Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global earphones and headphones market size was valued at USD 64.56 Billion in 2025. The industry is expected to grow at a CAGR of 20.50% during the forecast period of 2026-2035 to reach a value of USD 416.71 Billion by 2035. The convergence of artificial intelligence, advanced device integration, and innovative audio technologies is fundamentally transforming the capabilities of earphones and headphones, thereby boosting the market growth.

These devices are evolving beyond simple audio playback to become integral components of users’ digital ecosystems. Consumers now expect seamless interoperability between their smartphones, wearables, and AI-powered assistants, prompting leading brands to introduce increasingly sophisticated features that deliver a highly personalized and cohesive audio experience.

For example, in August 2024, Google introduced the Pixel Buds Pro 2, equipped with the Tensor A1 chip and Gemini AI. These earbuds offer automatic sound adjustment, real-time language translation, and voice command responsiveness, all optimized within the Pixel ecosystem. Shortly thereafter, in September 2025, Samsung unveiled the Galaxy Buds 3 FE, which feature AI-enhanced call clarity, active noise cancellation, and effortless pairing with other Galaxy devices, thereby democratizing access to premium functionalities.

These advancements are not merely incremental, rather they are redefining how individuals communicate, interact, and consume audio content. This ongoing innovation primarily driving growth in the earphones and headphones market.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

20.5%

Value in USD Billion

2026-2035

*this image is indicative*

The rapid growth of streaming, gaming, and digital content consumption is significantly boosting the earphones and headphones market growth by increasing the demand for advanced personal audio solutions. Qualcomm anticipated this trend and introduced its S7 and S7 Pro Gen 1 Sound Platforms in November 2023, delivering ultra-low latency, spatial audio, and integrated Wi-Fi capabilities to earbuds and headphones. For manufacturers, this represents a pivotal advancement, enabling the delivery of richer, more immersive sound experiences. Consequently, audio brands are accelerating the release of wireless models equipped with sophisticated features to align with contemporary patterns in music consumption, video streaming, and gaming.

The earphones and headphones market trends are no longer focused solely on high-end headphones; there is a growing expectation for comprehensive features at accessible price points, driving growth in the mid-tier segment. For example, in February 2023, Sony unveiled the WH-CH720N and WH-CH520 wireless headphones, both incorporating the Integrated Processor V1 chip and advanced noise-cancelling technology at competitive prices. This democratization of premium features is broadening access to high-quality sound and noise cancellation, making superior audio experiences available to a more diverse consumer base across multiple price categories.

As fitness, cycling, running, and outdoor activities become integral to daily routines, consumers increasingly require audio equipment that can match active lifestyles. Recognizing this, Jabra launched its Elite 8 Active and Elite 10 earbuds in August 2023, offering IP68 durability, sweat resistance, Dolby Atmos support, and immersive spatial audio. Many companies in the earphones and headphones market are now targeting not only commuters and home listeners but also those engaged in movement and exercise, expanding the market and fostering greater brand loyalty among active users.

At the upper end of the market, audio companies are intensifying their focus on superior sound quality, premium materials, and refined aesthetics, resulting in a surge of luxury offerings. At CES 2024, Sennheiser debuted the MOMENTUM True Wireless 4 earbuds, featuring the Qualcomm S5 Sound Gen2 platform, aptX Lossless, Bluetooth 5.4, and Auracast support. These developments underscore an increasing consumer emphasis on acoustic fidelity and product prestige, indicating that headphones are viewed as both a functional accessory and a statement of personal taste, thereby expanding the earphones and headphones market scope.

Personal audio devices are extending beyond traditional gym and urban use, finding relevance in specialized sports and outdoor pursuits. At CES 2024, Shokz presented the OpenSwim Pro, bone-conduction waterproof earbuds tailored for swimmers and endurance athletes. Offerings such as these are establishing new sub-categories and attracting highly dedicated users. As consumers identify novel environments for audio consumption, the overall market continues to diversify and expand into new segments.

