Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global healthcare cloud computing market size was valued at USD 63.66 Billion in 2025 and is projected to expand at a compound annual growth rate (CAGR) of 16.80% from 2026 to 2035. Increasing demand for data security, growing adoption of digital healthcare solutions, and advancements in cloud technology are driving market growth. North America holds the largest market share due to technological advancements, robust healthcare infrastructure, and the widespread adoption of cloud-based services.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

16.8%

Value in USD Billion

2026-2035

*this image is indicative*

Cloud computing is transforming the healthcare sector by enhancing data management, accessibility, and security. It enables healthcare providers to store and access vast amounts of data while ensuring patient confidentiality. The increasing need for efficient data storage solutions and greater computing power supports market growth. Cloud computing facilitates telemedicine and remote patient monitoring, allowing healthcare providers to deliver patient-centered care more effectively. The ability to store and analyze large datasets helps providers improve diagnostic accuracy, treatment plans, and patient outcomes. Moreover, cloud solutions offer scalability and cost efficiency, enabling small and large healthcare organizations to optimize their operations. The integration of cloud computing in healthcare is also fostering innovations in medical research and clinical trials, enhancing collaboration and knowledge sharing across institutions.

Cloud-based systems are crucial for improving healthcare delivery through advanced data management. These systems support telehealth services, enabling virtual consultations and remote care. Additionally, cloud computing powers telemedicine platforms and enhances the management of electronic health records (EHRs), ensuring seamless data sharing. Advanced cloud infrastructure also facilitates real-time data analytics, providing healthcare professionals with actionable insights for better patient care and operational efficiency.

Key industry players in the healthcare cloud computing market include Microsoft, which offers comprehensive cloud solutions for secure data management; Google LLC, known for its advanced cloud infrastructure; and Koninklijke Philips NV, which integrates cloud technology in healthcare imaging and diagnostics. Amazon Web Services Inc. provides scalable cloud solutions.

Rising Demand for Advanced Data Analytics in Healthcare Cloud Computing to Drive Market Growth

The growing need for advanced data analysis and actionable insights is accelerating the adoption of healthcare cloud computing solutions. Technologies like machine learning and AI are enhancing data management, allowing healthcare organizations to make faster, data-driven decisions. These innovations improve clinical outcomes, operational efficiency, and financial performance while offering better data transparency and governance.

In May 2024, Health Catalyst, Inc. launched Health Catalyst Ignite®, a next-generation healthcare data and analytics ecosystem. This platform integrates advanced technologies, healthcare-specific data models, and self-service tools to provide better data management and governance. Ignite reduces costs by minimizing data duplication while enhancing decision-making through predictive insights. It allows healthcare organizations to integrate clinical, operational, and financial data seamlessly, improving scalability, flexibility, and accessibility without the need for extensive infrastructure changes.

Rising Adoption of Telemedicine Among Healthcare Providers to Drive Market Growth

The increasing adoption of telemedicine by healthcare providers is significantly boosting the healthcare cloud computing market. Telemedicine relies heavily on cloud computing to store, manage, and share patient data securely and efficiently. Cloud-based platforms enable healthcare providers to offer remote consultations, reducing the need for in-person visits and improving patient access to specialized care. As more healthcare providers embrace telehealth, the demand for robust cloud infrastructure is expected to rise, driving market growth.

In June 2024, Apollo Telehealth, in partnership with the Government of Manipur, launched a telemedicine-driven Primary Health Centre (PHC) in Borobeka, Manipur. This initiative, aimed at improving healthcare access in remote areas, provides specialized teleconsultations in fields like cardiology and orthopaedics. The PHC is equipped with advanced medical infrastructure and enables residents to consult with over 15 specialist doctors across India.

