Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global gas sensor market attained a value of nearly USD 1094.76 Million in 2025. The market is further expected to grow in the forecast period of 2026-2035 at a CAGR of 6.60% to reach about USD 2074.39 Million by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6.6%

Value in USD Million

2026-2035

*this image is indicative*

| Global Gas Sensor Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical Period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | 1094.76 |

| Market Size 2035 | USD Million | 2074.39 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 6.60% |

| CAGR 2026-2035 - Market by Region | Latin America | 7.1% |

| CAGR 2026-2035 - Market by Country | India | 7.5% |

| CAGR 2026-2035 - Market by Country | Brazil | 7.3% |

| CAGR 2026-2035 - Market by Gas Type | Methane | 7.8% |

| CAGR 2026-2035 - Market by End User | Automotive and Transportation | 8.3% |

| Market Share by Country 2025 | Mexico | 2.1% |

Gas sensors are designed to detect and measure the concentration of gases in the air. They play a crucial role in various industries by monitoring gas emissions, ensuring safety, and improving environmental quality which boosts the gas sensor demand growth. These sensors can detect hazardous gases like carbon monoxide, methane, and hydrogen among others, alerting users to potential leaks, pollution levels, or harmful concentrations.

Gas sensors provide essential benefits across various industries. They enhance safety by detecting hazardous gases like carbon monoxide or methane in real time, preventing accidents and toxic exposure. In addition, they play a critical role in environmental monitoring, ensuring air quality by detecting pollutants and helping industries comply with regulations to reduce emissions. The growth of the gas sensor market is driven by its increasing benefits as it offers cost efficiency, minimising the need for manual checks and preventing costly damages or downtime due to gas leaks. Their ability to improve safety, monitor the environment, and enhance operational efficiency makes them vital in numerous applications.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The gas sensor industry growth is being influenced by the stricter government regulations aimed at minimising air pollution and enhancing workplace safety leading industries such as oil, gas, and manufacturing to rely more on gas sensors to monitor emissions and detect leaks. Additionally, the rising focus on industrial safety is boosting the need for gas monitoring to safeguard workers and infrastructure.

The gas sensor market dynamics and trends are driven by the expanding development of smart cities and the increased integration of IoT systems. It is creating further demand for real-time air quality monitoring, using advanced gas sensor technologies. Growing awareness of the negative health effects of air pollution has also accelerated the adoption of gas sensors in both industrial and residential sectors.

The growing concerns over air quality and environmental protection are driving the demand of the gas sensor market. Urbanisation, industrialisation, and vehicular emissions have led to rising pollution levels, particularly in densely populated cities and industrial zones. To address these issues, governments and environmental agencies are implementing stringent regulations to monitor air quality and reduce harmful emissions. Gas sensors play a crucial role in these efforts by providing real-time data on the presence of pollutants such as carbon dioxide, sulfur dioxide, and nitrogen oxides.

Industries are also adopting gas sensors for emissions control to comply with environmental standards and avoid penalties. Additionally, the increasing focus on climate change and sustainable practices is prompting the integration of gas detection technologies in automotive systems, and industrial processes. As a result, the gas sensor market is experiencing significant growth, driven by the need for improved air quality and environmental sustainability.

According to the Open Government Data (OGD) Platform India, the number of new projects initiated in India, and the overall projects managed by CPSEs (Central Public Sector Enterprises) in India has increased during the fiscal years 2021-22 and 2022-23. CPSEs launched 37 new projects in 2021-22, which increased to 42 in 2022-23. IOCL (Indian Oil Corporation Limited) introduced 6 new projects in 2021-22, significantly expanding to 20 projects in 2022-23, with its total projects rising from 105 to 111. ONGC (Oil and Natural Gas Corporation) similarly experienced growth, adding 4 new projects in 2021-22 and 11 in 2022-23, bringing its total from 20 to 29. Collectively, the total number of projects across all CPSEs grew from 242 in 2021-22 to 252 in 2022-23, This expansion is expected to drive the gas sensor market revenue, particularly in the energy and industrial sectors, as these projects require accurate gas monitoring and safety standards.

According to the U.S. Energy Information Administration, in 2022, United States natural gas production reached 36,353,023 million cubic feet (MMcf), while the consumption is 32,288,230 MMcf. This rise in production activity requires advanced gas detection technologies to manage leaks, environmental safety, and operational efficiency, boosting the gas sensor industry revenue.

