Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Europe automotive extended warranty market size reached around USD 7717.38 Million in 2025. The market is projected to grow at a CAGR of 5.41% between 2026 and 2035 to reach nearly USD 13070.37 Million by 2035.

Base Year

Historical Period

Forecast Period

The European automotive sector is witnessing significant growth, with sales rising by about 17% in the first three quarters of 2023. Reportedly, battery-electric car sales witnessed rapid growth of 55% during the same period.

Europe has the presence of a significant number of ageing vehicles, increasing the adoption of extended warranties. For instance, the UK has 8.4 million cars over 13 years old.

Negotiable warranty terms for a small fee allow customized coverage, increasing interest in extended warranties. This flexibility boosts value and improves vehicle market competitiveness.

Compound Annual Growth Rate

5.41%

Value in USD Million

2026-2035

*this image is indicative*

Automotive extended warranty is an additional warranty that an individual can buy while purchasing a new car, or before the standard warranty expires. It offers a protection plan for vehicles that is valid for certain periods.

Extended warranties are carried out in accordance with European Union (EU) regulations in the region.

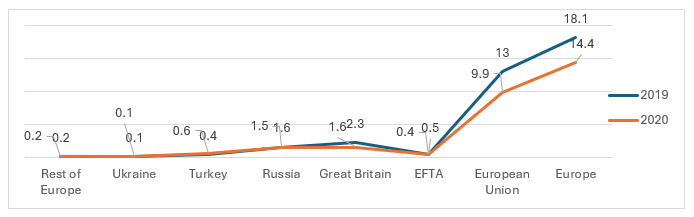

Figure: Number of new registered cars in Europe (million cars)

The rise in awareness of the extended warranty among consumers is expected to drive its demand in Europe. This is due to its benefits as it offers warranty coverage ahead of the warranty period to help sustain the vehicle for an extended period.

The European market for new vehicles is expected to grow due to the rising use of new cars and increased purchases of luxury vehicles. To further boost sales, manufacturers are offering extended warranties for new vehicles.

In 2022, passenger car registrations in the EU reached about 253 million. The countries with the highest number of registered cars include Germany, Italy, and France.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Increased awareness of the benefits of extended warranty; prevalence of diverse product offerings; advancements in technology; and prominent customer support and service are impacting the market growth.

In Europe, the automotive extended warranty market is growing due to consumers' increased awareness of the benefits of extended warranties. These warranties provide extra protection beyond standard coverage, offering peace of mind and encouraging consumers to protect their investments and reduce the risks of unexpected repairs.

The extended warranty market in Europe is the focus on providing strong customer support and service. Companies like Warrantywise in the UK is well known for their customer service, offering 24/7 claims support and a dedicated customer service team.

Companies in the extended warranty market in Europe are leveraging technological innovation to enhance their offerings. For example, companies like CarSure in Germany use advanced diagnostic tools and telematics to monitor vehicle health and predict potential issues.

Companies are providing options for extended coverage for specific components or systems that are more prone to failure based on the vehicle model and usage patterns. This approach can increase the perceived value of the warranty and attract more customers.

With the rapid advancements in automotive technology, there is an opportunity to expand warranty coverage to include new and emerging technologies. For example, offering warranties that cover electric vehicle (EV) components, such as batteries and electric drivetrains, can address the growing market for EVs in Europe and provide peace of mind to EV owners.

Modern vehicles feature complex advanced electronic components and software, making post-warranty repairs costly. This potential expense encourages consumers to opt for extended warranty options. Additionally, the competitive environment among European car dealerships leads to extended warranties being offered as a strategy to build customer trust and loyalty. Dealerships, working with warranty providers, often offer customized warranty plans tailored to individual needs and budgets, boosting the demand for automotive extended warranties in Europe.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Europe Automotive Extended Warranty Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Coverage

Market Breakup by End Use

Market Breakup by Operating Model

Market Breakup by Country

Based on end use, passenger cars account for a significant share of the market

In 2023, new passenger car vehicle registrations in Germany increased by 7.3% to 2,844,609 cars, an increase of more than the 2,651,357 cars sold in 2022. Passenger car warranties typically cover various components of the vehicle for a certain period after purchase, protecting against defects or malfunctions. Extended warranties for cars can be provided by manufacturers, dealers, or a third-party entity, in addition to the existing warranty. Volkswagen AG, the world's largest passenger car manufacturer based in Germany is considered the largest warranty provider on a global scale.