Rising Demand for Data Accessibility and Personalized Medicine to Enhance the Market Value

The healthcare cloud computing market is expanding due to increasing demand for enhanced data accessibility and personalized medicine. Cloud platforms enable healthcare providers to access patient data securely and in real time, improving patient care and operational efficiency. Personalized medicine, which prepares treatment to individual patient profiles, relies on vast datasets for precise analysis. Cloud computing facilitates this by offering scalable storage and advanced analytics. Additionally, the adoption of electronic health records (EHRs) and telemedicine platforms further accelerates market growth. Healthcare institutions benefit from cloud solutions through cost efficiency, improved collaboration, and faster research and development processes.

In March 2023, Fujitsu Limited launched a new cloud-based platform for the healthcare sector in Japan. This platform securely collects and analyzes health-related data, promoting personalized healthcare and drug development. It supports medical institutions and pharmaceutical companies in advancing individualized treatments and enhancing medical research.

Data Privacy Concerns and Significant Initial Investment May Limit Market Expansion

The growth of the market may be hindered by concerns surrounding data privacy and the substantial initial investment required for advanced technologies. Many modern devices, particularly those using artificial intelligence and cloud-based systems, collect and store sensitive customer information. This raises concerns about data security and compliance with privacy regulations, which may discourage both consumers and businesses from adopting these technologies.

Additionally, the high upfront costs associated with purchasing and maintaining advanced devices present a significant barrier for small and medium-sized enterprises (SMEs). This financial burden may limit market penetration, especially in emerging economies where healthcare and cosmetic budgets are more constrained. Addressing these challenges is essential for sustained market growth.

Increasing Demand for Flexible and Cost-Effective Infrastructure Drives Public Cloud Adoption

Based on the deployment model, the healthcare cloud computing market includes private cloud, public cloud, and hybrid cloud. Private cloud solutions provide exclusive infrastructure for individual healthcare organizations, ensuring greater data security and compliance with healthcare regulations. This model is preferred by large hospitals and research institutions handling sensitive patient information. It offers enhanced control over data and applications, reducing cybersecurity risks while ensuring operational efficiency.

Public cloud deployment is gaining traction due to its scalability and cost-efficiency. It enables healthcare providers to access advanced computing resources without investing in expensive physical infrastructure. Public cloud solutions are particularly beneficial for small and medium-sized healthcare facilities looking to scale their operations quickly. This model supports critical services like telemedicine, data analytics, and patient management, reducing operational costs while enhancing accessibility. Hybrid cloud combines the advantages of both private and public cloud models. This approach allows healthcare organizations to store sensitive data on secure private servers while utilizing public cloud resources for non-sensitive applications. Hybrid cloud deployment is ideal for organizations needing flexibility, as it enables seamless integration of various healthcare applications while balancing security and cost.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Rising Demand for User-Friendly and Easily Implementable Solutions Drives SaaS Adoption

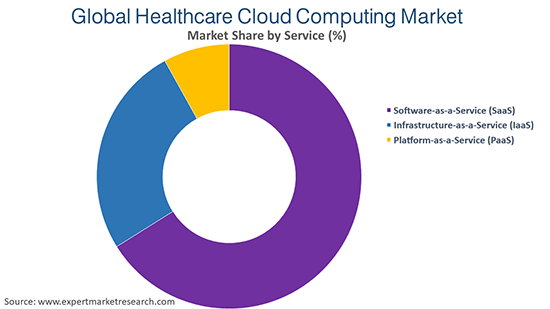

Based on the service model, the healthcare cloud computing market includes Software-as-a-Service (SaaS), Infrastructure-as-a-Service (IaaS), and Platform-as-a-Service (PaaS). Software-as-a-Service (SaaS) dominates the market due to its ease of use and quick implementation. SaaS solutions offer healthcare providers access to essential applications like electronic health records (EHR), patient management systems, and telemedicine platforms. These cloud-based solutions reduce the need for on-site maintenance, offer automatic updates, and ensure compliance with evolving regulations.

