Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The carbon nanotubes market attained a value of USD 10.96 Billion in 2025. The market is expected to grow at a CAGR of 16.50% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 50.47 Billion.

The rapid rise of electric vehicles (EVs), portable electronics, and renewable energy storage is driving the market for carbon nanotubes for enhancing batteries and supercapacitors. Carbon nanotubes (CNTs) improve conductivity, charge capacity, and cycle life by reinforcing electrodes, driving innovations. In June 2023, CHASM Advanced Materials introduced NTeC®-E conductive CNT additives for lithium-ion batteries to offer scalable, cost-efficient, and sustainable solutions This surge is making way for lightweight and durable batteries for green energy transition.

Carbon nanotube recycling is a significant contributor to the market, as it supports environmental sustainability and cost-efficiency. By recovering CNTs from used composites, electronic waste, or even plastic materials, manufacturers are reducing reliance on virgin raw materials and lower production costs. In January 2025, rice researchers revealed breakthrough carbon nanotube recycling method for enabling sustainable, eco-friendly production of advanced nanomaterials for diverse applications. This offers accessibility for large-scale applications in sectors, such as energy storage, electronics, automotive, and construction.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

16.5%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Carbon Nanotubes Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 10.96 |

| Market Size 2035 | USD Billion | 50.47 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 16.50% |

| CAGR 2026-2035 - Market by Region | Europe | 18.3% |

| CAGR 2026-2035 - Market by Country | UK | 17.7% |

| CAGR 2026-2035 - Market by Country | USA | 17.1% |

| CAGR 2026-2035 - Market by Method | Catalytic Chemical Vapor Deposition | 18.5% |

| CAGR 2026-2035 - Market by Application | Aerospace and Defense | 19.2% |

| Market Share by Country 2025 | Italy | 4.9% |

Wide adoption in polymer and composite manufacturing to enhance mechanical strength, electrical conductivity, and thermal stability is boosting the carbon nanotubes industry. Industries, such as automotive, aerospace, and construction are seeking CNT-reinforced composites for lightweight, high-strength parts. In October 2024, Dow and Carbice collaborated to develop advanced silicone-carbon nanotube thermal interface materials for improving electronics performance and reliability in mobility. This expansion is also promoting material innovation, durability, and sustainability, fuelling market growth in composites.

With the shrink in electronics and the strong demand for flexibility, carbon nanotubes are replacing traditional materials in transistors, interconnects, sensors, and flexible displays. Superior electrical and thermal properties of CNTs are allowing manufacturers to introduce smaller, faster, and more durable components. Companies are developing CNT-based transparent conductive films for supporting next-gen electronics and wearables. In January 2022, Toray Industries introduced a new printing tech for enabling semiconductor circuits on flexible films using high-performance semiconductive carbon nanotube composites.

Sustainability concerns in the carbon nanotubes market are leading to higher adoption of lightweight designs and energy-efficient devices. In August 2024, a research team at the Department of Energy and Chemical Engineering developed a breakthrough technology to transform waste plastics into valuable carbon nanotubes for promoting recycling. This trend is enhancing renewable energy devices and improving battery life while aligning with global green initiatives. Companies are also investing in CNT-enabled products to reduce carbon footprints, meeting stricter environmental regulations and consumer demand for eco-friendly products.

Advances in nanotechnology research & development across academia and industry is fostering novel applications of carbon nanotubes in electronics, healthcare, and materials science. In May 2025, Luxembourg Institute of Science and Technology’s spin-off STRAYPROTECT created a super-black carbon nanostructure coating for enhancing optical device precision. Government funding and private investments are stimulating innovations in CNT functionalization and integration, expanding commercial opportunities.

Collaborations between producers, research institutes, and end-users are accelerating product development and commercialization in the carbon nanotubes industry. In November 2024, OCSiAl partnered with Green Energy Origin to manufacture TUBALL™ BATT nanotube suspensions, boosting lithium-ion battery performance and strengthening Europe's sustainable battery supply chain. These partnerships combine technical expertise, resources, and real-world application insights for creating a faster route from research to market.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Carbon Nanotubes Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insight: Single-walled carbon nanotubes market is gaining traction for offering exceptional electrical, mechanical, and thermal properties. These tubes provide superior conductivity and strength, making them ideal for high-performance applications like semiconductors, sensors, and energy storage devices. Several companies focus heavily on this production for electronics and battery technologies. In May 2025, Zeon and Sino Applied Technology partnered to expand single-walled carbon nanotube conductive paste, advancing lithium battery use in electric vehicles. Advances in flexible electronics and next-generation displays are also driving strong demand and significant investment in this segment globally.

