Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global bromine market size was valued at USD 4.38 Billion in 2025. The industry is expected to grow at a CAGR of 5.00% during the forecast period of 2026-2035 to reach a value of USD 7.13 Billion by 2035. The growing prevalence of respiratory disorders and increasing awareness of effective treatment options are creating significant opportunities for market players in the pharmaceutical landscape.

Patients and healthcare providers are increasingly seeking affordable and accessible therapies for chronic conditions like allergic and nonallergic rhinitis, driving demand for established active ingredients such as Ipratropium Bromide. Capitalizing on this trend, in July 2025, Lupin introduced a generic version of Ipratropium Bromide Nasal Solution in the United States, offering two strengths of the nasal spray that are bioequivalent to Boehringer Ingelheim’s Atrovent.

With the reference product generating estimated annual sales of USD 63 million, Lupin’s entry is expected to broaden patient access, reduce treatment costs, and strengthen its presence in the competitive United States respiratory care sector. As generics gain traction, healthcare providers and patients benefit from enhanced treatment options, while the pharmaceutical industry continues to expand its footprint in high-demand, cost-sensitive therapeutic areas, further expanding the global bromine market scope

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5%

Value in USD Billion

2026-2035

*this image is indicative*

The global bromine market growth continues to demonstrate how production reliability can stabilize prices during periods of uncertainty. In Israel, strong operational performance from Dead Sea facilities kept June 2025 prices steady, even as geopolitical tensions and soft Asian demand pressured trade flows. ICL’s near 95% operating rate ensured adequate supply, while steady offtake from flame retardant, pharmaceutical, and agrochemical sectors provided price support. Despite higher freight costs and cautious buying in China and India, market fundamentals remained resilient.

Rising investments in water management infrastructure are driving the demand for bromine-based water treatment solutions. Governments across Asia are prioritizing clean water access and disinfection technologies to ensure long-term water security. In India, the 2025–26 Union Budget allocated INR 67,000 crore to the Jal Jeevan Mission, strengthening tap water networks and expanding the use of advanced purification systems. With an emphasis on smart technologies and public-private partnerships, the initiative is accelerating the adoption of bromine compounds for effective disinfection across urban and rural applications.

Growing industrial reliance across sectors, such as batteries, electronics, and aerospace has intensified the global focus on supply security, driving bromine demand. Nations are prioritizing domestic capacity to minimize import dependence and stabilize production chains. In July 2025, China Railway Construction Kunlun Investment Group initiated the country’s largest bromine extraction project in Hebei’s Tangshan region. Using advanced seawater extraction technology, the facility is set to strengthen China’s resource independence and support its long-term strategy for sustainable industrial self-reliance.

Supply constraints are driving bromine prices higher in the United States, as expensive imports and disrupted logistics tighten availability. Severe winter storms along the Gulf Coast, geopolitical tensions at key ports in China and Jordan, and anticipated tariffs forced buyers to secure limited stocks quickly, pushing costs up. Manufacturers are ramping up inventories to hedge against shortages, while steady demand from flame retardants, drilling fluids, and energy storage keeps pressure on supply. These factors collectively underscore how supply-side disruptions actively propel bromine market dynamics forward.

Industries worldwide prioritize safety and environmental compliance, demand for innovative flame retardants is intensifying. Regulatory pressure is pushing manufacturers to adopt safer, high-performance solutions. In 2024, the European Chemicals Agency (ECHA) flagged aromatic brominated flame retardants for potential EU restrictions to minimize exposure to persistent and toxic substances. This is accelerating the development of advanced bromine-based alternatives, prompting R&D investments, product innovation, and market adoption. Companies are proactively aligning with evolving standards, reinforcing bromine’s critical role in sustainable, high-performance industrial applications.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Bromine Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insights: Hydrogen bromide dominates industrial applications with its critical role in pharmaceutical synthesis and semiconductor etching, driving steady demand in high-tech sectors. Organobromine compounds, widely used in flame retardants and biocides, have surged as global safety standards and pest control needs intensify. Bromide salts, including sodium bromide, support oil and gas drilling operations by maintaining wellbore stability and pressure control. Other bromine derivatives continue to enable niche applications, ensuring the chemical’s versatility across diverse industrial processes and reinforcing its essential position in manufacturing.

