Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global bilberry extract market attained a value of USD 486.58 Million in 2025 and is projected to expand at a CAGR of 6.89% through 2035. The market is further expected to achieve USD 947.38 Million by 2035. Rising prescription nutraceutical adoption is pushing bilberry extract suppliers toward pharmaceutical-grade standardization, enabling long-term B2B contracts with healthcare brands and clinical nutrition companies.

Supplement brands in the United States are reformulating their vision care products with higher anthocyanin concentrations to use this as a reason for charging higher prices. Secondly, the manufacturers who make the products under contracts want fewer, standardized botanicals so that it is easier for them to meet the regulations, thereby shaping up the bilberry extract market dynamics. This gives an advantage to suppliers who provide tested extracts whose effectiveness is proven. These two motivators together make both volume and pricing more predictable in the market.

Demand in the bilberry extract market is gradually surging, particularly from EU-based supplement manufacturers, due to clinical support for anthocyanins in retinal microcirculation. In November 2023, Indena S.p.A. expanded its bilberry extract portfolio with Mirtoselect and Enovita that use circular-economy design to upcycle waste, cut environmental impact, and support sustainability and human health across their supply chains. This initiative shows a trend towards pharma-grade positioning rather than mass-market supplements. Suppliers are emphasizing traceability, batch consistency, and clinical evidence to maintain long-term B2B supply contracts.

The bilberry extract market is slowly changing from a commodity botanical sourcing approach to value-added ingredient systems. Manufacturers devote resources to controlled extraction processes, solvent optimization, and standardized potency levels to align with the increasingly stringent regulatory requirements. In the United States, dietary supplement purchasers are demanding the provision of stability data and health claims that are scientifically validated, especially for eye health products. For example, Maypro Industries offers its proprietary and branded ingredients portfolio, Bilberon, tailored for eye health. Such a structural improvement is drawing pharmaceutical and medical nutrition brands that are in search of compliant, science-based ingredients.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6.89%

Value in USD Million

2026-2035

*this image is indicative*

Bilberry extract suppliers are gradually adjusting their practice to meet pharmaceutical manufacturing standards. These include extraction techniques that are validated, impurity profiling, and clinical documentation. dsm-firmenich and Indena's new strategic partnership, announced in January 2024, inaugurated a new 'Age of Nature' with botanical ingredients solutions that meet human health needs. Regulators in the United States and European Union are progressively increasing their scrutiny on botanical claims, which indirectly benefits compliant suppliers. This trend in the bilberry extract market not only increases the difficulty level to enter the market but also allows established players to focus on regulated health categories to have better pricing power.

Northern European governments are mobilizing local wild berry harvesting as one of the strategies for strengthening their regional bio-economies. The Ministry of Agriculture, Food and Forestry of Finland has increased the financial support for the sustainable bilberry picking programs since February 2025, thus, helping to better predict the harvest yield of the future. These programs go a long way in helping the extract makers directly as they ensure constant availability of the raw materials, redefining the bilberry extract market dynamics. Companies that purchase their raw materials from government-supported regions have noticed lower seasonal fluctuations and better traceability.

Rather than making broad antioxidant claims, product development is progressively centering on health outcomes that can be targeted. Owing to its vascular support properties, bilberry extract is becoming a popular ingredient in diabetic nutrition. Brands are offering eye-health combinations with standardized bilberry extracts. The demand for such application-oriented products is prompting suppliers to adjust the levels of potency as well as the compatibility of the formulations, accelerating the bilberry extract market value. In December 2025, Dr. Raymund Garza, optometrist, announced the official launch and availability of Jubileye Health Dry Eye & Glare Defense, a premium, clean-label supplement designed to support eye comfort and visual clarity.

Top producers of bilberry extracts are implementing vertical integration to have a better control of their cost structures and quality. They are making capital investments in the areas of raw berry sourcing, in-house extraction, and downstream formulation support. This strategy not only lessens the reliance on third-party processors but also results in better batch consistency. B2B purchasers are paying more attention to suppliers that have the whole process under their control, boosting growth in the bilberry extract market. For example, 3DX-Bilberry from Asiros is a bilberry extract verified by U-HPLC-qTOF fingerprint, processed by advanced extraction technology.