Infrastructure-as-a-Service (IaaS) provides virtualized computing resources over the cloud, allowing healthcare organizations to manage vast amounts of data and computational workloads. IaaS is essential for tasks requiring significant computing power, such as medical imaging, big data analytics, and remote patient monitoring. It allows providers to scale resources as needed while minimizing hardware costs and optimizing operational efficiency.

Platform-as-a-Service (PaaS) supports the development and management of healthcare applications. This model allows organizations to create custom solutions tailored to their specific needs. PaaS enhances collaboration between developers and healthcare professionals, fostering innovation in patient care, medical research, and clinical workflows. It provides a flexible framework for integrating new technologies while maintaining data security and regulatory compliance.

Growing Adoption of Electronic Health Records Drives Demand for Clinical Information Systems

Based on application, the healthcare cloud computing market includes clinical information systems (CIS) and nonclinical information systems (NCIS). Clinical information systems (CIS) enhance patient care by improving data management and accessibility. This segment includes electronic health records (EHR), which store comprehensive patient data, improving care coordination and decision-making. Picture Archiving and Communication Systems (PACS) and Radiology Information Systems (RIS) manage and share medical imaging data, enhancing diagnostic accuracy. Computerized Physician Order Entry (CPOE) allows electronic entry of medical prescriptions, reducing errors and improving patient safety. Pharmacy Information Systems (PIS) optimize medication tracking and dispensing, enhancing efficiency. These integrated systems improve clinical workflows, facilitate better patient care, and ensure compliance with industry regulations.

Nonclinical information systems (NCIS) focus on managing the financial and administrative aspects of healthcare. This segment includes Revenue Cycle Management (RCM), which automates patient billing and payment processes. Automatic Patient Billing (APB) and Payroll Management Systems improve operational efficiency by automating repetitive administrative tasks. Claims Management facilitates accurate processing of insurance claims, reducing errors and improving reimbursement rates. Cost Accounting provides insights into financial performance, enabling better resource allocation and financial planning. These systems enhance organizational efficiency and ensure smooth financial operations.

Increasing Demand for Accessible Cloud Solutions Drives Adoption Among Healthcare Providers

Based on end users, the healthcare cloud computing market includes healthcare providers and healthcare payers. Healthcare providers form the largest end-user segment, including hospitals, clinics, diagnostic centers, and ambulatory care facilities. Cloud-based solutions help providers manage patient data, improve care delivery, and streamline operations. Electronic health records (EHRs), telemedicine platforms, and remote patient monitoring systems enable real-time access to critical information, enhancing patient outcomes and reducing operational costs. The ability to scale computing resources based on patient volume is particularly beneficial for healthcare providers seeking efficiency and improved patient care.

Healthcare Payers include insurance companies and government agencies managing health plans. Cloud computing enables payers to streamline claims processing, improve member services, and leverage data analytics for better decision-making. Cloud-based systems enhance the accuracy of claims management, facilitate real-time data sharing, and reduce administrative costs. These solutions also allow payers to manage large volumes of patient data securely and comply with regulatory requirements.

The healthcare cloud computing market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America holds the largest market share, driven by advanced healthcare infrastructure, widespread adoption of digital health technologies, and strong government support. The United States leads the region due to significant investments in cloud-based solutions for healthcare providers, increasing demand for electronic health records (EHRs), and the rapid integration of artificial intelligence (AI) in healthcare services.

Europe is a significant contributor to the healthcare cloud computing market due to increasing digital transformation in healthcare systems. However, new regulatory developments may impact market growth. In July 2024, Germany enacted stricter requirements for processing health data using cloud computing under Section 393 SGB V of the Social Security Code – Book V. This regulation aims to ensure secure cloud adoption across statutory healthcare systems covering approximately 90% of the German population, potentially affecting medical research involving pharmaceuticals and medical devices.

