Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global deepwater and ultra-deepwater drilling market was valued at USD 6.43 Billion in 2025. The market is expected to grow at a CAGR of 6.80% during the forecast period of 2026-2035 to reach a value of USD 12.41 Billion by 2035. Increasing adoption of AI-driven subsea monitoring, autonomous drilling systems, and hybrid floating production solutions is accelerating efficiency and reducing operational risks in the market.

The industry is being driven by the increasing demand for offshore oil and gas production to meet rising global energy requirements. Technological advancements in subsea drilling systems, dynamic positioning, and floating production units are enabling operations at depths exceeding 3,000 meters. According to the deepwater and ultra-deepwater drilling market analysis, deepwater production is set to increase by over 60% between 2022 and 2030, growing from 6% to 8% of overall upstream production. Ultra-deepwater production, from depths of 1,500 meters and above is growing fast and by 2024 it was expected to account for more than half of all deepwater production.

Government initiatives are further bolstering market growth. Brazil’s ANP (National Petroleum Agency) launched auctions in June 2025, promoting ultra-deepwater exploration in the pre-salt basins, while the United States Department of the Interior continues to provide leasing opportunities in the Gulf of Mexico for advanced offshore projects, boosting growth in the deepwater and ultra-deepwater drilling market. Similarly, Norway’s Petroleum Directorate supports sustainable deepwater exploration through regulatory frameworks that encourage technological innovation while ensuring environmental compliance.

Additionally, rising investments in renewable-integrated floating platforms and dual-purpose drilling rigs are expanding opportunities for hybrid energy solutions. Companies are increasingly focusing on autonomous drilling systems and AI-enabled predictive maintenance to enhance operational efficiency. Coupled with the growing global energy demand, these developments position deepwater and ultra-deepwater drilling as critical contributors to long-term offshore production strategies.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6.8%

Value in USD Billion

2026-2035

*this image is indicative*

The integration of AI, robotics, and advanced subsea equipment is transforming deepwater drilling operations. Companies like Transocean and Saipem are deploying autonomous drilling platforms and real-time monitoring tools, enabling safer operations at extreme depths. Dynamic positioning systems allow drillships to maintain precision in rough offshore conditions, boosting deepwater and ultra-deepwater drilling market opportunities. For example, Transocean’s Deepwater HD rigs support ultra-deepwater projects exceeding 3,500 meters, enhancing productivity while minimizing downtime. These innovations reduce operational costs and enhance the viability of previously inaccessible offshore reserves.

Government programs globally are spurring market growth. Brazil's pre-salt auctions, the United States' Gulf of Mexico leasing programs, and Norway's offshore technology incentives are facilitating exploration in the deepwater and ultra-deepwater areas. Such policies offer fiscal incentives, guarantee regulatory compliance, and spur investment in cutting-edge drilling technology, driving demand in the deepwater and ultra-deepwater drilling market. Governments are catalyzing innovation and long-term market equilibrium for offshore energy production by lowering the barriers to entry and ensuring safe operations.

Global energy consumption is projected to increase by 30% by 2050, according to the deepwater and ultra-deepwater drilling market analysis. Deepwater and ultra-deepwater drilling is critical to bridging the supply-demand gap, especially for oil and natural gas. Offshore fields such as Brazil’s pre-salt and West Africa’s ultra-deepwater reserves are experiencing accelerated development to meet industrial, transportation, and power-generation needs. This trend supports continuous investments in drilling infrastructure, subsea equipment, and predictive maintenance systems.

AI-enabled predictive maintenance, digital twins, and real-time drilling analytics are revolutionizing operational efficiency in deepwater projects. Companies like Schlumberger and Halliburton are using AI to optimize well trajectories, reduce equipment failures, and monitor environmental conditions. This data-driven approach improves decision-making, minimizes downtime, and ensures adherence to strict safety and environmental standards, creating a competitive advantage for early technology adopters, reshaping the deepwater and ultra-deepwater drilling market trends and dynamics.

Sustainable drilling practices are becoming critical, with emphasis on minimizing environmental impact. Advanced blowout preventers, zero-discharge systems, and hybrid floating platforms enable compliance with stringent regulations. For example, Equinor’s Johan Sverdrup field employs eco-efficient subsea technologies to reduce carbon footprint. Governments and international bodies mandate adherence to environmental standards, driving operators to adopt energy-efficient and safer drilling technologies, while ensuring responsible exploitation of offshore reserves.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Deepwater and Ultra-Deepwater Drilling Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

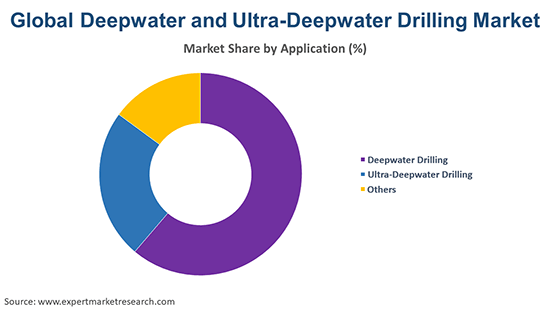

Market Breakup by Application

Key Insight: Deepwater drilling largely contributes to the deepwater and ultra-deepwater drilling industry growth due to established offshore reserves and mature basin development, while ultra-deepwater drilling grows fastest through high-yield pre-salt and extreme-depth projects. Niche applications such as marginal fields and hybrid energy-integrated offshore platforms are supporting specialized exploration opportunities, offering operators new revenue streams. All these applications are shaping a more diverse, technologically advanced, and resource-optimized offshore drilling landscape, enabling long-term energy security and efficiency-driven exploration strategies.

