Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global halal food market attained a value of USD 2.60 Trillion in 2025. The industry is expected to grow at a CAGR of 16.50% during the forecast period of 2026-2035 to attain a value of USD 11.97 Trillion by 2035.

Base Year

Historical Period

Forecast Period

Vietnam, Malaysia, and the UAE are top halal meat importers, while India, Pakistan, and Brazil are the main exporters, according to industry reports. The growing import-export flow facilitates market expansion, increasing access to halal-certified meat products, and encouraging innovation in halal food offerings to cater to diverse consumer needs.

The Department of Islamic Development Malaysia (JAKIM) has certified over 16,000 products as halal, reflecting the country's commitment to halal standards. This extensive certification enhances consumer confidence, expands the availability of halal products, and strengthens Malaysia’s position as a global leader in the market, encouraging international trade and driving market growth.

Canada’s halal food market is projected to grow significantly, currently valued at around USD 1.5 billion, as reported by the Halal Monitoring Authority and Statistics Canada. This growth is driven by an increasing Muslim population, evolving consumer preferences, and greater availability of halal-certified products, supporting the market expansion both domestically and internationally.

Compound Annual Growth Rate

16.5%

Value in USD Trillion

2026-2035

*this image is indicative*

Halal food, which is allowed under Islamic law, provides various advantages. It promotes health and hygiene through stringent quality controls and excludes harmful additives. Moreover, halal practices prioritize humane treatment of animals and encourage sustainable sourcing, benefiting the environment and local communities, thus driving demand of the halal food market. In October 2024, Nestlé Malaysia introduced the world’s first KitKat Chocolate Drink, offering the iconic KitKat experience in every sip. Made locally in Shah Alam, the drink utilised 100% sustainably sourced cocoa and received HALAL certification from JAKIM, reflecting the “Buatan Malaysia” spirit.

The halal food market dynamics and trends are being influenced owing to inclusivity by serving diverse populations and offering a wide array of flavors from different cultures. For Muslims, halal food meets religious obligations, bringing spiritual fulfillment and peace. Sharing halal meals also reinforces community ties, enhancing social connections among adherents. In India, halal certifications are issued by private organizations and Islamic bodies, with notable certifying entities including Halal India Pvt Ltd and Jamiat Ulama-i-Hind Halal Trust.

The global Muslim population is expected to reach nearly 2 billion by 2030, driving demand for halal products. Increasing recognition of halal food's ethical sourcing and quality, along with perceptions of health benefits, further expands halal food market opportunities and aligns with the rising interest in clean, ethical eating. In September 2023, Unilever launched a new line of ethically sourced halal-certified sauces under its Knorr brand. This range focuses on sustainability and quality, aiming to meet the growing demand for responsible food choices among consumers.

Increased international trade and investments in halal certification have increased accessibility to halal products globally. The market has diversified beyond traditional items to include snacks, beverages, and plant-based options. Additionally, the growth of e-commerce has made it easier for consumers to find and purchase certified halal products. In 2022, the U.S. halal food export market reached approximately USD 1.5 billion, according to USDA reports. This growth of the halal food industry was fueled by rising demand from both domestic consumers and international markets.

Rising demand for plant-based halal products, shifting focus on sustainability and ethical consumerism trends are propelling the halal food market.

The demand for plant-based halal products has been increasing as more consumers adopt vegetarian and vegan diets for health and environmental reasons. Companies are expanding their ranges to include halal-certified meat alternatives, appealing to both Muslim consumers and non-Muslims interested in sustainable eating. This trend in the halal food market reflects a broader shift toward healthier lifestyles and ethical sourcing, encouraging manufacturers to innovate with a variety of flavors and ingredients. The growth of this segment not only satisfies dietary needs but also fosters inclusivity, attracting a wider audience seeking halal certification in plant-based options. In August 2024, Kelava, Malaysia, launched halal and HACCP-certified plant-based ice cream, ensuring their products met these essential standards and became accessible to a larger audience, including those adhering to Islamic dietary practices.