Warranty options for these types of vehicles differs based on the manufacturer and region. LCVs and MCVs come with standard warranties that cover a certain period or mileage. From January to April 2023, France and the UK had the highest LCV registration volumes followed by Germany, Italy, and Spain.

Based on operating model, used passenger cars significantly contribute to the Europe automotive extended warranty market revenue

Used vehicles with extended warranty are considered to have higher resale value. Used vehicles are typically regularly maintained and in best condition, making it a more attractive purchase for any potential new owner over another car that isn’t covered.

A warranty product for new vehicles offers protection against mechanical and electrical failures, shielding drivers from costly repair expenses. In today's climate of escalating repair costs due to inflation and supply chain challenges, pre-purchased warranty products prove to be exceptionally valuable, providing financial security to vehicle owners.

Market players offer extended warranty services that can vary in terms of duration covered, services offered, cost effectiveness, insurance cover provided, among others.

Volkswagen Group is a top global automobile and commercial vehicle manufacturer and the largest carmaker in Europe. Founded in 1937, the company operate in Europe, North America, South America, Asia Pacific, and other regions.

Canopius is a global speciality and Property & Casualty (re)insurer with locations in the UK, the US, Bermuda, Singapore, and Australia. Founded in 2003, the company provides underwriting (re)insurance services across over 130 countries.

BMW engages in manufacture of premium cars and motorcycles. The German company consist of 4 brands in automotive segment, i.e., BMW, MINI, Rolls-Royce and BMW Motorrad. The BMW Group production network consists of over 30 production sites spread worldwide.

The Renault Group is a global automotive company that operates in more than 128 countries and has a strong presence in Europe, especially in France. The company offers extended warranty services to its customers, providing them with additional coverage beyond the standard warranty period.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the Europe automotive extended warranty market are Stellantis N.V., Ford Motor Company, Mercedes-Benz Group AG, and CG Car-Garantie Versicherungs-AG, among others.

Germany is home to three renowned automotive manufacturers such as Volkswagen Auto Group, BMW, and Mercedes. These manufacturers offer extended warranties, with BMW offering up to 2 years, Volkswagen up to 3 years or 150,000 kilometres, and Mercedes allowing annual extensions up to 200,000 kilometres.

The Polish automotive sector is a significant contributor to the country's economy, accounting for approximately 10% of total industrial production and representing about 4% of GDP. The average age of cars in Poland being 14.5 years indicates that there is a significant number of older vehicles on the road. Therefore, more customers are looking for ways to ensure the long-term reliability of their cars, making extended warranties an attractive option.

Global Extended Warranty Market

United States Auto Extended Warranty Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 7717.38 Million.

The market is projected to grow at a CAGR of 5.41% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 13070.37 Million by 2035.

The coverages for extended warranties include mileage-based, more than 24 months, 12 months to 24 months, and up to 12 months.

The key countries include the United Kingdom, Germany, France, Italy, Spain, Poland, and others.

The end uses include passenger cars, LCV and MCV, bus, and others.

The operating models of vehicles are used passenger cars and new passenger cars.

The key players in the market include Volkswagen AG, Canopius Group, BMW AG, Renault Group, Stellantis N.V., Ford Motor Company, Mercedes-Benz Group AG, and CG Car-Garantie Versicherungs-AG, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Coverage |

|

| Breakup by End Use |

|

| Breakup by Operating Model |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share