Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

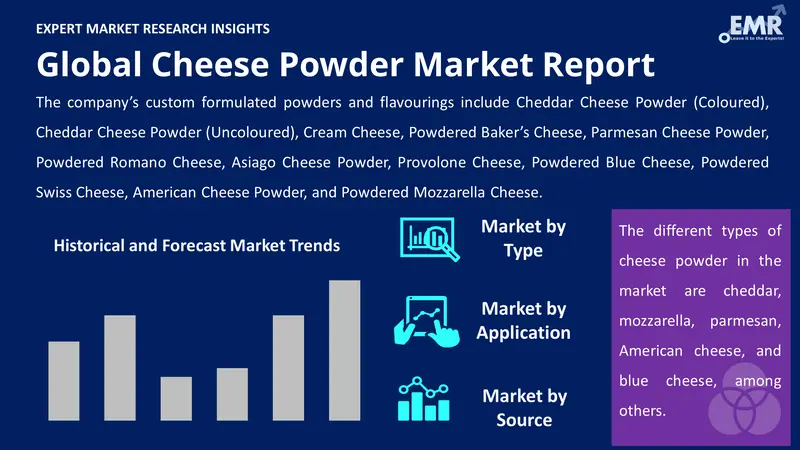

The cheese powder market attained a value of USD 5.35 Billion in 2025. The market is expected to grow at a CAGR of 6.80% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 10.33 Billion.

With the rise of veganism and lactose intolerance awareness, leading producers in the cheese powder industry are innovating to create dairy-free cheese powders derived from plant-based sources. These vegan cheese powders mimic the taste and texture of dairy cheese, catering to a growing consumer segment seeking alternatives. In December 2024, Armored Fresh launched two new plant-based cheeses, Grated Parmesan and Grated Kimchi Parmesan for expanding its alt-dairy offerings. This trend reflects broader dietary shifts and opens new revenue streams in the plant-based and specialty foods sectors.

Stringent food safety regulations and quality standards globally ensure that cheese powder products meet high safety benchmarks, increasing consumer trust. Regulatory frameworks promote transparency in labelling and encourage manufacturers to adopt best practices in production. Compliance with international food standards facilitates cheese powder export and import activities, supporting market globalization. In June 2025, India’s FSSAI proposed new quality standards for cheese powder, addressing regulatory gaps in processed food safety. Enhanced regulatory environments also drive innovation in clean label and allergen-free cheese powder products, aligning with evolving consumer demands.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6.8%

Value in USD Billion

2026-2035

*this image is indicative*

Innovations in drying and processing techniques to enhance quality, flavour retention, and solubility is favouring the cheese powder industry revenue. Technologies help to improve texture and rehydration properties, making cheese powders more affordable and accessible. In May 2024 Danish food tech startup FÆRM secured EUR 1.3 million from the BioInnovation Institute to scale its fermentation based plant cheese platform. Enhanced production technology also allows for customized formulations tailored to specific industries

Advanced packaging solutions extend the shelf life of cheese powders and preserve flavour integrity. In January 2025, Perfect Italiano launched new grated Parmesan canisters in Australia, offering two varieties for ensuring freshness and convenience for consumers. These innovations reduce spoilage and waste, lower transportation costs, and enhance product appeal on retail shelves. Improved packaging technology supports broader distribution and increased consumer confidence in product freshness, driving market growth, especially in regions with challenging climates or logistics.

The cheese powder market outlook is impacted by the global growth of the foodservice industry, including restaurants, fast-food chains, and catering. As per the USDA, food sales at foodservice outlets across the United States reached USD 1.54 trillion in 2024. Cheese powder offers consistent flavour, convenience, and extended shelf life, making it ideal for chefs and food manufacturers. As foodservice providers innovate menu offerings with cheese-flavoured items, the reliance on high-quality cheese powder increases, fuelling market expansion.

Urban populations with rising disposable incomes tend to spend more on premium and processed food products, including cheese-flavoured snacks and ready meals. As per the United Nations Population Fund, the global urban population is estimated to rise to about 5 billion by 2030. This demographic shift encourages the consumption of convenience foods incorporating cheese powder. The correlation between urban lifestyle changes and cheese powder consumption is a significant market growth driver, especially in developing countries experiencing rapid urbanization.

Sustainability concerns influence the cheese powder market as producers seek to minimize environmental impact by optimizing resource use and reducing waste during manufacturing. Consumers increasingly favour brands with sustainable sourcing and production practices, encouraging companies to innovate eco-friendly cheese powder offerings. In November 2022, Kerry Group introduced upcycled cheese powders that are 45% lower in greenhouse gas emissions compared to standard cheese powders. This driver promotes long-term market viability by aligning with global sustainability goals and consumer values.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Cheese Powder Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insight: Cheddar dominates the cheese powder market, driven by its versatile flavour and wide application across snacks, sauces, baked goods, and ready meals. With strong consumer recognition globally, this segment boosts demand in both retail and foodservice channels. Cheddar’s sharp, tangy profile appeals across age groups and geographies, driving its usage in nacho seasonings, pasta mixes, and instant sauces. In July 2023, Fonterra introduced Anchor Cheddar Cheese in Indonesia to meet the growing demand for quality cheese in home cooking. The demand is further supported by cheddar's use in plant-based and clean-label formulations, boosting market penetration.