The growth of e-commerce is reshaping the halal food industry by enhancing the accessibility of halal products for consumers worldwide. Online platforms allow retailers to connect with wider audiences, especially in areas where halal items are scarce in physical stores. The halal food market dynamics and trends are strengthened by increasing consumer trust in online food shopping. Companies are prioritizing the creation of user-friendly websites and apps that provide seamless navigation and secure payment methods. Furthermore, the convenience of home delivery accommodates busy lifestyles, enabling consumers to purchase a wide variety of halal products with just a few clicks. In April 2023, Delivery Hero introduced bekal by foodpanda in Malaysia, providing end-to-end halal deliveries. This service included the nation’s only halal-certified delivery fleet, ensuring that food was sourced solely from halal-certified vendors and maintained its halal integrity throughout the delivery process.

Sustainability is increasingly becoming a central focus in the growth of the halal food market, as consumers place greater importance on ethically sourced products. Companies are implementing sustainable practices across production, packaging, and supply chains to meet this demand. This trend encompasses the use of eco-friendly materials, efforts to reduce carbon footprints, and the promotion of animal welfare within halal practices. As consumers grow more environmentally conscious, they seek transparency in sourcing and production processes. Brands that highlight their commitment to sustainability not only attract eco-aware customers but also bolster their reputations, fostering long-term growth and loyalty within the halal food sector. In January 2024, Burger King Nigeria, a global fast-food chain that recently began operations in Nigeria, received certification from the Halal Certification Authority for all its stores nationwide, reinforcing its commitment to maintaining the highest international standards for product quality.

Ethical consumerism trends are significantly boosting the halal food market, as consumers increasingly prioritise sustainability, animal welfare, and ethical sourcing. Halal food production standards, which require humane treatment of animals and environmental responsibility, align with these growing concerns. According to a 2022 report from the Food and Agriculture Organization (FAO), consumer interest in ethically sourced food is rising globally, particularly among younger generations. Halal certification ensures that products meet strict ethical standards, offering consumers reassurance that their food is produced in a socially responsible manner. This aligns with the broader trend towards transparency in food sourcing, with a particular focus on animal welfare and environmental impact. Halal food’s ethical standards are helping attract not only Muslim consumers but also ethical buyers from diverse backgrounds.

Globalisation and migration have played a key role in expanding the market, particularly in non-Muslim-majority countries. As Muslim populations grow due to migration, especially in countries such as the United States, Canada, the United Kingdom, and Australia, the demand for halal food products has increased significantly. As per industry reports, the Muslim population is growing at an accelerated rate, and will more than double from an estimated 3.45 million in 2017 to an estimated 8.1 million in 2050. Meanwhile, Muslims are expected to surpass Jews as the second-largest religious group, which will further fuel the demand for halal food products.

Also, non-Muslim-majority countries are seeing a rise in halal food availability in supermarkets, restaurants, and foodservice outlets. As more retailers and food manufacturers cater to this demographic, the market is benefitting from increased accessibility and visibility, creating new market opportunities. The halal food market is no longer confined to Muslim-majority countries but is becoming a mainstream segment globally.

The halal food market faces several key restraints, including a lack of standardisation in certification processes, which confuses consumers and manufacturers. Limited awareness of halal benefits among non-Muslims hampers market expansion. Higher production costs due to stricter guidelines make halal products less competitive. Supply chain challenges complicate operations, while cultural sensitivities can limit marketing effectiveness.

Regulatory barriers vary by country, adding complexity for exporters. Competition from non-halal products and consumer misconceptions about halal practices further challenge growth. Addressing these issues through collaboration, education, and clear communication is essential for the halal food market development.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Halal Food Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