The global headphones market dynamics are undergoing an evolution, with innovation extending beyond acoustics to encompass materials and craftsmanship. Brands are merging premium design elements with exceptional audio performance to appeal to both audiophiles and mainstream listeners. For instance, Fiio’s 2025 FT13 headphones are constructed from rare South American purpleheart wood, delivering a warm, clear tonal signature. This trend clearly signals that outstanding sound quality and distinctive design are now inseparable in defining modern audio products.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Earphones and Headphones Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product

Key Insights: Earphones prioritize convenience, catering to consumers seeking portability for mobile usage, streaming, or fitness activities. True wireless earphones have become ubiquitous, particularly among commuters and multitaskers. For instance, Skullcandy’s EcoBuds, introduced in March 2024, emphasize sustainability and affordability, making them accessible to a wide consumer base. Conversely, headphones are preferred by individuals seeking an enhanced, immersive audio experience. Features such as noise cancellation and superior comfort are particularly valued by remote workers, travelers, and those who require isolation for focused listening.

Market Breakup by Price

Key Insights: In terms of pricing, products less than USD 50 dominate sales volumes, contributing to the earphones and headphones market revenue as it attracts first-time buyers and frequent streamers with budget-friendly options. The USD 50– USD100 segment introduces advanced functionalities, including active noise cancellation and improved audio quality. A notable example is EarFun’s Air Pro 4+, launched in October 2025, which offers Hi-Res audio and sophisticated ANC capabilities at a sub-USD100 price point. The premium segment, exceeding USD 100, focuses on delivering superior sound fidelity, premium materials, and meticulous craftsmanship, targeting audiophiles and loyal brand enthusiasts.

Market Breakup by Technology

Key Insights: The market is further differentiated by technology into wired versus wireless. Wired models with active noise cancellation remain popular among users who prioritize lag-free, high-fidelity audio. However, most consumers now prefer wireless solutions for their portability, seamless connectivity, and integration of smart features. Bluetooth-enabled and smart headphones are experiencing accelerated adoption. Skullcandy’s Icon ANC, released in October 2024, exemplifies this trend with advanced noise cancellation and extended battery life, establishing a strong presence within the mid-premium segment.

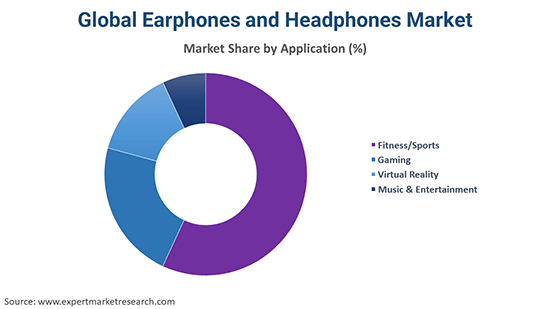

Market Breakup by Application

Key Insights: The proliferation of fitness and sports applications has pushed the earphones and headphones market development, surging the demand for earphones and headphones designed to withstand active lifestyles, emphasizing sweat resistance and secure fit. In response, Beats introduced the Powerbeats Fit earbuds in September 2025, specifically targeting consumers with dynamic routines. In the gaming sector, users increasingly seek spatial audio, minimal latency, and highly compatible devices. Virtual reality enthusiasts are prioritizing comprehensive 3D audio experiences, while those streaming music or films demand impeccable sound clarity and uninterrupted performance.

Market Breakup by Region

Key Insights: North America is distinguished by strong demand for premium brands and early adoption of new technologies. Europe prioritizes eco-conscious products and superior design aesthetics. The Asia Pacific region is experiencing the most rapid expansion, fueled by widespread smartphone upgrades and a growing appetite for advanced audio solutions; for instance, OnePlus launched the Buds 4 in July 2025 to enhance its technology ecosystem. Meanwhile, Latin America and the Middle East & Africa are witnessing increased consumer spending and market access through the growth of online retail channels.

By product, earphones witness high consumer preference

True wireless and in-ear earphones are benefiting from the trend toward portability and on-the-go streaming. Consumers desire compact devices with advanced functionalities, whether for commuting or multi-device use. JLab, for example, introduced the GO Pods ANC and JBuds Pods ANC in April 2025, offering hybrid noise cancellation and spatial audio at accessible price points. Such affordability enables more frequent product upgrades, attracting younger and value-oriented consumers.

