Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global enterprise risk management (ERM) market was valued at USD 5.21 Billion in 2025. Increased demand is fuelled by growing exposure to third-party cyber threats, prompting businesses to adopt integrated solutions aligned with ISO 31000 and NIST frameworks. In turn, the market is expected to grow at a CAGR of 5.30% during the forecast period of 2026-2035 to reach a value of USD 8.73 Billion by 2035.

Market growth can also be attributed to the surge in digital threats, stringent regulations, and a growing corporate demand for predictive analytics. As financial crimes and compliance breaches intensify, global organisations are integrating ERM solutions to safeguard assets and gain strategic agility. In January 2024, the Financial Conduct Authority (FCA) rolled out new risk governance standards that impacted several United Kingdom-based institutions. Parallelly, the United States’ SEC introduced climate-risk disclosure requirements in March 2024, compelling listed firms to embed ESG metrics into risk assessments.

Another standout trend in the enterprise risk management market is governments linking ERM compliance to incentives. The EU’s Digital Operational Resilience Act (DORA) incentivises firms that adopt real-time risk monitoring technologies, including AI-enabled risk dashboards. Innovations like adaptive risk engines and blockchain-based audit trails are also boosting the demand, particularly in banking and insurance sectors.

With increasing interconnectedness of risks in cyber, financial, regulatory, and climate sectors, organisations are leveraging ERM as a core pillar in strategic planning. The shift toward integrated, real-time risk visibility is gaining momentum, especially as investors and regulators demand more transparent, auditable, and resilient governance frameworks.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5.3%

Value in USD Billion

2026-2035

*this image is indicative*

Organisations are increasingly preferring AI-based ERM platforms to identify risk correlations and project future outcomes, boosting the enterprise risk management market development. Companies like Tesla, PayPal, and Visa have deployed machine learning models to predict operational risk events 90 days in advance, reducing exposure by a significant extent. The United Kingdom’s Centre for Data Ethics and Innovation is also supporting AI deployment in risk forecasting. This trend is disrupting conventional risk registers, making room for dynamic, self-learning engines. AI tools not only detect anomalies but also suggest pre-emptive actions. Especially in sectors like insurance and energy, predictive modelling enables real-time responsiveness to evolving geopolitical or climate risks.

The integration of environmental, Social, and Governance (ESG) risks into ERM frameworks has been a key trend that is shaping the enterprise risk management market dynamics. The EU’s Sustainable Finance Disclosure Regulation mandates climate-related risk disclosures, pushing firms to embed ESG metrics into risk matrices. For instance, in January 2024 Allianz launched an ERM dashboard aligning carbon exposure with investment risk. This alignment is driving ESG-oriented investments, where risk resilience is tied to sustainability KPIs. B2B buyers are now seeking partners with robust ESG risk ratings.

As per the enterprise risk management market report, advanced ERM tools now offer immersive dashboards powered by visual analytics and IoT data streams. For example, Barclays offers real-time cyber risk heatmaps for their executive board, enabling immediate actions. Governments are also embracing this trend. In April 2024, Singapore’s MAS co-developed interactive visual dashboards with 6 commercial banks including DBS, OCBC, UOB, Citibank, HSBC and Standard Chartered Bank to monitor systemic financial risks. This real-time capability is critical in volatile environments where reactive controls consume time. Stakeholders are investing in ERM systems that make risk visibility immediate, interactive, and intuitive.

Companies in the enterprise risk management industry are merging with RegTech ecosystems to automate compliance updates, track regulatory shifts, and manage audit trails. For example, in September 2024, the Digital Securities Sandbox (DSS), the United Kingdom counterpart of the EU DLT Pilot regime, was launched by the Bank of England (BoE) and Financial Conduct Authority (FCA). By permitting businesses to function under a temporarily altered legal and regulatory framework, the DSS will make it easier to deploy emerging technologies, including DLT, in the issuance, trading, and settlement of securities. By combining the notary, maintenance, and settlement functions typically performed by central securities depositories (CSDs) with the management of a trading venue, the sandbox will enable newcomers to participate. These tools track jurisdictional regulation changes in real-time, translating them into actionable workflows. Capgemini’s ERM suite now includes embedded regulatory AI that flags non-compliance risks. This convergence reduces costs, increases speed-to-compliance, and keeps organisations audit-ready.