Contract manufacturing consolidation is one of the main reasons for changing buyers' preferences in nutraceuticals procurement. For example, Seppic’s fermented wild bilberry extract SEPITONE aligns with rising “inside-out beauty,” boosting skin radiance and complexion in clinically backed nutricosmetics. Producers of bilberry extracts who have both the scale and the compliance credentials are securing long-term contracts. The FDA's botanical consistency guidance has been one of the key factors that have supported this move. The trend not only cuts down on fragmentation but also increases the dependence of the supplier-buyer relationship, thus creating quite stable bilberry extract market opportunities.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Bilberry Extract Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Source

Key Insight: Conventional bilberry extract is the natural choice for high-volume buyers looking for scale, consistency, and pricing discipline. Organic extract caters to the needs of brands that are focused on traceability, certification, and premium pricing. Both segments facilitate different commercial strategies, boosting the bilberry extract market penetration. In July 2024, Fruit d’Or revealed new organic and conventional wild blueberry whole-fruit powders, rich in antioxidants, for supplements, foods, and beverages. Manufacturers, on the one hand, have to balance their portfolios in such a way as to secure their margins and at the same time, cater to the buying community.

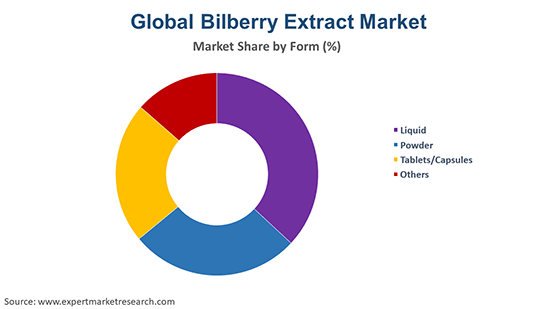

Market Breakup by Form

Key Insight: Form-based segmentation as considered in the bilberry extract market report, reflects manufacturing priorities. Powder extract supports scale, stability, and cost control. Liquid extract addresses performance-driven applications requiring rapid absorption. Tablets and capsules depend heavily on powder inputs, while other forms serve niche applications. Buyers select formats based on processing efficiency, storage, and delivery needs. Suppliers maintain multiple formats to serve diversified end uses. This balance allows flexibility while protecting operational efficiency across the market.

Market Breakup by Sales Channel

Key Insight: Indirect sales support flexibility and market reach. Direct sales enable control, collaboration, and margin optimization. Small-scale buyers remain distributor-dependent. On the other hand, large-scale buyers increasingly prefer direct sales channels. Suppliers balance both channels to protect volumes while building strategic accounts. This dual-channel structure defines commercial strategy across the bilberry extract market.

Market Breakup by End Use

Key Insight: The end-use segment can be considered an extension of the different risk tolerance and compliance levels that occur in these applications. Dietary supplements provide the base volume for the bilberry extract market, while pharmaceutical products, despite being a smaller segment, have higher value and higher quality requirements. Food and cosmetic applications follow their growth trajectory on a variable scale whereby the formulation matches particular segments.

Market Breakup by Region

Key Insight: Regional dynamics mirrors the supply and demand balance situation. Europe acts as the source of supply and expertise. Consumption growth is mainly driven by Asia Pacific. In November 2025, Lush, the British beauty brand, made a comeback in India by a licensing partnership with Bilberry Brands, a company based in Bengaluru, starting their debut online with the plans of stores in big cities. North America has a strong focus on compliance while Latin America and Middle East continue to be regions that present lucrative opportunities offering scalability.. This is one of the ways how the bilberry extract market expansion strategies are being shaped by regional companies in the market.