The U.S. Energy Information Administration reported that in 2023, China saw a 7% increase in natural gas consumption compared to 2022, which equates to an additional 2.6 billion cubic feet per day (Bcf/d). Consumption increased across all sectors, with the residential and commercial sectors experiencing an 8% rise (0.7 Bcf/d), and the electric power sector seeing a 10% increase (0.5 Bcf/d). China’s domestic natural gas production accounted for 58% of its total supply, producing an average of 21.7 Bcf/d, a 6% increase (1.2 Bcf/d) from the previous year highlighting the growing need for efficient monitoring and safety systems, particularly in the residential, commercial, and power sectors thus boosting the gas sensor market.

Amphenol Corporation

Alphasense, Inc.

Dynament Limited

Gastec Corporation

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

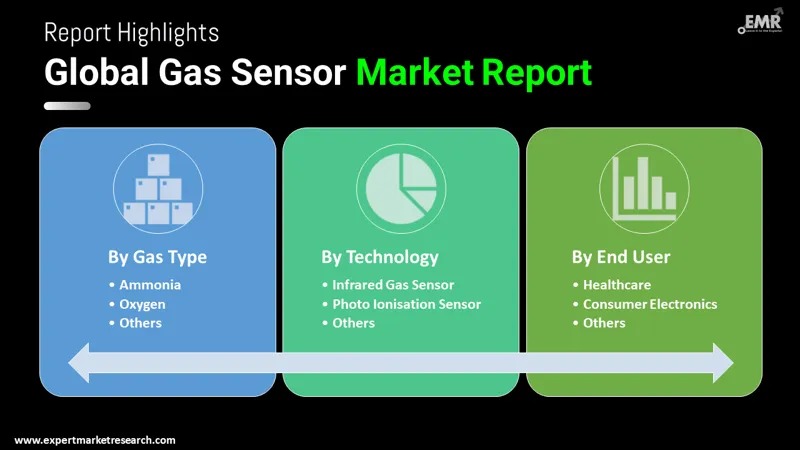

The EMR’s report titled “Gas Sensor Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Market Breakup by Gas Type

Market Breakup by Technology

Market Breakup by End Use

Market Breakup by Region

| CAGR 2026-2035 - Market by | Country |

| India | 7.5% |

| Brazil | 7.3% |

| China | 7.1% |

| UK | 6.5% |

| USA | 6.2% |

| Canada | XX% |

| Germany | XX% |

| France | XX% |

| Italy | 6.0% |

| Japan | XX% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Mexico | XX% |

The growth of the gas sensor industry is driven by its increasing use in industrial applications, particularly for safety and emissions monitoring. The industrial sector demands constant monitoring of hazardous gases, such as carbon monoxide, methane, and volatile organic compounds, to prevent accidents and ensure worker safety. Gas sensors are heavily deployed in industries like petrochemicals, manufacturing, and mining, where harmful gas leaks can pose significant risks. Additionally, regulatory requirements related to environmental protection further drive their use in industrial settings.

The automotive and transportation sector is the leading driver of gas sensor demand growth, primarily due to increasing environmental regulations and the push for safer, more efficient vehicles. Gas sensors are critical for monitoring and reducing vehicle emissions, ensuring compliance with stringent global emission standards. These sensors are also used in detecting harmful gases, improving vehicle air quality, and contributing to passenger safety. The rise of electric vehicles (EVs) and the development of autonomous vehicles have further amplified the demand for advanced gas sensor technologies. As EVs incorporate sophisticated monitoring systems for battery safety and air management, gas sensors play a pivotal role in ensuring optimal operation. Additionally, the need for real-time monitoring of air quality in smart transportation systems has boosted the integration of gas sensors.

The companies specialise in advanced interconnect systems, sensors, and antennas for a growing array of automotive applications, and manufacture and sell gas and water quality detection and measurement instruments.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global gas sensor market attained a value of nearly USD 1094.76 Million.

The market is projected to grow at a CAGR of 6.60% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035, reaching a value of around USD 2074.39 Million by 2035.

The major market drivers include rapid urbanisation and industrialisation and the rising demand for gas sensors in various end-use sectors, including automotive, healthcare, and defence and military, among others.

The key trends guiding the market growth are the growing integration of nanotechnology in gas sensors and the surging demand for detecting and monitoring gases in the oil and gas and chemical sectors.

The market is broken down into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

By gas type, the market is divided into carbon monoxide, methane, hydrogen, ammonia, oxygen, and others.

Based on technology, the market is broken down into infrared gas sensor, photo ionisation sensor, electrochemical gas sensor, thermal conductivity gas sensor, metal oxide-based gas sensor, catalytic gas sensor, and others.

Defence and military, healthcare, consumer electronics, automotive and transportation, and industrial, among others, are the major end users of gas sensors.

The competitive landscape consists of Amphenol Corporation, Alphasense, Inc., Dynament Limited, Gastec Corporation, and Honeywell International Inc., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Gas Type |

|

| Breakup by Technology |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share