market to meet the local demand, and, therefore, making it easier for electronics to be adopted in the developing markets.

KCM Corporation is a manufacturer of specialty materials that was established in the early 1970s. Its main office is in South Korea. The company promotes its product portfolio and manufacturing facilities globally to the electronics, coatings, and advanced ceramics industries.

Ferro Corporation, established in 1919, with its headquarters in Mayfield Heights, Ohio, is a worldwide supplier of performance materials and specialty chemicals. It markets its product portfolio and manufacturing facilities worldwide to the electronics, coatings, and advanced ceramics sectors, and has emerged as a prominent name in the global barium titanate market.

Fuji Titanium Industry Co., Ltd. was established in 1952 and is headquartered in Tokyo, Japan. They supply a wide range of titanium-based chemicals and materials that find applications in advanced ceramics, electronics, and industrial fields.

Nippon Chemical Industrial Co., Ltd. is a traditional manufacturer of inorganic chemicals and advanced materials located in Tokyo, Japan. Established in 1918, its product range supports electronics, ceramics, and other high-tech areas via the provision of high-purity chemical solutions.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market include Shandong Sinocera Functional Material Co., Ltd, among others.

Explore the latest trends shaping the Global Barium Titanate Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on global barium titanate market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 5.50% between 2026 and 2035.

Key strategies driving the market include capacity expansions for high-purity BaTiO₃, development of nano-grade and lead-free formulations, strategic partnerships with electronics OEMs, vertical integration of raw material sourcing, and application-specific product customization to support MLCCs, sensors, and advanced ceramic components.

The key trend guiding the growth of the market includes the growing adoption of the product as an environmentally friendly and lead-free substitute in electronic devices.

The major regions in the barium titanate market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The major applications of barium titanate are sensors, capacitors, thermistors, and opto-electronic devices, among others.

The key players in the market include KCM Corporation, Ferro Corporation, Fuji Titanium Industry Co., Ltd., Nippon Chemical Industrial CO., LTD., and Shandong Sinocera Functional Material Co., Ltd, among others.

In 2025, the global barium titanate market reached an approximate value of USD 1.89 Billion.

The major challenges that market players face include volatility in raw material prices, maintaining consistent material purity at scale, meeting stringent quality standards for miniaturized electronics, managing supply chain disruptions, and balancing rising production costs with competitive pricing pressures.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share