Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global biometrics technology market size was valued at USD 27.78 Billion in 2025. The industry is expected to grow at a CAGR of 10.20% during the forecast period of 2026-2035 to reach a value of USD 73.38 Billion by 2035. The market growth is largely due to the gradual uptake of biometric authentication in a range of real, high-value vertical applications gradually going beyond the financial services industry and into other industries.

The global biometrics technology market expansion is attributed to the growing importance of biometric authentication systems capable of managing real-world obstacles and providing reliable performance in a variety of settings. Additionally, the solution architectures are becoming more focused on reducing data exposure through safe, on-device processing. Such improvements pave the way for the usage of these systems in security, critical, and regulated sectors, where continued reliance on the technology depends on the availability of both high-quality trustworthy technology and ethical data handling.

The move towards digital transactions, remote access, and identity-based services has prompted organizations across industries to turn to biometrics for strengthening security without compromising on user convenience. For example, banks have adopted biometric payment solutions not only as a measure against fraud but also as a means of simplifying customer authentication. On the other hand, firms across a wide range of sectors, from corporate security to health and infrastructure, are employing biometric access control as a part of their overall digital strategy, contributing to the increasing demand in the biometrics technology market.

Such an amalgamation goes to show that biometric technology is no longer viewed simply as a single-use tool but is also considered by organizations as a scalable and integrable solution with the other existing systems, such as payment networks, access platforms, and identity management frameworks. Biometrics undoubtedly appears to be a pivotal technology that permits digital transformation to be not only secure but also smooth in terms of user experience, thereby facilitating easy identity verification in different settings and for various purposes.

During the interim phase of technological adoption, industry certifications, product releases, and related initiatives play a critical role in ensuring technological readiness and fostering public acceptance in the biometrics technology market. For instance, the IDEX Pay biometric card solution from IDEX Biometrics was officially recognized by Visa in August 2024, which is one of the prominent milestones that enabled mass production deployment through Visa's worldwide network and, at the same time, highlighted the role of biometrics in the evolution of payment and identity applications.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

10.2%

Value in USD Billion

2026-2035

*this image is indicative*

Strategic partnerships play a vital role in the growth of the biometrics technology market. They enable vendors to extend their reach across different geographical areas and, at the same time, fine-tune their products to suit local regulations, operations, and customers' preferences. Working with regional system integrators and technology firms, biometric companies can fast-track their deployment schedules and fortify their sales networks in both emerging and mature markets. Through such a strategy, businesses can enjoy quick product launches and continuous use of their solutions by enterprise and public sector applications. In December 2025, IDEMIA Public Security and Tsuzuki Denki Co. joined forces to advance biometric-based access management solutions in Japan.

The rising demand in the biometrics technology market for advanced biometric access control systems is mainly due to the increased security and efficient identity verification requirements in densely populated areas such as airports, transit hubs, and large venues. The systems can improve user flow without sacrificing accuracy, thus making them ideal for very large infrastructure projects and smart city initiatives. When public safety and operational efficiency are the major concerns, biometrics are slowly becoming part of public facilities. In September 2024, NEC Corporation announced the launch of a biometric authentication system that can simultaneously recognize many people.

OEM collaborations are one of the main ways through which biometric technologies are incorporated directly into access cards, credentials, and identity devices, thereby increasing the potential applications in the real world. Vendors improve security and, at the same time, make the user experience more convenient and allow for the system to be scaled up by embedding biometric sensors at the product design stage. Such partnerships facilitate the implementation of systems for the control of access in the corporate, industrial, and institutional environments. For instance, in March 2025, Fingerprint Cards AB entered a collaboration with Fuse Identities to introduce a biometric physical access card that comes with the FPC 1323 T Shape fingerprint sensor.

A growing trend in the biometrics technology market is licensing biometric software platforms to regional OEMs, which facilitates the rollout of authentication technologies while minimizing development costs and integration complexity. The approach is important in situations where government, financial services, and enterprise sectors lead the demand. By means of software licensing, biometric suppliers can expand the base of users adopting the technology while at the same time refraining from making huge investments in infrastructure. For instance, in April 2025, Fingerprint Cards AB renewed its iris recognition software licensing deal with Mantra Softech India, thus facilitating the spread of identity and access usage solutions on a broader scale.

