Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global business jets market size was valued at USD 35.50 Billion in 2025. The industry is expected to grow at a CAGR of 7.20% during the forecast period of 2026-2035 to reach a value of USD 71.15 Billion by 2035. The market is primarily influenced positively by the combination of strategic fleet agreements and the consolidation of operators through which OEMs are experiencing high demand.

Coordinated strategies, including bulk aircraft purchases and strategic partnerships, are driving efficiency, scale, and long-term business jets market stability. To cite an example, in September 2023, NetJets and Textron Aviation entered into a fleet agreement for the supply of up to 1,500 Cessna Citation aircraft, thus making NetJets the launch customer for the Citation Ascend. Bulk orders that secure long-term supply pipelines are being signed increasingly by large fractional and charter operators only. In addition to these accords, operator consolidation through M&A activities facilitates the strengthening of operator balance sheets and market reach, which in turn enables them to have larger, more diversified fleets and integrated service offerings.

Another example exemplifying is the announcement in February 2025 of the acquisition of Jet.AI’s aviation business by flyExclusive, which not only extended its platform capabilities but also its operational footprint. These strategic decisions, in aggregate, pave the way for the scaling of operators in a cost-efficient manner while OEMs witness an increase in the number of committed buyers for new aircraft models. Through the simultaneous use of fleet expansion and consolidation, the market becomes a more resilient ecosystem that can expand the business jets market scope and be supportive of long-term investment in business aviation infrastructure.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

7.2%

Value in USD Billion

2026-2035

*this image is indicative*

To satisfy the demand of corporate and charter operators who are progressively selecting advanced-generation business jets with better performance and safety features, OEMs are fast-tracking certification programs. For instance, Dassault Aviation’s Falcon 6X obtained EASA and FAA type certifications in August 2023. These approvals enable Dassault to deliver the aircraft and meet the needs of operators wanting longer-range and environmentally friendly platforms. Hence, the certification not only consolidates customer trust but also acts as a promoter for replacement purchases in the business jets market.

Operators and government clients require platforms for medical evacuation, surveillance, aerial firefighting, military training, and head-of-state transportation. The players in the market are reacting by setting up newly formed areas and providing specialized services to help these demands. To illustrate, Jetcraft established its Special Missions Aircraft Trading Team in November 2025, which sources preowned jets and oversees the modification processes for government and defense clients. The realization of such programs paves the way for business jets beyond the corporate travel sector, thus contributing to the growth of niche sector in the business jets industry and the expansion of the aftermarket for customization and retrofit services.

Ongoing upgrade efforts of in-flight digital cabin services and the connectivity of passengers, as operators and executives demand mobile-office experiences. New high-bandwidth, low-latency satellite solutions are attractive to both new-aircraft customers and those seeking retrofit opportunities. A case in point is Viasat, which enhanced its JetXP network in October 2024 to provide business aviation with expanded capacity and uncapped speeds. The improvements enable customers to rapidly adopt next-generation connectivity, which in turn opens business jets market opportunities spurred by the rising expenditures for modernized jets and retrofitting of the cabin in the aftermarket.

With the expansion of business jets fleets, operators have surged the need of strong aftermarket support and service networks, which they mainly consider while making purchase decisions. A good example would be the move by Heico Corporation’s Flight Support Group, which on 4 February 2025 purchased 90% of business jet MRO provider Millennium International. This step not only enhances Heico’s capability to support the business jet division but also sends a strong signal to OEMs and independent service providers about the value of the lifecycle stage. The presence of a well-developed MRO and service ecosystem, therefore, makes jet ownership more attractive and forms the basis of business jets market expansion.