By source, conventional bilberry extract holds the largest share of the market due to stable yields

Traditional bilberry extract continues to be the main contributor to sourcing volumes because of predictable supply and scalable harvesting models. Large-scale extract manufacturers account for controlled wild berry collection combined with contract farming to secure year-round processing capacity. This segment is lower in raw material volatility, which is helpful for B2B buyers who manage multi-market formulations. Conventional sourcing enables suppliers to meet tight delivery schedules of pharmaceutical and dietary supplement manufacturers. Cost stability also allows for long-term pricing agreements.

Organic bilberry extract is rapidly growing its share in the bilberry extract market as buyers want traceable, certificate-backed inputs. This segment draws premium nutraceutical and clean-label brands that position their products at higher margins. Organic sourcing is in line with increasingly stringent internal procurement policies of United States and European supplement companies. In May 2025, Eevia introduced FENO-ARONIA 50 Organic at Vitafoods 2025, a potent, excipient-free aronia extract with high anthocyanin content for premium formulations. Buyers are progressively demanding transparency at the supplier level about harvesting practices.

Powder form secures the largest share of the market due to formulation flexibility and logistics efficiency

Powdered bilberry extract drives major demand in the bilberry extract industry due to handling efficiency and formulation versatility. Contract manufacturers prefer powders for capsules, tablets, and dry blends. Powder form offers longer shelf stability and easier dosage standardization. It reduces transportation costs compared to liquid formats. Buyers value compatibility with automated filling systems. This form also supports private-label scalability. Suppliers can standardize potency across large batches with fewer losses. Powdered bilberry extract remains central to bulk procurement strategies.

Liquid bilberry extract is gaining traction due to formulation efficiency in functional beverages and clinical nutrition products. Liquid formats enable faster absorption, which supports efficacy-driven positioning. B2B buyers developing ready-to-drink products prefer liquids for reduced processing steps. Liquid extracts also allow precise blending in customized formulations. This segment benefits from growing interest in liquid nutrition formats. Suppliers are investing in stabilized liquid concentrates to address shelf-life concerns. In July 2025, McCormick launched a bright, ripened blueberry extract for baking, beverages, and desserts, enhancing year-round flavor versatility and culinary creativity.

Indirect sales continue to dominate the market due to distributor reach and procurement aggregation

Indirect sales remain dominant across the bilberry extract industry dynamics as distributors consolidate demand across multiple buyers. This channel simplifies access to regional markets for extract producers. Distributors manage logistics, compliance documentation, and local relationships. B2B buyers prefer indirect sourcing for smaller volumes and flexible ordering. Indirect sales also support faster market entry without direct infrastructure investment. Suppliers benefit from volume pooling and reduced administrative burden. This channel remains critical for mid-sized buyers as it supports steady output without long negotiation cycles.

Direct selling is rapidly expanding its bilberry extract market revenue share as buyers want to be more closely integrated with their suppliers. Pharma and food companies are turning towards direct agreements in order to have better quality control. In September 2023, Circe Scientific applied crystal engineering to fuse a blueberry anti-aging molecule with tryptophan, improving bioavailability for skin and oral health applications. Direct dealings make it possible to co-develop and tailor specifications. Suppliers get a clearer picture of their margins and become more accurate at forecasting. This distribution method is aligned with volume commitments that are made for the long term.

Dietary supplements register the largest market share due to repeat demand and standardized formulations

Dietary supplements remain the largest end-use segment for bilberry extract. This category benefits from consistent demand across eye health and general wellness products. Manufacturers rely on standardized extracts for repeat formulations. Volume stability supports long production runs. Supplement brands prioritize ingredient consistency to maintain label claims. This segment also allows faster product refresh cycles. Suppliers benefit from predictable ordering patterns. Dietary supplements anchor baseline demand for extract producers. This stability supports long-term capacity planning and investment decisions. In January 2026, Solabia Nutrition’s Brainberry showed clinically validated benefits for spatial working memory and brain vascular function in older adults.

Pharmaceutical applications are expanding as bilberry extract gains acceptance in targeted therapies. Buyers require validated potency and compliance-ready documentation. This segment favors suppliers with GMP capabilities. Pharmaceutical buyers demand tighter specifications, boosting the overall demand in the bilberry extract market. Margins are higher, but qualification cycles are longer. Suppliers investing in pharma-grade processes gain competitive advantage. This segment reshapes product development priorities. Pharmaceutical demand encourages deeper clinical alignment and quality investments.