The switch to cloud-based security infrastructure is fast becoming the reason for the adoption of biometric access control platforms that provide centralized management, scalability, and less on-premise complexity. Biometric systems that are cloud-native attract those organizations that must manage widely spread facilities and remote employees, as they can conduct monitoring in real time-time and have the most convenient option for expansion. This move shows how biometrics are converging with cloud and SaaS security models. In May 2025, Suprema Inc. released BioStar Air, a cloud-based biometric access control platform made specifically for multi-site enterprise deployments.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Biometrics Technology Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

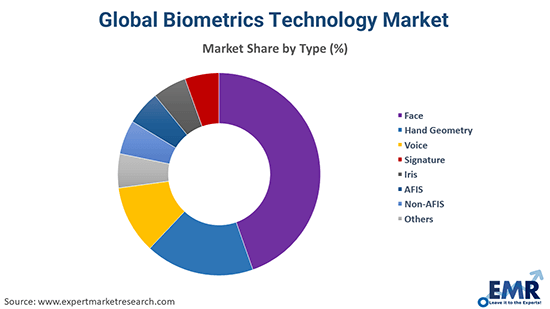

Key Insights: The biometrics technology market scope, comprises various types such as face, hand geometry, voice, signature, iris, AFIS, nonAFIS, and emerging modalities that cater to authentication needs of the different types. Face and iris biometrics lead the way in identity verification for travel and enterprises, whereas voice and signature are used for secure remote onboarding. AFIS systems are still essential for law enforcement, and nonAFIS solutions are geared towards consumer and mobile access. Vendors keep upgrading algorithm performance, scalability, and integration. Thales unveiled its Identity Verification Suite for secure biometric onboarding across multiple sectors in October 2025.

Market Breakup by End Use

Key Insights: The biometrics technology market caters to the end-use across industries such as government, banking & finance, consumer electronics, healthcare, transport/logistics, defense and security, and other markets, driven by specific application requirements. Governments mandate the use of biometric systems for national ID and border control. Banks and payment systems use biometrics as a method of stronger authentication to cut down on fraud. Consumer electronics come equipped with biometric sensors for unlocking devices, while healthcare uses biometrics to identify patients and keep their records secure. The transport and defense sectors use biometrics to increase security and monitor operations. CLEAR in October 2025 continued to add passports from 40 countries to CLEAR+ enrolment, facilitating biometric travel identity services.

Market Breakup by Region

Key Insights: Regionally, the biometrics technology market landscape includes region such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, showcasing biometric adoption patterns that have evolved because of policy, infrastructure, and investment. In fact, North America leads biometric implementations in the enterprise and transportation sectors. Europe focuses on regulated identity frameworks and secure access systems. Government-issued ID programs and digital banking integration have resulted in rapid growth in Asia Pacific. Latin America and MEA prioritize border security and financial identification. Vendors are strengthening their regional footprints by partnering and customizing their deployments, thus facilitating the adoption of localized solutions for various applications.

By type, fingerprint biometric innovation witnesses notable demand due to wide integration across application

Fingerprint biometrics are a major force in the market owing to the broad use in secure access, financial authentication, and government ID systems. Ongoing R&D into miniaturized sensors, better liveness detection, and encrypted communications between devices keeps fingerprints in smartphones, point of sale terminals, and identity devices. Furthermore, vendors optimize software toolkits to enable rapid integration into enterprise and cloud environments. BIOkey in October 2025, unveiled its EcoID III USB fingerprint scanner with FBI FAP20 certification, improved liveness detection, and encrypted device to host communication, thus emphasizing the role of certified fingerprint solutions across industries.

Palm and multimodal biometrics are witnessing significant demand in the biometrics technology market, as they provide higher uniqueness and spoof resistance, thus complementing the identity assurance level in complex settings. These modalities also facilitate voter registration, civil identity, financial inclusion, and secure transit applications. The need for rugged, mobile capture devices continues to increase, thus reconfirming the deployments of field operations and decentralized enrollment. In June 2025, Integrated Biometrics teamed up with GripID to unveil the GripID MANNIX mobile full-palm biometric device equipped with FBI-certified FAP60 capture, thus extending high-assurance palm identification.

By end uses, government sector shows robust growth driven by government-led identity programs

Government biometric programs continue to be the main factor of growth in the global biometrics technology market, as states adopt systems for voter registration, national ID, citizen services, and border control. Such huge projects require a combination of multimodal hardware, backend databases, and public service platform integration, thus forming the basis for long-term procurement and modernization cycles. Investments are directed at scalability, accuracy, and citizen experience. NEXT Biometrics in 2025 inked a multiyear MoU with an Indian partner to develop biometric modules with liveness detection for programs like national ID and Aadhaar, thus facilitating the rollout of government identity tech.

The banking and finance sector contributes significantly to the biometrics technology market revenue owing to the strong biometric adoption as institutions seek secure, frictionless authentication to combat fraud and enhance digital customer experiences. Fingerprint, face, and voice biometrics are increasingly used for onboarding, transaction approval, and AML/KYC compliance, reducing dependence on passwords and PINs. This transition supports scalable digital payments and trust-based banking. In October 2025, India introduced biometric authentication for instant UPI payments, strengthening secure, user-friendly payment verification across the financial ecosystem.

