Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global forestry equipment market was valued at USD 12.05 Billion in 2025. The market is expected to grow at a CAGR of 4.00% during the forecast period of 2026-2035 to reach a value of USD 17.84 Billion by 2035.

The forestry equipment market is undergoing a transformation from a traditional heavy-industry segment to a technology-driven sector. Advanced tools such as remote telemetry, drone surveillance, and autonomous harvesting units are now being deployed, reflecting a shift toward precision forestry. This technological evolution is enabling safer, more efficient, and data-rich operations across managed forests globally.

Global forest management practices are expanding, with the FAO reporting over 2.05 billion hectares under management. A growing share of these forests is embracing mechanised and sustainable harvesting methods, driving demand for smart and efficient forestry equipment.

Policy support is also fuelling global forestry equipment market growth. In the European Union, the Forest Strategy for 2030 promotes digitalisation in logging operations, encouraging the use of connected and automated machinery. Meanwhile, Canada’s Forest Innovation Program is funding AI-powered timber tracking systems, underlining a clear commitment to ESG compliance and traceable, sustainable forest resource management.

This digital surge has also helped counteract labour shortages, boosting the forestry equipment market development. For instance, Finland’s Metsä Group’s harvesting units are now equipped with real-time productivity sensors and VR support for operator training. Forestry 4.0 has also become operational. Demand for low-emission electric equipment is also growing as governments push stricter emission norms. In 2023, John Deere unveiled its electric excavator prototype, which reduces fuel consumption by a significant extent.

From harvesting heads embedded with smart pressure systems to loaders fitted with predictive maintenance software, the forestry equipment market is pivoting towards precision-driven and eco-efficient models. Regions like Asia Pacific and Latin America are investing in mobile forest processing units to tackle remote access issues. Meanwhile, climate-aligned investments and timber certification schemes are reshaping procurement strategies.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4%

Value in USD Billion

2026-2035

*this image is indicative*

Firms in the forestry equipment market are now deploying digital twins, virtual replicas of forests and equipment, to optimise planning and reduce errors. This innovation helps predict tree-fall direction, soil impact, and equipment wear. When integrated with GNSS and terrain-mapping tools, digital twins help B2B contractors plan mechanised routes with reduced downtime. These virtual models also support regulatory reporting, appealing to firms bound by emission and land-use disclosures.

Forestry equipment manufacturers are now engineering low-impact tyre systems and lightweight treads to reduce soil compaction, which is an essential concern in logging zones with fragile ecosystems. In line with this, John Deere began offering the fully integrated Central Tire Inflation System (CTIS) on its 8R Series tractors equipped with Independent Link Suspension as a standard feature in Spring 2024. The impact of such innovations is evident, with Finland’s Natural Resources Institute reporting over an 18% reduction in soil erosion using similar technologies as per a 2024 study. These advancements align with sustainable certification standards like FSC and PEFC. To enhance value, manufacturers are bundling these soil-health-oriented solutions with subscription-based telemetry systems that enable continuous terrain analysis. This integrated approach supports better forest regeneration outcomes and lowers long-term rehabilitation costs for B2B stakeholders.

Predictive analytics are gradually transforming the forestry equipment market dynamics. AI-based systems now monitor equipment stress, hydraulic oil life, and engine vibration. Komatsu Forest has developed a unique AI model for analysing deteriorated parts by collecting data from machines on the market at the time of deterioration and failure. These systems are particularly crucial for contractors operating in remote sites with limited repair access. Subscription platforms for B2B buyers now bundle data logs and actionable maintenance alerts, ensuring higher machine utilisation and budgeting accuracy.

Rather than transporting logs over long distances, decentralised biomass processors are being integrated into harvesters or nearby hubs, boosting the forestry equipment market development. These units convert residual timber into energy or pulp on-site. Brazil’s Embrapa Forestry is deploying mobile units to reduce carbon emissions tied to logistics. In India, state forestry boards are issuing tenders for biomass collection tied to renewable energy quotas. B2B vendors dealing in paper, packaging, and biofuels now see strategic value in such set-ups. These not only slash transport costs but also comply with circular economy mandates.