Market Breakup by Method

Key Insight: Chemical vapor deposition is particularly favored in the carbon nanotubes market for its scalability, cost-effectiveness, and ability. Widely used in both industrial and academic settings, this method involves the decomposition of hydrocarbon gases on a catalyst substrate. Companies are utilizing chemical vapor deposition (CVD) for producing multi-walled and single-walled CNTs used in electronics, coatings, and composite materials. In October 2024, OCSiAl launched its first European facility in Serbia using CVD technology to produce single-walled carbon nanotubes. As the demand for nanotubes rises, the segment remains the preferred and most economical production technique.

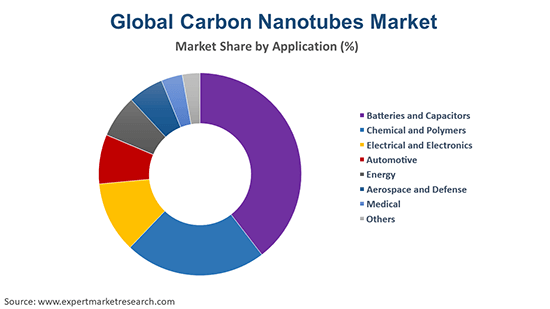

Market Breakup by Application

Key Insight: The carbon nanotubes industry value is expanding with wide usage in lithium-ion batteries and supercapacitors due to their excellent electrical conductivity, high surface area, and mechanical strength. Major EV battery makers incorporate multi-walled CNTs as conductive additives in electrodes. In June 2023, LG Chem revealed plans to build its fourth carbon nanotube manufacturing unit to meet the demand for next-gen materials for EV batteries. The segment further holds dominance in the market, driven by the explosive growth in electric vehicles, grid storage, and portable electronics as well as rising requirements for high-performance, reliable battery technologies.

Market Breakup by Region

Key Insight: North America leads the carbon nanotubes market due to strong infrastructure, advanced manufacturing capabilities, and significant investments in nanotechnology. In March 2025, the United States government-backed National Nanotechnology Initiative allocated USD 2.16 billion to support over 1,200 active nanotech projects in premier institutions. The region benefits from high demand for lightweight and conductive materials in electric vehicles, aerospace composites, and flexible electronics. Government funding and partnerships between academia and industry also accelerate CNT innovations, reinforcing the regional market growth.

Multi-Walled Carbon Nanotubes to Garner Popularity

The demand for multi-walled carbon nanotubes (MWCNTs) is growing for offering enhanced mechanical strength and durability. Industries are leveraging multi-walled carbon nanotubes to improve material toughness and thermal stability for industrial reinforcement. In June 2022, Bergen Carbon Solutions introduced MWCNTs to its portfolio after to scale production using its CO₂-to-nanofiber technology. Affordability and robust properties also ensure steady product demand, especially in sectors focused on structural enhancements and bulk material manufacturing.

CCVD & HiPCO Methods to Gain Traction

Catalytic chemical vapor deposition (CCVD) is gaining traction in the carbon nanotubes industry due to its ability to enhance yield and purity using metal catalysts. This method is highly suitable for producing vertically aligned and patterned CNT arrays. Companies employ CCVD for consistent single-walled carbon nanotubes production tailored to high-performance applications. This method also offers precision and superior material quality, making it increasingly attractive for next-gen nanotechnology applications.

The high pressure carbon monoxide reaction (HiPCO) method is deployed to yield extremely pure carbon nanotubes. HiPCO-produced carbon nanotubes are the most structurally uniform, making them a reference material for electronics, photonics, biomedical and sensing applications. This process is primarily used in research and specialized applications where purity as well as structural control are important, such as nanoelectronics and biomedical fields. Startups and research institutions are also deploying HiPCO for academic-grade materials.

Higher Carbon Nanotubes Application in Chemical and Polymers & Automotive

The carbon nanotubes market is expanding from the chemical and polymers segment due to increasing integration to develop advanced composites with improved strength, thermal resistance, and electrical conductivity. Industries use CNT-reinforced polymers for structural parts, flame retardants, and anti-static coatings. This segment is expanding rapidly in automotive, packaging, and construction, where lightweight yet durable materials are in demand. With widespread application in multiple end-use industries, chemical and polymer integration is gaining traction.

The automotive industry uses carbon nanotubes in body panels, tires, and electronic components to improve strength, reduce weight, and enhance electrical conductivity. Several companies are supplying nanotubes for EMI shielding and anti-static components in vehicles. CNTs are also used in sensors for in-vehicle electronics and smart systems. According to the IEA (International Energy Agency), over 4 million electric cars were sold during the first quarter of 2025. With this rapid growth in electric and connected vehicles, the product demand in automotive applications is further expanding.