Market Breakup by Region

Key Insight: North America dominates the global market with mature Gulf of Mexico reserves and advanced offshore infrastructure, while Asia Pacific observes growth through aggressive exploration in Malaysia, India, and Australia. Europe emphasizes sustainable offshore drilling supported by strict environmental frameworks, whereas the Latin American market expands via high-yield pre-salt basins. Meanwhile, the Middle East & Africa are increasingly leveraging untapped ultra-deepwater reserves, driving large-scale investments and technological adoption to secure future energy supplies and diversify regional economies.

By application, deepwater drilling accounts for the largest share of the market due to high offshore production needs

Deepwater drilling dominates the global market due to established infrastructure in regions like the Gulf of Mexico, Brazil, and West Africa. Mature deepwater fields provide steady production and attract continuous investment from international oil companies, leveraging advanced rigs, subsea systems, and AI-enabled operational tools for reliable extraction.

Ultra-deepwater drilling is witnessing rapid growth in the deepwater and ultra-deepwater drilling industry for exploration of pre-salt basins in Brazil, Angola, and Guyana. Cutting-edge drillships, autonomous subsea tools, and advanced blowout preventers facilitate operations beyond 3,000 meters. High potential reserves and technological advancements drive demand for ultra-deepwater solutions, positioning it as the fastest-growing application category.

North America secures the largest share of the market due to Gulf of Mexico production

North America leads the market, driven by its advanced offshore infrastructure in the Gulf of Mexico. The region benefits from next-generation rigs, dynamic positioning systems, and AI-based digital monitoring, which enhance operational safety and efficiency. Further, robust regulatory support in the forms of offshore leasing programs, tax credits, and long-term licensing agreements offers stability to operators.

The Asia Pacific deepwater and ultra-deepwater drilling market is growing at a fast pace, driven by drilling activities in Malaysia, Indonesia, India, and offshore Australia. Governments are encouraging ultra-deepwater investments via favorable policies and incentives, while growing regional energy demand fuels offshore development. Increased use of more advanced drilling technologies coupled with local content requirements is enhancing regional capabilities. In addition, strategic partnerships with international oil companies are facilitating knowledge transfer and capital flows, positioning the Asia Pacific region as a primary growth center in offshore drilling.

Global deepwater and ultra-deepwater drilling market players are emphasizing technological innovation, digitalization, and environmentally friendly offshore operations. They are concentrating their efforts on autonomous drilling systems, predictive maintenance with the aid of artificial intelligence, hybrid floating platforms, and eco-efficient subsea technology. Firms are venturing into previously untapped ultra-deepwater basins and incorporating renewable energy solutions into offshore platforms.

Deepwater and ultra-deepwater drilling companies are discovering profitable prospects in pre-salt reservoirs, West African offshore basins, and Southeast Asian ultra-deepwater exploration. Government initiatives and strategic partnerships with oil companies, coupled with spending on intelligent drilling and surveillance systems, are expected to boost firms with a competitive edge, fueling long-term expansion.

Diamond Offshore Drilling Inc., founded in 1953 and based in Houston, Texas, United States, is a deepwater and ultra-deepwater drilling services company. The firm employs technology-driven drillships and dynamic positioning-capable semi-submersibles with real-time monitoring systems. Diamond Offshore focuses on safety, efficiency, and environmental regulations while catering to leading oil and gas industry players around the world.

Valaris Limited, established in 1975 with its head office in the United States, is one of the largest offshore drilling contractors with a specialization in deepwater and ultra-deepwater drilling. Valaris has a drilling fleet of drillships, jack-ups, and semi-submersibles providing advanced well construction and subsea support. The organization prioritizes digital integration, such as predictive maintenance and remote monitoring, to enhance efficiency.

Saipem Spa, a Milan, Italy-based company founded in 1957, provides offshore drilling, engineering, and subsea services. Saipem employs advanced drillships and semi-submersibles with AI-based monitoring and autonomous subsea equipment. The company focuses on green-efficient technologies, including zero-discharge operations and hybrid floating platforms.

Schlumberger Ltd., established in 1926 and based in France, is a global oilfield services leader, from deepwater to ultra-deepwater drilling. Schlumberger uses AI, digital twins, and real-time analysis to refine drilling operations and forecast equipment failure. Its state-of-the-art subsea technologies, well construction solutions, and remote monitoring decrease risks and enhance efficiency.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other prominent players in the market include Transocean Ltd., Nabors Industries Ltd., Seadrill Limited, Ensco Rowan Plc, and Halliburton Co., among others.

Explore the latest trends shaping the deepwater and ultra-deepwater drilling market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on deepwater and ultra-deepwater drilling market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 6.80% between 2026 and 2035.

Stakeholders are investing in autonomous rigs, enhancing predictive maintenance, expanding into pre-salt and Southeast Asian ultra-deepwater projects, adopting eco-efficient technologies, and forming strategic partnerships with governments and oil majors.

Key drivers of the industry are various government initiatives to encourage foreign investment and increasing the production of oil and gas.

The major regions in the industry are North America, Europe, Asia Pacific, Latin America, and Middle East and Africa.

Deepwater drilling and ultra-deepwater drilling, among others are the major applications of the market.

The key players in the market include Diamond Offshore Drilling Inc., Valaris Limited, Saipem Spa, Schlumberger Ltd., Transocean Ltd., Nabors Industries Ltd., Seadrill Limited, Ensco Rowan Plc, and Halliburton Co., among others.

In 2025, the deepwater and ultra-deepwater drilling market reached an approximate value of USD 6.43 Billion.

Companies face high capital expenditure, complex ultra-deepwater environments, regulatory compliance pressures, technological integration challenges, and fluctuating oil prices affecting project viability and operational efficiency.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share