Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global electric truck market was valued at USD 1356.41 Million in 2025. The industry is expected to expand at a CAGR of 29.00% during the forecast period of 2026-2035 to attain a value of USD 17309.64 Million by 2035. Increasing demand for sustainable transportation solutions also fuels the electric truck market, spurred on by stricter emission regulations, government incentives, and increasing focus on carbon footprint reduction in logistics and freight.

Base Year

Historical Period

Forecast Period

Growing U.S. government support for zero-emission vehicles, such as electric trucks, is driving market demand. Electric trucks are gaining adoption due to policies aimed at reducing greenhouse gas emissions and government incentives and regulations toward carbon neutrality in transportation.

In December 2021, the Biden Administration's Executive Order targeted 100% electric vehicle purchases for federal fleets by 2035, which includes electric trucks. The mandate will fuel demand for zero-emission trucks as federal agencies replace older fleets with electric alternatives, leading to large-scale adoption and boosting market growth.

The federal government's decision to replace 380,000 vehicles with electric models, including around 30,000 zero-emission trucks annually, has significantly impacted the electric truck market. This shift not only supports manufacturers but also encourages private sector adoption, creating a ripple effect that expands the overall electric vehicle market, thus boosting the growth of the electric vehicle market.

Compound Annual Growth Rate

29%

Value in USD Million

2026-2035

*this image is indicative*

Electric truck sales have gained momentum due to rising demand for environmentally conscious transportation solutions and technological improvements of batteries. Higher environmental sensitivities, tougher emission regulations, and governmental incentives continue to push people toward electric trucks, especially in the commercial and logistics industries. Such factors are mainly responsible for pushing forward the electric truck demand.

Companies like Tesla, Rivian, and Daimler are currently at the top of the market offering lower operating costs, higher efficiency, and carbon footprint decreases. With improving charging infrastructure and increased ranges, the market is ready for further growth. The emphasis on reducing fleet emissions and using cleaner alternatives supports the growth in the electric truck market.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

With e-commerce growing, there is an increasing demand for electric trucks, especially in last-mile delivery services. Companies such as Rivian have developed electric delivery trucks designed specifically for the urban environment. This helps to reduce emissions and the cost of operation. The fact that Rivian and Amazon have collaborated to offer packages through electric vans illustrates how increased demand for environmentally friendly and low-cost delivery solutions drives the market for electric trucks in this niche area. This trend promotes eco-friendly logistics and boosts demand for electric trucks.

The rapid electrification of transportation to mitigate greenhouse gas emissions and surge cost-effectiveness is aiding the market growth. The increasing demand for fuel-efficient vehicles is surging the use of electric trucks, hence propelling the market growth. The rising adoption of heavy-duty electric vehicles to increase profitability and reduce carbon footprint is further augmenting the growth of the electric truck market. The increasing production of electric vehicle and hybrid electric vehicle segments by OEM manufacturers is propelling the market growth. Moreover, the rising demand for efficient trucks to reduce operational costs is significantly contributing to the market growth. Advancements in battery technology are surging the feasibility and economic competitiveness of electric trucks, which is augmenting the industry growth.

Electrification is becoming a trend in heavy-duty and long-haul freight trucking. The drivers are the environmental pressures and the savings from fuel. Companies like Volvo Trucks and Tesla are developing electric trucks to be used for long-distance hauls and for freight. One of the good examples of this is Tesla's Semi truck designed to cut transportation costs on long hauls and reduce emissions. The niche demand for electric trucks continues growing as logistics companies seek to decrease their carbon footprint while sustaining performance, thereby attracting investment and innovation in the sector.

Battery advancements, government incentives, fleet electrification, and charging infrastructure expansion drive electric truck market growth.

Advancements in battery technology are a dominant trend in the electric truck market. This will provide a longer range, faster charging, and lighter weight. Innovations in lithium-ion and solid-state batteries have improved truck performance significantly. Companies such as Tesla and Nikola are integrating next-generation batteries to improve energy efficiency and reduce downtime. Electric trucks will be more cost-competitive with traditional diesel trucks as the cost of the battery declines. These technological improvements are also a step towards larger adoption in logistics, freight, and long-haul trucking. They will go a long way to calm the fears of the industry about limitations in range and adequate charging infrastructure, thereby propelling the electric truck demand.

Government regulations and incentives play an important role in boosting growth in the electric truck market. Most governments have adopted tougher emissions standards and tax credits to facilitate the adoption of electric vehicles. In the U.S., programs like the Clean Truck Fund offer funding to businesses purchasing zero-emission vehicles. Similarly, Europe’s green transportation initiatives incentivize fleet operators to invest in electric trucks. These incentives make electric trucks more financially attractive for commercial fleets, enabling companies to offset higher upfront costs. The increasing regulatory pressure on reducing CO2 emissions also fuels the shift toward electric trucks in the freight and logistics industries.

