Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global fencing market attained a value of USD 35.92 Billion in 2025 and is projected to expand at a CAGR of 6.50% through 2035. The market is further expected to achieve USD 67.43 Billion by 2035. Increasing construction of high-security logistics corridors and data center campuses is accelerating demand for advanced fencing systems that merge physical durability with embedded sensors, remote diagnostics, and streamlined maintenance workflows.

The market is moving into a more technology-centric phase as vendors push beyond traditional steel or vinyl systems and lean into advanced security-embedded infrastructure. Belden Inc., for example, collaborated with Accenture to help develop and deploy physical AI systems for worker safety in factories and warehouses, in October 2025. The rising demand for perimeter intelligence across logistics hubs and critical utilities, where downtime from breaches can be costly is driving significant interest. According to the fencing market analysis, attempted intrusions at grid-connected facilities crossed 70% in 2022, nudging procurement teams to prefer fencing suppliers that embed detection, diagnostics, and remote analytics straight into their perimeter systems.

Manufacturers are also moving toward more modular, maintenance-light fencing architectures. Several large players, including Betafence and Ameristar have been engineering composite hybrid fences using powder-bonded mesh panels and anti-corrosion coatings that extend field life considerably in high-salt or industrial zones. Buyers in sectors like petrochemical storage, airport expansions, and mega-warehousing projects are now signing multi-year upgrade contracts rather than opting for basic fencing replacements. This fencing market trend also reflects that security budgets are consolidating around integrated perimeter packages that combine physical barriers with active digital monitoring.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6.5%

Value in USD Billion

2026-2035

*this image is indicative*

Buyers demand embedded sensing that turns a fence into an early-warning layer. Vendors like ASSA ABLOY and Betafence are integrating fiber-optic intrusion detection, radar-ready mounts, and edge analytics so a perimeter panel can localize a cut or climb and push a validated alarm to a cloud SOC, changing the fencing market trends and dynamics. In July 2021, Heras launched GeoPoint sensor system that utilizes multiple sensors that are distributed along the fence line to detect movement and vibration. For B2B purchasers, this trend moves fencing from capex line-item to a capability that ties directly to incident-reduction KPIs.

Industrial and coastal projects are demanding fences that survive aggressive climates with lower maintenance. Suppliers are developing powder-bonded mesh with nano-ceramic topcoats and marine-grade stainless alloys that extend service life in salt spray zones, propelling demand in the fencing market. In October 2025, Grouse Railing, in Cananda, introduced a new line of Vancouver composite fencing designed for both residential and commercial properties. Ports, petrochemical terminals and desalination plants are specifying such engineered finishes to avoid frequent repaint cycles and to keep maintenance crews off dangerous sites.

Large infrastructure and events require secure perimeters. Modular fencing pods, containerized gate systems and pre-tested rapid-mount posts are filling that need. Companies like Ameristar and smaller regional specialists are offering plug-and-play kits that integrate gates, cameras and power in a single palletized shipment, reducing site setup from weeks to days. Governments running emergency shelter or temporary border infrastructure programs have adopted these solutions, awarding short-term contracts that often convert into multi-year replacement or upgrade deals once permanent budgets arrive, widening the fencing market scope. For example, AMICO Security offers ANC Fence System received an M5.0 security rating in compliance with the ASTM F22781-10 standard, which is used to test the forced entry resistance of security fence systems.

Procurement teams are asking for recycled-content panels, low-VOC coatings, and take-back programs to meet municipal ESG rules. Suppliers are responding with galvanized steel panels made from higher recycled content, PVC alternatives using bio-resins, and cradle-to-cradle certifications. In October 2024, Birkdale launched a new composite fence panel range called the DuraPost VISTA that provides both beauty and durability at an affordable price, the panels can be used for boundary fencing or to create sleek garden features, responding to the surging demand in the fencing market. Public tenders in Europe and North America are now scoring bids on embodied carbon and recyclability, making sustainability a commercial differentiator. For B2B sellers, offering certified recycled materials and a documented end-of-life pathway helps win contracts from environmentally conscious owners and large developers.