Market Breakup by Application

Key Insight: The bakery and confectionery segment is a significant consumer of the cheese powder market, due to surging need to enhance flavour and texture in cheese breads, crackers, and savoury pastries. Cheese powders add a rich, creamy taste while providing shelf stability. Companies supply customized cheese powders for bakery applications, driving innovation with clean-label and organic options. In April 2024, Butter Buds Inc. introduced Cheese Buds® Simple Cheddar Cheese Concentrate, a clean-label and GMO free powdered cheese concentrate with uses in sauces, soups, seasonings, and baked goods. The rising demand for snack bars and cheese-filled baked goods worldwide boosts this segment.

Market Breakup by Source

Key Insight: Conventional cheese powder industry revenue is expanding, due to its widespread availability, lower cost, and broad application across food industries. Major players offer a wide range of conventional options tailored to various flavour profiles and functionalities. In October 2024, Pure Dairy partnered with Great Lakes Cheese to enhance the global reach of conventional cheese powders. The conventional segment also benefits from established supply chains and consistent quality, making it the preferred choice for large-scale food manufacturers prioritizing cost efficiency and taste.

Market Breakup by Region

Key Insight: North America holds a large share in the cheese powder market, driven by strong demand from the food processing and convenience food industries. The United States and Canada feature major cheese powder manufacturers and consumers, with innovations and expansions. In October 2022, DFA expanded its Zumbrota plant by adding a new facility and spray dryer that boosts specialty cheese powder output by ~30%. Rising consumption of processed snacks, ready meals, and sauces fuels market growth. Additionally, the region’s preference for cheddar and American cheese powders supports dominance, strengthening North America’s leadership in the sector.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Mozzarella & Parmesan Cheese Powder to Gain High Performance

Mozzarella cheese powder market share is growing largely due to its popularity in Italian cuisine and rising use in bakery and frozen foods. Known for its mild, creamy taste and excellent meltability, this cheese is frequently used in pizza-flavoured snacks and coatings. The surge in frozen and ready-to-eat pizzas globally drives mozzarella powder usage in seasoning blends. Companies leverage mozzarella in shelf-stable pasta kits and as a topping powder in snack foods. Innovations in dairy technology also allow the development of low-fat mozzarella powders, supporting health trends.

Parmesan holds a significant share of the cheese powder market, valued for its rich, umami flavour and long shelf life. This cheese is widely used in salad dressings, dry pasta mixes, and gourmet seasonings. In North America and Europe, it appears frequently in snack coatings and as a finishing powder for frozen meals. Companies provide customized parmesan powders to food manufacturers. In September 2024, Armored Fresh introduced a plant-based, oat milk-based Grated Parmesan cheese powder, leveraging patented technology to replicate traditional grating processes. The popularity of Italian cuisine and meal kits also supports growth.

Growing Cheese Powder Penetration in Sweet and Savoury Snacks & Sauces, Dressings, Dips, and Condiments

The cheese powder industry plays a vital role in sweet and savoury snacks, including chips, popcorn, and extruded snacks. This segment benefits from increasing preference of consumers for bold and diverse flavours. Cheese powder enhances taste without compromising texture, making it a popular choice among manufacturers. Major players supply large volumes to snack producers. Recent launches cater to health-conscious consumers. With rising snacking trends globally, especially in North America and Europe, this segment holds a strong position but ranks below bakery and confectionery in cheese powder consumption.

Sauces, dressings, dips, and condiments represent a growing segment for the cheese powder market, as they are used to provide creamy texture and rich flavour in cheese sauces, salad dressings, and dips. In April 2022, Aarkay introduced a high-purity cheese powder line targeting dips, mayo, and condiment sauces. The demand for convenient, ready-to-use products has led companies to develop specialized cheese powders targeting this segment. The organic and clean-label trends have further spurred innovation in cheese powder formulations. This segment’s growth is also fuelled by expanding foodservice and home cooking trends, particularly in emerging markets.

Surging Demand for Organic Cheese Powder

The organic segment of the cheese powder market is rapidly growing. Driven by increasing consumer demand for clean-label and natural products, organic cheese powders are made from milk sourced from organically raised animals. Companies and smaller artisanal producers are innovating organic cheese powders to cater to specialty food markets. In May 2025, Natural Grocers expanded its Organic Cheese lineup with five new house brand varieties under its clean-label pasture-raised dairy standards. This segment’s expansion is also fuelled by trends toward sustainability and transparency in food sourcing along with appeal in premium snacks, health foods, and plant-based cheese alternatives.