Market Breakup by Application

Key Insights: Biocides applications of the bromine industry help maintain industrial water quality, preventing microbial growth in cooling towers and treatment systems. Flame retardants incorporating bromine are integral to fire-resistant materials in electronics, textiles, and construction, responding to strict global safety mandates. Bromine-based batteries, such as zinc-bromine flow systems, are gaining momentum in energy storage due to scalability and efficiency. Clear brine fluids are indispensable in drilling operations, while fine chemicals and agricultural products leverage bromine’s reactivity to boost crop protection and pharmaceutical synthesis, reflecting its growing functional importance, propelling the market value.

Market Breakup by Region

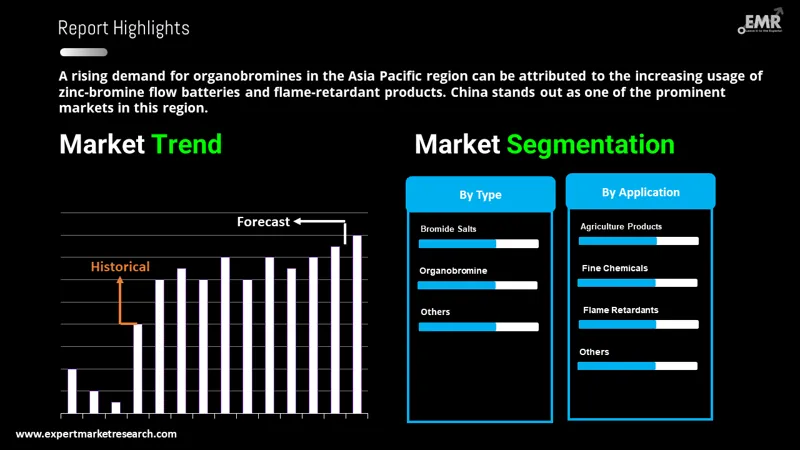

Key Insights: North America bromine industry leverages bromine extensively in flame retardants and oil and gas sectors, reflecting strong industrial investments. Europe focuses on sustainable applications, particularly bromine-based biocides and fine chemicals, aligned with environmental regulations. The Asia Pacific region, driven by rapid industrial growth in China and India, is adopting bromine across multiple sectors, from agriculture to high-performance materials. Latin America and the Middle East and Africa are gradually increasing bromine consumption, supported by expanding agricultural initiatives and oil and gas projects that stimulate derivative demand across the regions.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

By type, hydrogen bromide to continue to witness strong market interest

Rising industrial-scale chemical manufacturing is fueling growth in the hydrogen bromide market. Industries increasingly depend on hydrogen bromide as a key intermediate for producing flame retardants, pharmaceuticals, and specialty chemicals. Large-scale production facilities and process optimizations ensure steady supply to meet growing demand from electronics, energy, and chemical sectors. As manufacturers expand operations and integrate hydrogen bromide into their production chains, the market is witnessing accelerated adoption, positioning hydrogen bromide as a vital chemical for enabling efficient, high-performance industrial processes across multiple applications.

Bromide salts are witnessing high demand owing to the rising demand for high-efficiency bioprocessing for protein purification and chromatography. Biopharmaceutical companies are scaling operations to meet global demand for monoclonal antibodies and complex biologics. In June 2024, Ecolab’s Purolite, in partnership with Repligen, launched DurA Cycle affinity resin at BIO 2024, enhancing large-scale purification processes. Supported by expanded United States and the United Kingdom manufacturing facilities, this move exemplifies how innovation, strategic partnerships, and increased production capacity are driving bromide salts adoption in industrial-scale biopharmaceutical manufacturing.

By application, flame retardants to represent substantial market share

As global safety standards tighten and industries prioritize sustainable, high-performance materials, the demand for advanced flame retardants is accelerating. Bromine-based solutions are increasingly replacing legacy chemicals to meet these evolving needs. In December 2023, FRX Innovations drove this trend with its Nofia® products, entering clean energy, automotive, electronics, textiles, and construction applications. With 237 active customer projects and commercial shipments already underway, the adoption of these innovative flame retardants underscores bromine’s pivotal role in enabling safer, eco-friendly, and high-performing industrial materials worldwide.

The bromine-based battery applications account for a substantial bromine market share as sustainable energy storage gains momentum. In April 2024, the Puyallup Tribe teamed up with Portland’s Skip Technology to roll out hydrogen-bromine flow batteries in Fife, Washington. Leveraging 3D-printed components and a dedicated manufacturing facility, these batteries capture and store solar and wind energy efficiently, without relying on rare-earth minerals. This bold collaboration not only accelerates renewable adoption but also showcases bromine’s emerging role as a versatile, eco-friendly alternative in large-scale energy storage, positioning the segment for rapid industrial uptake.