In the global earphones and headphones market, headphones covering over-ear and on-ear models emphasize immersive sound quality and enduring comfort. Demands from professionals, gamers, and audiophiles continue to elevate performance standards, compelling manufacturers to innovate. Bose exemplified this trend with the release of the QuietComfort Ultra Headphones in September 2023, integrating advanced spatial audio and industry-leading noise cancellation. These developments are advancing the premium market segment and redefining consumer expectations for high-end audio experiences.

By price, the less than 50 USD category register robust growth

The less than-USD 50 tier is fuelled by growing smartphone penetration in emerging markets and demand from budget-conscious users for wireless audio with essential features. For example, realme launched the Buds T110 in India in April 2024, offering 10 mm dynamic drivers and AI ENC at an accessible price point. These low-price options accelerate household penetration, encourage first-time users, and spur upgrade cycles among entry users.

The above-USD 100 category thrives on premiumization in the earphones and headphones market, with consumers willing to invest in high-fidelity audio, advanced ANC and luxury design. For instance, Sony announced the WH-1000XM6 headphones in May 2025, featuring its new HD Noise Cancelling Processor QN3 and 12-mic adaptive system. By offering flagship experiences, brands lift average selling prices and reinforce the aspirational value of premium audio gear.

By technology, wireless category gains higher traction

Leading audio brands are actively ramping up their wireless headphone portfolios to meet demand for smarter, more connected listening experiences. For instance, JBL introduced the Tour ONE M2 in April 2023, featuring hybrid True Adaptive ANC, JBL Spatial Sound and seamless Bluetooth 5.3 pairing across devices. This launch highlights how JBL is positioning wireless ANC models not just as audio accessories, but as integrated lifestyle devices, thereby driving up market uptake in the premium wireless segment.

While wireless dominates consumer growth, companies are still innovating wired headphone models for creators and specialised users, demonstrating consistent growth of wired earphones and headphones market. For example, Audio Technica launched its ATH-M50xSTS and ATH-M50xSTS-USB in January 2023, designed and marketed as the world’s first headsets tailored specifically for live-streaming and content creation. By targeting this professional niche, Audio-Technica preserves relevance in the wired category and supports overall market segmentation expansion.

By application, fitness and sports demonstrate notable growth

Fitness and sports applications are fueling growth as users seek durable, comfortable audio gear suited to workouts, tracking and outdoor use. Manufacturers are emphasizing sweat-proof builds, secure fit and integrated health sensors. For example, Sennheiser launched the MOMENTUM Sport earbuds in April 2024, with in-ear heart rate and body-temperature sensors alongside high-fidelity sound. These innovations are enabling wearables to double as workout companions and audio devices, broadening the market’s reach beyond casual listening.

Gaming is a major application category contributing to the rising demand in the earphones and headphones market, as immersive sound, low latency and communications quality become essential to competitive players and streamers. Audio brands are responding with headsets that deliver advanced spatial audio, multi-platform connectivity and customisable software. For example, Logitech G introduced the Astro A20 X wireless gaming headset in September 2025, featuring dual-device connection and broadcast-quality mic. This push into gaming-optimised audio devices is expanding usage occasions and increasing replacement frequency among enthusiasts.

By region, Asia Pacific is emerging as a lucrative market destination

Throughout the Asia Pacific region, leading brands are accelerating the expansion of their smart wearable and audio portfolios by introducing advanced AI capabilities and a broader range of products. Huawei is demonstrating significant progress in this area, having launched the Watch GT 6 series and FreeClip 2 ear-clip headphones in September 2025, both featuring enhanced health monitoring and extended battery performance. The competitive landscape is intensifying as additional regional companies increase investment in research and development, strengthen their product ecosystems, and tailor features to meet the specific preferences of local consumers.