Surging Cheese Powder Consumption of Europe & Asia Pacific

The cheese powder market in Europe is benefiting from high consumer awareness about quality and variety. Germany, France, and the United Kingdom show strong demand for premium and artisanal cheese powders, including Parmesan and mozzarella variants. European manufacturers focus on sustainable production and organic options, with startups innovating in animal-free cheese powders. The region’s food service industry also heavily relies on cheese powders for convenience and flavour enhancement. Regulatory support for clean-label products and increasing vegan alternatives contribute to the steady regional growth.

Asia Pacific is the fastest growing segment of the cheese powder market. Rising urbanization, expanding foodservice sectors, and changing dietary habits in China, India, and Japan drive demand. As per Asian Development Bank, over 55% of the Asian population is expected to be urban by 2030. Increasing adoption of Western-style snacks, ready-to-eat meals, and processed foods encourages cheese powder use. Companies are partnering with local players to expand production and distribution. The region also shows immense potential due to rising disposable incomes and interest in diverse cheese flavours, including cheddar and mozzarella powders.

Key players in the cheese powder market are deploying strategies that focus on innovation, expansion, partnerships, and sustainability to meet growing global demand. Companies are increasingly developing clean-label, organic, vegan, and fortified cheese powder variants to align with health-conscious consumer preferences. Technological advancements in spray-drying, encapsulation, and freeze-drying are enhancing flavour retention, shelf life, and texture, improving product quality and performance. Strategic mergers, acquisitions, and partnerships allow players to expand market share, gain advanced technologies, and diversify product portfolios.

Global expansion is another core focus, particularly into emerging markets in Asia-Pacific, the Middle East, and Latin America, where demand for convenience foods and Western flavours is rising. Investments in large-scale production facilities also ensure supply chain efficiency and regional presence. Additionally, players are emphasizing sustainability by reducing emissions, improving energy efficiency, and adopting recyclable packaging. E-commerce and direct-to-consumer strategies are being utilized to reach new customer bases. Overall, innovation, expansion, and sustainability form the backbone of the market's competitive strategies.

Founded in 1972 and headquartered in Tralee, Ireland, Kerry Group is a global leader in taste and nutrition solutions. The company is renowned for its innovation in clean-label and plant-based ingredients. Through strategic acquisitions and research, Kerry has advanced functional food technologies and expanded its global footprint in foodservice.

Established in 2015 via the merger of Kraft Foods and H.J. Heinz, the company is headquartered in Chicago and Pittsburgh. Kraft Heinz is known for its iconic food brands and innovation in convenience foods with strong focus on portfolio optimization, including divesting non-core businesses and investing in better-for-you product lines.

Archer Daniels Midland Company (ADM), founded in 1902 and headquartered in Chicago, the United States, is a global agricultural processing and food ingredient powerhouse. The company is recognized for innovations in plant-based proteins and sustainable ingredients and has made significant strides in bio-based product development and eco-friendly processing technologies.

Founded in 1951 and based in Ringe, Denmark, Lactosan specializes in cheese powder production. Known for its proprietary fermentation and drying techniques, the company supplies tailored cheese solutions to global food manufacturers. Lactosan’s innovations focus on flavour stability, clean-label formulations, and optimizing cheese applications for soups, snacks, and sauces.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the cheese powder market are Aarkay Food Products Ltd., among others.

Discover the latest cheese powder market trends 2026 with our detailed report. Download your free sample today to explore key growth drivers, market size, and competitive insights. Stay ahead in the industry with expert analysis and strategic forecasts. Get your cheese powder market report sample now to make informed business decisions and capitalize on emerging opportunities.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 6.80% between 2026 and 2035.

The key strategies driving the market include product innovation with clean-label, organic, vegan, and fortified options to meet evolving consumer preferences. Technological advancements in drying and encapsulation enhance product quality, while mergers and acquisitions expand market reach. Additionally, growth in emerging markets and foodservice sectors fuels demand.

Rapidly growing fast-food industry and changing dietary preferences of people are the key industry trends propelling the market's growth.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The different types of cheese powder in the market are cheddar, mozzarella, parmesan, American cheese, and blue cheese, among others.

The significant applications are bakery and confectionery, sweet and savoury snacks, sauces, dressings, dips, and condiments, and ready meals, among others.

Based on source, the market is classified into conventional and organic.

The key players in the market report include Kerry Group Plc, The Kraft Heinz Company, Archer Daniels Midland Company (ADM), Lactosan A/S, and Aarkay Food Products Ltd., among others.

In 2025, the market reached an approximate value of USD 5.35 Billion.

Cheddar dominates the market, driven by its versatile flavour and wide application across snacks, sauces, baked goods, and ready meals.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Source |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share