Business jet buyers nowadays require cabin experiences that are at least equal to ground offices or premium air travel, thus forcing OEMs and retrofit specialists to prioritize digital cabin enhancements. An illustration of which could be the completion by Business Jet of the first Starlink satellite internet installation on a Gulfstream GV aircraft in August 2024. This upgrade fits perfectly with the trend of remote-working executives and the ever-increasing need for high-speed connectivity in-flight. When cabins are turned into digital workspaces, connectivity and cabin tech serve as differentiators in the purchasing decision, thereby supporting the market growth.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

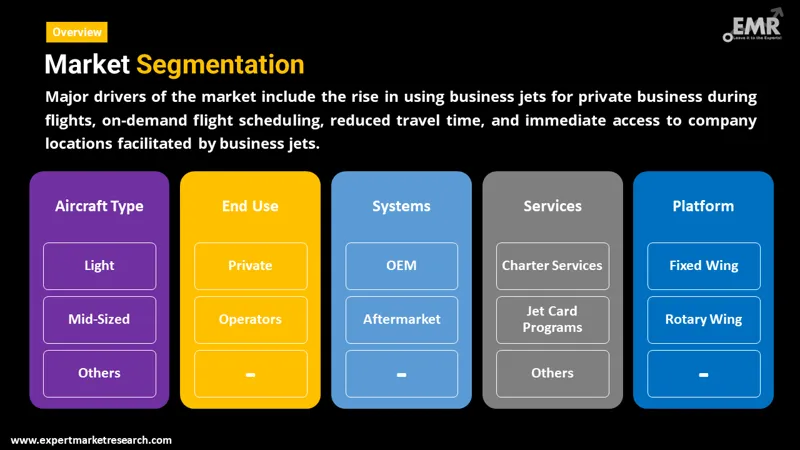

The EMR’s report titled “Global Business Jets Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Aircraft Type

Key Insights: Light jets are predominantly used for short flights and attract demand from charter and owner-pilot users whereas mid-sized jets are a compromise on range, cost, and comfort of the cabin. For example, Embraer Praetor 600 for the first half of 2025 has nearly doubled compared to the same period in 2024. Large cabin jets are used for ultra-long-haul trips and VVIP fleets, whereas airliner-class conversions serve ultra-luxury travel. OEMs are tailoring their offerings, increasing their production footprints, and aligning after-sales networks to take advantage of the growth in all these segments of the business jets market.

Market Breakup by End Use

Key Insights: Private buyers, such as high-net-worth individuals and corporate executives, seem to be highly attracted by the long-range capabilities, improved connectivity, and custom cabins as part of a larger trend in the business jets market. Moreover, flexibility and exclusivity also influence demand. At the same time, operators like charter firms and fractional ownership platforms are growing their fleets, changing service models, and investing in digital booking solutions to address the increased corporate and frequent flyer demand. Just to illustrate, a recent fundraising event drew attention to this transformation; Flexjet LLC managed to get an USD 800 million investment in July 2025, indicating that there would be a significant increase in the fleet and a considerable number of younger high-net-worth users.

Market Breakup by System

Key Insights: The global business jets market is divided into OEM and aftermarket systems, which are differently involved in the growth of the sector. The OEM sales are boosted by new aircraft deliveries, innovations, and cabin customization to satisfy the changing customer preferences. Whereas the aftermarket segment has an edge over the former with retrofits, upgrades, maintenance, and connectivity that add value to the aircraft lifecycle. The market players are committed to enlarging their service networks, enhancing their predictive maintenance features, and issuing digital solutions, thus keeping up the demand and creating stronger engagement opportunities in both OEM and aftermarket channels.

Market Breakup by Services

Key Insights: Charters are building their fleet and digital platforms to address the need for on-demand travel. Jet cards providers are contributing substantially to the business jets market growth, owing to the increasing use of fixed hour blocks to lock in rates and make the booking process easier. Operators, on the other hand, are more inclined towards offering debit-based hours that allow a lighter commitment. Meanwhile, a fractional company gives its users an option of buying a share in a jet, thus lessening the need for capex. As an example, Jet Aviation inaugurated its Jet Card program across EMEA on 9 December 2024, thus allowing prepaid hours and guaranteed availability worldwide. These changes facilitate market engagement, promote utilization, and sustain both new and pre-owned aircraft markets.