There is a significant uptake of electric trucks among logistics companies to implement their electric fleet plans. Companies like UPS, DHL, and FedEx are investing highly in electric delivery trucks to minimize carbon emissions while achieving sustainability targets. Electric trucks have lower running costs in terms of consumption and servicing compared to their diesel counterparts. Fleet electrification is fast becoming one of the significant trends within the commercial transportation industry due to increased uptake in companies adopting sustainability and cleaner technologies. The adoption will speed up further because electric trucks become increasingly viable for daily logistics operations due to cost efficiency and improvement in the charging infrastructure, thus boosting the electric truck market revenue.

Development of charging infrastructure will facilitate the growth of the electric truck market. Expansion of fast-charging networks across major highways and logistics hubs addresses one of the major challenges that electric trucks face: charging time and availability. Companies like Tesla and ChargePoint are investing in charging stations specifically designed for commercial vehicles. Such infrastructure development reduces the range anxiety associated with electric trucks, thus enabling long-haul trucking and efficient route planning. An enhanced charging network would allow electric trucks to seamlessly operate in urban and regional freight transportation, accelerating the adoption of electric trucks in the logistics sector.

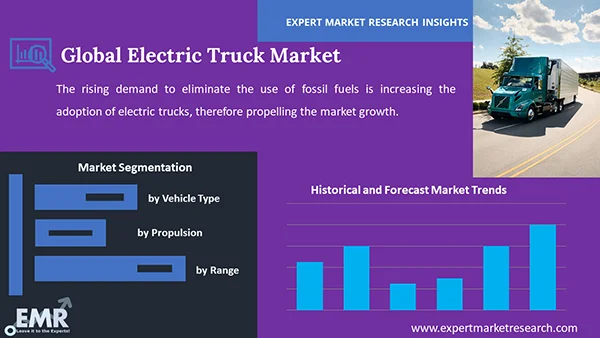

The rising demand to eliminate the use of fossil fuels as an energy source in transportation is driving the growth of the electric truck industry. New and innovative product launches by the leading companies are further accelerating the market growth. The reducing price of batteries owing to technological advancements is also expected to propel the industry growth. This is further decreasing the total cost of ownership (TCO) of electric trucks. Moreover, the scarcity of professional drivers, as well as the low profit margin of traditional trucks, is accelerating the transition to electric trucks. The trend of logistics efficiency is surging the use of electric trucks, therefore augmenting the electric truck market growth.

The development of charging infrastructure, which is a prerequisite for the functioning of an electric truck, is expected to aid the market growth. For instance, Volvo Group, Daimler Truck, and Volkswagen’s AG heavy truck line entered into an agreement to build various high-performance public charging stations for electric heavy-duty trucks and buses around Europe in July 2021. In addition, the rapid development of prototypes of diverse electric trucks by manufacturers is anticipated to fuel the market growth. Increasing investments in renewable energy and energy efficiency are leading to the production of innovative electric trucks, which is projected to significantly contribute to the industry growth.

There is a massive opportunity in the electric truck market due to the rising demand for last-mile delivery solutions. Companies are increasingly looking at changing to electric trucks for deliveries in urban areas due to emission reduction and environmental regulatory pressures. Governments across the globe, including the U.S. and Europe, are providing incentives and subsidies for adopting electric vehicles, making it easier for companies to transition to electric trucks. This trend is supported by the need for clean, efficient delivery solutions and robust charging infrastructure.

The electric truck market is rapidly developing high-capacity batteries that can be charged at a faster rate, thereby bolstering the electric truck market dynamics and trends. Such companies as Volvo Trucks are ahead of the game with their electronic axle technology, which puts the motor, gearbox, and axle in a single unit. It thus helps to optimize battery space by giving a model such as the Volvo FH Electric 600 km of range per charge. These are some of the technologies that can make electric trucks become more viable in long haul transport.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Electric Truck Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

The major propulsions of electric trucks are:

The market can be broadly categorised on the basis of its vehicle types into:

Based on range, the market is divided into:

Market Breakup by Region

By Propulsion Analysis

As per electric truck market analysis, propulsion technologies are driving the electric truck market. Battery electric trucks, promising a bright future for Tesla and Volvo, are increasingly on demand with much better capacities and recharging times, which makes them viable for long distances. Hybrid electric trucks offer greater efficiency than gasoline power while reducing emissions, perfect for urban logistics. PHEVs provide flexibility by offering electric and traditional fuel options. FCEVs, like Toyota, use hydrogen for fast refueling and are set to revolutionize long-haul transport. Diverse propulsion systems are integral in reducing operational costs and environmental impact, fueling the adoption of electric trucks worldwide.

Market Analysis by Vehicle Type

As per electric truck industry analysis, the global electric truck market is gaining traction due to various factors. Light-duty electric trucks are attractive to urban delivery fleets due to lower operating costs and zero tailpipe emissions. Medium-duty trucks enjoy longer range capabilities, thus attracting logistics companies involved in regional distribution. Heavy-duty electric trucks are gaining ground in long-haul applications with improvements in battery technology and charging infrastructure. The rising level of government incentives and increasing focus on sustainability are encouraging the adoption of all vehicle types.

Range Insights

There are increasing demands for electric trucks with various ranges as different segments meet specific use cases, aiding the electric truck demand. Ranges of 0-150 miles gain popularity in urban deliveries based on cost and smaller battery sizes. The 151-300 miles segment is becoming popular for regional transport by balancing cost and range, while the trucks offering more than 300 miles are more set up for long-haul transport in tandem with improvements in battery technology and infrastructures.