Surging Carbon Nanotubes Demand in Europe & Asia Pacific

Europe holds significant share in the carbon nanotubes market, driven by robust industrial innovation and sustainability goals. Germany, the United Kingdom, and France are supporting CNT adoption in automotive, renewable energy, and construction sectors. Moreover, the push toward electric mobility and green energy solutions is increasing the demand in battery electrodes and composite reinforcements, solidifying Europe’s role in shaping the market advancements.

| CAGR 2026-2035 - Market by | Country |

| UK | 17.7% |

| USA | 17.1% |

| China | 16.3% |

| France | 16.2% |

| Mexico | 16.0% |

| Canada | XX% |

| Germany | XX% |

| Italy | XX% |

| Japan | XX% |

| India | XX% |

| Australia | 11.6% |

| Saudi Arabia | XX% |

| Brazil | XX% |

Asia Pacific carbon nanotubes market share is growing with the expanding electronics, automotive, and energy sectors, particularly in China, Japan, and South Korea. The demand for CNTs in lithium-ion batteries, semiconductors, and structural materials continues to rise. In July 2024, researchers at Peking University's Center for Carbon-Based Electronics unveiled the world's first carbon nanotube-based tensor processor chip, offering a promising solution for energy-efficient applications. Asia Pacific is further expected to grow due to increasing industrialization, government support, and domestic nanotech advancements.

Key players in the carbon nanotubes market are adopting a range of strategic initiatives to strengthen their position and capitalize on growing demand across industries. Technological innovation is urging companies to invest heavily in research & development to enhance properties, such as conductivity, strength, and thermal resistance, making them suitable for applications in electronics, aerospace, energy storage, and automotive sectors. Strategic partnerships and collaborations with research institutions, end-use industries, and material science firms are also common, enabling the development of tailored solutions.

Many firms are also expanding production capacities to meet rising global demand, particularly for multi-walled nanotubes due to their cost-effectiveness and versatility. Geographical expansion is another focus, especially in emerging markets, where industrial applications are rapidly growing. Sustainability is becoming increasingly important, prompting players to explore eco-friendly production methods and recyclable nanomaterials. Additionally, companies are adopting competitive pricing strategies, forming long-term supply agreements, and entering licensing deals to increase market penetration and ensure steady revenue streams.

Founded in 2004, Arkema Group is headquartered in Colombes, France, and specializes in advanced materials, including carbon nanotubes through its subsidiary, Graphistrength®. Arkema offers CNTs for use in electronics, composites, coatings, and energy storage, with a focus on enhancing material strength, conductivity, and lightweight properties.

Toray Industries, established in 1926 and headquartered in Tokyo, Japan, is a global leader in high-performance materials, offering carbon nanotubes primarily for use in aerospace, automotive, and electronic sectors. Toray’s CNT technologies support lightweight, durable, and conductive solutions, contributing significantly to advancements in composite materials.

Carbon Solutions, Inc., founded in 1998 and headquartered in Riverside, the United States, is known for its production and functionalization of carbon nanotubes and other nanomaterials. The company supplies high-purity CNTs tailored for academic research and industrial use,

particularly in electronics, coatings, sensors, and energy storage technologies.

Established in 2005, Cheap Tubes Inc. is headquartered in Grafton, the United States and offers a broad range of carbon nanomaterials. The company serves sectors like electronics, biomedical, aerospace, and energy, with a focus on affordability and customized nanotechnology solutions.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the carbon nanotubes market are Nanocyl SA, Jiangsu Cnano Technology Co., Ltd, and CHASM Advanced Materials Inc., among others.

Download our free sample report today to explore the latest carbon nanotubes market trends 2026, growth opportunities, and competitive strategies. Stay ahead in the evolving nanomaterials industry with Expert Market Research’s reliable insights and actionable data. Get your comprehensive market overview now!

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 10.96 Billion.

The market is projected to grow at a CAGR of 16.50% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 50.47 Billion by 2035.

Key strategies driving the market include technological innovation, strategic partnerships, expanding applications in electronics and energy, focus on sustainable production and recycling, increasing R&D investments, adoption of eco-friendly materials, and regional market expansions to meet rising demand across automotive, aerospace, and healthcare industries.

The key trends guiding the market growth include the ongoing R&D activities to enhance the applications of carbon nanotubes, the rising demand for multi-walled carbon nanotubes, and technological advancements and innovations.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The major types of carbon nanotubes are single walled and multi walled.

The significant methods in the market include chemical vapour deposition, catalytic chemical vapour deposition, and high pressure carbon monoxide reaction, among others.

The major applications of carbon nanotubes are batteries and capacitors, chemical and polymers, electrical and electronics, automotive, energy, aerospace and defence, and medical, among others.

The key players in the market report include Arkema Group, Toray Industries, Inc., Carbon Solutions, Inc., Cheap Tubes Inc., Nanocyl SA, Jiangsu Cnano Technology Co., Ltd, and CHASM Advanced Materials Inc., among others.

The North America leads the market due to strong infrastructure, advanced manufacturing capabilities, and significant investments in nanotechnology.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Method |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share