Buyers are preferring integrated service deals that are inclusive of installation, remote monitoring, maintenance, and scheduled panel replacement. This trend in the fencing market is driven by asset managers who want stable OPEX forecasting and by insurers who offer premium reductions for active monitoring. Vendors are packaging warranties, spare-parts pools and SLAs with remote diagnostics while some are even offering performance-based contracts where availability and incident-response SLAs determine final payments.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

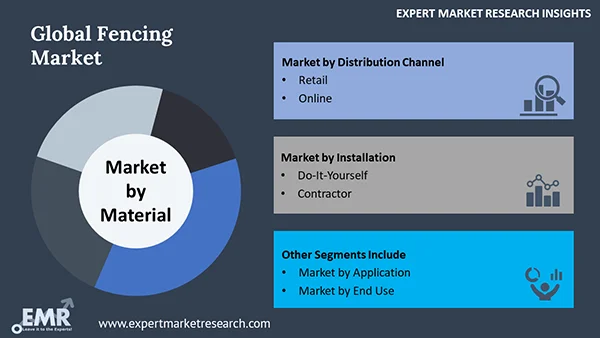

The EMR’s report titled “Global Fencing Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Material

Key Insight: Material choices include metal, wood, plastic/composite and concrete. Metal dominates where security and certification are mandatory. Wood is often chosen for aesthetic and heritage projects. Plastic/composites are observing growth in the fencing market dynamics for corrosive or low-maintenance contexts while concrete and precast segments serve heavy-duty, blast-resistant or acoustic needs. Suppliers that offer cross-material hybrid systems, metal cores with composite cladding, or concrete footings with sensor-ready steel panels, are winning multi-disciplinary projects.

Market Breakup by Distribution Channel

Key Insight: Distribution channels as considered in the fencing market report spans retail, online, direct OEM and contractor procurement. Retail excels at local availability and small-lot flexibility. The online channel is growing for standardized products, repeat buys and digital spec integration. Direct OEM sales serve bespoke, high-value projects with engineering support. Contractors often bundle supply, installation and maintenance. Buyers are selecting channels by project scale.

Market Breakup by Installation

Key Insight: Installation routes include contractor, DIY, hybrid (contractor-assisted DIY), and specialist authorized installers. Contractor installations dominate for regulated, high-risk environments due to compliance and warranty concerns. DIY is growing where modular kits and digital instructions lower barriers for small buyers. Hybrid models are emerging as owners install basic panels and call certified teams for gates and sensors.

Market Breakup by Application

Key Insight: Residential applications lead the fencing market in terms of unit volumes, favoring aesthetic, low-maintenance and smart-ready panels. Agricultural fencing prioritizes biosecurity, livestock containment and low-cost repairs. Innovations include electrified modular posts and rust-proof mesh for corrosive farm chemicals. Industrial applications demand high-security, anti-ram and sensor-ready systems with durable coatings and service bundles.

Market Breakup by End Use

Key Insight: End-use categories as included in the fencing market report are government, petroleum & chemicals, military & defense, mining, energy & power, transport, and others. Governments procure certified, auditable systems, whereas petroleum/chemical sites need corrosion-resistant, anti-static and fire-rated fences. Military and defense require blast-resistant and classified installations. Mining prioritizes rapid-deploy, erosion-resistant fences. Energy and power demand EMC-compatible, sensor-integrated perimeters and transport (airports, ports, rail) focus on integrated surveillance and anti-intrusion barriers.

Market Breakup by Region

Key Insight: Asia Pacific majorly drives fencing demand with industrial and residential buildouts. Europe is growing fast in premium, certified, and sustainable solutions. North America emphasizes integrated sensor-fence packages and contractor networks. Latin America demands cost-effective, rapid-deploy systems for border and port security. The market in Middle East & Africa focuses on heavy-duty, climate-resistant and anti-ram solutions for energy and infrastructure projects.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

By material, metal leads the market due to durability, security specs, and industrial application demand

Metal fencing including galvanized steel, stainless mesh, and welded wire, remains dominant because it delivers unmatched strength, tamper resistance and long-life performance required by industrial, transport and critical-infrastructure clients. Major suppliers are innovating metal solutions with enhanced galvanizing chemistries, thermal-spray ceramic topcoats for extreme environments, and pre-assembled welded panels that speed field labor. For example, Agricultural and fencing supplier, StowAg offers a brand-new range of metal fencing systems. Service providers are also offering lifecycle coating renewals and recoating warranties to protect long-term asset value.

