Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global family offices market size was approximately USD 100.66 Billion in 2025. The market is estimated to grow at a CAGR of 7.40% during the forecast period of 2026-2035 to reach a value of USD 205.54 Billion by 2035.

Base Year

Historical Period

Forecast Period

Reportedly, North American family offices have about 20% of their wealth in real estate.

The presence of a large number of wealthy families and high-net-worth individuals that turn to family offices to manage their wealth and other financial needs is aiding the market growth.

A growing number of family offices in the North American, Asia Pacific, and European region are increasing their investments in eco-conscious businesses that are working towards reducing social and environmental issues, especially climate change.

Compound Annual Growth Rate

7.4%

Value in USD Billion

2026-2035

*this image is indicative*

Reportedly, there are about 10,500 family offices on a global scale. Geographical dispersal, including global investments and family members settling away from their family’s home base for work or education, is creating a need for well-established and fabricated wealth management services. The family office, thus, deals with the administration and effective day-to-day management of a family’s cross-border wealth.

The complexity of tax legislation owing to the geographical dispersal of wealth is another factor that is leading to a growing demand for family offices.

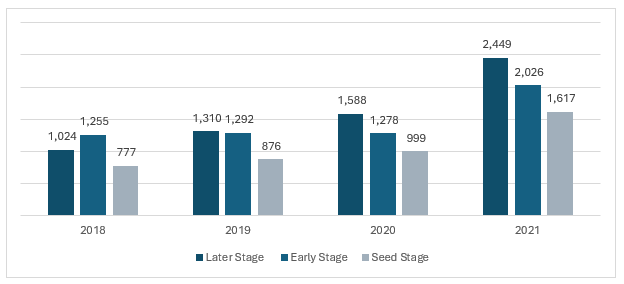

In 2022, family offices contributed to around one-third of the total capital invested in startups.

Figure: Investments In Family Office Startups (2018-2021)

Increasing wealth of private entities; growing inclination towards connected environments; rising number of ultra-HNWIs; and rising adoption of artificial intelligence are the major factors impacting the family offices market growth

There is an increase in private wealth driven largely by the riches made in the growing tech market. Modern entrepreneurs are turning towards multi-family offices to manage their complex investments spread globally owing to their innovative and global mindset.

Companies are inclined towards developing a connected investment market by supporting, growing, and aligning their network of clients and contributors. They are focusing on their strengths, utilising technology to position themselves as market differentiators, reducing operational complexities, and enhancing their efficiencies so that clients are comfortable, further mobilising employees to increase their efficiency.

The rising number of ultra-high-net-worth individuals is driving the popularity of family offices for wealth management over traditional wealth management firms.

AI can help family offices forecast events by recognising patterns quickly. Additionally, AI, robo-advisers, and digital reporting systems are anticipated to enable them to help their clients manage their wealth more closely, leading to the family offices market development.

Virtual family offices (VFO) are adopted by families spread across geographies and require fewer complex services. The advanced technologies being adopted by companies in the family offices market are leading to more secure processes, with VFOs representing a cost-effective method to receive remote on-demand services.

Multi-family offices globally are investing in mergers and acquisitions, focused on inorganic and disruptive growth. Such strategies are expected to help them increase their scalability within a short period while ensuring maximum productivity.

Family offices in Europe, North America, and the Asia Pacific, are potentially increasing their investments in cryptocurrency and businesses that target sustainability. A significant number of family offices in Europe have a toehold in cryptocurrency as they expect it to become a mainstream asset class and see it as a promising investment. The trend of investing in sustainability is boosted by the need to protect the environment and support the development of eco-conscious businesses. Family offices are targeting their investments at businesses working towards reducing climate change.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Global Family Offices Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Asset Class

Market Breakup by Region

Based on asset class, alternative investments dominate the global family offices market share

Family offices and ultra-rich families have been seeking investments in various assets, including blockchain, structured credit, and forestry, among others, aligning their investment processes with a new generation of wealth.

The influx of value-driven and young wealth holders and evolving sources of wealth are likely to boost the focus on new asset classes and impact-focused investment.

Based on type, single family office accounts for a significant share of the family offices market

For ultra-affluent families, single-family offices (SFO) have gained popularity owing to the control, autonomy, and personalised attention it offers to these families.

Meanwhile, multi-family offices (MFO) are favoured by modern wealth owners owing to the increased level of specialisation offered by them. MFOs provide their clients with customised services and knowledge and have distinguished themselves as trusted advisors for wealthy investors.

With a growing number of families interested in outsourcing only the investment oversight of its capital, the adoption of virtual family offices (VFO) is anticipated to increase, where advisors can be accessed online as and when needed. The benefits of adopting VFOs, such as affordability and flexibility and the availability of several professional advisors that work together to manage the family's financial matters, are enhancing their popularity.

With the growing wealth in the Asia Pacific and rising numbers of billionaires, especially in China, families have started to focus on institutionalising family wealth management and in-sourcing fund management operations through family office solutions.

Family offices are becoming popular in Europe, particularly in wealthy areas such as Monaco, Switzerland, and London. As more wealthy families and ultra-high-net-worth individuals resort to the family office solution, the market is expected to further grow in the region.

Meanwhile, with an increase in wealth generation in North America, family offices have been diversifying their investments in various areas like healthcare tech, metaverse, NFTs, and Web 3.0, among others.

With the growing need for transparency and the demand for real time data to enhance decision making, family offices are embracing technology to facilitate more proactive management.

Headquartered in the US, Cascade Investment Group is a registered investment adviser company focused on offering services free from conflicts of interest brought about by large corporate ownership.

Founded in 2009, MSD Partners, L.P. is a leading investment firm focused on maximising long-term capital appreciation across its core areas of investing expertise which include credit, growth, private capital, and real estate.

With headquarters in the UK, the company offers services including long-term planning to routine transactions and administration.

Glenmede, headquartered in the United States, offers its services to clients globally including institutions, consultants, and advisors with a contemporary approach to institutional investing that provides long-term value for clients.

Bessemer, headquartered in the United States, is a privately owned company engaged in providing investment management, wealth planning, and family office services.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

United Kingdom Family Office Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market attained a value of about USD 100.66 Billion in 2025.

The market is estimated to grow at a CAGR of 7.40% during the forecast period of 2026-2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 205.54 Billion by 2035.

The key types are single family office, multi-family offices, and virtual-family office.

The key regional markets for family offices are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The asset classes include alternative investments, equities, bonds, cash or cash equivalents, and commodities.

The driving factors include increase in private wealth, rising adoption of technologies such as artificial intelligence for financial management, and growing need for personalized financial services.

The key players in the market include Cascade Investment Group, Inc., MSD Partners, L.P., Stonehage Fleming Family and Partners Limited, The Glenmede Trust Company, N.A., and Bessemer Group, Incorporated, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Asset Class |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share