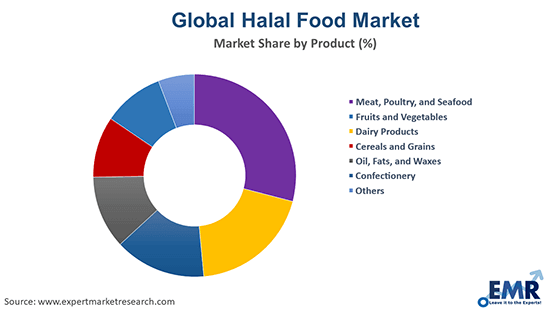

Market Breakup by Product

Market Breakup by Distribution Channel

Market Breakup by End Use

Market Breakup by Region

Market Analysis by Product

Halal meat, poultry, and seafood adhere to strict hygiene and quality standards, ensuring fresher, safer food that promotes health. Ethical sourcing emphasises humane treatment of animals, appealing to consumers focused on animal welfare. For Muslims, these products fulfill dietary laws, while also attracting non-Muslims interested in ethical eating. The rising demand presents significant growth opportunities in the halal food market for businesses targeting health-conscious consumers. In November 2023, Deli Halal introduced a new line of halal-certified sliced meats. The Kansas-based producer of halal-certified meat and cheese products announced that it launched this line to mainstream supermarket chains, including Giant Food Stores and Stop & Shop Supermarkets, across New England and much of the East Coast.

Halal-certified fruits and vegetables provide essential nutrients, vitamins, and minerals, contributing to a balanced diet and overall well-being. Many producers use sustainable farming practices, appealing to environmentally conscious consumers, thus positively impacting the halal food industry revenue. The halal certification fosters inclusivity by catering to both Muslim and non-Muslim shoppers seeking healthy, ethically sourced options. Transparency in the certification process builds trust and confidence in food choices within the halal market. In mid-2023, Sustainable Farms introduced a range of halal-certified organic fruits and vegetables. This certification guarantees that the products adhere to halal standards, attracting health-conscious and ethically minded consumers seeking responsibly sourced produce.

Market Analysis by Distribution Channel

Traditional retailers in the halal food market benefit from established trust within local communities, understanding cultural needs, and offering personalized service. Their active community engagement reinforces commitment and fosters consumer loyalty, ensuring customers feel assured about the authenticity and quality of the halal products they purchase. Retailers such as "Al-Madina Halal Grocery" and "Khalil's Halal Meats" provide a diverse selection of halal items, including spices, snacks, and fresh fruits and vegetables. Additionally, specialty stores like "Mezban" and "Halal World" exclusively offer halal products, catering to a wide range of consumer preferences.

Online retailers boost the halal food demand growth by providing convenient access to products from home, offering a wider selection than physical stores. They facilitate price comparisons, increase awareness of halal standards through targeted marketing, and cater to busy lifestyles with home delivery options, making shopping easier for consumers. HalalGuys offers online ordering for their renowned halal street food, while Zabihah helps users locate halal restaurants and shop for halal products. Saffron Road provides a variety of halal-certified frozen meals and snacks.

Europe Halal Food Market Analysis

Europe is witnessing a notable increase in the halal food demand, particularly in Germany, Italy, and France. Halal food caters to the dietary needs of Europe's growing Muslim population, promoting inclusivity in culinary offerings and expanding market opportunities. KFC began offering halal chicken in several European countries, including the Netherlands and Germany, in late 2023, aiming to meet growing consumer demand.

North America Halal Food Market Trends

The North American halal food market value is poised for significant growth, driven by leading brands like Saffron Road, The Halal Guys and Al-Safa. The halal food market boosts economic growth by generating jobs in production and retail, while also fostering innovation through the creation of new products and flavors, appealing to a wider audience. The Halal Guys announced the opening of multiple new locations in major U.S. cities in late 2023, further popularising their halal platters and sandwiches while providing online ordering options.

Asia Pacific Halal Food Market Insights

In India, brands such as Al-Baik and Zabiha highlight the growing halal food market share in the Asia-Pacific region. Halal food in India meets Islamic dietary laws, catering to the Muslim population while ensuring quality and safety through strict standards, appealing to a wider audience. In September 2023, Meatzza launched a new range of halal-certified frozen meat products, which included kebabs and ready-to-cook options, designed to offer convenience while ensuring quality.

Latin America Halal Food Market Analysis

Key markets in the region include Brazil, Mexico, and Argentina, where there is significant demand for halal food market. In September 2024, Alimentos Halal Mexico launched a new line of halal-certified snacks and meat products. Targeting both Muslim and non-Muslim consumers, this initiative seeks to expand the availability of halal options, promoting inclusivity and ethical sourcing in the Latin American market.