By region, Asia Pacific leads the market growth driven by supportive policies attracting investments

Asia Pacific's biometrics technology market is growing at a fast rate. It is mainly driven by government digital identity initiatives, the rise of mobile banking, and public service authentication. Biometrics infrastructure and scalable enrollment solutions are drawing investments from large populations and the aid of supportive policies. Local regional integrators and global technology partners customize deployments to the local languages and ecosystems. During Q1 2025, World (formerly Worldcoin) extended iris biometric registration and verification in Southeast Asia and launched marketing campaigns in the Philippines, Indonesia, and Thailand, showing the cross-border acceptance of state-of-the-art biometric verification.

Biometrics in the Middle East and Africa are rapidly emerging to be lucrative destinations for biometrics technology market players owing to the surging demand across sectors such as defense, government, and critical infrastructure. Secure access, identity verification, and facility control deployments that are focused on helping national security and enterprise compliance requirements. Working with local integrators and focusing on rollouts increases the capacity for regional implementation. In November 2025, BIOkey completed an identity and biometric security deployment at a major Middle East defense organization that is worth a large amount of money, thus increasing the vendor presence in high-assurance markets.

Major global biometrics technology market players are utilizing strategic partnerships and collaborations to broaden their geographic outreach and speed up deployment. Collaborating with regional system integrators, technology providers, and OEMs, vendors can tailor solutions that comply with local regulatory requirements and customer preferences. This strategy results in quicker commercialization, facilitates government, finance, and enterprise sector penetration, and consolidates the whole biometrics ecosystem through the combination of top-notch hardware, software, and cloud platforms.

Besides that, many biometrics technology companies are putting their money into product innovation and multimodal solutions to ramp security, precision, and convenience up a notch. Innovations in fingerprint, face, iris, and palm biometrics, along with AI-powered algorithms and liveness detection, facilitate identity verification at various levels of reliability across sectors. Cloud platforms, mobile enrolment devices, and scalable enterprise systems enable a smooth integration, which helps in adoption within transport, healthcare, banking, and public infrastructure domains, thus fostering the expansion of the global biometrics technology market revenue.

Accu-Time Systems, Inc., established in 1984 with its main office in Dallas, Texas, is a company that specializes in workforce management and biometric access control solutions. They concentrate on providing scalable and integrated time, tracking, and authentication systems to enterprise and industrial clients.

BIO-key International, Inc. is a company that was established in 1993 and is in Wall Township, New Jersey. The company provides fingerprint and multimodal biometric authentication solutions that are at the forefront of technology. It is a maker of secure identity verification platforms, which are used in government, finance, and enterprises, positioning the firm as a leader in the biometrics technology market.

DERMALOG Identification Systems GmbH is a company established in 1995 and located in Hamburg, Germany. It is a large manufacturer and supplier of biometric identification technology such as fingerprint, face, and iris recognition systems. The company offers secure authentication and identity management solutions to governments and enterprises around the globe.

Fujitsu Limited is a company established in 1935 and has its main office in Tokyo, Japan. It is a worldwide technology company that, besides its IT services and infrastructure, also offers biometric solutions. Its biometrics lineup consists of fingerprint, palm, and face recognition technologies that can be applied to highly secure access, identity management, and government projects.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market include HID Global, among others.

Explore the latest trends shaping the Global Biometrics Technology Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on global biometrics technology market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global biometrics technology market reached an approximate value of USD 27.78 Billion.

The market is projected to grow at a CAGR of 10.20% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 73.38 Billion by 2035.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Key strategies driving the market include partnerships and collaborations to expand reach, product innovation with multimodal and AI-enhanced solutions, and cloud-based or OEM integrations. Companies are also targeting regional markets while ensuring compliance with local regulations to capture government, enterprise, and consumer opportunities efficiently.

The key market trends guiding the growth of the industry include the rapid technological advancements.

Face, hand geometry, voice, signature, iris, AFIS, and non-AFIS, among others are the major types included in the market report.

Government, banking and finances, consumer electronics, healthcare, transport/logistics, and defence and security, among others are the different end uses of the product.

The key players in the market include Accu-Time Systems, Inc., BIO-key International, Inc., DERMALOG Identification Systems GmbH, Fujitsu Limited, and HID Global, among others.

Major challenges include data privacy concerns, high implementation costs, system integration complexity, and interoperability issues. Regional regulatory differences, lack of standardization, and resistance to adoption further slow market growth, while ongoing technology upgrades increase operational and research and development demands.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share