Market Breakup by Platform

Key Insights: Fixed-wing business jets market mainly sees demand from corporate and VIP travel whereas, in the commercial and military segments, the focus is on passenger transport and defense missions. Rotary-wing aircraft can be found in all three sectors, i.e., civil, commercial, and military, and are used for various purposes such as medevac, offshore, and surveillance. For instance, Bell Textron presented its Bell 525 Relentless helicopter in July 2023 for both civil and offshore operations. OEMs are continuing with platform upgrades, avionics improvements, and mission-specific customization to align with changing operational requirements.

Market Breakup by Region

Key Insight: Across regions, business jet companies are innovating to capture growing demand. In North America, OEMs like Gulfstream and Bombardier enhance cabins and connectivity to attract corporate and private travelers. European operators such as Dassault Aviation and Embraer modernize fleets, launch digital booking platforms, and offer bespoke VVIP services. Asia Pacific players establish service hubs, form strategic partnerships, and expand fractional ownership programs. In Latin America and the Middle East & Africa, operators like Flexjet and Jet Aviation focus on premium charter services, regional hubs, and customized aircraft solutions, driving regional market growth.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

By aircraft type, light jet are gaining traction

The demand for light business jets is rising as buyers look for cheaper, more flexible, and shorter-range platforms which still provide modern amenities. Manufacturers are pretty much in sync with this trend, for instance, in June 2023, Honda Aircraft Company declared the launch of its new light jet, the HondaJet 2600 Concept, for the commercial market. This maneuver emphasizes how producers target improved fuel consumption, better cabins, and more pilot-friendly features to attract both the charter and owner-operated demand. As the number of cost-conscious corporate flyers and owner-operators grows, so does the demand for light jets.

The demand for ultra-long-range, large business jets market, is skyrocketing as a result of the desires of wealthy individuals and corporations for nonstop global missions with luxurious interiors. One such example is the announcement by Airbus Corporate Jets of the ACJ TwoTwenty in October 2024, featuring six cabin zones, a 5,650 nm range, and a work-friendly layout. Hence, manufacturers are not simply marketing large jets as mobile executive suites but rather as the rest of an elevated lifestyle. This transformation invites customers to upgrade or broaden their fleets, thereby stimulating the high-end business jets sector to flourish.

By end-use, private category register robust growth

The private ownership segment is propelled by high-net-worth individuals looking for exclusivity, custom cabins and effortless worldwide access. Two main trends dominate here: the rise of younger wealthy buyers and the flexibility of fractional shares. As an illustration, L Catterton led an USD 800 million investment in Flexjet in July 2025, a move which clearly communicates investor confidence in the luxury private aviation market. The diversification of ownership models and the evolution of buyer profiles are two factors that prompt OEMs and cabin customization companies to not only elevate but also widen their portfolios to cater to the expected standards of private owners.

Meanwhile, the operator segment which includes charter, fractional and lease providers, is expanding the business jets market scope through fleet expansion, fresh service models and global footprint extension. As an illustration, on September 4, 2024, Airshare declared the expansion of a nationwide fractional program in the lower 48 states of the U.S., thus providing jet card and ownership choices from coast to coast. Operators are scaling fleets and services as utilizations rise and corporate travel rebounds, a move that also enables OEMs to expedite production and delivery to meet the volume demand driven by operators.

By system, OEM system show significant uptake

The OEM portion of the business jets market is the main source of the upward trend that is accompanied by new aircraft deliveries, a solid order backlog, and the evolution of model launches to cater to customer expectations. For example, on 29 March 2024, the Gulfstream G700 was granted FAA certification, thus, it is the customer deliveries that are now possible and the large cabin segment is essentially being revitalized. Manufacturers are taking steps with larger cabin choices, newest avionics and longer regional manufacturing footprints to attract the worldwide market. The focus on shorter lead times and richer feature sets is turning new build jets into a more viable option for owners and operators.

