Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

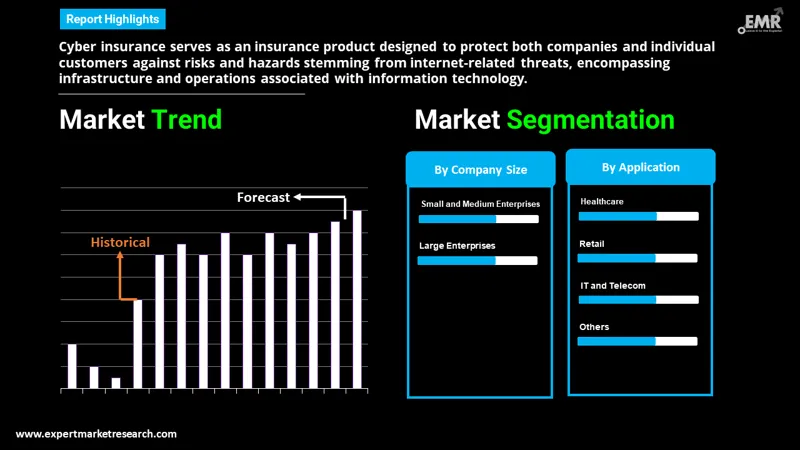

The global cyber insurance market attained a value of USD 15.89 Billion in 2025 and is projected to expand at a CAGR of 24.20% through 2035. The market is further expected to achieve USD 138.78 Billion by 2035. Rapid adoption of AI, IoT, and cloud-native architectures is multiplying systemic cyber exposures, pushing enterprises to buy advanced policies that offer continuous risk monitoring, faster claims workflows, and broader digital-asset protection.

The global market is expanding fast as insurers shift from generic coverage to deeply engineered, analytics-heavy risk solutions. A notable development shaping this transition came in July 2025, when Munich Re expanded its new Cyber Coverage suite, integrating real-time ransomware probability scoring. This advancement matters because global ransomware incidents surged nearly 300 times according to the cyber insurance market analysis, pushing enterprises to demand insurance products that evaluate exposures with far better accuracy and flexibility.

Major insurers and reinsurers are also investing aggressively in AI-based risk modeling, attack-surface management, and automated claims triage. Companies like AIG, Chubb, and AXA XL are restructuring their cyber portfolios around industry-specific profiles, giving high-risk verticals such as BFSI, healthcare, and logistics more adaptive coverage frameworks, influencing the cyber insurance market growth trajectory. For example, in May 2025, CyberCube partnered with Aviva to leverage AI for advanced cyber threat actor intelligence and improved portfolio risk management. These players increasingly collaborate with cybersecurity vendors to integrate telemetry into underwriting systems, narrowing loss ratios while giving clients actionable insights instead of only financial indemnity.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

24.2%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Cyber Insurance Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 15.89 |

| Market Size 2035 | USD Billion | 138.78 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 24.20% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 25.9% |

| CAGR 2026-2035 - Market by Country | India | 26.0% |

| CAGR 2026-2035 - Market by Country | China | 25.8% |

| CAGR 2026-2035 - Market by Company Size | Small and Medium Enterprises | 26.2% |

| CAGR 2026-2035 - Market by Application | IT and Telecom | 26.4% |

| Market Share by Country 2025 | Mexico | 2.0% |

Ransomware continues to be the primary growth motivator for cyber insurers as threat actors scale extortion, data-leak and double-extortion tactics. Insurers are seeing larger, more complex claims and longer business interruption tails, which is forcing capacity limits, higher retentions and stricter underwriting standards. The rise of many new ransomware groups and continued daily incident volumes is pushing insurers to require better incident response, segmented backup strategies and negotiated access to IR vendors as policy conditions, accelerating the cyber insurance market revenue growth. In October 2025, HyperBunker raised USD 920,000 seed funding for a new anti-ransomware device that goes beyond simple data backup.

New rules including EU’s NIS2, DORA and national equivalents, and sectoral regulation are expanding mandatory cybersecurity standards, governance, and incident reporting. Organizations subject to these rules are seeking cyber insurance not only for indemnity but to demonstrate risk transfer and compliance readiness, insurers are embedding compliance conditions into policies and offering advisory services to help customers meet obligations, changing the cyber insurance market dynamics. In November 2025, for instance, CyberCatch Holdings, Inc. announced the launch of a unique and innovative solution for the 337,968 defense sector suppliers in the United States who must now comply with new CMMC regulation. This is increasing demand for tailored coverages and regulatory-aligned endorsements, while regulators’ emphasis on resilience is pushing insurers to underwrite only with robust cyber hygiene.