Forestry equipment manufacturers are designing cabins focused on reducing operator fatigue and boosting productivity. Touchscreen interfaces, panoramic windshields, and biometric seat-adjustment technology are becoming standard in high-end models. Ponsse’s new “Ergo Harvester” has been designed to improve the operator's driving comfort and working efficiency, as well as increasing the efficiency and management of forest machine companies. Japan’s Forestry Agency has endorsed such systems to improve work safety. B2B leasing firms now promote these features as productivity enhancers, enabling longer, more efficient shifts while maintaining compliance with local labour safety norms.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Forestry Equipment Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product

Key Insight: Product types as considered in the forestry equipment market report cater to varying operational needs. Harvesters dominate the industry due to their automation compatibility and volume efficiency. Forwarders and skidders remain essential for timber transport but are slowly being optimised for emissions. Loaders and feller bunchers serve high-volume, commercial plantations. Meanwhile, mulchers are gaining favour for their eco-utility in land clearing and reforestation preparation. Bunchers and other niche tools serve specialised operations, particularly in steep or mixed-terrain forestry.

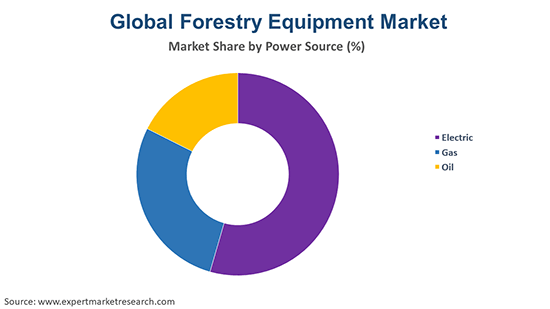

Market Breakup by Power Source

Key Insight: Oil remains dominant in the forestry equipment industry for its field reliability, particularly in rugged, large-scale operations. Gas-powered tools remain prevalent in mobile, low-load applications. However, electric power sources are rapidly becoming attractive due to lower maintenance, zero tailpipe emissions, and funding incentives. Companies are increasingly evaluating hybrid models that offer electric drive with fuel backup for extended shifts.

Market Breakup by Region

Key Insight: North America continues to dominate the forestry equipment market due to mechanisation, policy funding, and mature B2B ecosystems. Europe is pivoting to electric forestry fleets under its Green Deal programme. Asia Pacific, led by India and China, is catching up fast, combining ecological restoration with production scale-ups. Latin America remains a promising growth zone, especially in Brazil, where decentralised processing is surging. Meanwhile, Africa and the Middle East are focusing on soil restoration and sustainable harvesting through grants and public-private partnerships.

By Product, Harvester Registers a Significant Share of the Market

Harvesters remain the dominant segment accelerating the forestry equipment market value. These are especially used in regulated logging environments where precision and yield consistency matter. These machines, now equipped with real-time mapping and AI-driven cutting heads, significantly reduce felling time and increase volume yield per hectare. In Sweden and Finland, harvesters with automatic tree identification systems are becoming the norm. Companies like Ponsse and Komatsu Forest have integrated smart saw positioning and bark thickness detection, improving cut quality and waste control.

Mulchers are seeing explosive growth in the forestry equipment market, boosted by regions where reforestation, firebreak creation, or land clearing for agroforestry are top priorities. These machines are evolving fast with low-emission electric motors and adjustable blade torque for terrain-specific mulching. Companies like FAE and Tigercat are now launching tracked mulchers embedded with topographic sensing to avoid root zone damage. In wildfire-prone California and Australia, municipal contracts are favouring mulchers over traditional bulldozers for their reduced ecological impact.

By Power Source, Oil Continues to Secure the Maximum Share of the Market

Oil-based power sources continue to dominate the forestry equipment market, especially in heavy-duty forestry equipment operating in remote terrains. Their high energy density, better torque control, and established servicing ecosystem make them suitable for long-shift operations in dense forests. However, manufacturers are innovating within this category as well. They are introducing cleaner-burning engines and hybrid boosters to reduce carbon output. The U.S. Forest Service continues to heavily rely on oil-based skidders and forwarders, particularly for salvage logging after wildfires.

Electric forestry equipment is advancing rapidly, driven by emission regulations and operational cost savings. From compact electric mulchers to hybrid harvesters, the application area is broadening. John Deere and EcoLog have released electric forwarder prototypes with regenerative braking systems. These machines not only lower GHGs but also operate quieter, which makes them suitable for urban-forest interfaces. In Germany, government subsidies under the Bonn Challenge are promoting electric logging trials. Battery-swapping stations and solar-charging logistics further amplify electric forestry equipment adoption rates.