Cyber risk is now viewed as a top priority for business continuity. ERM platforms are integrating with Security Information and Event Management (SIEM) tools to monitor vulnerabilities in real time. For example, Lloyds Banking Group embedded ERM into their cybersecurity framework to simulate breach scenarios and recovery paths. United Kingdom’s National Cyber Security Centre is supporting this alignment by providing threat intelligence feeds compatible with ERM tools. As cyber threats grow in volume and velocity, B2B clients are inclining towards partners with holistic cyber-risk governance embedded within their ERM approach.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Enterprise Risk Management Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

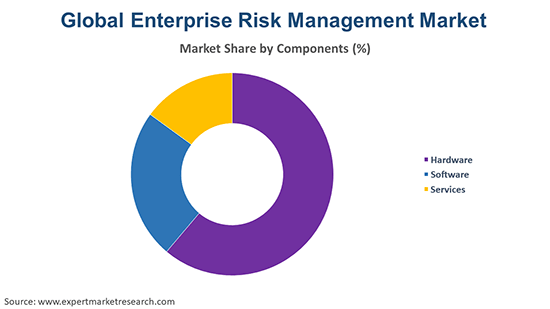

Market Breakup by Component

Key Insight: The global market spans across hardware, software, and services, each playing a role in driving organisational resilience. Software leads in functionality and innovation, enabling seamless integration with enterprise ecosystems. Services offer tactical execution and regulatory alignment in a modular fashion. Hardware, being essential for sectors like defence or critical infrastructure, plays a supportive role in housing real-time data feeds or operational control systems.

Market Breakup by Institution

Key Insight: Enterprise risk management adoption varies across institutions, shaped by regulatory scrutiny and operational complexity. Banks dominate the market due to systemic exposure and supervisory expectations. Credit unions follow, focusing on community-centric governance. Specialty finance firms are ramping up ERM investments to meet investor and regulator demands. Thrifts, although smaller, are integrating risk modules to enhance transparency. The intensity and type of risk, whether credit, operational, cyber, or ESG, determines ERM strategy. Institutional culture also influences how ERM is implemented, from boardroom mandates to operational risk mapping.

Market Breakup by Region

Key Insight: The enterprise risk management industry is shaped by legal environments, digital readiness, and industrial diversity. North America dominates in adoption and technology innovation, while Europe aligns ERM with ESG and regulatory harmonisation. Asia Pacific shows rapid uptake, driven by digital finance expansion and regulatory evolution. Latin America is emerging fast through fintech-led demand, while the Middle East and Africa are gradually integrating ERM in critical sectors like energy and banking.

By Component, the Software Category Accounts for the Bigger Share of the Market

Software remains the largest and most critical component contributing to the global market value, especially due to its scalability and ability to integrate with enterprise tech stacks. Risk management software is evolving into intelligent, customisable platforms featuring AI modules, regulatory compliance tracking, and scenario modelling. For example, MetricStream’s ERM platform offers predictive analytics for risk clusters. Financial institutions are opting for SaaS-based ERM systems to stay agile in fast-changing regulatory environments.

Services, including consulting, implementation, and managed risk services, are experiencing the rapid growth in the enterprise risk management market. As regulatory environments become multifaceted, organisations seek external expertise to tailor ERM strategies. Firms like PwC and EY now offer ERM-as-a-Service for financial institutions adapting to Basel IV and Solvency II frameworks. The market further observes a surge in demand for risk maturity assessments, gap analysis, and cloud-migration support. Hybrid delivery models, blending onsite and remote expertise, have been in demand. Services are increasingly bundled with technological upgrades, which makes them integral for holistic risk strategy deployment.

By Institution, Banks Register the Dominant Share of the Market

Banks currently dominate the enterprise risk management market due to their heavy exposure to financial, cyber, and regulatory risks. From credit risk scoring to anti-money laundering (AML) systems, ERM tools are deeply entrenched in bank workflows. Companies like Barclays and HSBC use advanced ERM platforms for real-time scenario planning aligned with Basel IV. Central banks are also enforcing tighter stress-testing protocols, making ERM adoption non-optional. With integrated reporting frameworks and compliance-linked incentives, banks are investing in systems that not only mitigate risk but also inform lending, investment, and capital allocation strategies.