Artificial intelligence is accelerating both attack sophistication with automated phishing, deepfake social engineering and defenders’ analytic capabilities. For insurers, AI is enabling better predictive models, automated underwriting and claims triage, but also increasing attack frequency and new systemic threat vectors. In November 2025, Rockwell Automation launched SecureOT, a cybersecurity suite enhancing industrial safety by boosting asset visibility and compliance, widening the cyber insurance market scope. Insurers are therefore investing in AI-enabled threat scoring, real-time telemetry ingestion and model governance to keep loss ratios sustainable while developing new policy triggers that reflect dynamic exposures. Industry papers highlight rapid AI adoption across insurance functions and the need to manage model risk carefully.

Buyers, especially SMEs, are preferring policies that combine prevention with rapid, parametric payouts for defined events. Insurtechs are packaging telemetric monitoring, tabletop exercises, and guaranteed IR access into policies to reduce severity and speed recovery, creating new cyber insurance market opportunities. In July 2025, Intersys India cyber insurance services launched to help re/insurers and brokers support policyholders with better cyber risk visibility. This is changing pricing models toward subscription and loss component structures and creating opportunities for vendor partnerships with MSSPs and EDR vendors.

Cyber insurance is fast-growing but cyclical, while market capacity and pricing react to loss years and systemic events. Premium pools are expanding as more sectors and regions adopt cyber cover, yet reinsurers and primary carriers demand stronger underwriting data. This is encouraging innovation in policy wording, multi-year programs, and risk aggregation analytics to prevent systemic exposure. The combination of growing premiums and rising losses is prompting carriers to diversify product design and deepen actuarial modelling to keep the market sustainable.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Cyber Insurance Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Company Size

Key Insight: Company size as considered in the cyber insurance industry report defines demand and product complexity. Large enterprises need bespoke capacity, multi-jurisdictional wording, and active loss-control partnerships while SMEs demand simple, affordable, telemetry-driven packages with rapid IR access and parametric options. Brokers and carriers are segmenting distribution, white-glove actuarial support for big accounts and digital, automated journeys for SMEs.

Market Breakup by Application

Key Insight: BFSI requires transaction and fraud modules with strong controls. Healthcare needs clinical continuity and regulatory defence. IT/telecom focuses on infrastructure interruption and service SLAs, accelerating demand in the cyber insurance market. Retail deals with POS and supply-chain fraud while other verticals vary by data sensitivity and physical-digital linkage. Insurers are therefore offering verticalized products, embedding sector-specific cyber hygiene preconditions and setting bespoke response playbooks.

Market breakup by Region

Key Insight: North America is mature with complex, high-limit programs. The cyber insurance market in Europe is regulation-driven, demanding compliance alignment. Asia Pacific is scaling rapidly with untapped SME demand. Latin America and Middle East and Africa show opportunistic growth tied to digitalization. Strategic alliances with reinsurers, MSSPs, and local brokers have become critical to manage capacity, underwriting consistency and regulatory compliance across jurisdictions.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

By company size, large enterprises account for the largest premium share due to scale

Large enterprises dominate cyber premium pools because of concentrated digital footprints, complex supply chains and higher potential business interruption losses. These organizations demand broader capacity limits, bespoke wording such as multinational coverage, contingent business interruption, and integrated risk management services. Carriers are offering layered and captive-friendly programs, bespoke retentions and dedicated underwriting teams to handle complex exposures like third-party cloud outages or supply-chain attacks.

SMEs are the fastest-growing buyer group boosting the cyber insurance market revenue, due to increased awareness, regulatory spillover, and the rise of affordable, tech-enabled products such as micro-policies, subscription models, and quick IR access. Insurtech firms are bundling monitoring, automated patching signals, and rapid-response retainers into SME offerings, reducing post-breach claim sizes. In September 2025, Encora partnered with Howden to launch Cyber+, democratizing cyber insurance for SMEs across 30 countries. Parametric triggers and standardized indemnity products are simplifying underwriting and reducing acquisition costs.

By application, BFSI is leading the market owing to high data sensitivity and exposure

Banking, financial services and insurance remain the largest application because they hold high-value customer data, run real-time payment systems and are attractive targets for fraud and ransomware. BFSI clients demand extensive cyber liability, crime, and regulatory-response coverage along with sophisticated risk engineering services. Insurers are creating sector-specific modules addressing transaction fraud, payment-switch compromises and third-party cloud provider outages. In October 2025, Desjardins Insurance launched a new product for businesses looking for cybersecurity and fraud protection. Underwriting often requires advanced SOC maturity, PKI controls, and fraud detection tooling.

The cyber insurance market report indicates that healthcare applications are growing at the fastest pace because clinical systems, medical devices and patient data make incidents both costly and socially critical. Ransomware against hospitals causes immediate patient-care disruption and reputational damage, which raises claim severity. Carriers are developing healthcare-tailored products combining cyber liability with regulatory defense (HIPAA/GDPR breaches), patient notification support, and prioritized IR for clinical continuity.