Europe clocks in the leading market position due to sourcing infrastructure and regulatory alignment

Europe leads the bilberry extract market due to established sourcing networks and processing expertise. Nordic regions support reliable raw material access. European buyers emphasize compliance and traceability. Suppliers benefit from proximity to harvesting zones. Regulatory familiarity supports smoother commercialization. Europe remains the core supply hub for global buyers, reinforcing long-term supplier dominance. In February 2025, Eevia announced that the company booked new sales orders worth c. SEK 955 (KEUR 86), driven by stronger demand for its high-quality bilberry extracts across European customers.

Demand in the Asia Pacific bilberry extract market is rising due to expanding nutraceutical manufacturing. Regional brands are increasing production levels to cater to domestic as well as export markets that require higher quantities of extracts, with buyers increasingly opting for standardized extracts to support premium positioning. Regional expansion of local manufacturing is creating increased import requirements, while suppliers focusing on the Asia Pacific market are prioritizing partnership as well as distribution growth.

The market is partly consolidated as few players dominate the competition that revolves around extract standardization, control over sourcing, and innovation for specific applications. Leading bilberry extract market players are focusing on pharmaceutical,-grade anthocyanin profiles to obtain long-term supply agreements with supplement and clinical nutrition brands. The shift in product differentiation is moving away from generic antioxidant positioning towards eye health, metabolic support, and vascular formulations. There are opportunities in personalized extract concentrations, clean, label compliance, and traceable Nordic sourcing.

The market also allows bilberry extract companies to boost their profit margins through vertical integration and direct B2B sales models. Those firms that manage their regulatory readiness along with formulation flexibility will be able to attract high-end buyers effectively. When procurement teams minimize supplier bases, extract manufacturers with consistent batch performance and documentation capabilities can capitalize on this demand by strengthening their competitive advantages across nutraceutical and pharmaceutical value chains.

Bio Botanica, Inc., which was founded back in 1972 and has its headquarters in New York, United States, is a company offering standardized botanical extracts primarily to dietary supplement and pharmaceutical buyers. It serves the bilberry extract market through the development of custom extracts and application, driven formulations.

Foodchem International Corporation is a global supplier based in Shanghai, China, that was founded in 2006. The company primarily supplies bilberry extract to price-sensitive and volume-driven markets and hence, it focuses on scalable production and export efficiency.

NOW Health Group, Inc., established in 1968 and headquartered in Illinois, United States, integrates bilberry extract into its vertically controlled supplement portfolio. The company emphasizes in-house testing and formulation alignment. NOW caters to the market by prioritizing traceable sourcing and label transparency.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Unlock the latest insights with our bilberry extract market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 6.89% between 2026 and 2035.

Stakeholders are strengthening sourcing partnerships, investing in standardized extraction, expanding direct sales, aligning with clinical applications, and improving documentation to secure premium buyers and predictable demand.

The key trends guiding the market include surging innovations by key players, the increasing R&D activities aimed at demonstrating the effectiveness of bilberry, and the rising demand for functional food.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading sources of bilberry extract in the market are organic and conventional.

The significant forms of bilberry extract in the market are liquid, powder, and tablets/capsules, among others.

The major sales channels in the market are direct sales and indirect sales.

The various end uses of bilberry extract are food and beverages, pharmaceuticals, cosmetics and personal care, and dietary supplement, among others.

The key players in the market include Bio Botanica, Inc. Foodchem International Corporation, and NOW Health Group, Inc., among others.

In 2025, the market reached an approximate value of USD 486.58 Million.

Raw material volatility, climate-dependent berry yields, tightening botanical compliance standards, and rising documentation expectations continue to pressure margins while extending qualification timelines for bilberry extract suppliers globally.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Source |

|

| Breakup by Form |

|

| Breakup by Sales Channel |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share