Middle East and Africa Halal Food Driving Factors

The African halal food market is experiencing growth, particularly in Egypt, Ethiopia, and Morocco. Halal food enhances trade relations with countries with established markets, creating export opportunities for African producers. It also strengthens community ties among consumers, fostering social cohesion and shared cultural experiences. In September 2023, Al-Falah Foods launched a variety of halal-certified frozen meals and snacks in Kenya, targeting consumers looking for convenient halal meal options.

Innovative startups in the market for halal food offer numerous benefits, including diverse product offerings that cater to evolving consumer preferences. They emphasise health and wellness through ethically sourced ingredients and leverage technology to enhance production and customer experience. By challenging traditional players, these startups foster competition, leading to better quality and pricing. They also focus on cultural relevance, creating products that resonate with specific communities, and prioritize sustainability in sourcing and packaging. Additionally, their engagement with local communities builds brand loyalty, while effective marketing strategies increase awareness of halal standards and benefits, driving growth of the halal food industry.

Plant-Based Halal Foods (2024): This startup introduced a range of plant-based halal alternatives to traditional meat products. By focusing on ethical sourcing and sustainability, it aims to cater to the rising demand for vegetarian and vegan options among Muslim consumers and health-conscious individuals.

Halal Meal Kits (2023): Launched to simplify meal preparation, this innovative startup offers halal meal kits with pre-portioned ingredients and easy-to-follow recipes. It targets busy consumers looking for convenient yet authentic halal dining experiences at home, ensuring quality and adherence to halal standards.

Key players in the halal food market respond to the growing demand for premium products by offering a diverse range, including fresh and frozen meats, ready-to-eat meals, and specialty foods. They prioritize strict halal standards and quality control, ensuring ethical sourcing and processing. With a commitment to innovation and customer satisfaction, these companies serve both retail and foodservice sectors, aiming to meet diverse consumer needs while promoting healthy and authentic halal dining experiences.

Based in Dubai and established in 1981, specializes in halal food products, particularly frozen and processed foods. The company is recognised for its dedication to quality and authenticity, catering to the dietary needs of Muslims and health-conscious consumers worldwide, ensuring accessible and safe food options.

Founded in 1987 and headquartered in Malaysia, it is a prominent producer of halal food, focusing on seafood, poultry, and processed products. The company prioritizes quality, sustainability, and innovation, serving both local and international markets while maintaining rigorous halal certification and food safety standards.

Established in 1866 and headquartered in Vevey, Switzerland, is a global leader in food and beverage. The company offers a wide range of halal-certified products, emphasizing quality, nutrition, and sustainability. It caters to diverse consumer needs, including those of the Muslim community, through its extensive portfolio of brands.

Founded in 2014 and located in Malaysia, operates a halal e-commerce platform that connects consumers with certified halal products and suppliers. The company promotes transparency in halal sourcing, enhancing access to halal goods and building trust among consumers.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the halal food market report are Cargill Inc. and Tahira Foods Ltd. among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the halal food market reached an approximate value of USD 2.60 Trillion.

The market is assessed to grow at a CAGR of 16.50% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 11.97 Trillion by 2035.

The major drivers of the market include rising disposable incomes, growing Muslim population, and the rising demand for halal goods.

The rising consumer awareness regarding halal food products, along with major players investing in expanding their halal-certified food portfolio, is expected to be a key trend guiding the growth of the market.

The major regions in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The significant products of halal food considered in the market report include meat, poultry and seafood, fruits and vegetables, dairy products, cereals and grains, oil, fats, and waxes, and confectionery, among others.

The major distribution channels in the market are traditional retailers, supermarkets and hypermarkets, and online, among others.

The various end uses of halal food are household and food service.

The leading players in the market are Al Islami Foods, QL Foods Sdn Bhd, Nestlé S.A, DagangHalal Sdn. Bhd., Cargill Inc., and Tahira Foods Ltd., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Distribution Channel |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share