North America Electric Truck Market Opportunities

The United States government is investing significantly in zero-emission transportation, such as electric trucks, via the SuperTruck program. By 2030, 30% of medium- and heavy-duty vehicle sales are to be zero-emission. The national strategy of the Biden administration focuses on 100% zero-emission truck sales by 2040, with emphasis on developing infrastructure, primarily public-private partnerships, to decrease the emission of greenhouse gases and fuel costs.

Asia Pacific Electric Truck Market Trends

Asia Pacific is rapidly embracing electric trucks as part of national decarbonization goals. Countries like China, Japan, and India aim to decrease their transport emissions with large-scale investments in EV infrastructure. China alone accounts for over 50% of the global electric truck market. The region’s focus is on increasing EV adoption, with targets like Japan’s goal of 100% electric vehicle sales for buses and trucks by 2040.

Europe Electric Truck Market Dynamics

Europe is moving towards electrifying the heavy-duty trucking industry. The European Green Deal and its accompanying policies have set aggressive carbon-neutrality targets by 2050. In 2023, the European Union set a target to cut CO2 emissions from new trucks by 45% by 2030. The Netherlands and Germany are heavily investing in charging infrastructure, and the EU is encouraging a robust regulatory framework for electric trucks to be adopted.

Middle East and Africa Electric Truck Market Drivers

Diversification of energy sources and reducing reliance on oil are the main drivers of the electric truck market in the Middle East and Africa (MEA). Electric mobility investments by governments in the UAE, aiming to achieve zero-net emissions by 2050. The UAE is promoting incentives such as tax-free electric vehicles and developing infrastructure to accommodate electric trucks. Saudi Arabia is also investing in EV technology under Vision 2030.

Latin America Electric Truck Market Insights

Latin America is experiencing increasing interest in electric trucks, particularly in Brazil, that is focusing on decarbonizing its transport sector. Local initiatives include the "Brazilian Green Growth Program," which aims to accelerate adoption of electric trucks by 2030. Chile is also setting a precedent with electric mobility, targeting 100% of new buses to be electric by 2040.

Electric truck market players are focusing on improving electric truck technology. The improvement in battery efficiency and increasing the driving range of electric vehicles (EVs) are their primary objectives. They are investing heavily in R&D to introduce next-generation models with enhanced performance and reduce the overall cost of electric trucks. The electric truck companies are also targeting expansion into fast-growing markets particularly in North America and Europe and also due to stricter environmental regulations by providing green alternative options to the conventional combustion engines.

AB Volvo, founded in 1927 and based in Gothenburg, Sweden, has electric trucks on offer, such as the Volvo FH Electric for regional and intercity transport, the Volvo FE Electric for local distribution, and the Volvo VNR Electric in North America.

Daimler AG, established in 1926 in Stuttgart, Germany, offers electric trucks like the Mercedes-Benz eActros, which is intended for urban distribution with a range of up to 400 km.

Dongfeng Motor Corporation, established in 1969 in Wuhan, China, manufactures the Dongfeng V5 Electric and the Dongfeng T5 EV, which are aimed at urban logistics and regional distribution.

Scania CV AB, based in Södertalje, Sweden and established in 1891, offers electric trucks like the Scania R 500 Electric for long-distance transport and the Scania P 25 Electric for regional distribution.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other electric truck market players include Paccar Company, among others.

Electric truck startups aim to transform transportation by developing innovative, sustainable, and cost-effective electric trucks. They work towards improving the efficiency of the battery, reducing emissions, and providing eco-friendly solutions for industries such as logistics and freight. They aim to make electric trucks more accessible, reliable, and competitive with traditional diesel trucks.

Rivian

Rivian designs electric trucks for adventure and utility, targeting long-range battery life, off-road capability, and sustainability. Their all-electric R1T pickup features rugged performance for both city and off-road use.

Nikola Corporation

Nikola Corporation focuses on hydrogen-electric trucks to revolutionize the freight industry with zero-emission vehicles. Their hydrogen power trucks provide long-haul capabilities combined with clean energy, efficient transport solutions.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 1356.41 Million.

The electric truck market is assessed to grow at a CAGR of 29.00% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 17309.64 Million by 2035.

The rapid electrification of vehicles, the introduction of various favourable government initiatives, and rising research and development (R&D) activities are the major market drivers.

The key trends guiding the market include the rising demand for electric vehicles, the development of charging infrastructure, and new and innovative product launches.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The major electric truck market segments based on propulsion are battery electric truck, hybrid electric truck, plug-in hybrid electric truck, and fuel cell electric truck.

The different vehicle types considered in the market report are light duty, medium duty, and heavy duty.

0-150 miles, 151-300 miles, and above 300 miles, among others, are the various segments based on the range of electric trucks.

The major players in the market are AB Volvo, Daimler AG, Dongfeng Motor Corporation, Scania CV AB, and Paccar Company, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Propulsion |

|

| Breakup by Vehicle Type |

|

| Breakup by Range |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share