The aftermarket section accounts for a substantial share of the business jets market revenue, that is the operators, who are more inclined to consider lifecycle value, retrofit upgrades and service availability than acquisition cost only. One such starting point is the mission accomplished by QCM Design and Collins Aerospace in June 2024 to retrofit a small cabin business jet with certified connectivity, thereby making high-speed internet installation the easiest upgrade for retrofits. Service providers and MROs are busy bringing up to date predictive maintenance platforms, increasing the coverage of their global support networks and facilitating digital cabin/avionics upgrades. All these undertakings contribute to enhanced resale value, better utilization, and in the long run, business jet ownership becomes more economically feasible.

By services, charter services continue to witness strong market interest

With on-demand travel becoming more accessible to corporate and high net worth users, charter service models are going on a tear. Operators are doing it up with global fleets and flexible booking platforms to meet this trend. As an illustration, Wheels Up Experience Inc. declared on 17 June 2024 a simplified product portfolio that not only increased member access but also launched a charter program with private flight credit and connected commercial airline benefits. These innovations serve customers who are looking for ad hoc private flights instead of full ownership, thus increasing charter flights and fleet utilization in the business jets market.

Access to services through models like jet cards, debit as you fly schemes, and fractional ownership is becoming available to a broader audience with the lowering of upfront cost barriers and attracting new users. Each operator is coming up with ways to make membership more casual and prepaid flying more attractive to the less frequent travelers. These subscription style and usage-based programs broaden the customer base beyond the usual owners, encourage the trial route, and increase the utilization of fleets which is good for both operators and OEMs in terms of revenue and fleet efficiency.

By platform, fixed wing is experiencing notable demand

The business aviation market for fixed wing is vibrant and expanding, with corporate and high net worth buyers prioritizing range, cabin comfort, and operational flexibility. To fulfil shifting customer demands, OEMs like Bombardier, Embraer, and Gulfstream are upgrading the cabins and the avionics and expanding their production facilities across the board. Besides the revitalization and expansion of charter and fractional fleets, operators are also turning to digital platforms, predictive maintenance, and service networks for the achievement of their goals. The replacement cycles that are stimulated by co-ordinated activities of manufacturers and operators, in turn, drive a cyclical growth pattern in the sustained upward trend of the business jets market.

On the other hand, rotary wing aircraft in civil and commercial applications such as offshore transport, medevac, and VIP transport have become a major focus for manufacturers who are looking to release newly versatile and efficient helicopter models. As an example, Airbus Helicopters saw a double-digit (10%) increase in orders for 2024 compared to the previous year, indicating a significant rise in demand for its medium utility models in the civilian sector. The OEMs are reorienting their priorities towards lower operating costs, digital cockpits, and a worldwide service network. As operators refresh their fleets and take on new missions, the evolution of this segment acts as a catalyst for continued platform diversification and aftermarket growth.

By region, North America leads the market growth

The North America business jet market continues to be supported by strong corporate travel demand and a growing fractional ownership programs. To mature executives and high-net-worth individuals, companies are investing in fleet expansions, digital booking platforms, and high-tech cabins. Operators, thus, are also upgrading aftersales networks and service ecosystems, which together by ensuring reliability and efficiency, put forward a total that increases the appeal of business aviation across the region.

Demand for private and corporate jets in the Asia Pacific region is being driven by the rising economic growth and the increasing number of ultra-high-net-worth individuals. Operators are invigorating charter services, tailoring cabins, and setting up local maintenance hubs for trustworthiness and ease. As an instance, Embraer reached a significant milestone in August 2025 with the delivery of its 2,000th business jet, a Praetor 500, to a corporate client in Florida, which is a strong indication of the brand’s appeal to APAC corporate flight departments that are looking for advanced midsize jets. This trend is leading to the regional adoption of premium aviation solutions.