North America dominates the global industry owing to higher adoption and capacity

North America holds the strongest position in the market due to higher cyber insurance penetration, a mature broker market, and large data-rich organizations seeking transfer solutions. The region also hosts many primary reinsurers and insurtech innovators, enabling capacity and product experimentation. Carriers in North America are investing heavily in AI underwriting tools, threat intelligence partnerships, and claims automation to manage volumes and loss severity.

The cyber insurance market in Asia Pacific is growing fast as digital adoption, cloud migration and e-commerce expand rapidly across SMEs and large enterprises. National industrial policies are encouraging domestic insurers to underwrite cyber risk, while insurtech firms introduce low-touch distribution for SMEs. However, penetration remains low compared to North America and Europe, creating room for rapid premium growth. In January 2025, WTW launched a new cyber insurance facility, CyCore Asia, aimed at companies in Singapore and Hong Kong. Carriers are partnering with local MSSPs and brokers to bridge capability gaps. Investment in telemetric underwriting and parametric solutions is enabling scalable SME coverage in the region.

| CAGR 2026-2035 - Market by | Country |

| India | 26.0% |

| China | 25.8% |

| Saudi Arabia | 25.3% |

| Mexico | 24.8% |

| UK | 24.8% |

| USA | 23.4% |

| Canada | XX% |

| France | XX% |

| Italy | XX% |

| Japan | XX% |

| Australia | XX% |

| Brazil | XX% |

| Germany | 22.8% |

Leading cyber insurance market players are investing heavily in risk quantification platforms, API-based threat-intelligence feeds, and automated claims systems that minimize loss-adjustment time for enterprise clients. Many players are actively partnering with cybersecurity vendors to launch bundled solutions that merge real-time detection with pre-breach advisory, giving them more accurate loss forecasting and tighter risk control.

With ransomware severity increasing nearly every year, cyber insurance companies are refining exclusions, recalibrating capacity, and introducing parametric covers for cloud outages, SaaS disruptions, and systemic technology failures. At the same time, growing SME participation is opening opportunities for modular, usage-based cyber policies. Insurers who invest in behavioral analytics, continuous monitoring, and digital-forensic automation are expected to secure long-term competitive advantage.

Aon Plc, established in 1982 and headquartered in London, is one of the largest global brokers shaping how cyber risk is quantified and transferred. The company leverages its Cyber Quotient Evaluation platform, extensive incident databases, and advanced modeling engines to help clients benchmark threat exposure and negotiate tailored coverage.

American International Group Inc., founded in 1919 and headquartered in New York, is expanding its cyber underwriting capabilities with proprietary threat-scoring tools and sector-specific exposure models. AIG delivers integrated solutions combining pre-breach assessments, managed detection support, and digital forensics, catering especially to high-risk sectors like financial services and healthcare.

Allianz Global Corporate and Specialty SE, established in 2006 and headquartered in Munich, is strengthening its cyber portfolio by fusing insurance offerings with advanced threat-intelligence platforms and continuous security monitoring. The company provides multi-layered coverage designed for systemic cloud events, supply-chain compromise, and ransomware escalation.

Berkshire Hathaway Specialty Insurance Co., founded in 2013 and headquartered in Boston, United States, offers highly customizable cyber policies supported by deep financial capacity and a disciplined underwriting approach. BHSI is expanding specialty cyber solutions for industrial sectors where operational technology exposure is rising, helping clients address intertwined physical and digital risk scenarios with greater confidence.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the cyber insurance market report include Lockton Companies Inc., Chubb Group Holdings Inc., Munich Re, XL Catlin Insurance Co. UK Ltd., Zurich Insurance Co. Ltd., and The Hanover Insurance Group, among others.

Unlock the latest insights with our cyber insurance market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 15.89 Billion.

The market is projected to grow at a CAGR of 24.20% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035, reaching a value of around USD 138.78 Billion by 2035.

Stakeholders are strengthening data-sharing alliances, adopting AI-driven risk models, expanding parametric offerings, integrating cyber-resilience services with policies, and forming partnerships with threat-intelligence vendors to improve prevention and underwriting accuracy.

The key cyber insurance market trends include increasing awareness of cyber threats among high-level managers, growing number of mandatory legislations for data security, and rising investments in cyber insurance by small and medium enterprises.

The major regional markets are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The significant company sizes in the market for cyber insurance are small and medium enterprises and large enterprises.

The various applications of cyber insurance in the market include BFSI, healthcare, IT and telecom, and retail, among others.

The key players in the market include Aon Plc, American International Group Inc., Allianz Global Corporate and Specialty SE, Berkshire Hathaway Specialty Insurance Co., Lockton Companies Inc., Chubb Group Holdings Inc., Munich Re, XL Catlin Insurance Co. UK Ltd., Zurich Insurance Co. Ltd., and The Hanover Insurance Group, among others.

IT and telecom application is expected to grow at 26.4% CAGR through 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Company Size |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share