In contrast, Europe holds a significant share of the earphones and headphones market as it is characterized by a distinct emphasis on premium audio quality, with consumers valuing technological innovation, design sophistication and craftsmanship. In September 2025, Baseus collaborated with Bose and Knowles Electronics to introduce the Inspire Series, integrating Bose’s renowned acoustic engineering into a new lineup of earphones and headphones. This initiative aims to make high-end audio experiences more widely accessible. Such collaborations reflect the European market’s priorities: advanced noise cancellation, immersive sound quality, and attainable luxury, all of which are driving ongoing market growth.

Leading earphones and headphones market players, including Apple, Bose, Logitech, and Panasonic, are adopting innovative strategies to align with evolving consumer preferences. While the integration of advanced technologies such as active noise cancellation, spatial audio, and AI-driven sound optimization remains central, these organizations are also prioritizing design excellence and sustainability in material selection. Their objective is to deliver a superior user experience, whether for entertainment, gaming, or professional use.

Moreover, these earphones and headphones companies are advancing beyond product development by forming strategic partnerships, entering new markets, and expanding their global reach. Apple continues to enhance its AirPods portfolio, Bose emphasizes its premium noise-cancelling offerings, and Logitech and Panasonic are establishing distinct market positions—targeting gamers and fitness enthusiasts, respectively. Collectively, their investments in research, design, and intelligent technology underscore a commitment to producing audio solutions that are not only technologically advanced but also highly personalized and attuned to contemporary lifestyles.

Established in 1976 and headquartered in Cupertino, California, Apple Inc. has evolved into a global leader in consumer technology and digital services. The AirPods product line has set new standards in wireless audio through seamless connectivity, advanced noise cancellation, and innovative spatial audio features. Apple consistently redefines expectations for premium personal audio, earning widespread recognition for its technological advancements.

Founded in 1964 in Framingham, Massachusetts, Bose Corporation is renowned for its pioneering work in sound engineering and noise cancellation technologies. The company’s headphones and earphones are distinguished by their high-fidelity, immersive sound quality and ergonomic design, catering to both professionals and general consumers. Bose maintains a reputation for excellence within the earphones and headphones market.

Logitech Inc., established in 1981 in Lausanne, Switzerland, is a leading provider of personal peripherals and computer accessories. Its Logitech G and Ultimate Ears (UE) product lines are acclaimed globally for their innovative features and user comfort, particularly in wireless earphones and gaming headsets. Logitech is recognized for integrating superior performance with user-friendly design.

Founded in 1918 in Osaka, Japan, Panasonic Corporation is a prominent figure in the electronics industry, with a strong presence in audio equipment. Panasonic’s range of headphones and earphones combines precise Japanese engineering with contemporary aesthetics, appealing to both professionals and everyday users worldwide. The company remains at the forefront of the market by continually adapting to industry advancements.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market include Sennheiser Electronic GmbH & Co. KG, and others.

Explore the latest trends shaping the Global Earphones and Headphones Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on global earphones and headphones market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global earphones and headphones market reached an approximate value of USD 64.56 Billion.

The market is projected to grow at a CAGR of 20.50% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 416.71 Billion by 2035.

Key strategies driving the market include continuous innovation in AI-enabled and noise-cancellation technologies, sustainable product design, and ecosystem integration with smartphones and wearables. Leading brands are expanding globally, focusing on premium features, and enhancing localization strategies to attract Gen Z and tech-savvy consumers.

The key market trends guiding the growth of the industry include the increasing digitalisation and rising investments in product development by the key market players.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The significant products considered within the market report include earphones and headphones.

The different prices include less than 50 USD, between 50 to 100 USD, and above 100 USD.

The major technologies include wired and wireless.

The significant applications include fitness/sports, virtual reality, gaming, and music and entertainment.

The key players in the market include Apple Inc., Bose Corporation, Logitech Inc., Panasonic Corporation, Sennheiser Electronic GmbH & Co. KG, and others.

Asia Pacific holds the largest share of the global earphones and headphones market, supported by rapid smartphone adoption, growing middle-class income, and strong regional manufacturing by key players such as Huawei, Samsung, and Sony.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Price |

|

| Breakup by Technology |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share