Asia Pacific is witnessing rapid growth in healthcare cloud computing due to increasing investments and digital innovation. In January 2025, Microsoft announced a US$3 billion investment in India to expand AI and cloud computing infrastructure, including new data centers in Pune, Chennai, and Mumbai, with a fourth planned by 2026. This investment supports the growth of India’s AI ecosystem, fostering public-private collaborations with companies like Apollo Hospitals to advance cloud-based healthcare solutions. Such initiatives are expected to accelerate cloud adoption and improve patient care in the region.

Latin America is experiencing steady growth in healthcare cloud computing, driven by increased government efforts to modernize healthcare systems and improve patient outcomes. Countries such as Brazil and Mexico are adopting cloud-based electronic medical records (EMRs) and telemedicine services. Growing digital literacy and the expansion of public health programs further support cloud computing adoption across the region.

The Middle East and Africa are emerging markets for healthcare cloud computing, with increasing investments in digital healthcare infrastructure. Countries like Saudi Arabia and the United Arab Emirates are promoting cloud-based solutions to enhance patient care and data management. Government initiatives such as Saudi Vision 2030 and growing demand for telehealth services are expected to boost the adoption of cloud computing in the healthcare sector, improving accessibility and operational efficiency.

Leading companies in the healthcare cloud computing market are prioritizing strategic partnerships and acquisitions to enhance their analytics services and expand their global reach. By collaborating with healthcare organizations and technology firms, these companies aim to develop advanced cloud-based solutions that improve data management, patient care, and operational efficiency. Such initiatives also enable industry leaders to strengthen their market position, deliver innovative healthcare solutions, and meet the growing demand for secure and scalable cloud computing services worldwide.

Leading companies in the healthcare cloud computing market are focusing on strategic partnerships and acquisitions to enhance their analytics services and expand their global reach. By collaborating with healthcare organizations and technology firms, these companies aim to develop advanced cloud-based solutions that improve data management, patient care, and operational efficiency. Such initiatives also enable industry leaders to strengthen their market position, deliver innovative healthcare solutions, and meet the growing demand for secure and scalable cloud computing services worldwide. Key players in the market include:

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is likely to reach a value of USD 300.81 Billion by 2035.

In 2025, the global healthcare cloud computing market was valued at approximately USD 63.66 Billion.

The market is projected to grow at a compound annual growth rate (CAGR) of 16.80% during the forecast period from 2026 to 2035.

Software-as-a-Service (SaaS) is the leading service model segment in the market.

The key factor driving the healthcare cloud computing market growth is the increasing demand for secure data storage, scalability, and AI-driven solutions, enabling efficient telemedicine, remote patient monitoring, and electronic health records (EHRs) management.

Top players in the healthcare cloud computing market include Microsoft, Google LLC, Koninklijke Philips NV, Amazon Web Services Inc., Athenahealth, Inc., CareCloud, Inc., Carestream Health Inc., ClearDATA Networks, Inc., and IBM Corporation.

North America is expected to hold a substantial market share, driven by the presence of advanced infrastructure, and rising investments in the healthcare domain.

Healthcare providers are expected to witness significant growth in the forecast period.

Major drivers of the healthcare cloud computing market include increasing demand for data storage, rising adoption of telemedicine, advancements in AI, improved patient data management, and growing government support for digital healthcare solutions.

Key trends in the healthcare cloud computing market include increased adoption of AI, telemedicine, data security, electronic health records (EHRs), and scalable cloud solutions for improved patient care and operational efficiency.

The healthcare cloud computing market offers Software-as-a-Service (SaaS), Infrastructure-as-a-Service (IaaS), and Platform-as-a-Service (PaaS), enabling secure data storage, advanced analytics, and seamless access to healthcare applications and services.

Healthcare utilizes cloud computing to improve data storage, accessibility, patient care, and operational efficiency, enabling telemedicine, remote monitoring, and secure management of electronic health records (EHRs).

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Service Model |

|

| Breakup by Application |

|

| Breakup by Deployment Model |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share