Leading business jets market players are directing their attention and resources are directed towards the development of autonomous and unmanned systems that will be employed in naval and industrial sectors. Various research and development projects are significantly contributing to the advancement of underwater robotics, simulation tools, and AI-enabled systems. A primary goal of these new technological applications is the implementation of a modular AUV platform which can enhance mission versatility and the user's ability to exploit the platform in various tasks and operational levels, hence, embodying the dual-purpose concept of strengthening not only defense but also commercial subsea operations, as well as satisfying the requirements of automation and accuracy that keep increasing in the same trend.

Advanced sensor systems, digitized controls, and the possibility for the remote operation of next-generation ROVs as well as AUVs are some of the features that are being worked on. The work concentrates on scalable electric systems, the layout of sonar and navigation innovations, and portable, changeable forms. The strategies and product improvements in the business jets market are used here as a tool to achieve the goals of such a vision serve to create more significant opportunities for the commercial and defense sectors of the underwater world in terms of safety, efficiency, and mission flexibility of the involved enterprises.

Honeywell International Inc. is a global conglomerate, with its head office in Charlotte, North Carolina, that provides aerospace products, building technologies, and performance materials. The company's aerospace division is a leader in technology and provides the most advanced solutions in the field of avionics, engines, and connected aircraft for commercial and business aviation.

Safran S.A. is a globally leading aerospace and defense company headquartered in Paris, France, specializing in aircraft engines, landing gear, and aerospace equipment. The company is an eco-friendly source of propulsion effectiveness, digital avionics, and maintenance solutions. It serves OEMs, airlines, and business jet operators worldwide.

Curtiss-Wright Corporation, a diversified aerospace and defense, was started in 1929, and is in Davidson, North Carolina. The company offers precision components, control systems, and advanced engineering solutions. Its products and services are applied in commercial, military, and industrial sectors with a focus on reliability, performance, and the latest technology.

Collins Aerospace, the result of the 2018 merger of UTC Aerospace Systems and Rockwell Collins, is a global provider of aerospace and defense solutions based vin Charlotte, North Carolina. The firm is a leader in avionics aircraft interiors, and mission systems, OEMs, airlines, and business jet operators, are supported with integrated products and services.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market include Meggitt PLC, Eaton Corporation Inc., Ametek, Inc., and other key players are actively shaping the market through innovations, strategic partnerships, and service expansions.

Explore the latest trends shaping the Global Business Jets Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on global business jets market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global business jets market reached an approximate value of USD 35.50 Billion.

The market is projected to grow at a CAGR of 7.20% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 71.15 Billion by 2035.

Key strategies driving the market include fleet expansion agreements, M&A activities, product innovations, enhanced in-flight connectivity, cabin customization, and investments in service networks and aftermarket solutions.

The key trends guiding the growth of the market include technological advancements and innovations and the growing air mobility in both in developed and developing countries.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The major aircraft types of business jets in the market are light, mid-sized, large, and airliners.

Private and operators are the major end use segments of business jets in the market.

OEM and aftermarket are the significant systems of the product. Both the segments are further divided into aerostructures, avionics, aircraft systems, and cabin interiors.

Charter services, jet card programs, debit as you fly programme, and fractional ownership are the several services of business jets considered in the market report.

Fixed wing and rotary wing are the major platforms of the product considered in the report.

The key players in the market include Honeywell International Inc., Safran S.A., Curtiss-Wright Corporation, Collins Aerospace, Meggitt PLC, Eaton Corporation Inc., Ametek, Inc., and other key players.

The global business jets market faces challenges such as high aircraft acquisition costs, regulatory compliance complexities, skilled labor shortages, and geopolitical or economic uncertainties that can affect demand and operational efficiency.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Aircraft Type |

|

| Breakup by End Use |

|

| Breakup by Systems |

|

| Breakup by Services |

|

| Breakup by Platform |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share