Plastic and composite fencing offers fast-paced growth in the fencing market as buyers seek low-maintenance, corrosion-free solutions for coastal developments, marinas and high-moisture industrial sites. New composite blends combine recycled polymers with mineral fillers and UV stabilizers to match stiffness while offering superior salt-spray resistance. Manufacturers are introducing fiber-reinforced polymer posts and injection-molded panels that mimic wood aesthetics but without rot.

By distribution channel, the retail category dominates the market for smaller projects

Retail channels including builders’ merchants, fencing specialists and regional distributors dominate smaller commercial and residential projects due to availability, flexible order sizes, and bundled services. Retailers stock standardized panels, posts and hardware and often offer on-demand cutting, pre-assembly and local warranty pickup. Suppliers are partnering with national distributors to create certified dealer programs that guarantee installation standards and spare-part availability, accelerating all time growth in the fencing market revenue.

Online distribution is the fastest-growing channel as specifiers and contractors increasingly source standardized fencing components, modular gates and monitoring kits through e-commerce and B2B portals. Digital catalogs with BIM assets, specification sheets and freight calculators speed procurement and allow for competitive, transparent quotes across regions.

By installation, contractor-installed systems dominate for complexity; DIY serving residential, quick fixes

Contractor installation clocks in the largest share of the market. Commercial, industrial and institutional projects sites demand certified construction methods, civil foundations, electrical integration and safety compliance. Professional installers bring engineered design adaptations, embedded conduit for sensors, reinforced footings for anti-ram barriers, and coordinated gate automation, that DIY cannot provide. In November 2025, Hoff announced the expansion of its decorative fencing division, offering a broader range of residential and commercial design options throughout Pennsylvania. Large fencing OEMs are building certified installer networks and offering training programs, ensuring consistent installation quality across regions. Contractors also provide maintenance contracts and spare-part logistics, creating a lifecycle revenue stream attractive to both vendors and buyers.

DIY installation is also accelerating the fencing market growth in the residential and small-commercial segment due to pre-engineered panel systems, plug-and-play gates, and comprehensive online support. Manufacturers are supplying modular kits with pre-drilled posts, snap-fit rails, and integrated conduit paths for future sensor fitment, letting savvy facility managers or small contractors install perimeter systems with minimal heavy machinery. E-learning, video guides and augmented-reality layout tools are reducing installation errors and expanding the DIY market.

Residential applications account for the largest market share driven by privacy and aesthetic upgrades

Residential fencing remains the largest application by units because homeowners and multi-dwelling developers continually invest in boundary upgrades for privacy, curb appeal, and low-cost security. Suppliers are creating modular, pre-finished panels and hybrid screens that combine decorative aesthetics with hidden sensor channels for lights and door contacts, enabling homeowners to add smart detection later without ripping out fences, propelling the fencing market value. Retailers and installers are packaging subscription-based maintenance and warranty tiers, turning one-off fence purchases into recurring revenue.

Industrial fencing is expanding its shares due to heightened security and compliance needs at logistics hubs, factories and ports. Demand for high-performance systems like anti-climb mesh, anti-ram barriers, and integrated sensor mounts that support thermal cameras and vibration detectors, is growing rapidly. In January 2025, Oldcastle APG announced the launch of Catalyst Fence Solutions, its flagship fence brand to cater to the rising demands from various industries. Suppliers are offering engineered perimeter packages with pre-tested anti-corrosion coatings, acoustic dampening for noisy sites, and conductive grounding for EMP-sensitive installations.

By end use, government accounts for the largest share due to compliance-bound procurement

Government end users such as municipalities, transport authorities, and correctional services, drive large, specification-heavy fencing contracts. These projects require documented compliance, certified materials, and traceable installation teams. Procurement is often tied to lifecycle cost metrics and resilience criteria, favoring vendors that can provide long warranties, anti-corrosion guarantees and integrated surveillance-ready mounts. Governments are also funding perimeter modernization projects such as ports, airports and border checkpoints that test sensor-fused fences and rapid-deploy containment solutions.

As per the fencing industry research, energy and power infrastructure is the fastest-growing end use as utilities and independent operators secure substations, wind farms, and grid-edge assets against theft, sabotage and wildlife intrusion. The need is for rugged, grounded fencing with integrated anti-climb features, radar-ready posts and fiber-optic intrusion sensing. Suppliers are bundling fence products with remote diagnostic gateways and compliance-ready documentation for regulators and insurers.