North America Retains its Dominant Position in the Market

The North America forestry equipment market’s dominance is driven by large-scale mechanised forestry and investment in wildfire prevention infrastructure. The U.S. Department of Agriculture has allocated over USD 2.6 billion for Wildland Fire Management, much of which is directed towards advanced equipment procurement. Canada’s forestry firms are leveraging AI-integrated skidders and autonomous drones to monitor yield and tree health. Private logging companies and state bodies alike are shifting towards data-backed, compliance-ready solutions. Additionally, commercial timber players are bundling equipment with carbon credit modelling services.

The Asia Pacific forestry equipment market is rapidly scaling up, with countries like China, India, and Indonesia increasing afforestation efforts and timber output. In India, the Forest Survey of India has digitised tree census programmes, encouraging demand for equipment with sensor capabilities. China’s aggressive push towards eco-restoration under its Green Shield Action has led to expanded logging bans in natural forests and mechanisation of planted forests. Japanese logging cooperatives are adopting smart forwarders and mulchers in reforestation projects.

Forestry equipment market players like John Deere, Ponsse, Komatsu Forest, and Tigercat are increasingly focusing on innovation in smart machine systems and real-time data analytics. The bundling of machinery with telematics dashboards, predictive maintenance subscriptions, and training platforms have been noticeable trends in the market. Electric and hybrid variants are also attracting B2B clients involved in ESG-aligned projects, such as certified timber sourcing and reforestation. Forestry equipment companies are also venturing into service-based models, leasing, fleet optimisation, and on-demand tech support, which is opening up new revenue streams. In high-regulation regions like the European Union, data compliance tools embedded into machinery are becoming a market differentiator. Additionally, partnerships with governments and local forestry cooperatives are creating access to emerging markets like sub-Saharan Africa and Southeast Asia.

Headquartered in United States and established in 1837, Deere & Company is a manufacturer of connected and intelligent applications and machines to revolutionise the construction and agricultural sectors. The company’s portfolio includes over 25 brands that provide innovative solutions for several end-use sectors. In 2021, the company generated net sales and revenues of USD 44.02 billion. With 75,600 employees in over 100 locations across the globe, 48% of its consolidated revenues and sales occurred outside the United States.

Komatsu Ltd. or Komatsu is a manufacturer of equipment and machinery used in utility, construction, forestry, and industrial applications. The company, headquartered in Japan, has 76 manufacturing facilities around the world and had a workforce of around 62,774 as of 2021. In August 2020, it launched new high-performance plasma cutting machines TWISTER TFPL10-6 and TFPL08-6. Its net sales reached JPY 69,393 million in 2021.

Established in 1970 and based in Tokyo, Japan, Hitachi Construction Machinery (HCM) is a subsidiary of the Hitachi Group that is engaged in the manufacturing, sales and service of construction machinery, transportation machinery, and other machines and devices. It was involved in the production of Japan’s first mechanical excavator. The company has a consolidated workforce of around 25,000 employees, with 80 subsidiaries and 22 affiliate companies. In 2021, the company generated consolidated revenue of JPY 1025 billion.

Founded in 1963, Barko Hydraulics manufactures heavy equipment for the forestry, site prep, and material handling industries. Its mission is to deliver durable and reliable purpose-built equipment that provides customers with the tools they need to become more successful, comfortable, and safe. Some of its premium brands include merchandising knuckleboom loaders, advanced line-up of harvesters and feller bunchers, industrial wheeled tractors, rough terrain carrier loader, and stationary electric loaders, among others.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market are Caterpillar Inc., and Rottne Industri AB, among others.

Explore the latest trends shaping the Forestry Equipment Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on Forestry Equipment Market Trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the forestry equipment market reached an approximate value of USD 12.05 Billion.

The market is projected to grow at a CAGR of 4.00% between 2026 and 2035.

Key strategies driving the market include investing in operator training, adopting hybrid-electric fleets, partnering with forestry boards, upgrading to AI-integrated systems, and offering equipment-as-a-service models to scale adoption and regulatory compliance efficiently.

The key challenges are high initial costs, operator skill gaps, lack of charging infrastructure for electric units, and fragmented regulatory frameworks across regions.

The major regions in the market are North America, Latin America, Europe, the Middle East and Africa, and the Asia Pacific.

The various products considered in the market report are harvester, feller bunche, forwarder, skidders, bunchers, loaders, and mulcher, among others.

The several segments based on power considered in the market report are electric, gas, and oil.

The major players in the market are Deere & Company, Komatsu Ltd., Hitachi Construction Machinery Co., Ltd., Barko Hydraulics, LLC, Caterpillar Inc., and Rottne Industri AB, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Power |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share