By region, North America holds the largest market share

North America is witnessing significant growth, driven by large-scale exploration projects such as the Green River Project in Utah. In October 2025, American Critical Minerals announced brine volumes exceeding two billion cubic meters, with bromine concentrations ranging up to 4,741 ppm alongside substantial lithium and potash targets. Leveraging extensive historical drilling data and insights from neighboring projects, this initiative underscores the region’s potential to secure critical bromine supplies for industrial, energy storage, and chemical applications, laying the foundation for sustained production growth and strategic resource development in the near future.

On the other hand, industrial growth and emerging technologies are driving bromine market share in the Asia Pacific, pushing companies to expand and innovate rapidly. In August 2025, GHCL Limited, India’s leading soda ash manufacturer, announced the construction of a new bromine plant, alongside a salt field in Kutch to support production. Targeting high-demand sectors like solar glass and electric vehicle batteries, GHCL is actively diversifying its chemical portfolio, capturing new opportunities, and positioning itself as a regional leader. This expansion underscores the accelerating adoption of bromine in key industrial and technological applications.

Market players in the bromine industry are actively investing in production capacity expansions, technological innovations, and process optimization to strengthen their global presence. They are focusing on developing advanced bromine derivatives for applications in flame retardants, water treatment, and pharmaceuticals. Strategic collaborations with suppliers and distributors are also being pursued to ensure reliable supply chains and enhance market reach. Additionally, many companies are adopting sustainable production practices to meet regulatory standards and improve environmental compliance, reflecting a long-term growth strategy.

To remain competitive, market players are diversifying their product portfolios and targeting emerging application areas such as specialty chemicals and high-performance materials. Companies are emphasizing research and development to create innovative solutions that meet evolving customer needs while maintaining cost efficiency. Investment in automation, quality assurance, and supply chain resilience is also a key focus to reduce operational risks. Furthermore, firms are exploring strategic partnerships, joint ventures, and regional expansions to capture new markets and strengthen their global footprint in the bromine sector.

Established in 1968 and headquartered in Tel Aviv, Israel, ICL Group Ltd. stands as a global leader in specialty minerals and chemicals. With a rich history rooted in the Dead Sea's mineral wealth, ICL has evolved into a diversified powerhouse, serving industries from agriculture to advanced materials.

Born from a legacy dating back to 1889, LANXESS was officially founded in 2004 following the spin-off of Bayer's chemicals division. Headquartered in Cologne, Germany, LANXESS has transformed into a prominent specialty chemicals company, focusing on sustainable solutions across various industries.

Founded in 1994 and based in Charlotte, the United States, Albemarle Corporation has grown from its origins in paper products to become a global leader in specialty chemicals and the bromine market. With a strategic focus on lithium, bromine, and refining catalysts, Albemarle serves customers in over 100 countries.

Established in 1999 as a joint venture between the Arab Potash Company and Albemarle Holdings LTD, Jordan Bromine Company is headquartered in Jordan. As the nation's exclusive producer of bromine, JBC has become a significant player in the global bromine market.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the bromine market include Tata Chemicals Ltd., among several others.

Explore the latest trends shaping the Global Bromine Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Get a free sample report or contact our team for customized consultation on global bromine market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 4.38 Billion.

The market is projected to grow at a CAGR of 5.00% between 2026 and 2035.

Key strategies driving the market include product innovation, expansion of production capacities, mergers and acquisitions, strategic partnerships, and diversification into high-value end-use applications like flame retardants, energy storage, and pharmaceuticals.

The increased demand from biocides, fire retardants, oil and gas drilling, and the surging demand for bromine in industries like cosmetics, textiles, pharmaceutical, and agro-fumigant sectors are the key trends propelling the market's growth.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The different types of bromine in the market are hydrogen bromide, organobromine, and bromide salts, among others.

The major application of bromine are biocides, flame retardant, bromine-based battery, clear brine fluids (CBF), fine chemicals, and agriculture products, among others.

The key players in the market include Israel Chemicals Ltd (ICL), LANXESS Corporation, Albemarle Corporation, Jordan Bromine Company (JBC), Tata Chemicals Ltd., among others.

North America holds the largest share of the global bromine market, supported by strong industrial demand, well-established chemical manufacturing infrastructure, and significant use in electronics, flame retardants, and energy storage applications.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share