Asia Pacific dominates the market backed by infrastructure and industrial growth

Asia Pacific clocks in the largest portion of the market revenue due to massive urbanization, port expansions, and industrial corridor projects that drive high-volume fencing demand across residential, industrial and transport sectors. Regional manufacturers are rapidly scaling coated-metal production, localized composite blending, and modular gate systems to reduce lead times. Governments in APAC are funding infrastructure and port security upgrades, creating predictable tender pipelines for perimeter systems.

The fencing market in Europe is the fastest-growing market for premium, certified, and sustainable solutions, driven by strict regulatory standards, urban regeneration projects, and increasing demand for circular-materials procurement. Buyers in EU markets are seeking low-carbon steel, recycled composites and documented end-of-life take-back programs. Security-conscious sectors like transport and energy are upgrading perimeters to sensor-ready, auditable systems tested against EU norms.

The global market is becoming increasingly innovation-led as manufacturers shift from conventional perimeter systems to intelligent, sensor-enabled, and low-maintenance solutions tailored for commercial, residential, and high-security users. Fencing companies are focusing heavily on corrosion-resistant alloys, composite materials, anti-climb mesh architectures, and IoT-linked perimeter alerts that help users reduce lifecycle costs and improve monitoring accuracy. Opportunities are opening in government infrastructure upgrades, utility-site modernization, and perimeter hardening across logistics parks where buyers favor products with long service life and rapid install ability.

Fencing market players investing in modular fencing systems, automated gate integration, and digitally configurable layouts are gaining traction with contractors seeking faster job completion. Additionally, partnerships with security-tech firms, green-material suppliers, and robotics-enabled fabricators are becoming central strategies for players looking to win long-term contracts.

Founded in 1959 and headquartered in the United States, Atkore International caters to the fencing market by combining its steel fabrication heritage with advanced perimeter products designed for industrial, utility, and commercial applications. The company focuses on high-strength tubular steel systems, rapid-fit modular assemblies, and corrosion-resistant finishes engineered for demanding outdoor conditions.

Based in the United States and established in the year 1982, Ameristar Perimeter Security serves the fencing industry with premium ornamental steel and high-security perimeter solutions designed for government, data centers, airports, and defense projects. The company is recognized for proprietary anti-ram and anti-climb fence architectures that comply with stringent homeland-security standards.

Founded in 1935 and based in Belgium, Bekaert addresses the fencing market through its global leadership in advanced steel wire technologies, offering high-tensile barbed wire, welded mesh, and coated wire products used in agriculture, commercial, and high-security installations. The company’s specialty lies in proprietary coatings that enhance corrosion performance and service longevity, enabling reliable installations in harsh climates and industrial zones.

CertainTeed Corporation, founded in 1904 and headquartered in Illinois, United States, caters to the fencing market with a broad portfolio of vinyl and composite fencing solutions engineered for residential and commercial applications. The company emphasizes low-maintenance, weather-resistant, and aesthetically customizable fencing that appeals to homeowners and large property developers.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the fencing market report include Gregory Industries and Betafence among others.

Unlock the latest insights with our fencing market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 35.92 Billion.

The market is projected to grow at a CAGR of 6.50% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach around USD 67.43 Billion by 2035.

Fencing companies are expanding partnerships, integrating smart sensors, adopting recycled materials, enhancing robotic fabrication, strengthening contractor networks, and offering modular solutions to capture demand from infrastructure, utilities, and commercial construction.

The key trends guiding the market growth include the growing requirement for privacy and safety in the residential sector and the rising demand for fencing in the agricultural sector.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The different materials used for fencing are metal, wood, plastic and composite, and concrete.

Retail and online are the significant distribution channels of the product.

The major segments based on the installation of fencing are do-it-yourself and contractor.

The various applications of fencing are residential, agricultural, and industrial.

The major end uses of fencing are government, petroleum and chemicals, military and defence, mining, energy and power, and transport, among others.

The key players in the market include Atkore International, Ameristar Perimeter Security, Bekaert, CertainTeed Corporation, Gregory Industries, and Betafence, among others.

Companies struggle with fluctuating raw material prices, compliance-heavy bidding processes, labor shortages in installation, and rising expectations for smart perimeter integration that requires continuous R&D investment and advanced manufacturing capabilities.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Material |

|

| Breakup by Distribution Channel |

|

| Breakup by Installation |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share