Specialty finance firms including leasing companies, peer-to-peer lenders, and private equity are now witnessing rapid demand for enterprise risk management to gain investor confidence and regulatory clearance. These firms often operate in niche verticals with unconventional risk profiles. Platforms like OnDeck and Funding Circle are now deploying cloud-native ERM modules to track risk-adjusted returns, fraud vectors, and portfolio volatility. Their lean operational models demand flexible, AI-enabled solutions.

By Region, North America Holds the Leading Position in the Industry

The ongoing dominance of the North American market is propelled by high regulatory rigour and sophisticated technology adoption. The United States’ Sarbanes-Oxley Act and Canada's OSFI guidelines have compelled firms to come up with structured risk reporting. Technology giants like IBM and Oracle offer ERM solutions tailored to complex regulatory environments. North American firms often pilot new technologies, like AI for risk classification or blockchain for audit trails, accelerating the enterprise risk management opportunities.

Asia Pacific represents the fastest-developing regional market, driven by regulatory transformations, financial inclusion, and digital economy acceleration. In December 2024, the Monetary Authority of Singapore expanded its risk governance framework, prompting regional firms to adopt formal ERM solutions. India and China are also pushing digital lending reforms, catalysing demand for AI-based risk analytics. Local start-ups and banks are investing in cloud-native ERM tools to manage rising cyber and compliance risks. Additionally, cross-border data regulations and ESG disclosures are compelling enterprises to re-develop their risk infrastructures, spurring collaborations between fintech firms and legacy institutions across the APAC region.

Leading enterprise risk management market players are investing in flexible, cloud-native solutions with embedded analytics and real-time reporting. Focus areas of these firms include cross-border regulatory intelligence, ESG risk alignment, and automated audit readiness. Providers are also forming alliances with RegTech firms and cybersecurity specialists to offer full-stack risk solutions. They are offering vertical-specific solutions including banking, healthcare, or manufacturing for better differentiation.

Moreover, enterprise risk management companies find growth opportunities in mid-market penetration and hybrid deployment models. Some of the key trends observed in the market include AI-powered modelling, ESG integration, real-time dashboards, RegTech integration, and cybersecurity governance. As compliance demands grow and risk complexity escalates, players offering unified yet adaptive ERM ecosystems, are expected to lead the market in the coming years. Geographic expansion, especially in APAC and MEA, is also a key agenda for players seeking growth beyond saturated Western markets.

SAI Global Pty Limited, established in 1922 and headquartered in Sydney, focuses on governance, risk, and compliance platforms. The company offers industry-specific ERM frameworks integrated with real-time incident management modules.

Capgemini SE, founded in 1967 and headquartered in Paris, delivers consulting-led ERM solutions embedded with AI and blockchain. Their ERM services are widely adopted in banking and telecom sectors.

Dell Inc., founded in 1984 and based in Round Rock, Texas, United States, offers infrastructure-backed ERM systems that blend cybersecurity resilience with predictive threat modelling, tailored for large enterprises.

Fidelity National Information Services, Inc., or FIS, founded in 1968 and headquartered in Florida, United States, provides ERM platforms for financial institutions, with built-in compliance tracking and scenario stress testing.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market are Infosys Limited, LogicManager Inc., and Fidelity National Information Services, Inc., among others.

Explore the latest trends shaping the global enterprise risk management market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on enterprise risk management market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the enterprise risk management market reached an approximate value of USD 5.21 Billion.

The market is projected to grow at a CAGR of 5.30% between 2026 and 2035.

The market is estimated to grow in the forecast period of 2026-2035 to reach about USD 8.73 Billion by 2035.

Key strategies driving the market include investing in AI-led analytics, aligning ERM with ESG mandates, co-developing with RegTechs, expanding into APAC, and embedding ERM into strategic planning to enhance agility and compliance efficiency.

The key trends guiding the growth of the market include technological advancements and standardisation of risk management solutions and policies.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Hardware, software, and services are the major components in the global enterprise risk management market.

The major institutions in the market include banks, credit unions, speciality finance, and thrifts.

The major players in the market are SAI Global Pty Limited, Capgemini SE, Dell Inc., International Business Machines Corporation, Infosys Limited, LogicManager Inc., and Fidelity National Information Services, Inc., among others.

The key challenges are complex cross-border regulations, integration silos, shortage of risk analytics talent, and legacy IT limitations.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Component |

|

| Breakup by Institution |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share